Research fads, which create bubbles in academia, gobble up resources and crowd out exploration of competing ideas.

Investment-related academic bubbles have a cost. In the best case, money is lost by investors chasing fragile ideas. In the worst case, the general public suffers real pain when the economy at large is hit directly, such as in the 2008 global financial crisis.

Academics and practitioners alike can stop contributing to bubbles by being more skeptical and curious, and reaffirming a commitment to the scientific method in which theories are testable, verifiable, and falsifiable.

We often talk about bubbles in financial markets. Bubbles also exist in popular ideas and in academic research. Research fads gobble up resources and crowd out exploration of competing ideas until the hot topic is exhausted. By then, the topic of the day is often stretched dangerously beyond its usefulness.1

To state the obvious, academe—an extraordinary source of ideas and insights— is no less susceptible to bubbles than is the stock market. The bubble phenom- enon is not, by any means, unique to finance theory. String theory, anyone? String theory is a brilliant hypothesis that fails the most basic test for scientific method: it’s unfalsifiable. The theory cannot be tested and therefore cannot be shown to be false.

As consumers of academic research, we should seek to take the good and leave the bad, mindfully aware we cannot easily discern one from the other. As quants, we should aim to be healthy skeptics, neither gullible nor overly cynical, hyper-alert to the risks and consequences of data mining and selection bias. We should also recognize that much of academia disregards the inconveniences of trading costs, bid–ask bounce, missed trades, implementation constraints, and other portfolio construction nuances. Finally, we should harbor no illusions that—apart from the “free lunch” of diversification—the quest for alpha is easy, inefficiencies are lasting, or great ideas will not be quickly arbitraged away.

Anatomy of an Academic Bubble

Intellectual prowess does not imbue immunity to the susceptibility of participation in bubbles. Johannes Kepler, best known today for documenting the mathematics of planetary motions, was far prouder of his skills as an astrologer. In addition to inventing calculus and discovering gravity, Isaac Newton was equally passionate about alchemy. Sure enough, astrology and alchemy were contagious ideas of their eras, and those eras’ greatest minds went along for the ride.

Academic bubbles arise for precisely the same reason that bubbles arise in financial markets—human nature. An academic bubble typically starts with a truly significant and timely research insight. The researcher behind the groundbreaking insight receives well-deserved professional accolades, lasting credit, and splendid career growth. Soon enough, the halls of academe bustle with a growing roster of professors and post-docs pursuing similar research, likely out of genuine interest in the new insight. Students are encouraged, explicitly or not, to embrace the new approach. Those who go into the so-called real world follow the precepts they were taught. Within academe, newly minted PhDs seeking tenure often align their work with more senior colleagues. Very quickly, a dominant set of questions takes precedence, and other work is de-emphasized, even shunned.2 In the extreme, ideas that do not align with the dominant body of knowledge are labeled heretical, some- times explicitly, and dismissed altogether.

A good example of this phenomenon is the current ubiquitous reliance on neo-Keynesianism in the macroeconomics profession. Is it surprising that a field of economics that applauds the role of government in the macroeconomy garners generous government funding, while competing views do not? We surmise that Keynes himself would be hard-pressed to earn tenure in today’s academic community given his reluctance to rely on permanent deficits, preferring to run surpluses in good times, which can fund deficits in bad times, borrowing as needed if a recession is deep enough.

Eventually, sometimes with painful delay, one-time heresies are eventually accepted within both economics and the so-called hard sciences.3 Among these, we count continental drift; origin of species; heliocentric solar system and Newtonian physics; expanding universe (and now, accelerating universe); atoms and quarks; quantum physics, loathed by none other than Einstein himself; impact theory of mass extinctions; behavioral finance; and in the medical field, hand washing to avoid the spread of illness. All of these theories were viewed as heretical at the outset, and all are now received wisdom.

The theory of continental drift, for example, was put forth by a series of scientists beginning in the late 1500s through the mid-1800s. Alfred Wegener made the first modern attempt at formalizing the concept in the 1910s. The idea was rejected as recently as the 1950s, just years before the theory of plate tectonics forced earth scientists to accept the concept that once and for all (Oskin, 2015). Similarly, Darwin’s The Origin of Species, published in 1859, was greeted with skepticism and derision, if not downright hostility. Decades after its introduction, Darwin’s theory of evolution still faced significant challenges. Even today, it remains controversial in certain groups outside the scientific community (Boffey, 1982).

Hand washing, with self-evident merit today, faced unbridled doubt and incredulity when first suggested to the medical community (Davis, 2015). In the mid-1800s, Hungarian doctor Ignaz Semmelweis worked in the maternity clinic at the General Hospital in Vienna. Seeking to reduce the number of women dying from childbed fever, he studied two maternity wards, one staffed by male doctors and the other by female midwives. He observed that women were dying at a rate five times greater at the male-staffed clinic than at the female-staffed clinic. After ruling out (by experimentation) a few differences in treatment, Semmelweis, in frustration, took time off to travel to Venice.

Upon his return, Semmelweis learned of a pathologist who had taken ill and died after conducting an autopsy (a common practice in medicine at the time) on a patient with childbed fever. During the autopsy, the pathologist pricked his finger. Semmelweis knew childbed fever was being spread at the hospital. He knew that male doctors—but not midwives—conducted autopsies between deliveries and surmised that particles from the autopsies were traveling on the doctors’ hands, making the next patient ill. Semmelweis introduced chlorine for doctors to wash their hands with after autopsies and before deliveries. Sure enough, the rate of childbed fever deaths fell sharply. Remarkably, the doctors rejected the idea, because it meant they were to blame for the hospital deaths. The doctors at the maternity clinic eventually rebelled, and Semmelweis was fired!

Bubbles in academic finance and economic theory generally do not jeopardize lives, but they can adversely affect an individual’s career, not to mention collective prosperity. In finance, large sums of money are often put to work chasing popular ideas, whether they ultimately prove brilliant or flimsy.4 When strategies blow up, markets crash, and/or the economy tanks—or all three, as in the case of the global financial crisis—professional investors and academics may eventually need to reckon with monsters they have created.

In addition to the more traditional forms of excesses in capital markets, such as the tech bubble, the housing bubble,5 and the more recent global financial crisis, we believe bubbles and crashes continuously play out on a small scale all over the world; only the big bubbles are relatively unusual.

We acknowledge the impressive strides made in finance over the last 50 years, both in research and in practice. We joyfully embrace important innovation and insights, while endorsing a healthy skepticism about feverish study of minor incrementalism in extending these insights. Skepticism is not cynicism. In the last quarter-century, quantitative methods have evolved to become a major force in the investing world (Zuckerman and Hope, 2017),6 while behavioral finance has been reshaping academic finance. Progress is wonderful. Devoting all available resources to examine every nuance of a past innovation, to an extent that crowds out the opportunity to identify new insights, is less so.

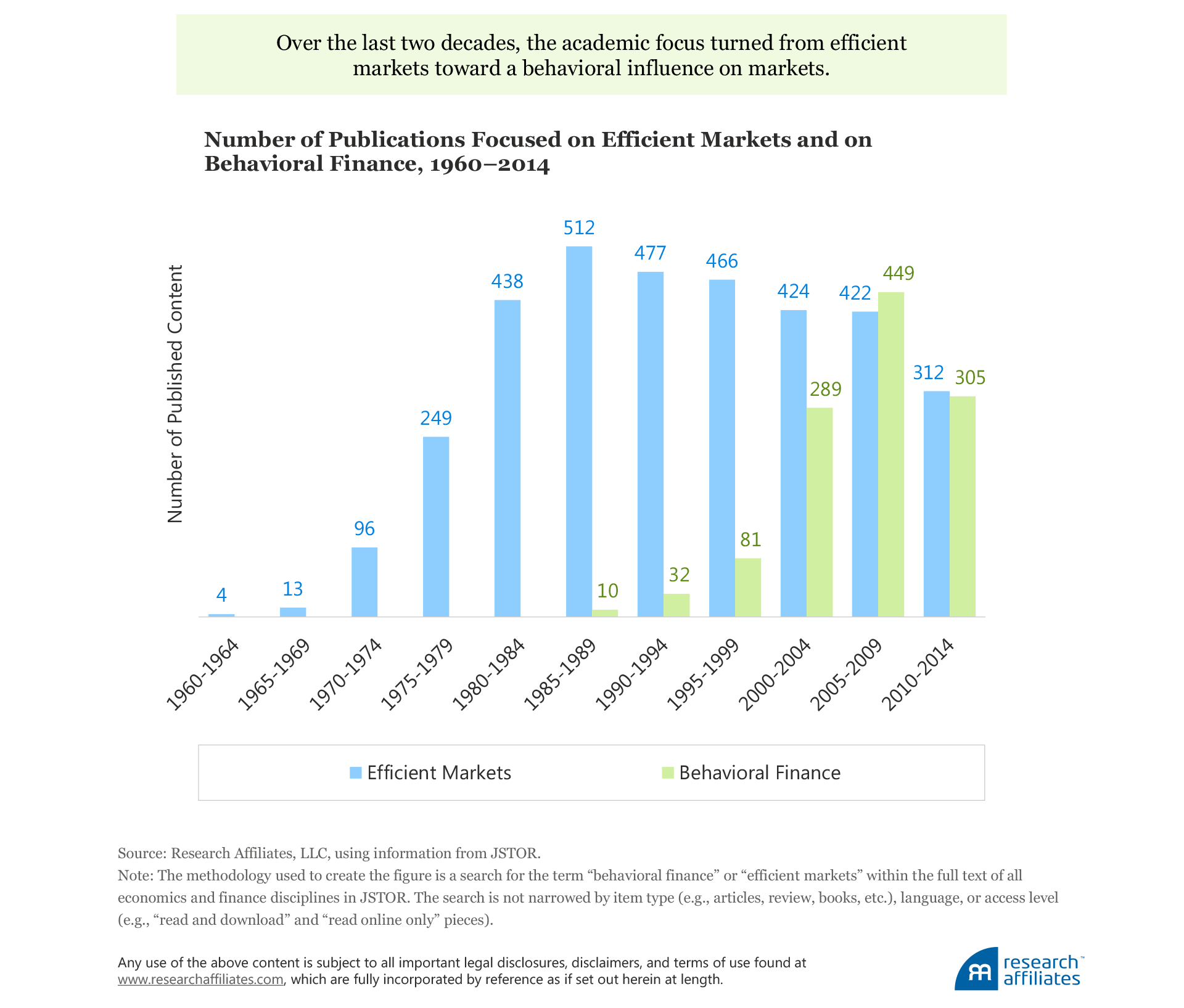

One of us vividly remembers how the efficient market hypothesis (EMH) crowded out the exploration of market inefficiencies in the 1980s and 1990s. EMH is another of those innovations that fails the core test of scientific method: it’s unfalsifiable!7Fortunately, over the last two decades or so, the academic mainstream has moved from a near-universal presumption of market efficiency, for which the sole reward of putting capital to work is a quasi-constant market risk premium, to a growing acceptance that markets are man-made constructs subject to behavioral phenomena, with risk premia that are both multidimensional and time varying.8 This evolution in thought is obvious in the increasing number of publications since the mid-1980s with a focus on behavioral finance and the falling number with a focus on efficient markets.

A Brief History of Ideas in Finance

Our admittedly very incomplete history of finance research seeks to point out the real-world consequences of academic bubbles. Along the way, we highlight the key insights with a long shelf life, those insights that hugely benefit investment strategies. Investors lose when the strategies they select are built on insights that can be arbitraged away overnight. Consistent with the broad chronology of financial thought, we start with the evolution of theory and move to more recent empirical work.

From Golden Days to Stormy Nights in Finance Theory

The early days of finance as an academic discipline addressed head-on the overwhelming uncertainty of financial markets. With high volatility and little structure on which to rely, Paul Samuelson’s Foundations of Economic Analysis (1947) introduced the mathematical machinery of modern economics, and Harry Markowitz’s “Portfolio Selection” (1952) brought us modern portfolio theory (MPT). Economics and finance now had a mathematical foundation and a process for portfolio construction.

At its core, MPT demonstrated that, even lacking granular knowledge of the specific circumstances facing individual companies, significant improvements in investment outcomes were possible simply by taking advantage of diversification. Initially, this deep insight allowed investors to apply powerful tools in the portfolio construction process, such as mean-variance optimization. Contrary to popular belief, MPT does not require an efficient market, or a random walk, or log-normal return distributions in order to construct superior portfolios.

Since MPT’s earliest days, the practitioner community broadly adopted these tools. This was, in a way, a turning point, the first time researchers realized that better performance characteristics could be created from thoughtful and systematic portfolio construction. The insight underlying MPT has shown itself to be robust and broad, with a seemingly perpetual shelf life, and is as successful an outcome as any we have seen in finance research, theory, and practice over the past century.

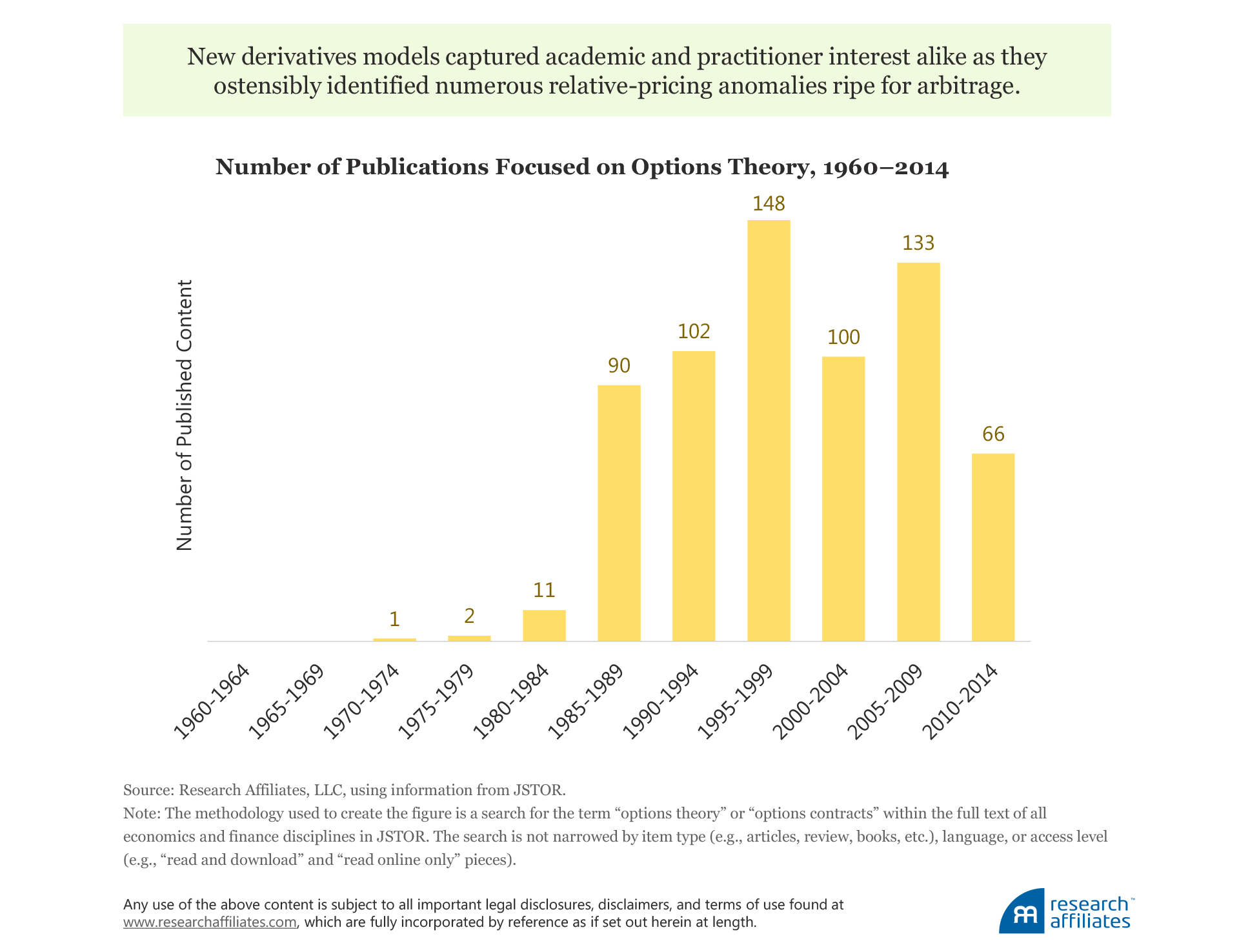

Now, consider the development of derivatives pricing in the early 1970s. The key insight leading to the Merton-Black-Scholes (MBS) (Merton [1973] and Black and Scholes [1973]) formula was that continuous trading, creating “dynamically complete” markets, makes it possible to price options on a stock, with no need to predict the future stock price. In fact, MBS demonstrated that the expected return on a stock plays no role in the pricing of options, making it possible to manage risk (some apparently even thought, conquer risk), while sidestepping the perilous exercise of predicting whether the price of IBM stock would go up by 2%, 5%, or 8% over the next week, month, or year.9

Taken one step further, if companies—rather than stocks—are the fundamental unit of analysis, corporate debt and equity could be structurally related to one another via the same principles. With this understanding, Merton (1974) produced a model for pricing corporate debt, a truly extraordinary insight that created a wide following among researchers, who could suddenly address an endless array of new applications.

The theory now in place, derivatives markets matured quickly. The real world—powered by a healthy dose of profit motive—saw an opening at the table with the development of portfolio insurance. But as theory—based on continuous markets—ran headlong into implementation challenges in discontinuous markets, the strategies sharply exceeded their capacity, contributing to the 1987 market crash.

According to the new models, related securities ought to move in related ways. In the messy real world of financial markets, theory fell short.10 Repeated departures from these relative-pricing relationships were suggestive of relative-value trades. All of a sudden, arbitrage profit-taking opportunities could be identified and harvested over and over again. In a snowball effect, more academic papers were addressing relative-pricing identities, and more practitioners set up shop to take advantage of these alpha opportunities.

The supply of ideas can sometimes create its own demand, until the wave comes crashing down. Long Term Capital Management (LTCM) famously collapsed in 1998, losing billions for its investors, billions more in ripple effects through its trade counterparties, and allegedly putting our global financial system at significant risk. As in the case of the more-recent global financial crisis, intervention ostensibly averted a full-scale disaster, but we’ll never know whether the damage of the crisis would have exceeded the damage of the intervention. We do know that the interventions, in both cases, prevented Schumpeter’s “creative destruction,” purging the economy of the reckless facilitators of LTCM’s hyper-leverage, some of whom went on to facilitate the 2008 global financial crisis.11

Looking back, it seems that a deep and robust insight had taken on a life of its own, proliferating derivative results (forgive the pun) in the academic literature. These results were then excessively and blindly adopted in the practice of finance, with occasionally disastrous repercussions. While not perfectly related to the initial theory on dynamic replication of options, the work on pricing other types of derivatives, such as mortgage-backed securities and credit default swaps, contributed to the heroic mindset that culminated in the global meltdown of the late 2000s.

From Day Traders to Backtesters: The Empirical Finance Bubble

The 1990s gave us far more than just famous hedge funds “blowing up.” The decade paved the way for the tech bubble, democratizing computing power and allowing unprecedented access to data. Market participants convinced themselves a new world had arrived and that markets need not concern themselves with antiquated concepts of valuation, such as price-to-book or whatever fundamental they once deemed relevant. At the peak of the tech bubble, nearly 15% of the Russell 1000 Growth Index consisted of companies that had not paid dividends and had earned virtually no profits in at least five years!12 The bubble eventually burst, sensible valuations reasserted themselves, and most of the day-trading class went back to their day jobs.

For many in academia and in practice, the tech bubble and its extraordinary collapse called for a deep reassessment: Perhaps markets were not perfectly efficient! Human psychology could create deviations from textbook predictions. Thus—and this is the crucial intellectual turning point—predictable excess returns could be generated by systematically “outsmarting” the inherently flawed investing masses.

In the meantime, empirical finance work had been gaining a strong reputation, perhaps even a superiority relative to theory, with the groundbreaking work of Fama and French (1992), among others. By the 2000s, computers and data had become cheap enough that finance professors, their graduate students, and quantitative practitioners alike gained universal access to market data, the precise premise on which the tech bubble had been predicated. And so, an entire generation of academe has gone on to substitute capital (the great “backtest machine”) at the expense of labor (carefully designed theories).

So far, the great backtest machine has blessed our industry with over 500 factors; according to the literature, they all work, and almost all have statistical significance over their respective period of study. Fama–French regressions demonstrate they are not just clones of the value, size, and momentum factors. The implication is that we can turn our investments over to a roster of factor strategies, all with fabulous backtested results. To be sure, some in academia and in the practitioner community resisted the temptation of data mining. For these skeptics, value, carry, momentum, and a handful of other factors remain the sole robust sources of excess returns to which investors likely ought to trust their investment dollars.

Recently, the Fama–French (1992) model has been extended to a fifth factor (low investment) (Fama and French, 2014), a testament to the reluctance of the authors to proliferate at the same pace as their disciples. The world at large has been less cautious. Every new cohort of graduate students must complete dissertations and generate significant t-stats along the way. In parallel, the purveyors of investment products must find new products to launch. Yet again, supply is creating its own demand, and a new intellectual bubble, along with a product proliferation bubble, has formed on the back of empirical finance.

In 2016, we published a series of papers, beginning with “How Can ‘Smart Beta’ Go Horribly Wrong?” In the series (Arnott, et al. [2016] and Arnott, Beck, and Kalesnik [2016a,b]), we point out that—at least until 2016—not one of the 500-odd papers in support of new factors had bothered to ask a rather fundamental question: Did my factor (or anomaly or strategy) benefit from a tail wind of rising relative valuations, which created an illusion of alpha, and which may reverse in the case of mean reversion in valuations? We point out that some of these factors owe much (or all) of their past efficacy to rising relative valuations. We point out that some of the most popular factors worked, on average, less than half as well after publication as before. And we point out that valuation is powerfully predictive of future factor returns.

In 2017, we are publishing a series of papers (Arnott, Kalesnik, and Wu [2017] and Arnott, Clements, and Kalesnik [2017] with two more articles forthcoming) titled “Alice in Factorland.” In this series, we point out that factor returns earned in mutual funds are typically much smaller than the theoretical returns of academic long–short paper portfolios (although with certain exceptions, such as the size factor); that factors cannot reliably replicate other strategies without introducing higher turnover and risk, and lower capacity and returns; that factors can be used to predict which mutual funds will perform well, by buying the out-of-favor, cheap factors; and that the momentum factor has special challenges that have contributed to momentum managers’ general failure to add value.

The eventual collapse of the factor research bubble—and factor product proliferation—may cause collateral damage among respected academics, tarnishing their reputations; among practitioners who offer factor products based on backtests without careful consideration of factor valuation; and among investors who entrust their capital to the less rigorous operators of the great backtest machine.

Sifting through the Rubble

Although the negative implications of academic bubbles are a significant part of our narrative, the insight at the core of most bubbles generally has merit. Remember the tech bubble. At its core was a belief that cheap computing power and unprecedented access to data would revolutionize the way we live and work. That belief has been proven right. Some of the darlings of the tech bubble have indeed revolutionized the world of today. So let’s not throw the baby out with the bath water. Instead, we can extract a few long-shelf-life principles and put them to work in the service of investors:

- Modern Portfolio Theory. Diversification (and careful portfolio construction, more generally) can dramatically improve investment outcomes, and may be the closest example of a free lunch we’ve come across.

- Derivatives Pricing. Today, derivatives markets are mature to a degree unimaginable a generation ago, affording investors around the world access to far broader investment opportunities than ever before.

- Tech Bubble. The lessons of the tech bubble are lessons in humanity and humility. An underlying investment thesis may be right, but investors tend to be swayed to irrational extremes. In the end, valuations matter.

- Empirical Finance. Factor research has made our reality richer than many were even willing to consider only 20 years ago. Excess returns can be tied to “factors” that go beyond the market portfolio. Value, size, and carry, and perhaps a few others, have proved to be robust investment strategies, both in backtests and in live portfolios. Momentum seems powerful, if we can overcome the trading costs. Referring to the principle that “valuations matter,” the expected excess returns associated with each of these strategies will tend to vary with valuations, and likely with macroeconomic conditions.

Quants: Don’t Be Blind to Bubbles

Academic bubbles tap into almost exactly the same elements of the human psyche as market bubbles so we feel good while the trend is hot, and everyone involved enjoys lots of reassuring company. Sadly, there is a price to pay. The societal cost is real. In the best of cases, money is lost by investors chasing fragile ideas with their hard-earned investment dollars. In the worst cases, the general public suffers real pain when the economy at large is hit directly. We believe that, for most researchers, “doing the right thing” should be sufficient reason to avoid knowingly (or carelessly) chasing academic bubbles. If that alone isn’t sufficient motivation, allow us to point out that long-standing and strong reputations have been tarnished, sometimes beyond repair, by chasing academic bubbles.

Let’s not offer the financial world’s equivalent of “cold fusion.”

Our goal in examining the history of academic bubbles is to help academics and investors avoid being drawn into the next bubble, once it’s underway. But better than knowing how to dodge a bubble is for the bubble to never get going. How do we limit bubble formation? The ideal way to inhibit bubbles would be to change the incentive structure in academia and the practice of finance, but “ideal” is rarely practical; typically, it requires those in control to act against their own narrow self-interest.

An easier way exists. Suppose we seek, and encourage others, to be more skeptical and more curious. Suppose we reaffirm a commitment to the essence—not just to the veneer—of the scientific method, as we dutifully apply Ockham’s razor with skepticism toward excessive complexity. Suppose we also remind ourselves that theories are helpful, but they are not scientific knowledge unless they are testable, verifiable, and falsifiable; neither string theory nor the efficient market hypothesis pass this requirement.13

If enough of us commit to taking this path, academic bubbles will be less likely to get out of control. Instead of EMH crowding out any examination of market inefficiencies for a quarter-century, its reign would last only a few years. Instead of academia fixating on factors until 500 (and counting) are unearthed, new topics can garner serious resources after the discovery of a few dozen.

From Blindness to Sight

In short, we in the investment community will be well served by being skeptical of popular ideas, including our own. For the more courageous among us, let’s pursue ideas that aren’t overly popular. This path will always be lonelier, but it can also be more fun. Following this path, we have better odds that we may come across more ideas that are truly new and interesting. In addition to being intellectually liberating, accepting the world with all its flaws can help investors achieve better outcomes. Such a collective ramp-up in our curiosity and hunger for new ideas can show us a richer reality, including an acceptance that investment returns may be predictable in some ways (e.g., likely changing over time with inefficiencies coming and going).

When the blindness of the herd is replaced with clear-eyed skepticism, academic finance and investment practice can form a more perfect union. That said, the recent broad-based bull market in empirical finance notably relating to “factors” should give us pause. Bull markets end. The biggest bull markets often end badly, built on a belief that “this time is different.” We’re not convinced this time is different.

Endnotes

1. In our series “Alice in Factorland,” we note that over 500 investment “factors” have been published in the last quarter-century. How many of these factors work? According to the published literature, all of them. How many are statistically significant? As a first approximation, almost all of them. How many of their advocates posed this simple question: Did my factor benefit from a tail wind from rising relative-valuation multiples? To the best of our knowledge, this question was never asked before we asked it in 2016, but that’s not the point of this article.

2. One of us (Arnott) had an email in 2006 from an assistant professor at a European university who was seeking data and advice to test his ideas on the Fundamental Index™ and to explore the sources of its historical alpha. After an exchange of emails, silence reigned for about 90 days. On inquiring how the work was going, we got the disappointing reply that the academic was advised by the head of his department that, if he wanted any hope for tenure, he should abandon his investigation of Fundamental Index immediately.

3. As the physicist Max Planck famously quipped, “Science advances one funeral at a time,” as the guardians of the status quo are felled by the passage of time.

4. In the terminology of Nassim Taleb, we may refer to such ideas as fragile, or susceptible to failure.

5. As an aside, the housing bubble may not have originated within academe, but the fire was fueled by quants who thought risk could be dissipated across the financial system. Indeed, the golden era of copula models came crashing down with markets in 2007–2008 (MacKenzie, 2008).

6. One such exciting development in quantitative methods is the extension of the Fama-French-Carhart factors (size, value, and momentum) into a formal means for constructing factor-tilt portfolios and for performance attribution. And the continuing pursuit of innovation in the investment sphere and in the infrastructure of finance is leading to fascinating work, such as Harvey (2014), a study of blockchain technology.

7. Consider that, with each anomaly, the advocates for EMH alter the definition of efficiency. Now we have the equity risk premium, redefined on an intertemporal and issue-specific basis, to save the EMH. Pardon us, but is there a difference between a risk premium that is unique to an individual stock at a given point in time and an inefficient market?

8. One of us was also an early, vocal advocate for a time-varying equity risk premium (Arnott and Ryan [2001] and Arnott and Bernstein [2002]), although not as justification for market efficiency. Indeed, the “risk premium puzzle”—the notion that the observed equity risk premium was far higher than the level of stock market risk could possibly justify—disappears almost entirely when we realize that upward revaluation of stocks in the second-half of the 20th century provided fully 4% a year of the return for US stocks; the stock market dividend yield fell sevenfold in 50 years, from 8% to 1.1%.

9. As an aside, a betting market should be set up for the sake of predicting when IBM will be replaced with a more du jour corporate name in the exposition of textbook finance.

10. As George Box, of Box–Jenkins fame, so eloquently put it, “All models are wrong; some models are useful.” Wouldn’t it be nice if the academic and quantitative practitioner community taped this message to their bathroom mirrors so they would see it every time they brush their teeth?

11. Alan Greenspan claimed that the global financial system would have melted down without the LTCM intervention. Ben Bernanke claimed that unemployment would have topped 25% without the intervention that occurred in response to the 2008 global financial crisis. We’ll never know the truth, because nonintervention or a lesser intervention was not tried. We do know Lehman Brothers and Bear Stearns, star players in the run-up to the global financial crisis, were both saved in the LTCM intervention. We do not know whether institutions saved in the most recent intervention will create problems in the years ahead, based on mistakes similar to those that sowed the seeds of the global financial crisis.

12. Of all Russell 1000 Growth constituents on March 31, 2000, 15% had paid no dividends and had a PE ratio that was either negative or in excess of 250X for the preceding five years. At the lower—yet still very elevated—100X threshold for PE, the fraction was 19%.

13. The goal line often changes with the benefit of technology, as was the case when continental drift graduated to verified scientific knowledge after we could measure continental movement over a human span (e.g., 25 years) and extrapolate that movement across millions of years. Lo and behold, the continents merged at roughly the same time, give or take 50 to 100 years.

References

Arnott, Robert D., Noah Beck, and Vitali Kalesnik. 2016a. “To Win with ‘Smart Beta’ Ask If the Price Is Right.” Research Affiliates (June).

———. 2016b. “Timing ‘Smart Beta’ Strategies? Of Course! Buy Low, Sell High!” Research Affiliates (September).

Arnott, Robert D., Noah Beck, Vitali Kalesnik, and John West. 2016. “How Can ‘Smart Beta’ Go Horribly Wrong?” Research Affiliates (February).

Arnott, Robert D., and Peter Bernstein. 2002. “What Risk Premium Is ‘Normal’?” Financial Analysts Journal, vol. 58, no. 2 (March/April): 64–85.

Arnott, Robert D., Mark Clements, and Vitali Kalesnik. 2017. “Why Factor Tilts Are Not Smart ‘Smart Beta.’” Research Affiliates (May).

Arnott, Robert D., Vitali Kalesnik, and Lillian Wu. 2017. “The Incredible Shrinking Factor Return.” Research Affiliates (April).

Arnott, Robert D., and Ronald J. Ryan. 2001. “The Death of the Risk Premium.” Journal of Portfolio Management, vol. 27, no. 3 (Spring): 61–74.

Black, Fischer, and Myron Scholes. 1973. “The Pricing of Options and Corporate Liabilities.” Journal of Political Economy, vol. 81, no. 3 (May/June): 637–654.

Boffey, Philip M. 1982. “100 Years after Darwin’s Death, His Theory Still Evolves.” New York Times (April 20).

Davis, Rebecca. 2015. “The Doctor Who Championed Hand-washing and Briefly Saved Lives.” Podcast on NPR Morning Edition (January 12).

Fama, Eugene, and Kenneth French. 1992. “The Cross-Section of Expected Stock Returns.” Journal of Finance, vol. 47, no. 2: 427–465.

———. 2014. “A Five-Factor Asset Pricing Model.” Working paper (March).

Harvey, Campbell R. 2014. “Bitcoin Myths and Facts.” Working paper (November 2).

MacKenzie, Donald. 2008. “End-of-the-World Trade.” London Review of Books(published May 8, 2008), retrieved July 27, 2009.

Markowitz, Harry. 1952. “Portfolio Selection.” Journal of Finance, vol. 7, no. 1 (March): 77–91.

Merton, Robert. 1973. “Theory of Rational Option Pricing.” Bell Journal of Economics and Management Science, vol. 4, no. 1 (Spring): 141–183.

———. 1974. “On the Pricing of Corporate Debt: The Risk Structure of Interest Rates.” Journal of Finance, vol. 29, no. 2 (May): 449–470.

Oskin, Becky. 2015. “Continental Drift: Theory & Definition.” LiveScience.com (February 4).

Samuelson, Paul. 1947. Foundations of Economic Analysis. Cambridge, MA: Harvard University Press.

Zuckerman, Gregory, and Bradley Hope. 2017. “The Quants Run Wall Street Now.” Wall Street Journal (May 21).