As a result of soaring valuations, tech leviathans now account for historically extreme levels of concentration in cap-weighted indices.

Concentration risk highlights the vulnerability of cap-weighted indices to short-term volatility and irrationality.

Equal-weight indices offer broad-market exposure to mitigate concentration risks but design flaws limit their potential.

The RAFI™ Fundamental Index strategy provides a superior alternative for broad-market exposure that has theoretical and practical advantages.

Create your free account or log in to keep reading.

Register or Log in

Keeping your money spread across many stocks and industries is the only reliable insurance against the risk of being wrong. But diversification doesn’t just minimize your odds of being wrong. It also maximizes your chances of being right.

”Eating the World

Over recent decades, the hot tech trends (from search to cellphones to social media to the digital economy and now to AI) have been a predominantly American story. Likewise, American equity markets dominate a larger and larger share of investors’ portfolios every year, led chiefly by the technology leviathans. As of the end of 2023, the “Magnificent Seven” accounted for a “modest” two-thirds of the S&P 500’s performance over the past year.1 These seven stocks accounted for 28% of the S&P 500 by weight at year-end, a level of concentration not seen in decades. On their own, their cumulative capitalization was greater than any equity market around the world, except for the US.2 For that matter, US markets now account for almost 70% of the MSCI World Index.3

When concentration is the deliberate result of an investment strategy, it can create the potential to outperform the broader market. For example, investors who recognized the impact of chiplet technology reaped incredible rewards as Nvidia rival AMD turned the corner from the verge of bankruptcy. But when investors unconsciously allow portfolios to drift into concentrated positions, the fate of the broader portfolio necessarily becomes tied (as a function of weighting by price) to the specific circumstances—and the risks—of a few select securities. In such cases, a small change in Apple’s earnings due to geopolitical risk can have a massive impact on an investor’s portfolio. But this possibility is almost beside the point because it misses the real issue: If an investor had an informed belief that these names would maintain their leadership for years, why not consciously lean into these firms?

The answer depends on whether animal spirits are driving the truly incredible run-up of a few major AI players.4 We believe the current AI euphoria parallels the excitement over the Internet in the 1990s, when another revolutionary technology transformed the world. Markets are at levels of concentration not seen in decades. The risk to investors in passive market-cap indices is that as the run continues, the FOMO (fear of missing out) effect and lofty growth expectations will drive increasing valuations while underlying fundamentals struggle to keep pace. In other words, the downside risk will grow as the yield falls. The traditional market-cap index ignores these concerns (or the behavioral element) and assumes perfect efficiency. Hence, the growing investor interest in a broad-market alternative.

The risk to investors in passive market-cap indices is that as the run continues, the FOMO (fear of missing out) effect and expectations will drive increasing valuations while underlying fundamentals struggle to keep pace.

”The case for a broad-market strategy is simple and has three aspects: history, speed, and performance. Historically, few market leaders could sustain their dominant position as competitive forces and entropy undermined seemingly secure redoubts. Of the largest 10 stocks globally at the start of each decade, only two at most (and often only one) were able to defend their position a decade on. This historical pattern has been repeated over time, both internationally and at the sector level.5 We don’t need to look too far back for an example. In 2022, we saw FOMO for the FANGs (Meta/Facebook, Apple, Amazon, Netflix, and Alphabet/Google) turn into a rout as Meta and Tesla declined by 72.3% and 65% from the market peak at the end of 2021. Meta has staged a stunning recovery. Tesla has not.

As demonstrated by the performance of mega-cap technology stocks in 2022, these shifts in expectations can create explosive compressions in valuations, quickly erasing gains. The principle also holds outside US markets. For example, Chinese regulators effectively “cut-down” the BATs (Baidu, Alibaba, and Tencent—China’s largest tech companies) with surprisingly strong regulatory action in February 2021. Looking to another period when one region dominated equity indices, Japanese equities quickly went from approximately 45% of global equity markets in 1989 to 25% within four years. An interesting phenomenon occurs when bubbles pop. Market-cap indices typically show disappointing performance, yet the average stock outperforms. Consequently, any broad-market indices that break the link between price and weight should outperform cap-weight indices during these corrections.

The standard market-cap index is vulnerable to flights of fancy by investors. Current levels of concentration only heighten that risk. While markets are semi-efficient over the long run, prices over the short run reflect some degree of error. Strategies that break the link between price and weight capitalize on this by harvesting the pricing error as a function of decreased exposure to the most expensive and vulnerable stocks while benefiting from mean-reversion of oversold names. In the current period of elevated concentration, alternative indices can provide broad-market exposure as well as diversification in the event that a shock disrupts the current growth story of a few AI superstars.6

When Average is Exceptional

Equal-weight portfolios are conceptually simple and are used as the classic benchmark for academic papers. They offer an intuitive, transparent way to get broad-market equity exposure while excising the specific company risk generated by animal spirits at the tail of a bull run. As the name “equal-weight” suggests, these portfolios take equal-sized positions in the smallest and largest stocks by capitalization. Mechanically, the strategy works by harvesting a persistent rebalancing alpha through realizing the gains of recent winners and reinvesting into recent laggards. The underlying economic logic is that the economic “rents” of recent winners are competed away (or regulated away) and that disfavored companies have the agility and market incentives to transform their own businesses.7 The tendency of stocks to mean-revert coupled with disciplined rebalancing provides the tailwind for the strategy.8 Consequently, this “alternative” indexing strategy directly deals with the issue of concentration risk in the most popular equities of today, and notably for investors, it can generate incredible value in the periods following the popping of an equity bubble, as happened in 1989, 1999, 2008, and 2020. While current concentration levels are not indicative of an imminent blowoff, the late stages of bubbles are characterized by elevated levels of concentration, which is precisely when an alternative index can generate the most value.

Better yet, there is some market momentum in favor of equal-weight indices. Concerns over concentration translated into nearly $13 billion in assets flowing into the largest S&P equal-weight ETF in 2023, a trend that has continued in 2024.9 Furthermore, the thesis has begun to be validated by a broadening of performance across US equity markets, with the S&P 500 equal-weight index surging to a new high after Christmas and sustaining that momentum into 2024. There has been a corresponding rise in dispersion among the Magnificent Seven in 2024, as Nvidia and Meta continue to surge ahead for the moment while Apple and Tesla struggle.

But Why Settle for Average?

We believe investors can gain broad-market exposure in a more thoughtful way. The RAFI Fundamental Index strategy provides a superior alternative broad-market index on both theoretical and practical grounds.

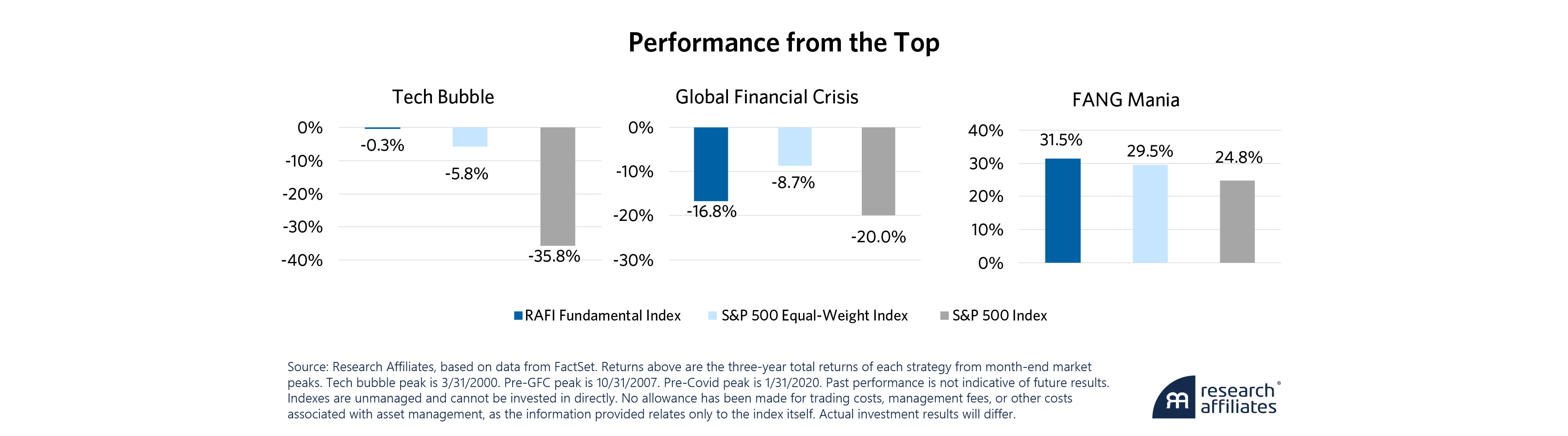

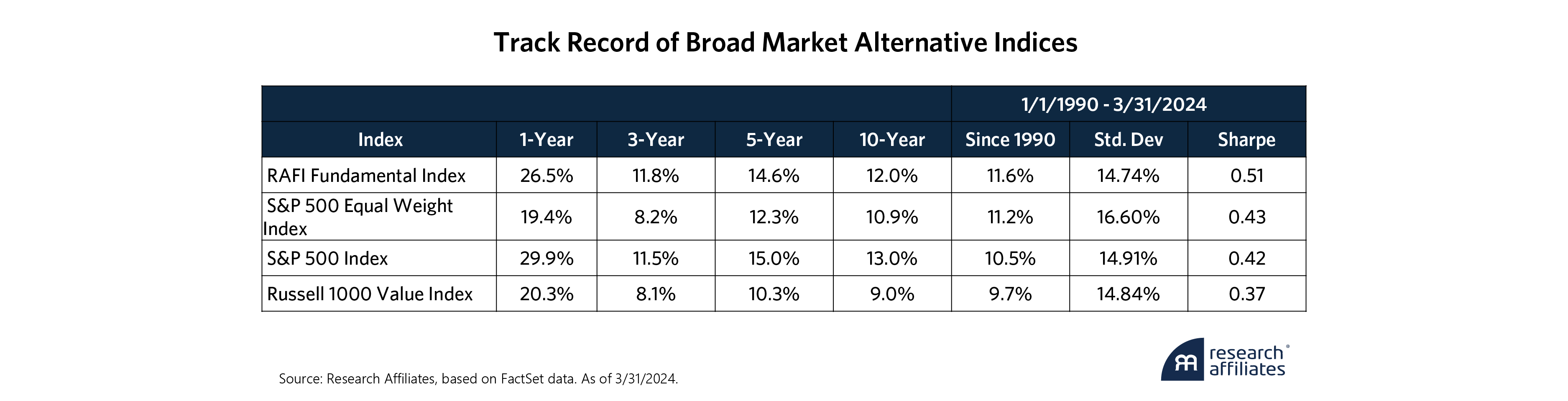

Over the long run, the RAFI approach has maintained a small, persistent lead over the equal-weight index and a substantive edge over a cap-weight index and cap-weight value index, despite the RAFI strategy having a noticeable value tilt. How does the RAFI construction fare during bubble peaks?

In 2000, investors piled into the technology names laying the road for the internet. Over the following two years, the S&P 500 declined by 16.9% while a simple equal-weight index earned 19.2%. The RAFI strategy rocketed ahead, up 25.4% over that period. COVID generated a FOMO effect among investors because the disruption was seen as accelerating the switch to the new digital economy. But when that story was exhausted, the FANG stocks saw their valuations collapse precipitously from December 2021. The S&P dropped by 9.2%, but the equal-weight index dropped only 1.3%, while the RAFI strategy added 3.7% during 2022. Over the next two years through the end of 2023, the RAFI strategy added 8% in absolute terms over the market capitalization weighted index.

We believe investors can gain broad-market exposure in a more thoughtful way. The RAFI Fundamental Index strategy provides a superior alternative broad-market index on both theoretical and practical grounds.

”The only time that the RAFI strategy trailed a naïve equal-weight alternative was during the Global Financial Crisis. Both alternative indices handily outpaced the market-cap index from its peak in October 2007. The RAFI alternative kept pace with the equal-weight index initially but lagged slightly over longer periods as the uncertainty surrounding firms with large economic footprints in financials and industrials (such as Citigroup, Bank of America, and General Electric) weighed on the portfolio. This relative underperformance actually points to a virtue of the RAFI strategy as an alternative index, an economic story. A strategy that is anchored to fundamentals and designed to “look through” the cycle might be expected to face headwinds when firms with a large real impact on the economy are in turmoil. A naïve equal-weight approach doesn’t offer similar answers for periods such as 2000 and 2021. An equal-weight index’s construction is simple, but the underlying intuitions for performance are confusing.

A Superior Alternative

The RAFI provides investors with a superior broad-market alternative for three major reasons: underlying economic intuition, volatility, and implementation and scalability.

Underlying Economic Intuition

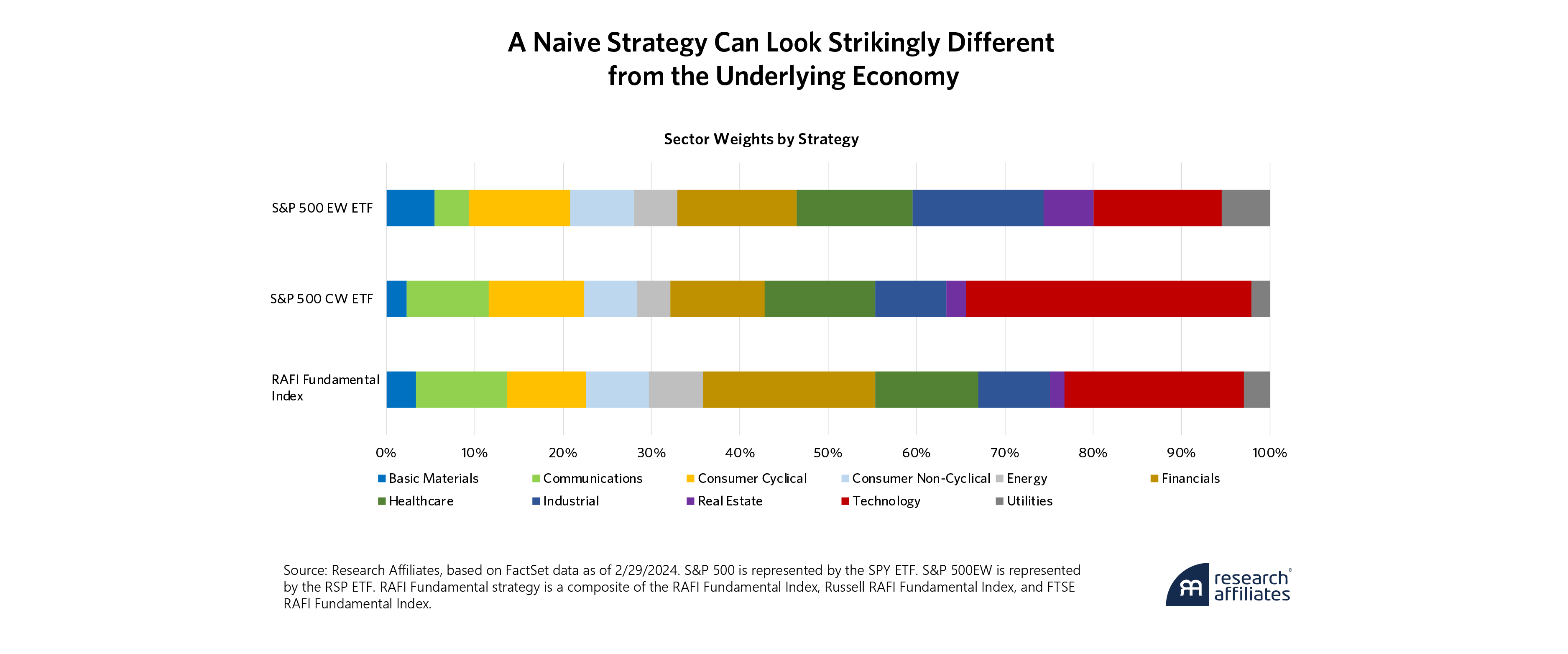

As one of the oldest “systematic” strategies, equal-weight strategies are sometimes referred to as naïve because they are simple to the point of being information insensitive. Portfolios are arbitrarily driven by the number of securities rather than a company’s economic impact. In contrast, the RAFI methodology produces a portfolio construction tied to the economic size of a company and also harvests the same rebalancing alpha as prices move toward their economic weight.10 In the result is a portfolio purposely crafted to reflect the broader economy.

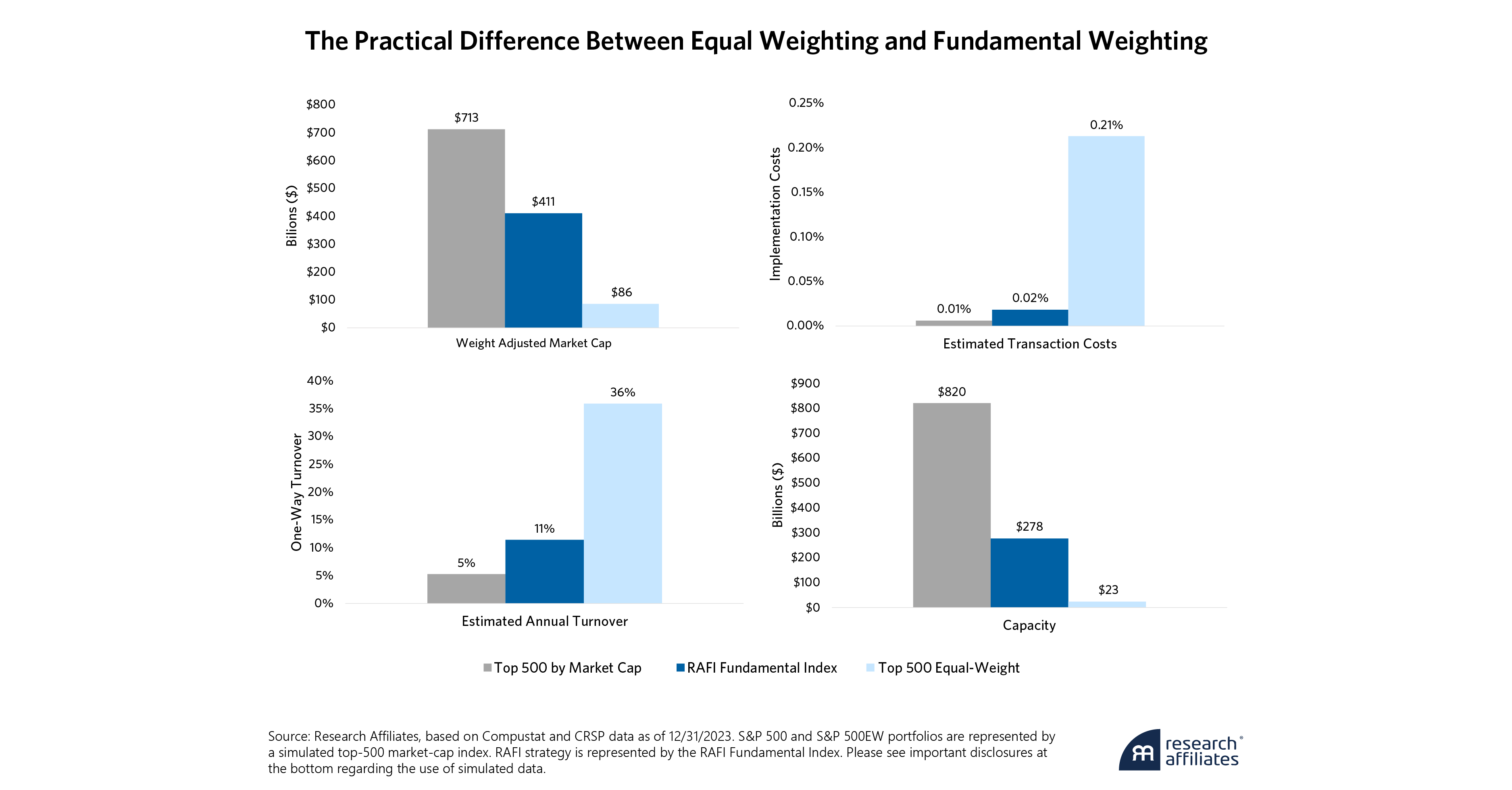

The equal-weight index has a pronounced bias towards small-cap stocks, with a weighted average market cap (WAMC) of $83 billion, compared with $713 billion for the S&P 500 (as of year-end 2023).11 Larger firms with a greater established impact on the economy have a dramatically diminished impact on the portfolio, but in the RAFI methodology, companies are weighted in proportion to their economic size. Thus, the average size of the RAFI portfolio reflects the footprint of larger firms (WAMC of $411 Billion).

The lack of a coherent economic rationale can make a naïve equal-weight strategy an uncomfortable alternative to a cap-weight index. As seen in the figure above, the strategy’s sector allocations look dramatically different from the market-cap strategy. The RAFI strategy, however, broadly aligns with the S&P 500, adjusted for any sector-specific hype. This alignment makes sense if we believe markets are broadly yet not completely efficient. It also underlines the arbitrary nature of the equal-weight algorithm, as corporate actions and changes to the number of names can alter the sector tilts of the strategy. The contrast between the economic incoherence of the equal-weight strategy and the logic of the RAFI strategy has knock-on consequences for each strategy’s return profile.

Volatility

The favorable consequence of following this logic is a strategy with dramatically lower volatility than the equal-weight index. The RAFI strategy’s annualized volatility is roughly in line with the cap-weight index (14.74% for the RAFI strategy versus 14.91% for the S&P 500), but the equal-weight index is significantly more volatile at 16.61%. Scaling returns to risk, the RAFI Fundamental Index achieves a 0.51 Sharpe ratio versus 0.43 for the equal-weight strategy.

The RAFI methodology looks through the cycle by using five-year averages to determine a company's size and a weight to rebalance back to in the portfolio. These metrics tend to change slowly, avoiding the kind of sharp movements that can be seen in other alternative indexes and providing the investor with a more stable and comfortable journey. Careful design (rather than chance) generates a less-volatile portfolio that frees up risk budget in a portfolio.

Implementation and Scalability

A desirable broad-market alternative provides a durable equity exposure that scales to match investor needs and rising interest. The simple yet thoughtful design of the RAFI strategy results in a strategy that is not only cheaper to trade but also requires fewer trades and consequently has the ability to preserve its gains as more investors join the trade.

As one of the oldest “systematic” strategies, equal-weight strategies are sometimes referred to as naïve because they are simple to the point of being information insensitive.

”Equal-weight indices trade smaller, more illiquid stocks as a natural byproduct of assigning equal weights to the largest and smallest companies. This implementation drag compounds as the equal-weight strategy requires frequent rebalancing (of both winners and losers) to avoid the natural drift back to market-cap weighting. By representing the broader economy, the RAFI design results in fewer dollars being absorbed by truly small companies while also requiring fewer trades to maintain the desirable link to the underlying economic size of a company. The combination of these attributes functionally has different implications for the two approaches. As more money flows into equal-weight strategies, they become more expensive to trade, resulting in a persistent drag on performance, but the RAFI strategy ideally trades toward the long-term value of firms, with favorable trading dynamics enabling the strategy to sustain large allocations.

To put some numbers to this analysis, consider a simulated portfolio of the top 500 stocks by market cap equally weighted and rebalanced quarterly, as shown in the chart below. For $10 billion in assets under management, 21 basis points will be spent to trade the equal-weight portfolio, more than 10x the cost of the RAFI-weighted strategy.12 Trading back to equal-weight results in almost 36% annual turnover. The combination of these factors means the portfolio has an effective capacity of 23 billion dollars before estimated transaction costs rise over 50 basis points. This trade can become quite crowded.

Or, to put it in more practical terms, consider the example of Hasbro, which had a market cap of $7.1 billion at year-end and accounted for 0.02% of the S&P 500. Imagine approximately 10% of assets in the S&P 500 (or $650 billion) flowing to the S&P 500 equal-weight index. The result would be nearly $1.3 billion, or a fifth of Hasbro’s current market capitalization flowing into the company. But Hasbro accounts for only 0.03% of the index with the RAFI strategy, reflecting its small underlying business. Simply put, the RAFI strategy is built to scale now when investors are seeking to diversify their US allocation.

A Little Thought, a Lot of Power

It has been said that history doesn’t repeat itself, but it often rhymes. In a time of technological tumult, the recent Nvidia gold rush rhymes with hype cycles of the past. Investors would be wise to diversify. Alternative broad-market indices harvest the premia generated by human irrationality over the long run, benefitting particularly in moments when bubbles pop. Breaking the link between price and weight enables these indices to avoid the consequences of mania and profit from the return to the fundamentals. Equal-weight portfolios are a popular yet naïve approach to harness these benefits, but arbitrary active sector weights, high and costly turnover, and a lower trading capacity all threaten the effectiveness of the strategy. The RAFI strategy achieves the same or better performance benefits compared with the equal-weight index, but its thoughtful construction avoids the economic incoherence and trading shortfalls of equal-weight strategies. Investors are right to seek an alternative to market-cap indices during periods of mania. They should choose a smart alternative.

Please read our disclosures concurrent with this publication: https://www.researchaffiliates.com/legal/disclosures#investment-adviser-disclosure-and-disclaimers.

End Notes

1. Through September, the Magnificent Seven (Alphabet, Apple, Amazon, Meta Platforms, Microsoft, Nvidia, Tesla) had accounted for 85% of gains.

2. Or, in other words, one could combine all the companies in the UK, French, and German markets and still be well short of the combined capitalization of the Magnificent Seven at year-end.

3. This information was as of 12/31/2023.

4. Please see our article “The Nvidia/AI Singularity: Breakthrough, Bubble, or Both?”.

5. Please see our article “The Winner’s Curse: Too Big to Succeed?".

6. A concern we certainly share and expound on in “Nvidia/AI Singularity: Bubble, Breakthrough or Both?".

7. Discussed in “The Winners Curse: Too Big to Succeed?” and also highlighted by S&P in “Concentration within Sectors and Its Implications for Equal Weighting,” which notes that concentration tends to mean-revert within sectors.

8. Or any strategy that breaks the link between price and weight, as we note in our paper “The Surprising Alpha from Malkiel’s Monkey and Upside-Down Strategies”.

9. According to Research Affiliates analysis, based on Morningstar data.

10. The different RAFI Fundamental Index strategy variations all capture an average of a combination of cash flows, book value, dividend yield, and sales with minor adjustments by strategy for intangibles or leverage. Five-year averages of these numbers are used to ‘look through’ the economic cycle and, on margin, better reflect medium-term mispricing.

11. The equal-weight strategy inevitably results in exposure to what is known as the small-cap anomaly. That anomaly has been thoroughly dissected since its discovery in the 1990s. We (and others) have noted that being small isn’t a virtue in itself. We’ve noted in our contributions that the small-cap space is a less efficient market with fewer participants, a greater chance for mispricing, and, consequently, a fertile ground for factor investing. Once again, this size bias may be better harvested by a deliberately crafted strategy.

12. This number scales up linearly based on assets under management.