Since its rise to popularity nearly a decade ago, “smart beta” investing has gone horribly wrong relative to expectations.

Our early 2017 valuation-based forecasts for smart beta strategies, while correlated with realized performance, turned out to not be pessimistic enough.

Almost every strategy we analyzed experienced underperformance and decreasing relative valuations vs. the market portfolio and its large allocation to Magnificent Seven stocks.

Our current forecasts of smart beta returns paint a very different picture—we expect nearly every investing style featured here to outperform.

In our February 2016 article, “How Can ‘Smart Beta’ Go Horribly Wrong,” we warned that the burgeoning landscape of factor-based systematic equity strategies might turn out to be more desert than oasis, more dust bowl than bread basket. “Mean reversion could wreak havoc in the world of smart beta,” we wrote. “Many practitioners and their clients will not feel particularly ‘smart’ if this forecast comes to pass.”

Create your free account or log in to keep reading.

Register or Log in

At the time, these practitioners were promising the world—exposure to equity markets plus additional excess returns from well-known and well-vetted sources of factor premia—all in low-fee, index-like products. Our advice to investors was simple: Manage your expectations. Rosy simulations of investment styles that would have done well in the past rarely account for a potential source of that outperformance: rising valuations.

Rosy simulations of investment styles that would have done well in the past rarely account for a potential source of that outperformance: rising valuations.

”If a smart beta strategy beats the market by 2% per year for 20 years but its valuation relative to the market also rises by 2% per year, what does that imply about that strategy’s future alpha potential? In our view, it indicates that continued outperformance is unlikely, maybe even impossible. Why? Because no strategy can grow more expensive relative to the market portfolio ad infinitum. At best, we’d expect this source of “premium” not to generate any excess returns going forward. At worst, we’d anticipate that the strategy is now overpriced and that mean-reverting valuations will lead to negative relative performance in the future.

That was how “smart beta” could go horribly wrong.

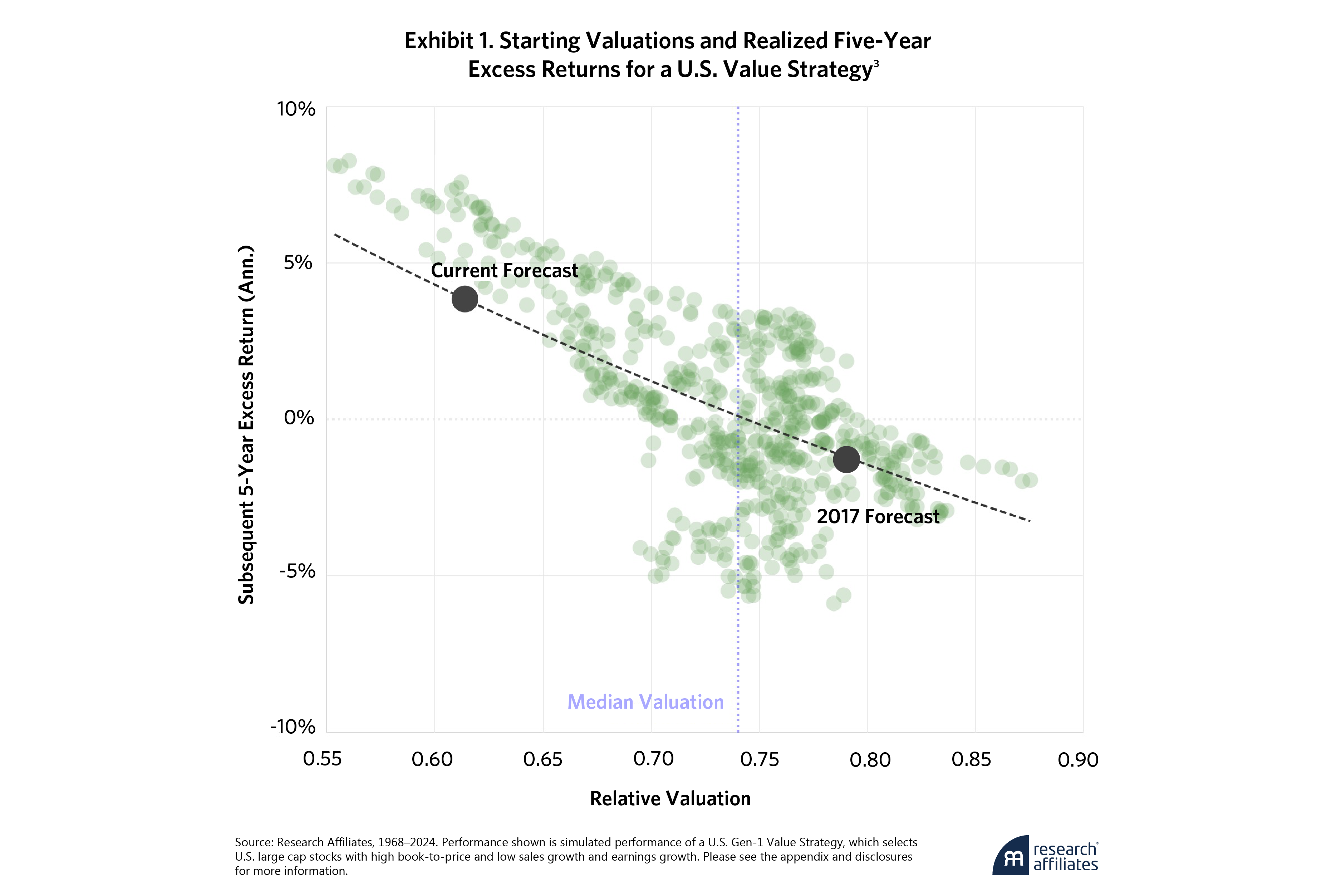

We featured this analysis in the first of a four-part series exploring the smart beta outlook. The series finale, “Forecasting Factor and Smart Beta Returns (Hint: History Is Worse than Useless),” published in February 2017, culminated in a more formalized and robust expected returns model for simulated smart beta strategies using data through year-end 2016.1 These expected excess return forecasts rely on a strategy’s valuation, specifically the ratio of its valuation to the market’s as well as how that ratio compares to its historical norms.2 Exhibit 1 shows the relationship between a smart beta strategy’s excess return expectation and its relative valuation, which is the core of our expected returns model.

Dusting Off Some Old Forecasts

Those early 2017 forecasts, which included many for our own Research Affiliates Fundamental Index (RAFI) strategies, were more pessimistic than expectations based on simple past performance would have suggested. But as it turns out, they weren’t pessimistic enough.

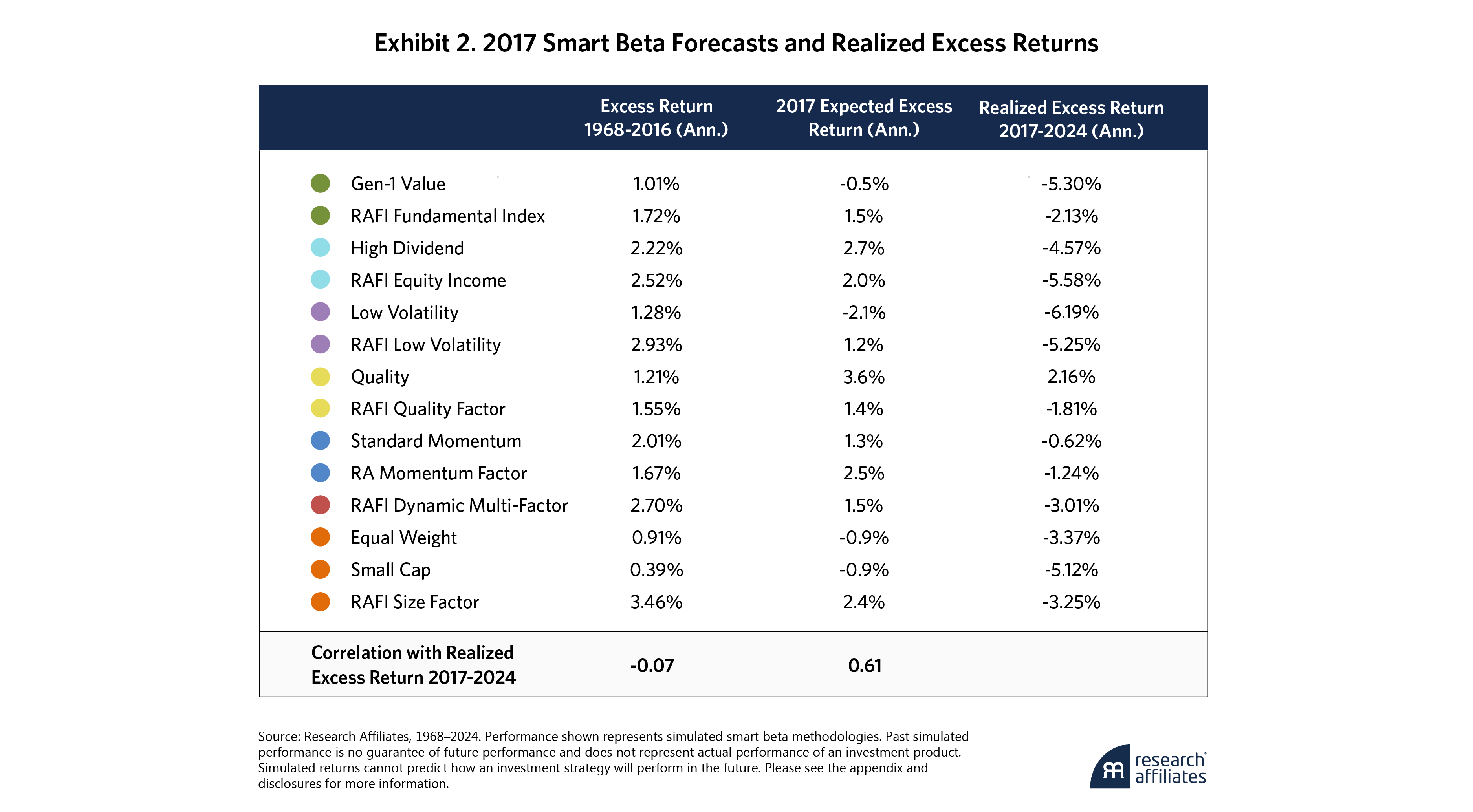

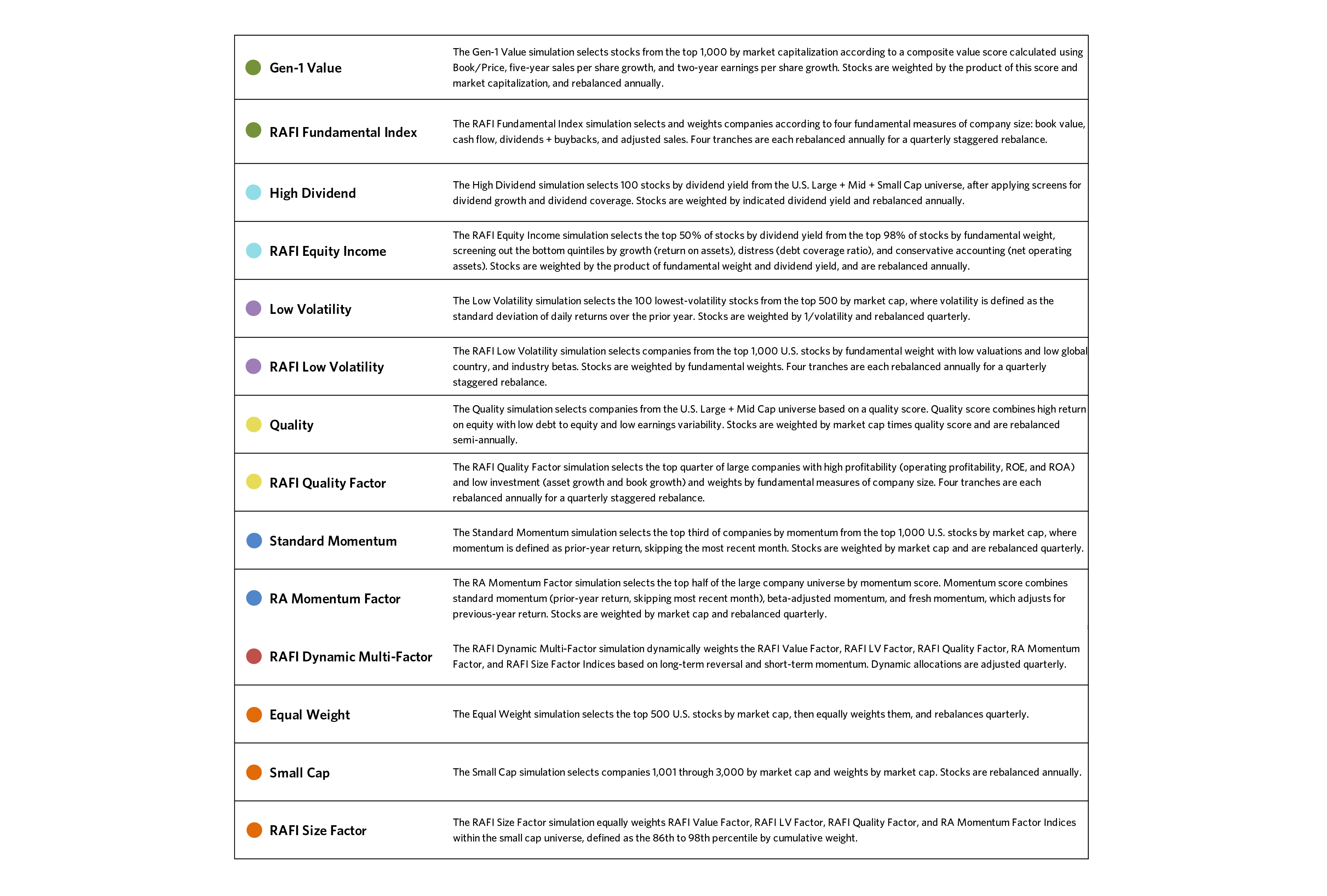

Exhibit 2 shows how these simulated strategies fared through year-end 2016, along with our forecasts of their expected excess returns from February 2017 and their realized excess returns in the eight years through year-end 2024. These strategies are color-coded into Value (green), Dividend (light blue), Low Volatility (purple), Quality (yellow), Momentum (blue), Multi-Factor (red), and Small Cap (orange) categories, with their realized excess returns listed in the last column.

Ouch. No smart beta strategy was spared. They all lagged the market benchmark by up to 6% per year for eight years. Only the Quality strategy outperformed the market. When we made our forecasts, Quality was undervalued and thus had our highest expected return. The Low Volatility strategy, which had our bleakest forecast, ended up having the worst performance of the group.

Did this relationship come down to luck? Perhaps. But think about what smart beta investors had to contend with in early 2017. Given a long menu of enticing new products, all they had to rely on to develop their future return expectations was past performance, or worse, back-tested past performance. Unfortunately, history can be worse than useless in these sorts of analyses. The historical performance of these smart beta strategies had close to zero correlation, or even a slight negative correlation, to their realized excess returns.

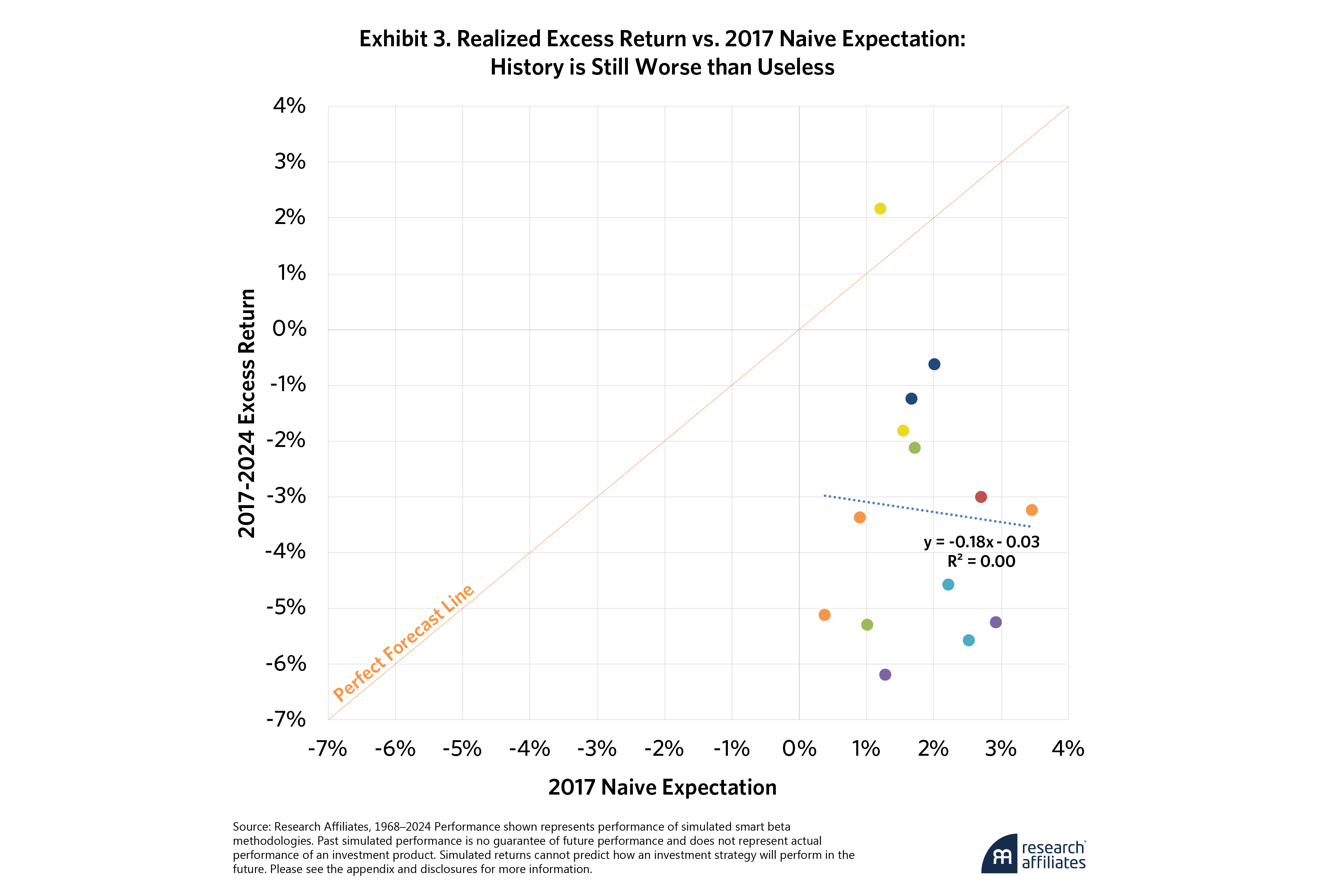

Exhibit 3 shows the relationship between a naive future return expectation developed from historical past returns and the subsequent performance of these 14 strategies.

The x-axis plots performance expectations based on each strategy’s historical excess returns in early 2017, and the y-axis plots the realized excess return over the following eight years. The y=x line, therefore, represents a perfect forecast. Most strategies underperformed expectations by a wide margin. This is smart beta going horribly wrong. But past returns even failed to anticipate the rank order of the various strategies’ future performance. History was worse than useless.

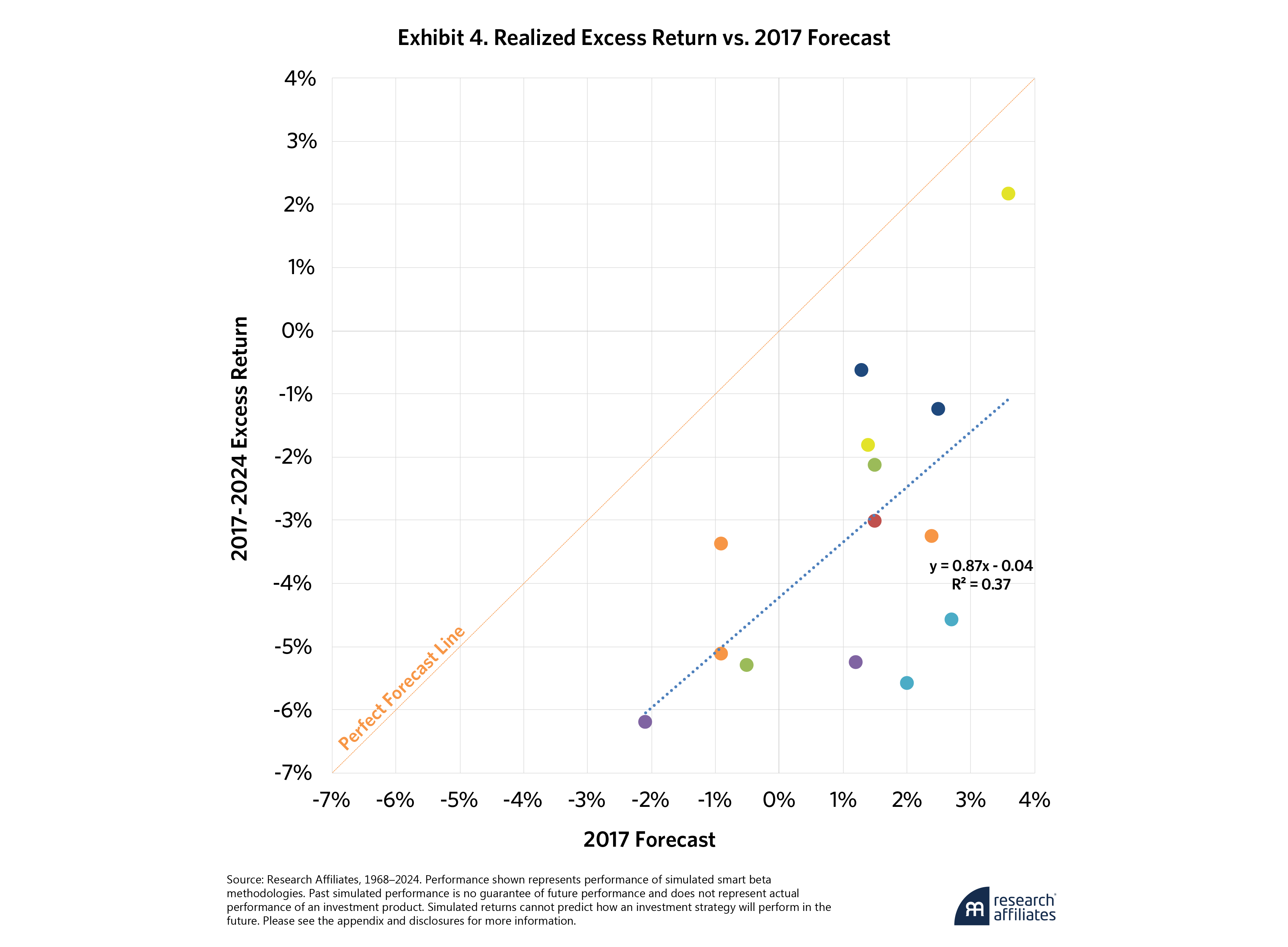

But how did our valuation-based performance expectations for the 14 factor-based strategies compare to their realized performance? Exhibit 4 shows the relationship.

Not even our gloomiest predictions anticipated the relative rout that broke out across the smart beta space. Realized excess returns all came in below our original forecasts. While we tried to convince investors to lower their expectations, they should have dialed them down by another 400 basis points (bps) per year.

Not even our gloomiest predictions anticipated the relative rout that broke out across the smart beta space. Realized excess returns all came in below our original forecasts.

”On the bright side, there is a lesson here: Valuations do matter. This is indicated by the positive relationship between the out-of-sample realized returns and the valuations-based forecast. The strategies with the highest valuations relative to the market and to their own histories had the most bearish forecasts and went on to have the worst performances. Those with the lowest relative valuations and highest forecasts ended up being the best performers.

This gives us hope that the relationship between current valuations and future excess returns is still intact and that valuations are still relevant today.

Smart Beta Post-Mortem

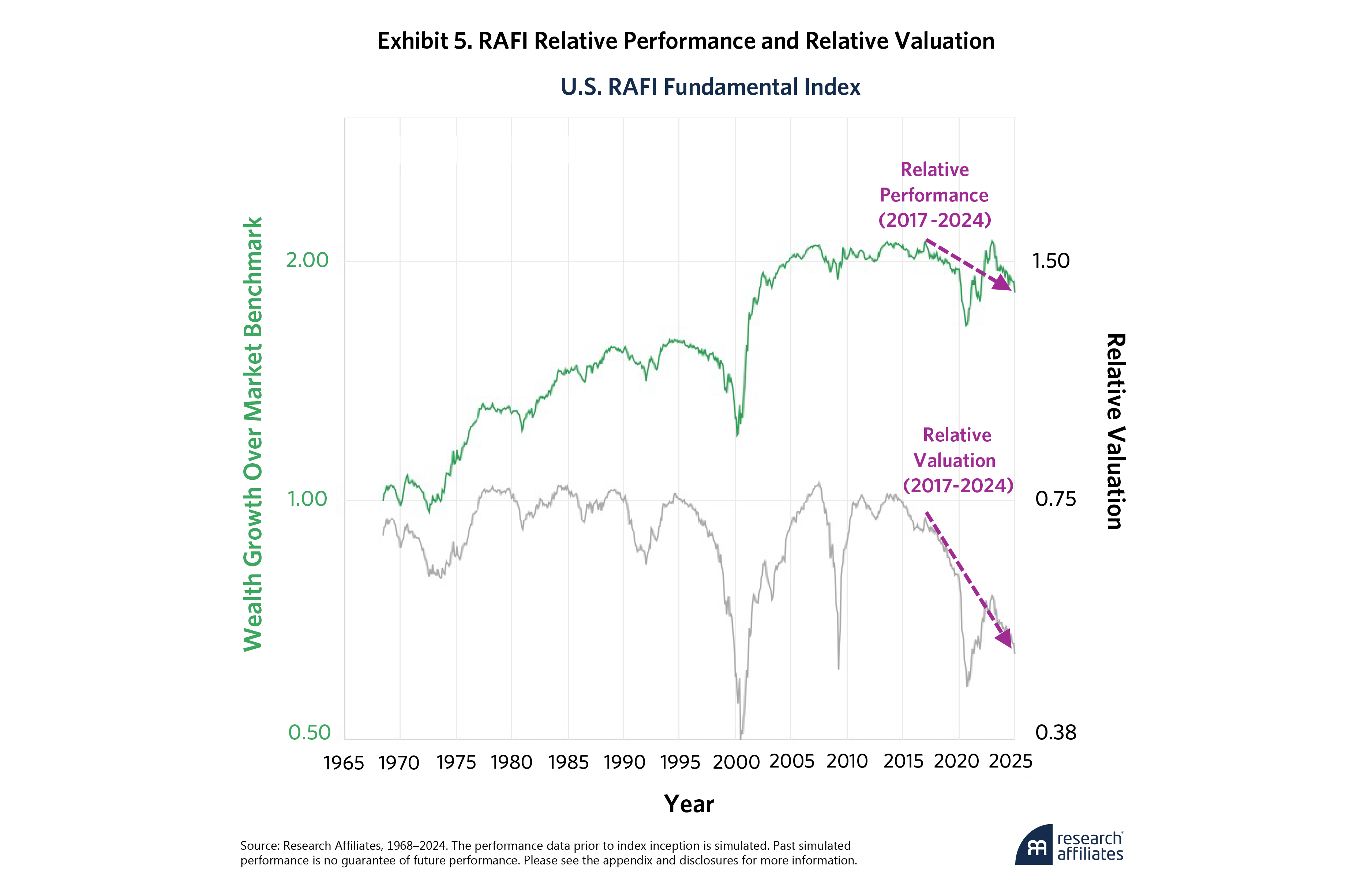

So, what happened? How on earth did smart beta go even more horribly wrong than our most dour forecasts? The answer again lies in valuations. Exhibit 5 shows RAFI’s relative performance in green and its relative valuation vs. the market benchmark in gray.

A systematic equity strategy’s excess return tends to correlate with its valuation relative to that of the market. As a strategy cycles into cheaper valuations, performance often faces a headwind. As it grows more expensive, or comes back from its previously cheap valuations, this tends to coincide with return tailwinds at its back. Note that in this case, the two lines tend to diverge over the long term, meaning that the strategy generates a return premium in excess of its change in valuation over extended intervals. We call this divergence “structural alpha.”

But in the short term, the two lines tend to run in parallel, so over limited time frames, like our eight-year sample period, changes in valuation often dominate relative performance. RAFI’s –2.13% excess return vs. the market since early 2017 coincides with an annualized –4.81% change in valuation.

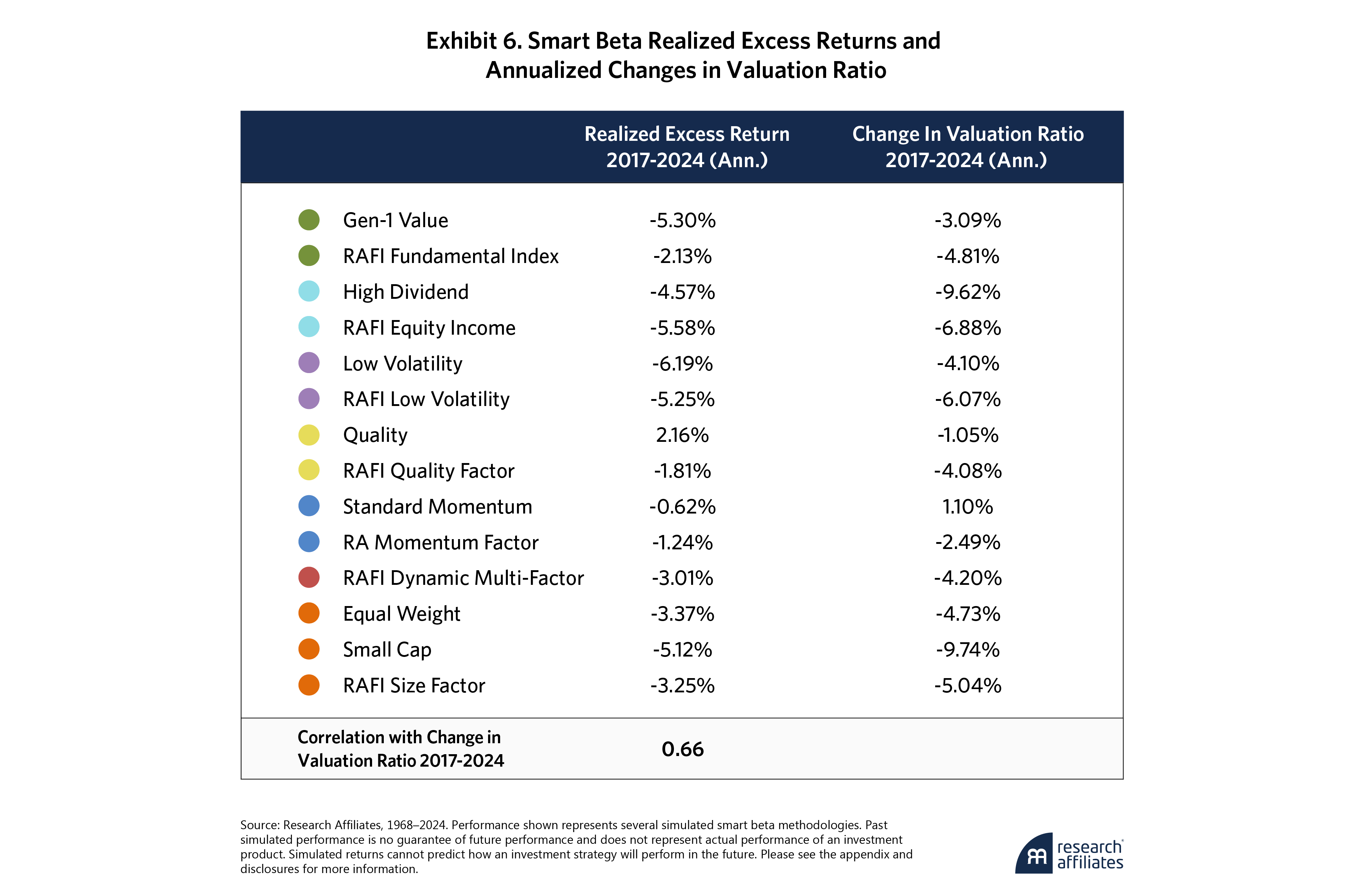

Exhibit 6 shows this excess return and the accompanying annualized valuation change of our 14 strategies.

Since early 2017, RAFI and other Value strategies became cheaper relative to the market. They weren’t alone. So did Dividend, Low Volatility, Quality, Momentum, Multi-Factor, and Small Cap strategies.

What a Coincidence!

What are the odds that the valuations of all but one smart beta strategy decreased relative to the market over this span?4 Assuming each strategy’s valuation ratio is independent of all the others, the odds of them all declining simultaneously are 1 in 214, or 1 in 16,384. The probability that exactly one strategy had a positive value is 14 in 16,384. The odds of all or all but one strategy independently falling in valuation over this period are 15 in 16,384, or 0.09%!

Of course, these valuation ratios are not independent. No matter how disparate smart beta categories are from one another, each valuation ratio is benchmarked to the market. The market valuation is literally the common denominator of every ratio. The driving force behind the cheapening of all these investment styles has been the increasing valuation and market concentration in a handful of the largest stocks of the cap-weighted market portfolio.

No matter how disparate smart beta categories are from one another, each valuation ratio is benchmarked to the market. The market valuation is literally the common denominator of every ratio.

”A New Hope?

The smart beta performance landscape looks pretty bleak. Value investors, low volatility investors, small cap investors—all have suffered, on a relative basis, next to the behemoth that is the market cap-weighted portfolio of the largest U.S. stocks.

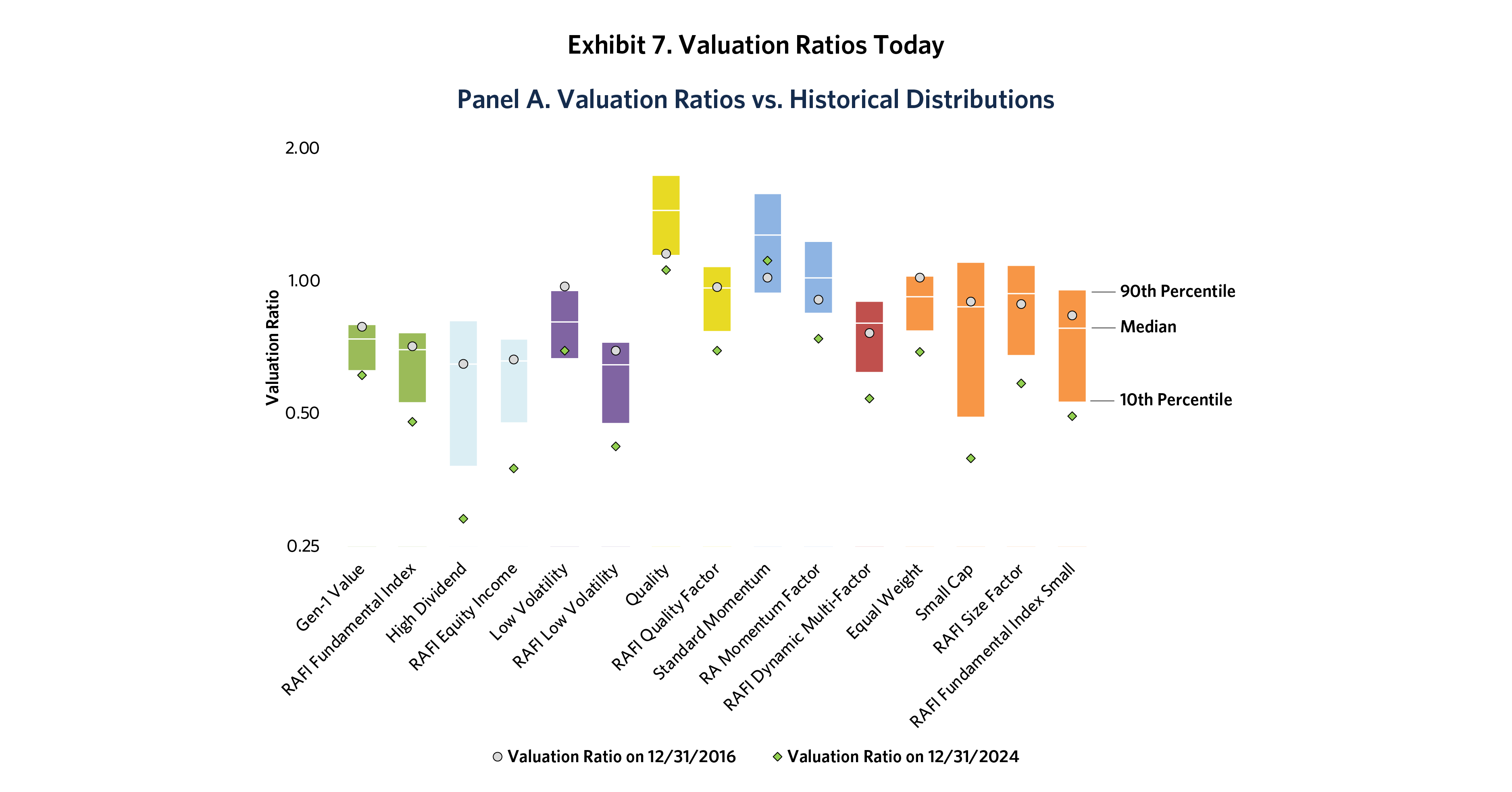

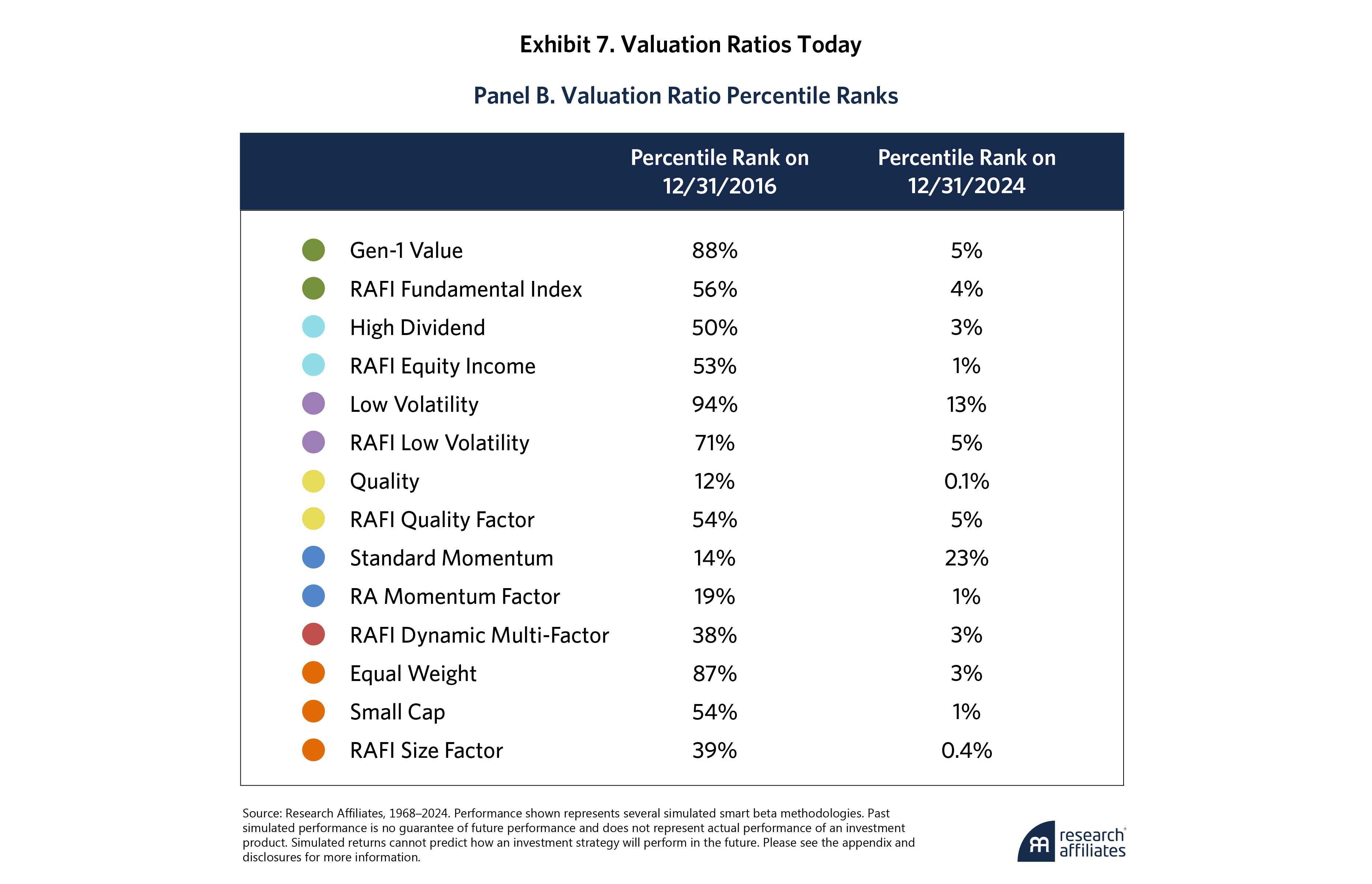

But there is a silver lining. The same declining valuations that led to pervasive smart beta underperformance have resulted in near-all-time lows in relative valuations for just about every style of systematic equity strategy. Exhibit 7 shows today’s valuation ratios vs. their historical distributions as well as their current percentile ranks.

Even if every strategy permanently remains at these lower valuations, the revaluation headwind to smart beta will cease unless valuations become even cheaper. In this case, smart beta strategies with structural alpha will deliver modest but reliable outperformance. More likely, some degree of mean reversion will prevail, and smart beta valuations will thus correct to the upside, perhaps in the not-too-distant future. Valuations moving towards equilibrium creates a tailwind that may mean every factor portfolio will outperform over the next eight years.

It is worth noting that we analyzed the relationship between relative valuations and realized excess returns over long samples that include multiple market peaks and troughs. Extended relative valuations and the resulting relative performance can occur in bull and bear markets alike. For example, the deeply discounted relative valuations of value portfolios during the height of the tech bubble and the depths of the global financial crisis (GFC) snapped back during the ensuing bear and bull markets, respectively. It seems that mean-reversion in relative valuations can happen whether our future equity markets are up, down, or sideways.

Of course, calling the end of a trend, like betting against a bubble or any form of market timing, is among the more fraught activities in investing. Reversion to the mean is a powerful force, but it doesn’t keep to a knowable schedule. So, manage your expectations and your risk by diversifying your exposures.

Reversion to the mean is a powerful force, but it doesn’t keep to a knowable schedule. So, manage your expectations and your risk by diversifying your exposures.

”In 2016, we explained why misplaced expectations about smart beta could go horribly wrong. And they went more horribly wrong than we anticipated. Now, we believe there may be hope for all smart beta strategies. If markets receive a wake-up call and valuations revert, a multitude of systematic factor-based equity strategies could all have a field day. After eight years of going horribly wrong, smart beta investing may now go horribly right.

Please read our disclosures concurrent with this publication: https://www.researchaffiliates.com/legal/disclosures#investment-adviser-disclosure-and-disclaimers.

Appendix: Smart Beta Simulation Methodology

End Notes

1. We simulate popular smart beta strategies rather than use live indexes. This gives us a longer history, going back to 1968 in the United States, and allows us to compare valuations on an apples-to-apples basis using the same underlying company-level data and starting universe across all strategies. The performance figures, both past and forecasted, reflect our simulations of these common smart beta strategies.

2. We use an aggregate of four measures of relative valuation: The Price/Book of the strategy divided by the Price/Book of the market, the Price/5yr Sales of the strategy divided by that of the market, the Price/5yr Earnings of the strategy divided by that of the market, and the Price/5yr Dividends of the strategy divided by that of the market. We take the geometric average of these four ratios to get an aggregate measure of a strategy’s relative valuation, which we hereafter refer to as simply “relative valuation.” Our expected returns model compares a strategy’s relative valuation to its historical norms to forecast the strategy’s expected excess returns.

3. Each data point in this chart represents a month in the history of the U.S. Gen-1 Value strategy, plotting that month’s future excess return vs. its starting relative valuation. The negative slope indicates that the best relative performance comes during periods when the strategy is relatively cheap and vice versa. Note that the dotted line, which represents our forecast at each level of relative valuation, is not a perfect fit for this data. That is because our expected returns model shrinks model parameters using data from other regions and strategies to achieve more robust out-of-sample model performance. This results in a tempered expectation on the left side of this chart as compared to what we observe in-sample from low valuations. The expected excess returns model is formulated as:

\[ E[\text{Excess Return}]_{P,R} \;=\; E[\text{Structural Alpha}]_{P,R} \;+\; \text{mean\_reversion\_coefficient}_{P}\;z\!\bigl(\ln\bigl(\text{val\_ratio}_{P,R,t}\bigr)\bigr) \]

For a detailed description of these components and how they are computed, see the “Modeling Equity Style Strategies” section of “RA Capital Market Expectations Methodology,” from Research Affiliates, October 31, 2024.

4. With the exception of one Momentum strategy that has high turnover between value and growth stocks. This results in a volatile level of relative valuations that has about equal odds of going up or down during any given period. Nevertheless, this does not mean valuations are useless even for Momentum strategies, as Momentum tends to crash when it is most overvalued. See Arnott, Robert D., Noah Beck, and Vitali Kalesnik. “To Win with ‘Smart Beta’ Ask If the Price Is Right.” Research Affiliates, June 2016.

References

Arnott, Robert D., Noah Beck, Vitali Kalesnik, and John West. “How Can Smart Beta Go Horribly Wrong?” Research Affiliates, February 2016.

Arnott, Robert D., Noah Beck, and Vitali Kalesnik. “Forecasting Factor and Smart Beta Returns (Hint: History Is Worse than Useless).” Research Affiliates, February 2017.