Heightened inflation and lower real wages, recessionary fears and the likelihood of rising unemployment, are all part of the outlook for 2023. This scenario is justly worrying for investors.

RAFI Fundamental Index strategies have tended to perform well in such an environment, offering investors a potential safe harbor for their portfolios.

We examine three themes that support an allocation to one or more RAFI strategies: today’s historically cheap valuations, RAFI’s performance in past inflationary environments, and RAFI’s performance in bear markets and recessions.

Global economic indicators are spooking investors. The US Bureau of Labor Statistics recently released its monthly inflation summary. Consistent with the global phenomenon of elevated inflation rates, the CPI all items index increased 6.5% over the 12 months ending December 31.1 December marked the twenty-first straight month the index has been above 4%, leaving little room for belief that the current inflationary spell is transitory (it’s not).2 Although the positive news of US Q3 and Q4 2022 real GDP growth of 3.2% and 2.9%, respectively, largely mitigated the bad news of two consecutive quarters of negative growth in Q1 and Q2 2022,3 announced layoffs at many large firms and a slowdown in hiring and spending are fueling concerns about a recession in 2023 (Kelly, 2022, and Rupp, 2022).

Where can investors turn now to safeguard their equity portfolios? While past performance is not a guarantee of future results, RAFI™, a contrarian, value-oriented strategy, has tended to do well in this type of environment. In fact, not since the equity market low of the 2008 global financial crisis (GFC) has the outlook for RAFI Fundamental Index™ strategies been this attractive. We examine three themes that position RAFI well over the next year: today’s historically cheap valuations, RAFI’s performance in past inflationary environments, and RAFI’s performance in bear markets and recessions.

Create your free account or log in to keep reading.

Register or Log in

RAFI’s Historically Low Valuation

Factor investing, the process of systematically investing in firms with a set of desirable characteristics,4 has struggled in recent years to deliver excess return to investors, and the value factor has struggled the most. Although value has enjoyed a bounce back over the last 18 months, prior to that the value factor underperformed for almost a decade, largely due to the expanding multiples of technology and other growth companies.

Value’s performance hit its nadir in the summer of 2020 as Covid closed the old economy and apparently harkened the transition to a new, technology-driven future. By the end of 2020, the cumulative 10-year underperformance of value versus growth was 218% (6.7% annualized). After its 2020 low, value rebounded as the economy reopened and growth-driven technology stocks struggled. From September 2020 through December 2022, value outperformed growth by a cumulative 36.4% in the developed markets and 25.4% in the emerging markets.5 Even after this spurt of explosive performance, value remains primed to deliver excess returns for investors, with the factor currently trading at the bottom half of its cheapest decile in history relative to growth (Arnott, Kalesnik, and Wu, 2021).

Historically low valuations have typically led to subsequent higher expected excess returns.

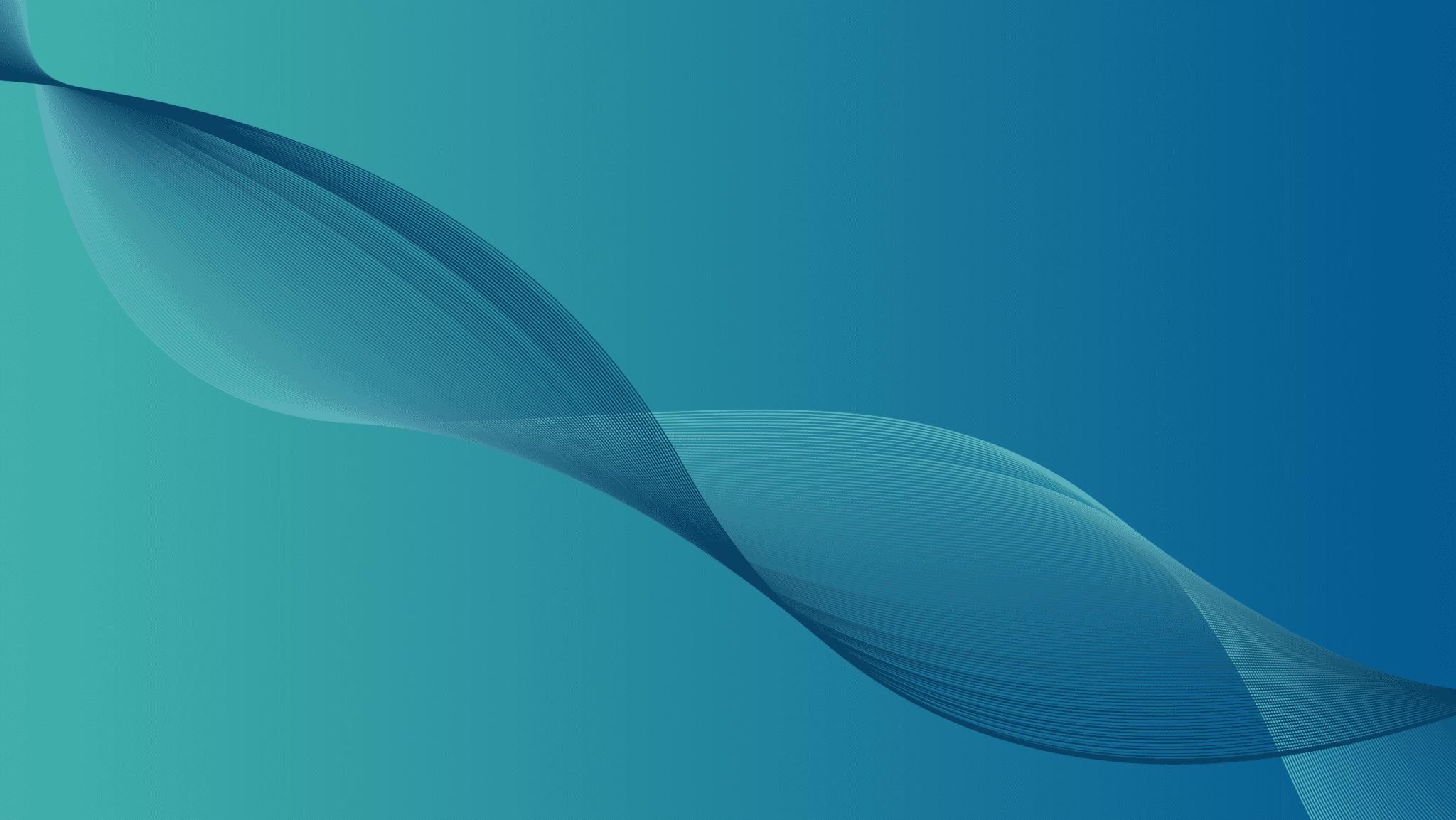

”A byproduct of the RAFI Fundamental Index approach is a dynamic value tilt. By using fundamental measures of company size as a rebalancing anchor, the strategy tilts away from popular, trendy, and typically expensive companies toward unpopular companies that are trading at attractive valuations. As a result, RAFI strategies have not been immune to the past decade’s value headwinds and, despite strong recent performance, are trading at historically low valuations. At the end of Q4 2022, even after a strong rally in performance, RAFI was trading in the cheapest quartile of its historical valuations in most regions around the world. In the United States, Developed Markets, and Europe, the RAFI strategy was at the 88th, 86th, and 87th percentile, respectively, of its historical valuations relative to a cap-weighted index.

History suggests that historically low valuations have typically led to subsequent higher expected excess returns. Using the RAFI Fundamental Developed Index as an example, we see that the discount (measured by an average of price-to-earnings ratio, price-to-book value ratio, price-to-sales ratio, and dividend yield) is currently 42%. Historically, when the discount of RAFI versus the cap-weighted benchmark is at this level, five-year subsequent excess returns compared to the benchmark have been 3.9% in the developed markets, meaningfully surpassing the long-horizon historical excess return of 2.0%. Looking across all regions, the average expected five-year excess return is 2.8%.

RAFI in Inflationary Environments

Before turning to why investors should consider value-oriented strategies in inflationary environments, let’s put today’s elevated inflation rate into historical perspective. Throughout the 2010s, a period of relative geopolitical stability, inflation ran at a relatively subdued annualized rate of approximately 1.8%. Many stories, such as aftershocks of the GFC, continued globalization, and secular stagnation, developed as possible explanations for continued low inflation.

Coincidentally, esoteric ideas, such as nominal gross domestic product (NGDP) targeting and modern monetary policy, entered the economic discourse and both the US Federal Reserve and European Central Bank implemented quantitative easing, dramatically expanding their balance sheets. Nevertheless, inflation remained stable. The situation changed dramatically in early 2020 with the beginning of the Covid pandemic. The resulting shut down of the global economy threatened to induce a deflationary recession. Taking a lesson from the GFC, fiscal and monetary authorities acted decisively by lowering interest rates, increasing liquidity, supporting the flow of credit to households and businesses, and passing legislation to provide financial support to the populace.

Soon the inflation situation began to change. In March 2021, the inflation print ran slightly ahead of pre-Covid levels with a year-over-year increase of 2.6%. The trend continued steadily throughout the rest of the year, reaching 7.1% in December 2021. In February 2022, a land war rocked the European continent and created a massive shock to global energy supplies. The March 2022 inflation print hit a year-over-year rate of 8.6%, peaking in July at nearly 9.0%.

While the Fed began with a cautious 25 bp hike in March, by June, the central bank had rapidly recalibrated, hiking rates at an aggressive 75 basis-point clip to achieve a target range of 4.25% - 4.0% by December from 0.25% - 0.50% in March. Supply chains finally started to normalize as worldwide demand fell. By December 2022, year-over-year inflation dropped to 6.5%. Does this mean inflation is tamed? Although it is possible inflation could revert to pre-Covid levels, we note several reasons to hedge that bet. Deglobalization could reverse the trend of cheaper goods. Geopolitical risk, dormant for the last 30 years, is alive and well. Unemployment is just off record lows, and the US consumer has capacity to spend, given both savings and income transfers. Each of these themes alone, and certainly in combination, could drive a higher inflation regime than we experienced over the past decade.

Over the last 90 years value has posted wins in high-inflation environments.

”In addition, the mechanical aspects of how the BLS calculates the inflation rate and the structural forces in the economy both support higher inflation expectations in the months ahead.6 Headline CPI should remain elevated over the next year due to the high monthly prints in 2022. Not until July 2023 will the large month-over-month prints of early 2022 drop out of the year-over-year CPI measure.7 Housing, or shelter, now 32% of CPI and growing, has a substantial impact on the headline inflation number. The cost of shelter is captured through a measure known as owners’ equivalent rent of residences (OER). OER is the imputed cost that a homeowner estimates their home would rent for today on a monthly basis, unfurnished and without utilities. The measure lags the market by slightly more than a year. Consequently, the hot property market of 2021–2022 will continue to impact headline CPI into 2023 (Bolhuis, Cramer, and Summers, 2022). Energy is likely be another source of inflationary pressure as the global economy attempts to transition more rapidly to a decarbonizing world (Andaloussi et al., 2022). The end of zero-Covid in China combined with an uncooperative OPEC may further fuel rising energy costs and could provide a substantial inflationary shock around the world.

So, why should investors consider value-oriented strategies in inflationary environments? Equity valuation at its essence prices a stream of cash flows into the future. The required rate of return (part of the denominator in a dividend discount model) captures both the equity risk premium and the risk-free rate. Following that intuition, changes in interest rates (the consequence of the Fed’s reacting to elevated inflation) can have knock-on effects for firm valuation depending on when those expected future cash flows are expected to arrive. As interest rates rise, the cost of capital becomes more expensive and companies trading at high multiples (because of generous earnings expected in the future) see those multiples contract. We can also impute a corresponding “normalization” in multiples for companies whose valuations are not contingent on generous growth far into the future. While conceding no clear empirical link exists between value’s outperformance and higher interest rates (Maloney and Moskowitz, 2020), we feel strongly we can learn important lessons from history (which we will address in the next section). Given current low valuations, (which we discussed in the previous section), value-oriented strategies may offer a meaningful refuge in the present market and economic environment.

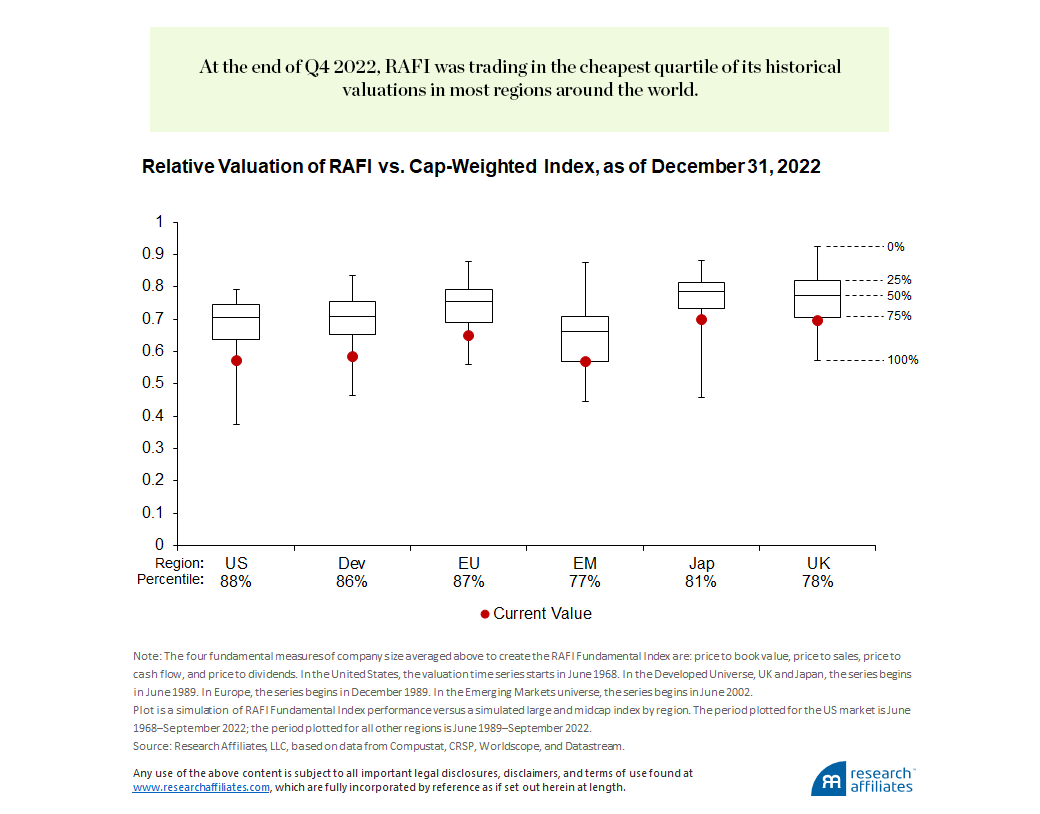

What can we learn from the past? We plot the performance of the Fama–French high-minus-low (HML) book-to-market value measure for the US equity market versus US core CPI, annualized by decade for the past 90 years. Our simplified example shows a positive trend with stronger excess returns during decades of relatively elevated inflation.

The 1970s was a decade of high inflation with an arguably lax Fed at the wheel. The tailwind of massive federal spending on guns (Vietnam War) and butter, combined with the supply shocks from an OPEC embargo, superficially parallels the situation today. Annual inflation rates throughout the decade were in the range of 7.7%, while the value factor’s nominal excess returns averaged 7.4%. In the 1980s, a decade of elevated but declining inflation and healthy growth, the value factor chalked up healthy nominal excess returns of about 5.1% annually compared to annualized inflation of roughly 5.6%. One can surmise that the RAFI Fundamental Index strategy stands to benefit from elevated inflation rates, given its dynamic value tilt.

In contrast, the 1990s and 2010s were decades in which value stumbled. In both periods, value generated negative excess returns in the midst of moderate to low inflation. Although these two decades are the most recent, we do not believe that proximity should be construed as an indication of value’s performance over the next decade. Note that the value factor posted positive excess returns during the post-WWII boom of the 1950s and 1960s as well as in the 2000s. Another consideration is that value’s negative performance in the 1990s appears to be an artifact of timing as the rampant growth-driven tech bubble moved markets through the end of the decade, peaking in March 2000. In summary, over the last 90 years value has posted wins in high-inflation environments and has typically delivered positive excess returns in lower-inflation environments.

RAFI in Recessionary Periods

Fearing prolonged inflation, the Fed has embarked on a monetary policy of aggressive tightening. In 2022, the fed funds rate rose 425 basis points, ratcheted up seven times from 0.25% to 4.40%, while the Fed continued to reduce its balance sheet. The Fed’s actions heighten the threat of recession, particularly on the heels of two consecutive quarters (Q1 and Q2 2022) of declining real US GDP growth. Given that Q3 growth flipped back to positive territory, and with Q4 growth estimates likewise positive, a potential recession may very well be mild8. Of course, we cannot know the future, and the possibility of a recession looms.

So, how has the RAFI Fundamental Index approach historically fared in recessionary periods? Kalesnik and Polychronopoulos (2020) examined the effect of recession on value and other factor strategies. They looked at six recessionary periods (as classified by NBER) that were accompanied by bear markets9 and found that value tends to provide downside protection during a bear market drawdown and to outperform over the full drawdown/recovery period. They also observed marked performance differences in the bear market periods depending on whether the bear market’s cause was a bubble’s bursting or a shock to fundamentals.

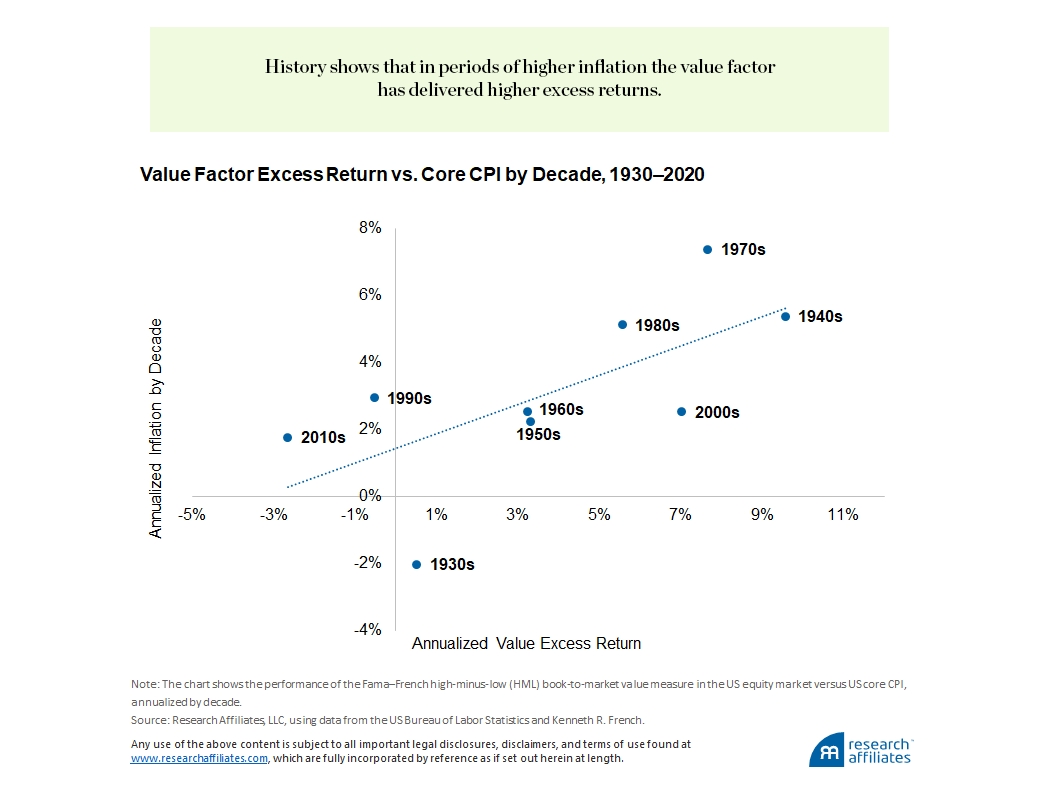

We extend their analysis to the RAFI Fundamental US Index. We find similar results. The following table highlights the Nifty Fifty/Oil Crisis and the Tech Bubble Crash. Whereas RAFI’s outperformance on average during all bear markets associated with recessionary periods is a cumulative 8.4%, outperformance during bear markets caused by a shock to fundamentals is flat (1.3%), while outperformance during bear markets that follow a bubble crash is 22.4%! In addition, RAFI’s outperformance in recovery periods that follow bear markets tends to be much stronger when the source of the bear market is a bubble.

In the current environment, we observe several similarities to the recessionary periods accompanied by a bubble-induced bear market. First, the likelihood of a recession is relatively high given the Fed’s aggressive tightening policy and the consecutive quarterly declines in GDP growth in the first half of 2022. Second, at yearend 2022, the CAPE (cyclically adjusted price-to-earnings) ratio for the S&P 500 was approximately 28. Although US equities suffered sharp declines in 2022 (the S&P 500 fell 19.4% and Nasdaq dropped 33.1%), the CAPE ratio is still historically expensive, ranking in the top-decile relative to its history stretching back to 1881!10

RAFI’s past outperformance during bear markets that follow a bubble crash is 22.4%!

”Why do value-oriented strategies such as RAFI tend to perform well in a recessionary environment? Research suggests that market sentiment primarily drives the performance gap between value and growth stocks: value endures extended spans of disfavor by investors, while growth stocks tend to be popular and well loved by investors.11 This relationship tends to correct itself after a bubble period, characterized by extreme mispricing in equities. When the bubble bursts, equity prices tend to revert to the mean. The correction can be quite violent. The typical result is that value companies, already trading at low multiples, tend to outperform the market, and growth companies tend to underperform the market.

Conclusion

Investors have much to worry about in 2023 with heightened inflation and lower real wages, recessionary fears and the likelihood of rising unemployment, but investors can take steps to protect their portfolios. One step worthy of consideration would be an allocation to one or more of the RAFI Fundamental Index strategies, which we believed are poised to outperform going forward. We saw the beginning of that trend in 2022, with RAFI Fundamental Index strategies outperforming across regional markets. The RAFI Fundamental US Index and RAFI Fundamental Developed Index outperformed their benchmarks by 12.8% and 11.4%, respectively, for the year. The RAFI Fundamental Emerging Markets Index outperformed its benchmark by 4.2% in 2022. The themes of RAFI’s low valuation and historical outperformance during inflationary and recessionary periods suggest a potentially long runway for the strategy’s continued outperformance.

Please read our disclosures concurrent with this publication: https://www.researchaffiliates.com/legal/disclosures#investment-adviser-disclosure-and-disclaimers.

Endnotes

- https://www.bls.gov/news.release/cpi.nr0.htm

- Arnott and Shakernia (2022) show that once inflation crosses the 8% threshold, as it did in 2022, the median time to revert to 3% is nearly 11 years!

- https://www.bea.gov/data/gdp/gross-domestic-product

- “Desirable” refers to the factor’s being robust across several definitions, history, and geography as explained by Beck et al. (2016).

- Source is Factset. The developed markets return is calculated by subtracting the cumulative return of the MSCI World Value Index from the MSCI World Growth Index. The emerging markets return is calculated by subtracting the MSCI Emerging Markets Value Index from the MSCI Emerging Markets Growth Index.

- Cam Harvey, Research Affiliates’ director of research, explains the mechanical and structural forces that impact the CPI headline rate in the short video “Insights into the Inflation Print” (August 10, 2022).

- Arnott and Shakernia (2022) expound on the probabilistic paths for inflation over the next several years.

- Partner and Director of Research Cam Harvey has noted several reasons why we might expect a mild recession including tight unemployment numbers, the nature of layoffs among high skill workers, strong consumer and institutional balance sheets, the real yield curve rather than nominal yields and changes in behavior as consumers and companies alter their behavior in response to an inverted nominal yield curve.

- The six recessionary periods were Fiscal Tightening/Vietnam War (December 1968–June 1970), Nifty Fifty/Oil Crisis (November 1972–September 1974), Iran Oil Crisis/Monetary Policy Tightening (December 1980–July 1982), Monetary Policy Tightening (July 1990–October 1990), Tech Bubble Crash (April 2000–September 2002), and Global Financial Crisis (October 2007–February 2009).

- Source: http://www.econ.yale.edu/~shiller/data.htm.

- Further explanation as well as a summary of research papers on this subject are available in Kalesnik and Polychronopoulos (2020).

References

Andaloussi, Mehdi Benatiya, Benjamin Carton, Christopher Evans, Florence Jaumotte, Dirk Muir, Jean-Marc Natal, Augustus Panton, and Simon Voigts. 2022. “Near-Term Macroeconomic Impact of Decarbonization Policies.” Chapter 3 in World Economic Outlook: Countering the Cost-of-Living Crisis. International Monetary Fund (October).

Arnott, Rob, Vitali Kalesnik, and Lillian Wu. 2021. “Did I Miss the Value Turn?” Research Affiliates Publications (September).

Arnott, Rob, and Omid Shakernia. 2022. “History Lessons: How ‘Transitory’ Is Inflation?” Research Affiliates Publications (November).

Beck, Noah, Jason Hsu, Vitali Kalesnik, and Helge Kostka. 2016. “Will Your Factor Deliver? An Examination of Factor Robustness and Implementation Costs.” Financial Analysts Journal, vol. 72, no. 5: 58–82.

Boluis, Marijn, Judd Cramer, and Lawrence Summers. 2022. “The Coming Rise in Residential Inflation.” NBER Working Paper 29795 (February).

Harvey, Campbell. 2022. “Insights into the Inflation Print.” Research Affiliates Video Shorts (August 10).

Kalesnik, Vitali, and Ari Polychronopoulos. 2020. “Value in Recessions and Recoveries.” Research Affiliates Publications (June).

Kelly, Jack. 2022. “Wall Street Bankers Face Bonus and Job Cuts.” Forbes (December 4).

Maloney, Thomas, and Tobias Moskowitz. 2020. “Value and Interest Rates: Are Rates to Blame for Value’s Torments?” Journal of Portfolio Management, vol. 47, no. 6 (May): 1–23.

Rupp, Lindsey. 2022. “These Are the Tech Companies Slashing Jobs in an Uncertain Economy.” Bloomberg (December 7).