Value strongly outperforms in bear markets and over the full cycle of recession–recovery when preceded by the bursting of a bubble, characterized by a wide value–growth valuation dispersion.

In contrast, when a shock to fundamentals sparks a bear market, value tends to perform poorly, as was the case in the recent market downturn caused by the Great Lockdown.

Value, quality, and small-cap strategies all tend to perform well during recoveries regardless of the catalyst for the bear market and recession.

The value–growth valuation dispersion, already very wide before the February–March 2020 bear market, widened further to an all-time peak after the downturn, a sign that the market remains in bubble territory. Should the bubble burst, the closing of the valuation gap would imply an attractive opportunity for value investors.

Value strategies systematically invest in stocks with lower prices relative to company fundamentals. The structural dynamic in value’s process of buying what has fallen in price and selling what has appreciated is inherently uncomfortable. This discomfort can rise meaningfully in times of great economic distress.

The COVID-19 pandemic is having a massive impact on our personal and professional lives and taking a terrible toll on the global economy. Many estimates suggest that the economic implications of the lockdown on personal movement and business operations may be one of the strongest since World War II. February and March 2020 brought one of the most brutal bear markets in recent history, although the equity market has recovered substantially since its first-quarter bottom. Much uncertainty remains, however, about the length of local lockdowns around the world, possible second waves of the pandemic, how businesses will operate after the lockdown, the extent of the related economic damage, and, consequently, the performance of many strategies.

What can value investors learn from previous bear markets and recoveries? History doesn’t repeat, but it rhymes. Studying these episodes can improve our understanding of their unique risks and opportunities. In this article, we analyze the parallels between current and historical conditions by examining the bear markets, accompanied by recessions, the United States has experienced over the last 57 years. Since 1963, six episodes fit this definition.1

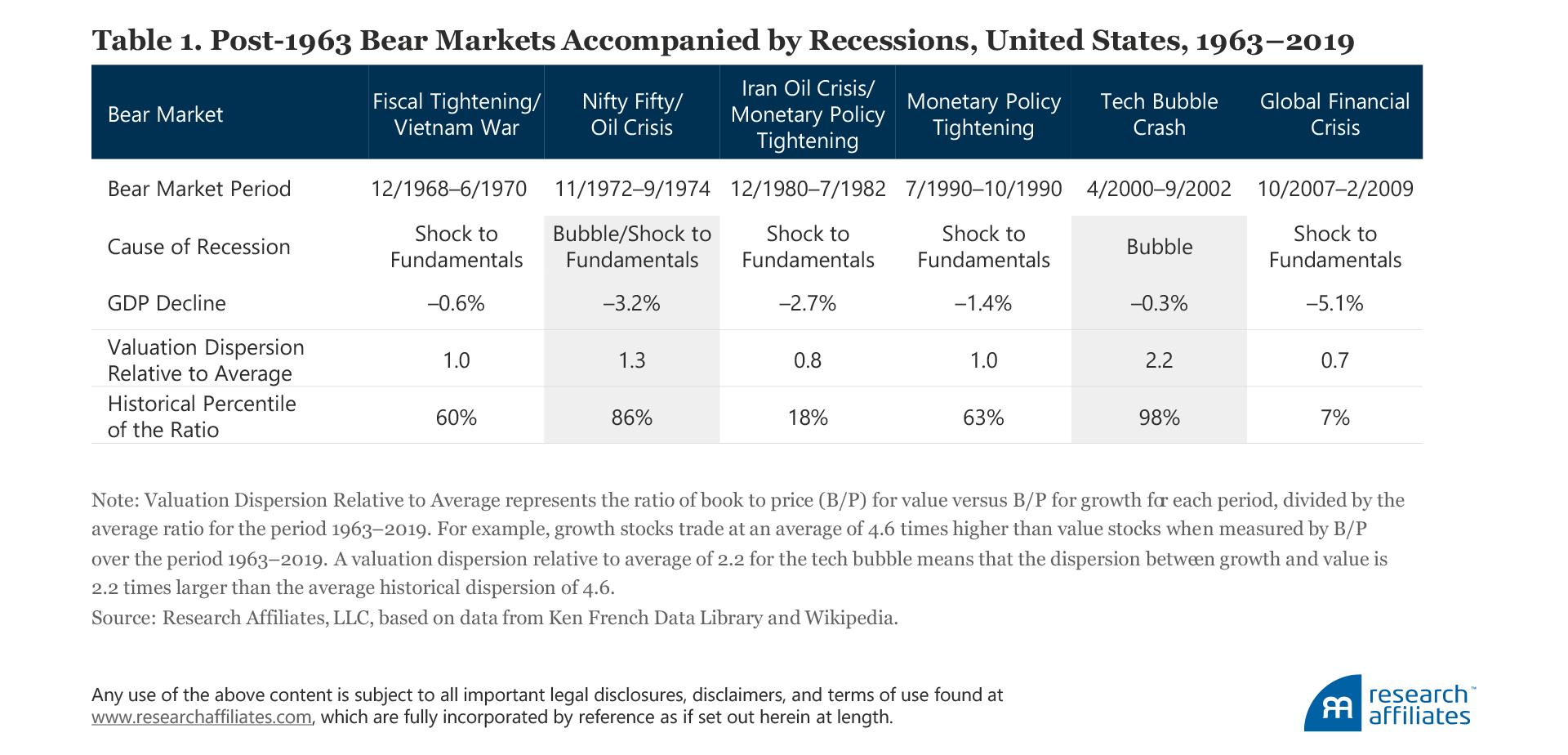

Two of the six bear markets were widely characterized as relative stock-valuation bubbles’ bursting,2 and the other four began with a shock to fundamentals. Importantly, all six were rare and unique events, with all but one event separated by a span of 7 to 10 years, which places limits on extrapolation.

We use these six episodes as case studies to explore the potential outcomes investors can expect when the market recovers. Our primary focus is on the implications for value strategies, but we also examine the implications for other factors. We conclude by reviewing the present crisis to assess the most likely parallels to historical observations.

Crisis and Opportunity

Economic crises, market declines, and extreme market volatility are all unnerving for most investors. Times of high uncertainty and fear, however, also create excellent investment opportunities.

The six US bear markets we study are the fiscal tightening and Vietnam War; Nifty Fifty bubble and oil crisis; Iran oil crisis and Volcker monetary policy tightening; early 1990s monetary policy tightening; tech bubble; and global financial crisis. The primary catalyst for four of the six market and economic downturns—fiscal tightening and Vietnam war, Iran oil crisis, early 1990s monetary policy tightening, and global financial crisis—was a shock to fundamentals. We view the catalysts, or at least meaningful partial catalysts, of the two remaining bear markets—the Nifty Fifty and the tech bubble—to be bubbles that burst.3 Although no clear guidelines for identifying bubbles exist,4 these two periods are frequently mentioned in the investment literature as bubbles.5

Importantly, in characterizing these two periods as bubbles, we are not implying that equity markets, on the whole, were overvalued, rather that only certain market segments experienced overvaluation. In both periods, we empirically observe significantly wider-than-average pre-crisis value–growth valuation dispersions (we provide these statistics later) that potentially signaled some level of irrational exuberance about specific cohorts of stocks. In both cases, the start of the bear market coincided with the shrinking of the valuation spread. We interpret this as the bursting of the bubble. In neither crisis did the more expensively priced stock cohorts recover to their pre-crisis valuations.6

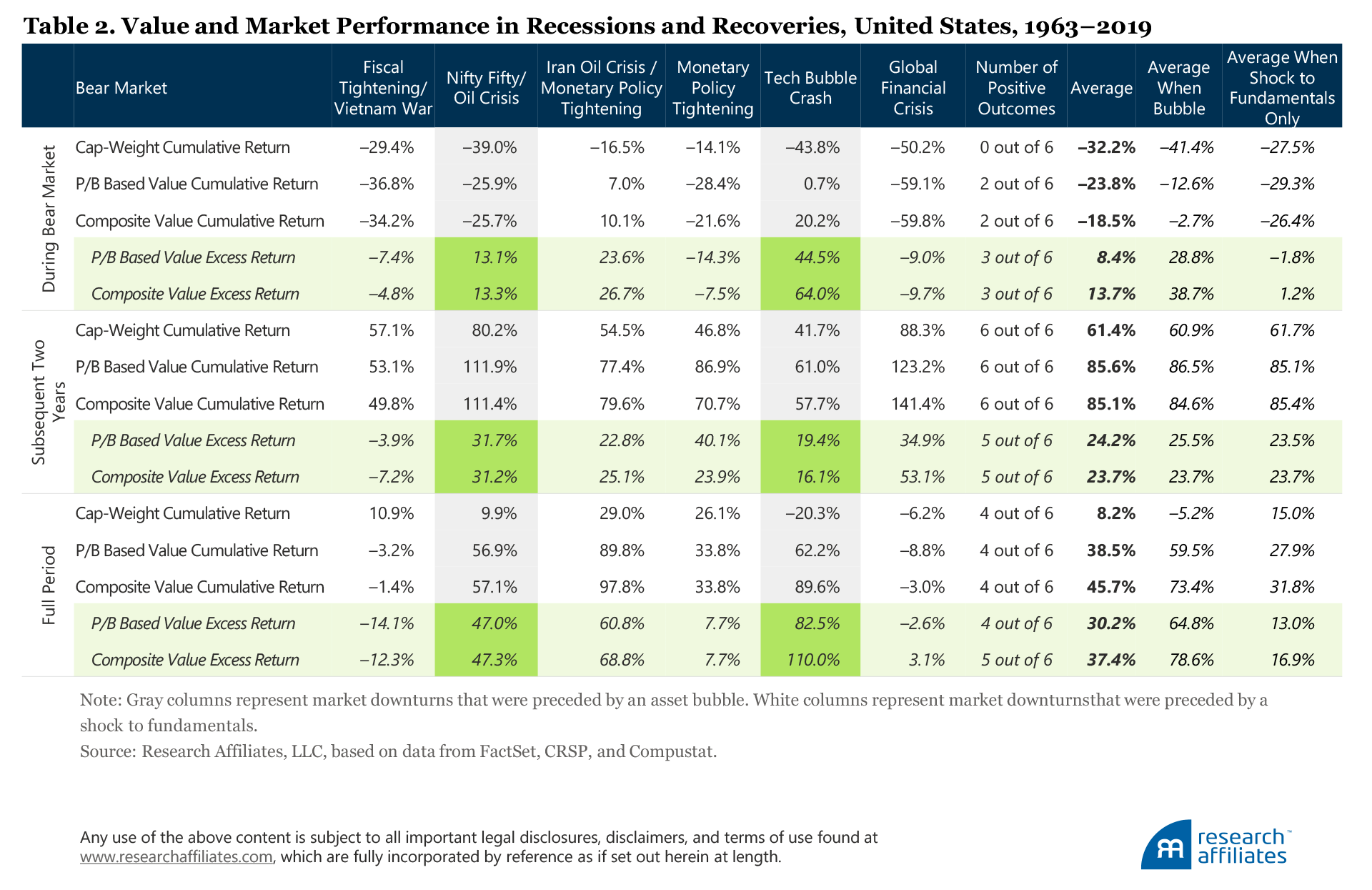

In the six market downturns we study, the S&P 500 Index, on average, experienced a 32% decline from the market peak to the market bottom. During these periods, the two value strategies in our analysis outperformed on average by 12%. When the market decline was preceded by (and partly caused by the burst of) an asset bubble and, characteristically, by a wide dispersion in value–growth valuations, value strategies did much better, outperforming the market by about 34% on average from the market peak to bottom. When the decline was caused solely by a shock to fundamentals, value stocks were hit relatively worse, not unlike our experience in the first-quarter 2020 bear market. Although we observe a wide valuation dispersion in the current period, the current crisis is not associated with the bursting of a bubble, unlike the Nifty Fifty and the tech bubbles.

During the six recoveries we study, value outperformed the market in five, each time by double digits; the average cumulative outperformance was 24%. The only case when value underperformed in the recovery was the period that coincided with the build-up to the Nifty Fifty bubble from 1970 to 1972. When the Nifty Fifty bubble burst, value handily outperformed growth, not only in the bear market but across the full downturn–recovery cycle.

Systematic strategies, such as low volatility, quality, and size, often described as factor investing or smart beta, have been gaining popularity and attracting assets at a rapid pace. These strategies, too, can represent both challenges and opportunities in turbulent times such as those we are currently experiencing. We find that low volatility strategies tend to exhibit a more muted decline than other strategies in bear markets and to rebound more slowly in market recoveries.

Over the full cycle, the low volatility portfolio chalked up the highest performance of the four systematic strategies other than value. Quality portfolios tend to show on average mild outperformance during bear markets and significant outperformance in the recoveries. The small-cap strategies tend to do quite poorly over the market’s decline, but offer dramatic outperformance during the recovery. Finally, the cross-sectional momentum strategies tend to suffer in both bear markets and market recoveries.

Bear Markets and Recessions over the Last 57 Years

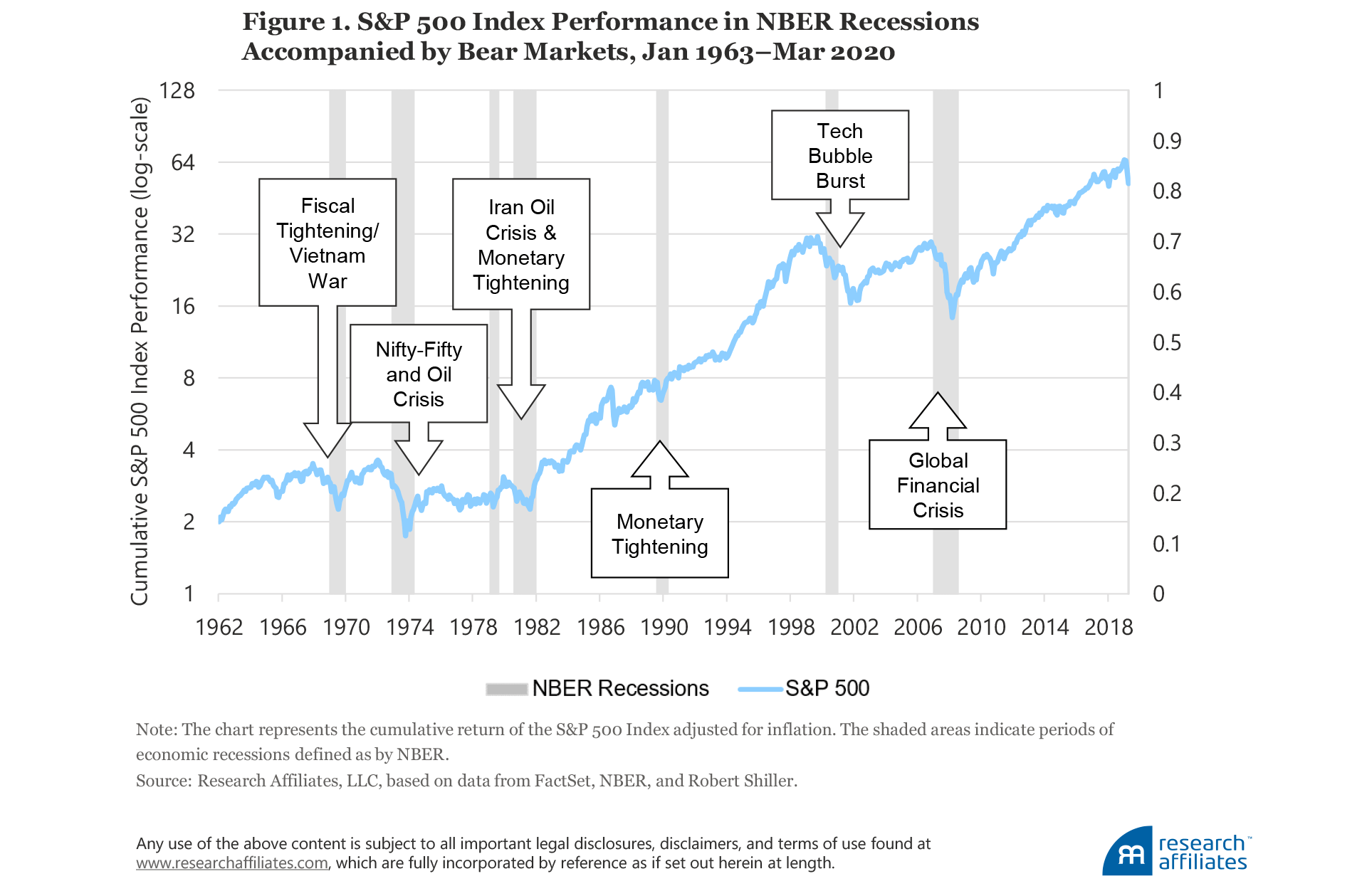

Since 1963, the United States has experienced seven economic recessions, shown in gray in Figure 1, as defined by the National Bureau of Economic Research (NBER). A pronounced equity bear market in which the S&P 500 lost 32% on average from peak to trough accompanied six of these seven recessions.

Fiscal tightening and Vietnam War. The close of the 1960s marked a nearly decade-long expansion, and inflation was on the rise. Deficit spending to support the Vietnam War and full employment both contributed to inflationary pressures. Fiscal tightening to address the budget deficits, and monetary tightening by the Federal Reserve through raising interest rates, preceded a mild recession late in 1969.

Nifty Fifty bubble and oil crisis. In the late 1960s and early 1970s, the stock market was booming, and about 50 companies, called the Nifty Fifty, were leading the charge. They included IBM, Xerox, General Electric, and Polaroid. These were the high-tech companies of the day, rivaling the innovation potential of Google and Amazon today. The mantra was that these companies were worth buying at any price. The result was the Nifty Fifty bubble. By 1972, the value–growth valuation dispersion was roughly 25% wider than the 57-year (1963–2019) average and wider than 86% of historical observations since 1963. The bubble burst when the Organization of the Petroleum Exporting Countries (OPEC) imposed an oil embargo and oil prices tripled, triggering an economic recession in November 1973 that lasted until March 1975, accompanied by an equity bear market and subsequent stagflation.

Iran oil crisis and Volcker monetary policy tightening. The Iranian revolution in 1979 caused a severe global energy crisis. At about the same time, Paul Volcker became chairman of the US Federal Reserve System. Under his leadership, the Fed adopted tighter monetary policies to curb inflation. The combination of the energy crisis and monetary tightening was the precursor of a recession that lasted from July 1981 through November 1982 and an equity bear market from December 1980 through July 1982.

Early 1990s monetary policy tightening. After a long economic expansion in the 1980s, another round of monetary tightening, rising oil prices after Iraq invaded Kuwait, and ballooning debt levels were all economic shocks that contributed to a brief recession lasting from July 1990 to March 1991.

Tech bubble. The widespread expansion of the internet in the 1990s created unique new business opportunities. Fueled by lower interest rates and reduced capital gain taxes, internet companies attracted speculative capital, launching a massive wave of initial public offerings. As a result, the value–growth valuation dispersion grew to be 120% wider than the historical average since 1963. Until displaced by the experience of first-quarter 2020, this had been the all-time high valuation dispersion. By April 2000, the bubble had begun to burst, leading to a vast reduction in wealth as many stock prices dropped precipitously. A relatively mild recession ensued over the March–November 2001 period.

Global financial crisis. In the early- to mid-2000s, low interest rates, advances in securitization, lax regulation, and reckless lending spurred a boom in the subprime mortgage market, fueling a housing bubble. By 2007, prices of subprime mortgages began a decline that led to an international banking crisis. The crisis culminated with Lehman Brothers’ default in September 2008. The global strain on the financial sector and the risk of further financial contagion substantially reduced access to credit and caused an economic downturn. Substantial government intervention was required to rescue the financial industry and to kick-start the economy. The subsequent recession lasted from December 2007 to June 2009.

Table 1 summarizes the key statistics of six recessions that were accompanied by bear markets in our study period. The recession during the January 1980–July 1980 period was omitted because it was not accompanied by a bear market. The average GDP decline across the six episodes is −2.2%. The mildest recession, with a GDP decline of −0.3%, followed the tech bubble, and the most severe, with a GDP decline of −5.1%, followed the global financial crisis.

Value’s Performance in Perilous Times

We examine the performance of two value strategies and the US equity market (S&P 500 Index) over each of the six bear markets. One value strategy uses book-to-price (B/P) ratio to define value; the other uses an average of five-year average sales-to-price, five-year average earnings-to-price, five-year average dividends-to-price, and most recent year-end book-to-price ratios. We calculate performance for each of the periods over the following intervals: 1) bear market (peak to trough); 2) recovery (two years following trough); and 3) full period (peak through two years after trough).

Performance analysis. Let’s begin by looking at performance during the bear market periods. Table 2 reports the results. The average market drawdown in these six bear markets was −32.2%. The decline tends to be more profound when preceded by a bubble, characterized by a wide relative valuation between value and growth: −41.4% (−39.0% and −43.8% for the Nifty Fifty and tech bubbles, respectively) versus −27.5% for the bear markets caused by a shock to fundamentals alone.

The average performance of the two value strategies over the six bear markets exceeded the market’s average performance; the average excess return was 11.0% driven by value’s performance in the two bear markets preceded by bubbles. Value showed no outperformance (−0.3%) during the bear markets caused by a shock to fundamentals alone. Value’s outperformance was stronger in the tech bubble crash, which was not associated with a strong shock to fundamentals. These observations are consistent with the idea that value stocks tend to be price sensitive, reacting negatively to a shock to fundamentals. Value stocks also tend to benefit after a bubble bursts.

Now, we compare value’s performance in the two-year period that follows the trough. The market recovered on average by 61.4%: 60.9% after a bear market preceded by a bubble and 61.7% after a bear market triggered by a shock to fundamentals alone. Both definitions of value outperformed over recoveries in five out of six cases. The only recovery in which value did not outperform followed the bear market related to fiscal tightening and the Vietnam War. The recovery from that crisis was associated with the build-up of the Nifty Fifty bubble. Value’s level of outperformance shows no discernable difference between recoveries related to bubbles’ bursting and those not.

Lastly, we analyze value’s performance for the period from peak to two years after the trough. The market’s average performance over this period was 8.2%. If a bubble preceded the bear market, the market on average ended the period below the pre-recessionary level by −5.2% and above by 15.0% if the recession was caused by a shock to fundamentals alone. Through the full cycle, value mostly outperformed. The average excess return for the two value strategies is 33.8%. The outperformance tends to be stronger when the bear market started with a wide valuation multiple (i.e., associated with a bubble): average outperformance of 71.7% with a bubble and 14.9% with no bubble.

Performance drivers. What drives value’s performance in bear markets and recoveries? Lakonishok, Shleifer, and Vishny (1994), Barberis and Shleifer (2003), and Barberis, Shleifer, and Wurgler (2005), among others, have suggested that the performance gap between value and growth stocks is primarily driven by market sentiment: value stocks tend to be out of favor with investors, while growth stocks tend to be popular and well loved by investors. Bubbles tend to be periods with extreme mispricing. When a bubble bursts, this reversion to the mean can be quite violent: value companies tend to outperform the market, and growth companies tend to underperform the market.7

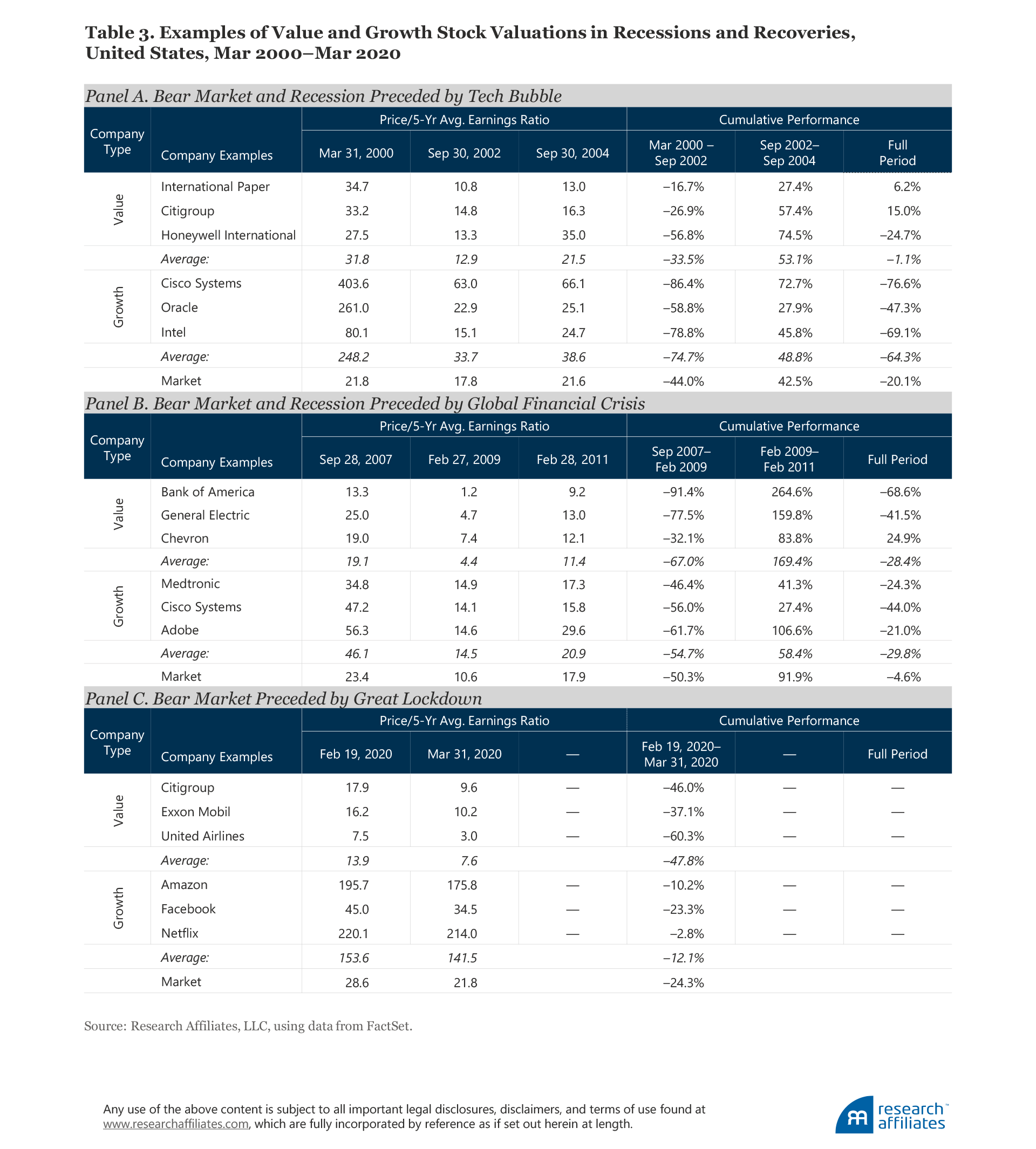

Value stocks can also have weak growth prospects or areas of distress and therefore command a relatively lower price than other stock classifications, such as growth. A shock to underlying fundamentals tends to hit these companies relatively hard, as demonstrated by Campbell, Polk, and Vuolteenaho (2010). In a recessionary environment, the risk assessment rises for these companies, and investors demand a higher return premium (lower share price) for holding their shares.To illustrate these dynamics, we analyze the bear markets and recoveries that follow the tech bubble and the global financial crisis as respective examples of a bear market associated with the bursting of a bubble and a shock to fundamentals. Table 3 displays the price-to-five-year average earnings (P/5YrE) ratio and the performance for a few stocks classified as value or growth as examples to illustrate typical behavior during both of the recession–recovery episodes.

Panel A compares the behavior of value and growth stocks following the bursting of the tech bubble. The value stocks are International Paper Company, Citigroup, and Honeywell. Before the bear-market recession, with an average ratio of P/5YrE of 31.8, they were not cheap, being 46% more expensive than the market, which was trading at a P/5YrE of 21.8. At the trough, however, their average P/5YrE was 12.9, lower than the market P/5YrE of 17.8. Certainly, the stock prices of these companies reflected recession-related operational problems, but also likely captured a risk premium for those investors willing to hold these stocks.

At the peak of the market, the growth companies we compare—Cisco, Oracle, and Intel—were priced at quite aggressive valuation multiples, about 1040% more expensive than the market. When the market decided that adding “.com” to a company’s name was actually not worth that much, the exuberantly priced tech growth stocks took a significant hit. At the trough, the average P/5YrE of the three growth stocks had fallen to 33.7 from 248.2 at the peak, but still remained above the market P/5YrE.

Both value and growth stocks benefited as the economy moved into recovery, but the three value stocks benefited more. As recessionary concerns eased, the fear premium embedded in the value stocks rewarded the value investors. We observe that in bubble-related bear markets, the value strategy wins in two ways: first, value stocks’ prices exhibit relatively less deterioration in the bear market, and, second, freshly cheap companies are available to rebalance into at the beginning of the recovery.

Panel B compares the behavior of three value stocks—Bank of America, General Electric, and Chevron—and three growth stocks—Medtronic, Cisco, and Adobe—following the global financial crisis. Before the bear market and recession, the gap between value and growth valuations was not that large: value companies were trading at an 18% discount to the market, and growth companies were trading at a 97% premium.

The collapse of several large financial institutions and fear of broader financial contagion made banks, companies that relied on credit, and companies in cyclical sectors very scary to hold as the bear market and recession unfolded. The stock prices of these types of companies dropped rapidly, and their valuation multiples reflected this adjustment. The average P/5YrE dropped to 4.4, a 58% discount to the market, reflecting not only the increased business risk, but also compensation to investors for bearing these risks.

When it became clear that the financial sector would withstand the shocks of the global financial crisis, these companies’ stock prices recovered, and their valuations climbed. From trough to recovery, the three value stocks’ average cumulative performance was 169.4% compared to that of the three growth stocks at 58.4%. Investors willing to rebalance into these companies at the time of peak fear (trough) earned a handy return.

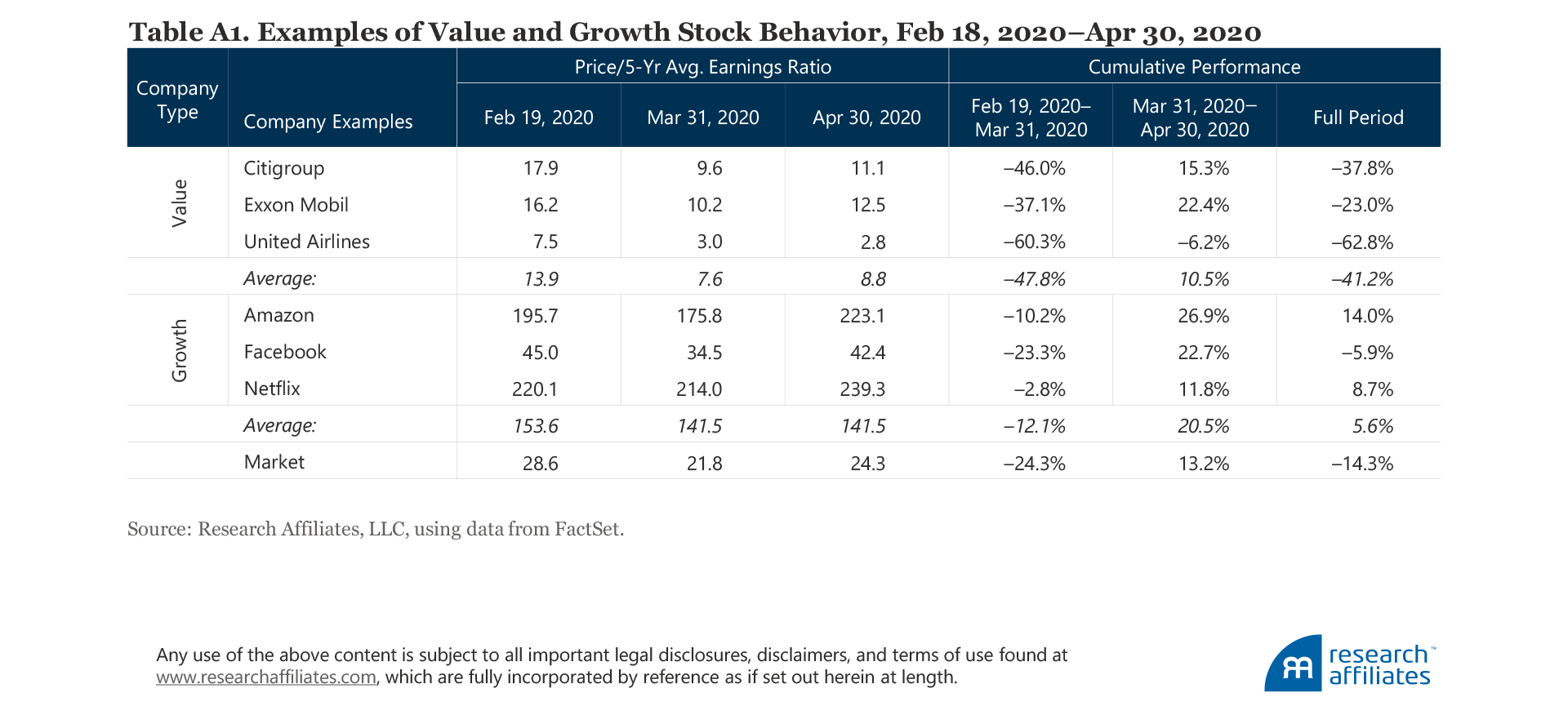

Panel C reports the same measures for selected value and growth stocks for the bear market caused by the COVID-19-related Great Lockdown. At this point, we do not know if the March low will be the cycle’s trough or an interim trough. We show P/5YrEs at the peak of the market on February 19 and after the significant market drop on March 31.8 Before the peak of the market, the stocks of many value companies in the energy, financial, and airline sectors were already quite unloved by the market. In contrast, Citigroup, Exxon Mobil, and United Airlines, our sample value stocks, were trading at a 52% discount to the market before the lockdown began. At the peak, our sample growth stocks—Amazon, Facebook, and Netflix, loved by a market expecting high growth rates for years to come—were trading at a 440% premium to the market.After the recent market low in March, the value companies’ stock prices had traded at even steeper discounts, embedding a larger “fear premium” for investors willing to buy them. The discount to the market measured by the P/5YrE was 65% at the end of March. The valuation comparison to the growth stocks was stark. At the end of March, the growth stocks were trading at a market premium of 550%, greater than the premium at the February peak.

We can generalize from our analysis by observing that before a recession investors appear to focus on opportunities and to ask, “What more can go right for this company?” During a recession, however, they do an about-face and appear to acknowledge all that can actually go wrong for these companies. Once in a downturn, the stock prices of value companies typically reflect the genuine business risks the companies face. Fear and uncertainty drive down the stock price, creating the potential for decent compensation for those investors willing to rebalance into these newly cheap stocks.

During a severe recession, the business risk, such as bankruptcy or partial nationalization, for an individual company in a troubled industry, such as energy, financials, or airlines, is quite real. Could United Airlines or American Airlines go bankrupt in the months to come? Of course! Nevertheless, the risk is likely limited to one, two, or maybe even several companies, not the entirety of the industry or sector. Therefore, if investors follow a disciplined and diversified approach, they can insulate themselves from much of the risk associated with a single company.

Behavior of Other Systematic Strategies

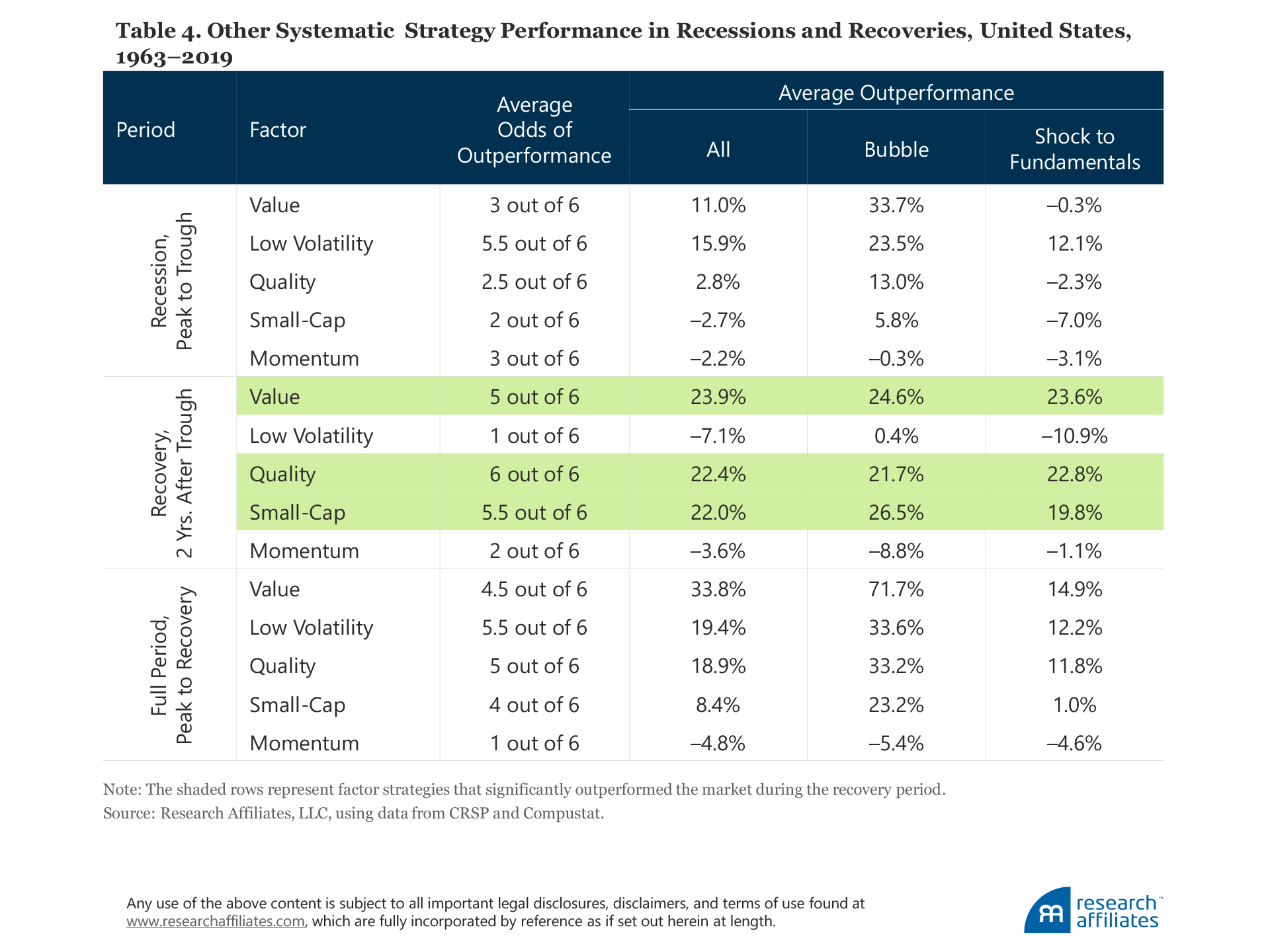

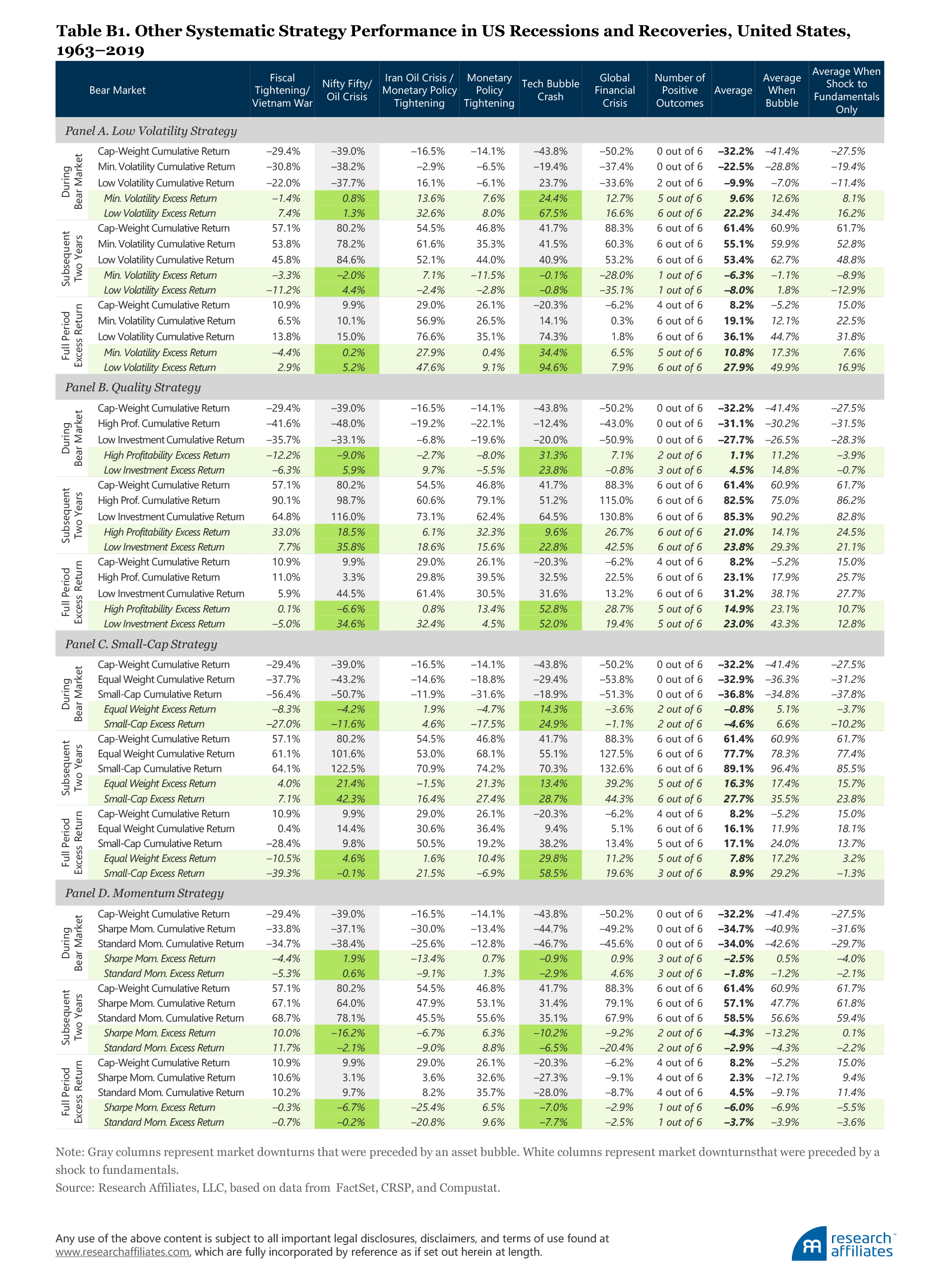

In the previous section, we examined value stocks’ behavior in two bear market episodes and their related recession and recovery periods. How do other systematic strategies behave in recession and recoveries? Table 4 summarizes the behavior over the study period for the value factor and four other popular factor strategies: low volatility, quality, momentum, and small-cap (also known as the size factor). We report the full details describing the last four factors’ performance for these periods in Appendix B. We also provide definitions of the systematic strategies in Appendix C.

Low volatility. The low volatility factor is one of the earliest identified factors. Haugen and Heins (1972) and Black, Jensen, and Scholes (1972) demonstrated that low risk (or low volatility) stocks are not associated with lower returns, meaning that on a risk-adjusted basis they offer a return advantage. Notably, the main advantage of low volatility or low beta strategies comes not necessarily from the higher total return, but from significant risk reduction.9

As we observe in our simulations, low volatility strategies tend to lose in declining markets. Still, both low-risk strategies we examine tend to fall by less than the market, outperforming in almost all of the six bear markets (odds of 5.5 out of 6). Outperformance tends to be larger if the bear market is caused by a bubble’s bursting (23.5%) and tends to be smaller when driven by a shock to fundamentals (12.1%).

In recoveries, low vol strategies slightly underperform, again, quite consistently in five out of six cases. Because the performance of these strategies deteriorates relatively less in a bear market than the performance of other strategies and because their performance lag in the recovery is relatively minimal, over the full cycle low vol strategies tend to outperform the market by a substantial margin (19.4%).

Quality. The quality factor does not enjoy a standard definition. Hsu, Kalesnik, and Kose (2019) surveyed the six most common quality definitions used by index providers and found that not all definitions or signals are robust. They found that high profitability and low (or conservative) investment are the two definitions of quality most strongly supported by the empirical evidence.

The two quality definitions we use in our analysis—high profitability and low investment—show slight outperformance in bear markets (2.8%). The outperformance comes from bubble-induced market downturns. It appears that stocks of companies with relatively more robust current fundamentals tend to hold their price much better when bubbles burst.

The quality strategies show strong performance in recoveries, beating the market in all six out of six cases. The companies included in quality strategies tend to be more profitable and conservatively run. They tend to have deeper and broader moats that allow them to withstand a recessionary environment as well as to take advantage of opportunities that may present themselves during a recession. The stocks of companies with strong fundamentals also exhibit good outperformance in recoveries (22.4%).10

Small-cap (or Size). Another early factor discovery, also one of the most popular today, is the size factor.11 Many small-cap companies are perceived as risky, operating closer to the potential for distress, and being less liquid than large-cap companies.

Our analysis shows that prices of small-cap stocks decline, on average, on par with the market. The decline is more extensive in bear markets attributable to a shock to fundamentals (−7.0%), which is not surprising given that small-cap stocks may be closer to distress, riskier, and more illiquid. These are all features investors fear in a recession. These fears put downward pressure on prices and embed a higher fear premium for investors willing to hold them.

During recoveries, small-cap stocks quite consistently outperform the large-cap market. The fears that keep investors from wanting to hold riskier small-cap stocks in recessions ultimately reward the investors who do own them as the market recovers (22.0%).

Momentum. Cross-sectional momentum was first documented by Jegadeesh and Titman (1993). Momentum is the tendency of stocks that did well in the last 12 months to continue outperforming and is one of the strongest regularities in empirical data. Cross-sectional equity momentum benefits from trend continuation. Deteriorating market conditions associated with recessions can be quite hostile to stocks included in momentum-driven strategies. In market downturns, market participants tend to overreact to information, rather than underreact, the latter being a driver of positive momentum in upward-trending markets. Daniel and Moskowitz (2016) found that momentum tends to exhibit crashes in periods of high volatility.

The long-only momentum strategies we analyze tend to underperform in both bear markets (−2.2%) and recoveries (−3.6%). Both types of market environments are highly volatile with choppy trading, and investors begin to overreact rather than underreact to the news. Choppy markets offer a very hostile environment to a strategy that relies on the continuation of relative trends over an annual horizon.12

In summary, after examining six downturns and subsequent recoveries (which we should remember is a small sample!), we find that value, low volatility, quality, and small-cap strategies tend to do quite well in bear markets following the bursting of a bubble. If the bear market, however, is driven by a shock to fundamentals, only the low volatility strategy appears to offer significant performance protection. We conclude that recessionary periods can create opportunities for factor investors. In the recoveries that follow the recessions, value, quality, and small-cap strategies tend to perform quite well.

Finding Opportunity in the Great Lockdown

The full scope of the economic damage done by the Great Lockdown is still unknown, but it looks to be massive. An early indication is the 40.8 million new unemployment claims filed for the 10 weeks ending March 21 to May 23. To put these numbers into perspective, they are seven times higher per week than the worst weekly claims ever filed during the worst of the 1982 recession and represent about 190 weeks of new unemployment claims at the weekly rate registered for the month of February 2020. In nonrecessionary times, as many people come off the unemployment rolls on average as make new jobless claims in any given week.

China’s experience may be indicative of what the United States can expect. In January/February 2020, the Chinese economy had year-over-year reductions of nearly 14% in industrial output, of roughly 20% in retail sales, and of approximately 24% in fixed asset investment. COVID-19 is likely to be the most substantial shock to the US economy since WWII, locking down a massive portion of the productive capacity of the world’s largest economy, breaking supply chains, and shuttering many businesses. Over just a few weeks in early March, circuit breakers halted stock market operations three times after the market suffered more than a 7% daily decline. From the S&P 500’s peak on February 19, 2020, to March 23, 2020, the S&P 500 fell by a daunting 34%.

The Great Lockdown, however, is not the only reason the equity market sold off so rapidly in February. Then and now much of the market can be characterized as being in bubble territory. An extreme market concentration in a handful of stocks—Facebook, Apple, Netflix, Microsoft, Amazon, and Alphabet (Google)—currently makes up over 23% of the S&P 500.13 Arnott et al. (2020) demonstrated that value is currently experiencing its longest drawdown versus growth by both duration and magnitude going back to 1963, and the valuation dispersion between growth and value is the widest it has ever been. As of March 31, 2020, value was trading at a relative valuation of 0.10 versus growth when measured by B/P.

In addition to bubble conditions, other contributors to the bear market slide beginning in February 2020 included:

- an expensive US equity market, which by historical standards was priced at about 30 times 10-year average earnings;

- an inverted yield curve in 2019 and other signs of a possible near-term recession;

- an abnormal risk tolerance by investors as evidenced by the anemic prospective returns offered by the major asset classes;

- considerable exposure by investors to strategies with embedded optionality and illiquid positions, which can massively backfire after a market shock and result in fire-sale prices; and

- one of the longest economic expansions and bull markets in recent history, paired with abnormally low volatility, which challenges the odds of continuing the upward trend.

We may or may not have seen the market bottom in this recession. In the past, bear markets have tested the lows over an extended period, but the unprecedented levels of fiscal and monetary stimulus being brought to bear in the current crisis may prop up share prices and prevent new market lows. Nevertheless, the Great Lockdown has already exerted tremendous negative pressure on the economy, and the associated uncertainty about future growth triggered a swift and deep equity bear market.

In the bear market we just witnessed, value and other factors took quite a severe hit. We have demonstrated this behavior is typical of bear markets caused by a big shock to fundamentals. Before the recent market downturn, the valuation dispersion was very wide, as is characteristic of a bubble period, and interestingly, actually widened further during the downturn, reaching all-time peak.

We know from the historical evidence that fear and volatility create investment opportunities. Patient investors, who are willing to accept these risks when share prices reflect the appropriate fear premium, should be handily rewarded in times of recovery when the economic uncertainty is resolved. Given the historically wide valuation dispersion, the resolution of uncertainty could be the trigger for the valuation gap to close and would imply an attractive opportunity for value investors.

Appendix A

Appendix B

Appendix C

Systematic Strategy Descriptions

Cap-Weight = the S&P 500 Index.

Book-to-Price-Ratio–Based Value = a simulated strategy that selects the top 30% of US stocks by B/P ratio within both the large-cap and small-cap spaces. The strategy is rebalanced annually at the end of June.

Composite Value = a simulated strategy that selects the top 30% of US stocks by the average of B/P ratio, five-year average E/P, five-year average sales-to-price ratio, and five-year average dividends-to-price ratio within both the large-cap and small-cap spaces. The strategy is rebalanced annually at the end of June.

Low Volatility = the average return of the following two strategies:

- Minimum Volatility: A simulated strategy that employs a constrained optimization on the Large + Mid Cap US equity universe to minimize volatility. Constraints include minimum and maximum constituent, country, and sector weights, and turnover. The optimization is recomputed semi-annually. Full details on the optimization approach can be found in “Methodologies Used in the Interactive Smart Beta Tool."

- Low Volatility: A simulated strategy that selects the 100 lowest-volatility stocks within the US from the top 500 by market cap, where volatility is defined as the standard deviation of daily returns over the prior year. Stocks are weighted by 1/volatility and rebalanced quarterly.

Quality = the average returns of the following two strategies:

- High Profitability: A simulated strategy that selects the top 30% of US stocks by gross profitability (sales minus cost of goods sold/assets) within both the large-cap and small-cap spaces. The strategy is rebalanced annually at the end of June.

- Low Investment: A simulated strategy that selects the top 30% of US stocks by low investment (measured by year-over-year change in total assets) within both the large-cap and small-cap spaces. The strategy is rebalanced annually at the end of June.

Momentum = the average returns of the following two strategies:

- Sharpe Ratio Momentum: A simulated strategy that selects US stocks from the starting universe based on momentum score. Momentum score combines prior 6-month and 12-month Sharpe ratios. Stocks are weighted by market cap times momentum score and are rebalanced semi-annually (in June and December) with additional rebalances triggered by volatility spikes.

- Standard Momentum: A simulated strategy that selects the top third of US stocks by momentum from the starting universe, where momentum is defined as prior-year return, skipping the most recent month. Stocks are weighted by market cap and are rebalanced quarterly.

Small-Cap (or Size) = the average returns of the following two strategies:

- Equal Weight: A simulated strategy that equally weights all stocks in the starting universe and rebalances quarterly.

- Small Cap: A simulated strategy that selects US stocks ranked 1,001–3,000 by market capitalization. Stocks are weighted by market cap and rebalanced semi-annually in June and December.

Please read our disclosures concurrent with this publication: https://www.researchaffiliates.com/legal/disclosures#investment-adviser-disclosure-and-disclaimers.

Endnotes

- The period we study from January 1963 through March 2020 includes seven recessions, as defined by the National Bureau of Economic Research. Six were accompanied by a bear market, beginning with the 1968 episode related to fiscal tightening and the ramp up in the Vietnam War. A short recession in 1980 was not associated with a bear market, and the bear market in 1987 was not accompanied by a recession. Since these periods are less representative of the current period we exclude them from this study.

- We explain how we are using the term bubble later in the article when we introduce and characterize the market drawdowns associated with the six recessions.

- The bear markets we classify as beginning with a shock to fundamentals may also have some bubble elements that occur prior to or coincident with their start; for example, the global financial crisis was preceded by a housing bubble, just one of several contributing factors. Importantly, unlike the Nifty Fifty and tech bubbles, a wide dispersion in equity market relative valuation was not the source of these recessions.

- For example, Eugene Fama, a staunch proponent of the efficient market hypothesis, has stated: “Statistically, people have not come up with ways of identifying bubbles” (“Are Markets Efficient?” Chicago Booth Review video, June 30, 2016. Available at https://www.youtube.com/watch?v=bM9bYOBuKF4).

- For example, Forbes (1977) and Baker and Wurgler (2007) referred to the Nifty Fifty period as a bubble, and Griffin et al. (2010) and Frehen, Goetzmann, and Rouwenhorst (2012) mentioned the tech bubble as a recent bubble example.

- The original observation that the Nifty Fifty stocks did not justify their pre-crises valuations was made by Forbes (1977). Two decades later, Siegel (1998) disputed that position, arguing that if investors had waited until 1997, peak valuations would imply only a modest overvaluation. Fesenmaier and Smith (2002) pointed out that Siegel’s claim is quite specific to certain stocks. Kalesnik and Kose (2014) also provided evidence that Siegel’s conclusion relied on an apples-to-oranges comparison of an equally weighted list of the Nifty Fifty stocks versus the capitalization-weighted S&P 500 Index. When both are measured on a similar, capitalization-weighted footing, the Nifty Fifty is shown never to have caught up to the market’s performance.

- The same events also have a risk-based explanation. Campbell, Polk, and Voulteenaho (2010) showed also that growth stocks tend to be more sensitive to variations in price-to-earnings (P/E) ratios, which they interpret as discount rate shocks. During recessions, market participants tend to demand higher compensation for bearing risk, which drives up the discount rate and disproportionately drives down the return of growth companies. Cornell (1999) suggested that value stocks tend to have larger cash flows closer to the present, whereas growth stocks tend to have larger cash flows further out in the future. This difference makes growth stocks more sensitive to variations in the discount factor.

- In Appendix A, we report valuation multiples and performance through April 30, 2020, which includes the strong market rebound that followed the March trough.

- Even in more-recent research, such as the findings of Arnott et al. (2019), the return difference between the low-beta and high-beta portfolios is not statistically significant. After being adjusted for market risk, this return becomes strongly statistically significant.

- Harvey et al. (2019) also found that quality portfolios tend to protect investors in market downturns.

- After examining the evidence, Beck et al. (2016) raised several concerns about the small-cap factor being a robust driver of performance. They concluded that other more-robust factors implemented in the small-cap space may offer better ways to benefit from the small-cap universe in which many factors offer more attractive returns because of higher volatility and greater likelihood of mispricing.

- We examine the long winner-side of the momentum portfolio. On a long–short basis, the behavior can be quite different; momentum crashes have been documented, to a large degree driven by the short leg of the portfolio. The behavior of cross-sectional momentum is also quite different from time-series momentum, which may actually be beneficial to investors in downturns as pointed out by Harvey et al. (2019).

- As of 5/13/2020. Source: Bianco Research.

References

Arnott, Rob, Campbell Harvey, Vitali Kalesnik, and Juhani Linnainmaa. 2019. “Alice’s Adventures in Factorland: Three Blunders That Plague Factor Investing.” Journal of Wealth Management, vol. 45, no. 4 (April):18–36.

———. 2020. “Reports of Value’s Death May Be Greatly Exaggerated.” Research Affiliates Publications (May 25).

Baker, Malcolm, and Jeffrey Wurgler. 2007. “Investor Sentiment in the Stock Market.” Journal of Economic Perspectives, vol. 21, no. 2 (Spring): 129–152.

Barberis, Nicholas, and Andrei Shleifer. 2003. “Style Investing.” Journal of Financial Economics, vol. 68, no. 2 (May):161−199.

Barberis, Nicholas, Andrei Shleifer, and Jeffrey Wurgler. 2005. “Comovement.” Journal of Financial Economics, vol. 75, no. 2 (February):283−317.

Beck, Noah, Jason Hsu, Vitali Kalesnik, and Helga Kostka. 2016. “Will Your Factor Deliver? An Examination of Factor Robustness and Implementation Costs.” Financial Analysts Journal, vol. 72, no. 5 (September/October):55−82.

Black, Fischer, Michael Jensen, and Myron Scholes. 1972. “The Capital Asset Pricing Model: Some Empirical Tests.” In Studies in the Theory of Capital Markets, edited by M. C. Jensen. New York: Praeger.

Campbell, John, Christopher Polk, and Tuomo Vuolteenaho. 2010. “Growth or Glamour? Fundamentals and Systematic Risk in Stock Returns.” Review of Financial Studies, vol. 23, no. 1 (January):305–344.

Cornell, Bradford. 1999. The Equity Risk Premium: The Long-Run Future of the Stock Market. New York: Wiley.

Daniel, Kent, and Tobias Moskowitz. 2016. “Momentum Crashes.” Journal of Financial Economics, vol. 122, no. 2 (November):221–247.

Fesenmaier, Jeff, and Gary Smith. 2002. “The Nifty-Fifty Re-Revisited.” Journal of Investing, vol. 11, no. 3 (Fall): 86-90.

Forbes. 1977. “The Nifty Fifty Revisited.” (December 15): 72–73.

Frehen, Rik, William Goetzmann, and Geert Rouwenhorst. 2012. “New Evidence on the First Financial Bubble.” Yale ICF Working Paper No. 09-04 (July 27).

Griffin, John, Jeffrey Harris, Tao Shu, and Selim Topaloglu. 2011. “Who Drove and Burst the Tech Bubble?” Journal of Finance, vol. 66, no. 4 (August): 1251–1290.

Harvey, Campbell, Edward Hoyle, Sandy Rattray, Matthew Sargaison, Dan Taylor, and Otto Van Hemert. 2019. “The Best Strategies for the Worst of Times: Can Portfolios Be Crisis Proofed?” Journal of Portfolio Management, vol. 45, no. 5 (July): 7–28.

Haugen, Robert, and James Heins. 1972. “On the Evidence Supporting the Existence of Risk Premiums in the Capital Markets.” Wisconsin Working Paper (December).

Hsu, Jason, Vitali Kalesnik, and Engin Kose. 2019. “What Is Quality?” Financial Analysts Journal, vol. 75, no. 2 (Second Quarter):44–61.

Jegadeesh, Narasimhan, and Sheridan Titman. 1993. “Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency.” Journal of Finance, vol. 48, no. 1 (March):65–91.

Kalesnik, Vitali, and Engin Kose. 2014. “The Moneyball of Quality Investing.” Research Affiliates Fundamentals (June).

Lakonishok, Josef, Andrei Shleifer, and Robert Vishny. 1994. “Contrarian Investment, Extrapolation, and Risk.” Journal of Finance, vol. 49, no. 5 (December):1541–1578.

Siegel, Jeremy. 1998. “Valuing Growth Stocks: Revisiting the Nifty Fifty.” AAII Journal (October):120–124.