The return of volatility in asset markets has caused investors to seek new forms of protection. Volatility targeting, the practice of adjusting the leverage in a portfolio to keep its volatility close to a desired target, has been gaining popularity.

The goal of volatility targeting is not enhanced returns, but rather to provide a more stable ride for investors over time. This approach can be applied to both single and multi-asset class portfolios.

During periods of extreme volatility, volatility targeting not only manages drawdowns and volatility more effectively than an unmanaged portfolio but can also alleviate panic selling.

In addition to volatility reduction, volatility targeted multi-asset strategies, like the Research Affiliates Global Multi-Asset Index, provide the benefits of diversification and increased risk-adjusted returns.

Introduction

Following a period of relatively calm asset markets from 2013-2019, in which the CBOE Volatility Index (VIX) averaged just below 15, volatility in asset markets has returned1 and investors have been looking for ways to protect themselves. A unique approach to risk reduction that has gained popularity in recent years is volatility targeting. Volatility targeting is the explicit practice of adjusting the leverage in a portfolio in an effort to keep its volatility close to a desired target. These types of strategies are increasingly popping up in exchange-traded funds as well as being the engine within various structured products, including fixed index annuities.

Create your free account or log in to keep reading.

Register or Log in

As with most things in academic finance, the study of portfolio volatility targeting started with equity portfolios. More recently however, investors, including Research Affiliates, have started utilizing this tool in multi-asset portfolios, providing diversification benefits across equities, bonds and commodities while keeping volatility within a manageable range.

In this paper we explain how volatility targeting works, examine applications across both single asset class equity portfolios as well as multi-asset portfolios and highlight the benefits of incorporating volatility targeting strategies in investor portfolios.

What is Volatility Targeting?

Volatility targeting is a portfolio management tool aimed at managing portfolio risk by targeting a particular volatility level and adjusting the positioning of the portfolio in an attempt to stay close to the volatility target. Although it is possible to implement volatility targeting with any asset, portfolios of derivatives provide a cost-effective implementation as trading is often done on a daily basis.

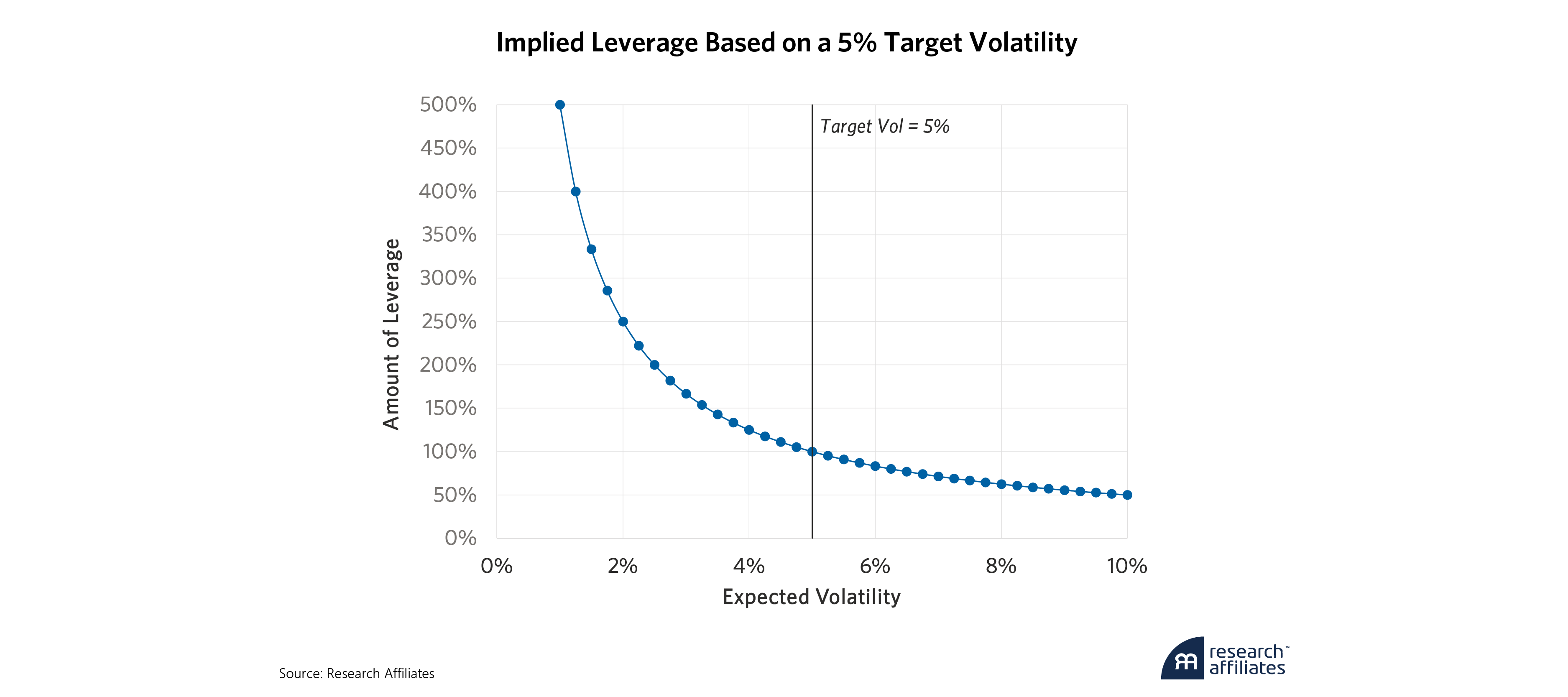

Following the research of Moreira and Muir (2017) the idea is very straightforward; one needs to simply scale asset weights in the portfolio by the ratio of the target volatility and the expectation of future volatility given the current asset mix. Obviously, the value of the targeting is greatly impacted by the quality of the volatility expectation model, but since these estimates are over short horizons, the fact that volatility tends to cluster2 makes this an “easier” effort. In equation form, the return of the volatility managed portfolio, is the volatility scaled return of the unmanaged portfolio which is simply the sum product of the asset weights and their returns.3 When expected volatility is below target, the portfolio should lever above 100% and vice versa if the target to expected volatility ratio is less than 14.

A Simple Volatility Targeting Example

Let’s examine a simple example of volatility targeting using a single asset class. In this example, we will compare an investment in the front month S&P 500 equity index futures contract with a 5% daily volatility targeted investment in the same index. For simplicity we’ll ignore the return of the cash collateral which equally affects both investments and focus on the excess return over cash of both investments.

As mentioned previously, the ability to implement volatility targeting relies on having an expectation of next period volatility. In this example we use a very simple model based on the maximum of trailing 10-, 20- and 30-day volatility. There are far more sophisticated methods for forecasting volatility, but even this simple method produces a full sample volatility close to our 5% target.

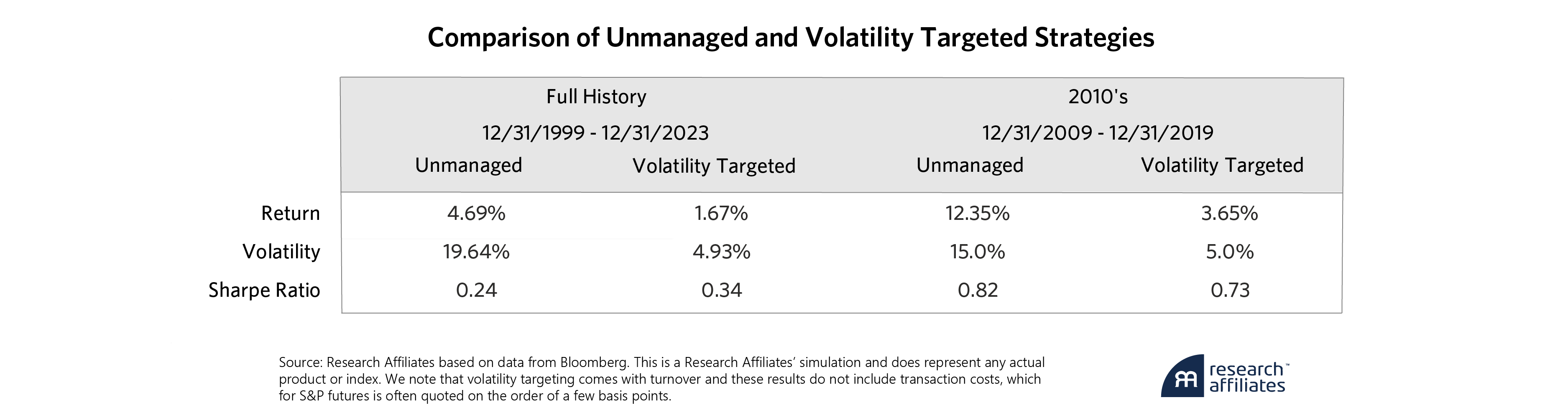

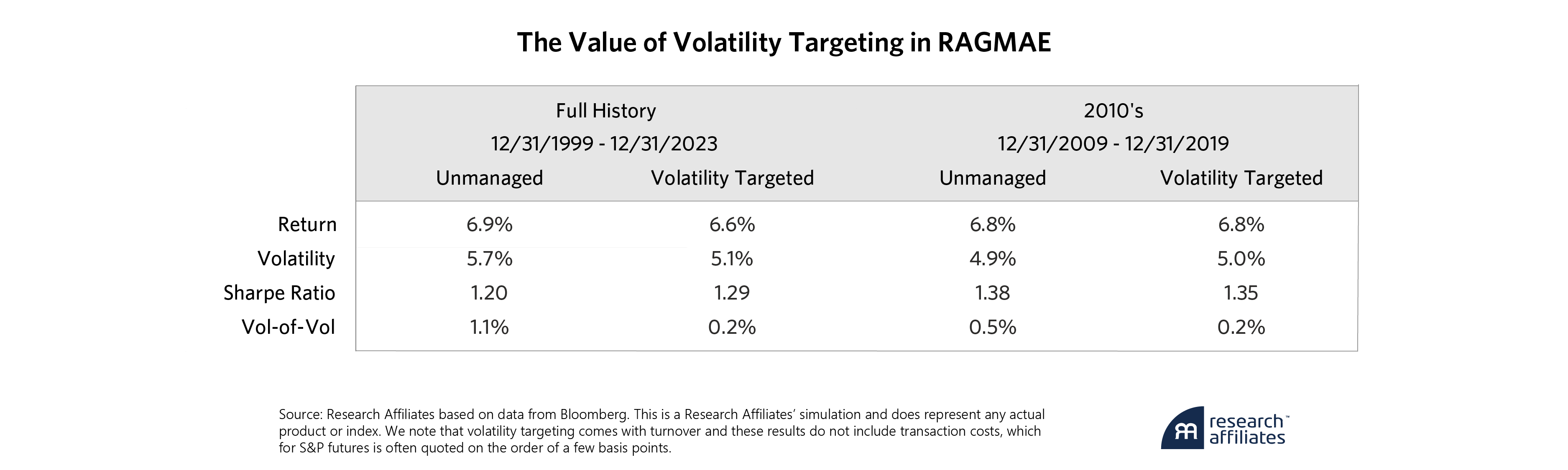

As we can see in this example, over the full sample the volatility targeted portfolio actually produced a higher Sharpe ratio than the unmanaged portfolio, before transaction costs. This is not all that uncommon, with Harvey and coauthors [2018], noting the relationship between risky assets and higher Sharpe ratios from volatility targeting. Although this is the case over long horizons, over short periods of time, the volatility of the environment is key. Focusing only on the relatively crisis-free decade from 2009 to 2019, we see the unmanaged portfolio outperformed on a risk-adjusted basis.

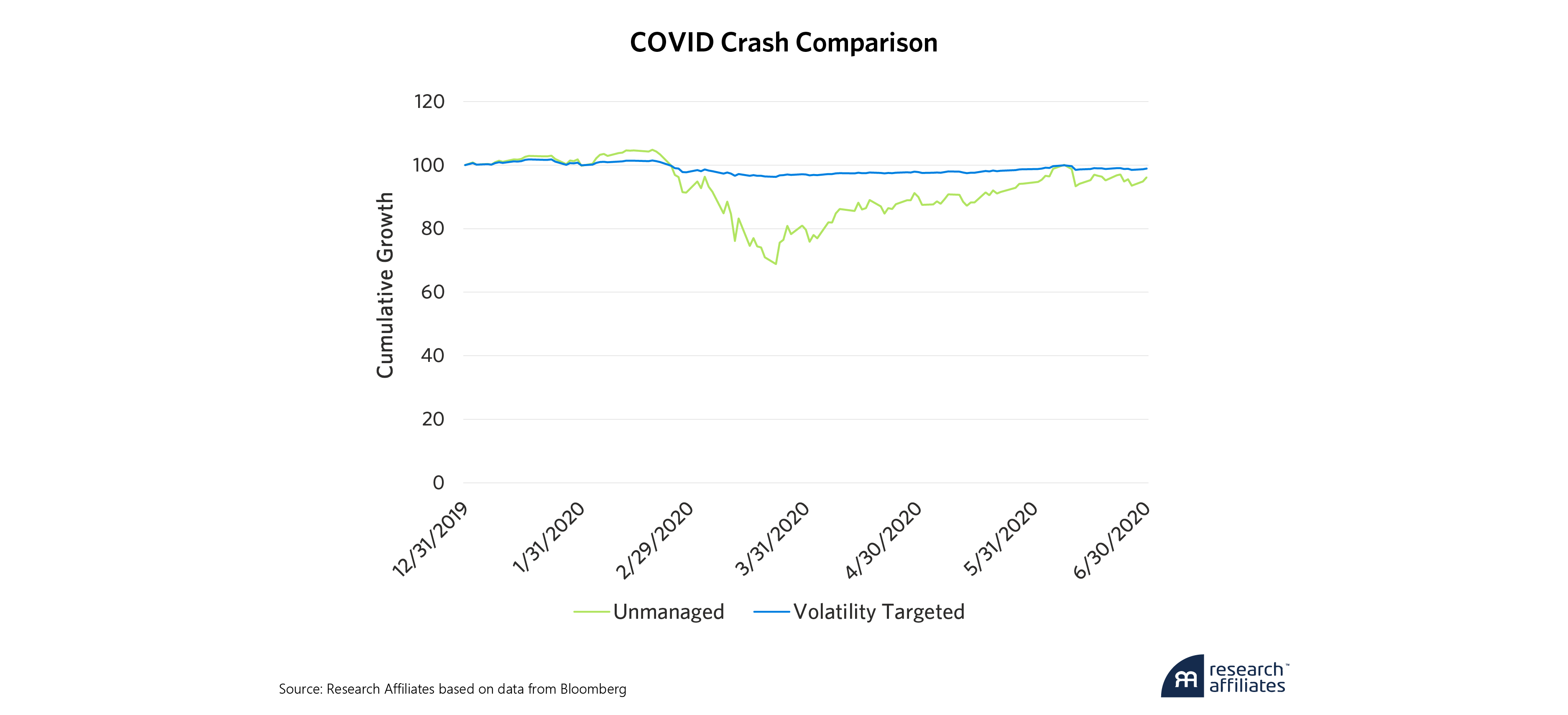

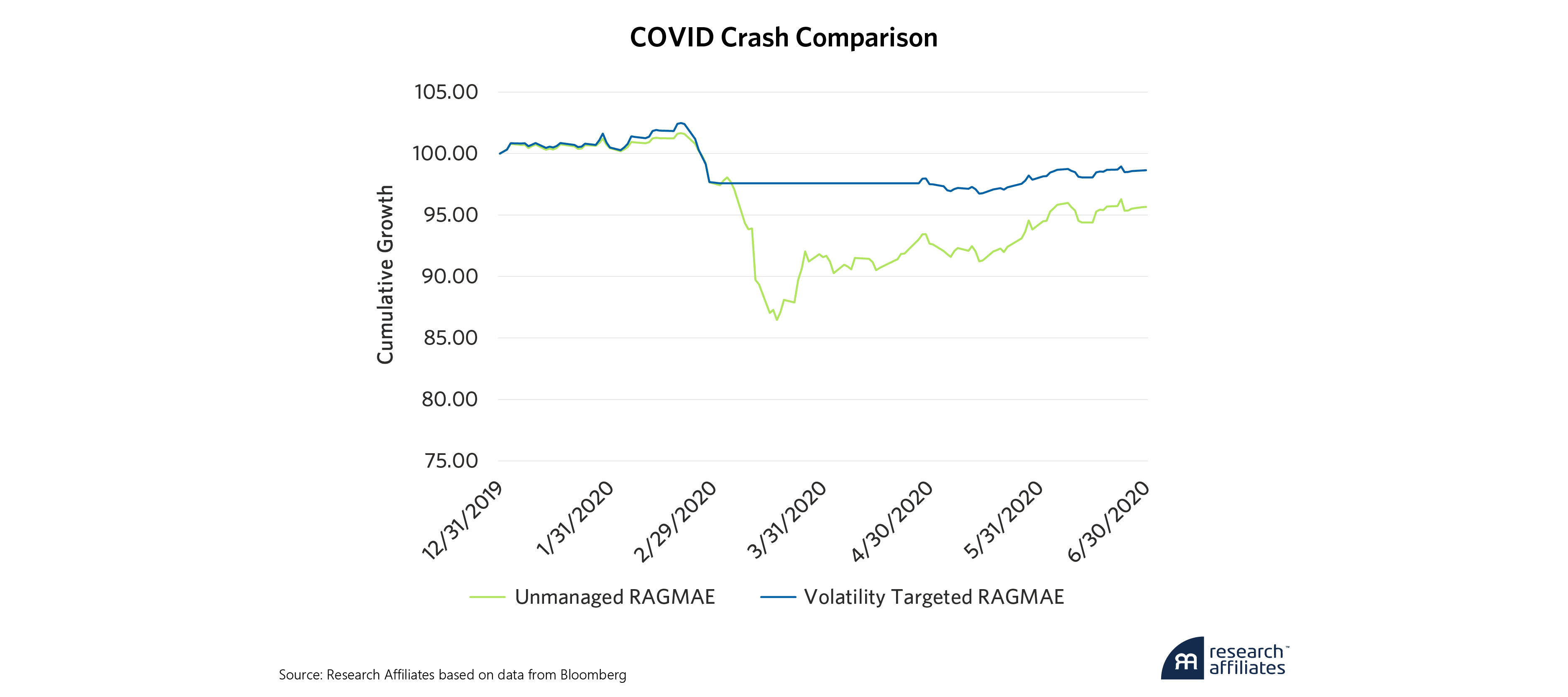

Although comparing Sharpe ratios over different periods is helpful to get a flavor for what’s happening, improving returns should not, in our opinion, be the focus of adding volatility targeting to a portfolio. Instead, the focus should be on the type of ride the investor is looking to get. This is easily seen during the COVID-19 crash of 2020. During this extremely volatile month, the unmanaged portfolio saw losses of close to 25% while the targeted portfolio was down less than 5%. Even though by the end of June the two strategies were virtually at the same level, for investors that panic and would have sold, or been forced to sell, during such a drawdown, the targeted portfolio would have alleviated the issue.

Volatility Targeting on a Multi-Asset Portfolio

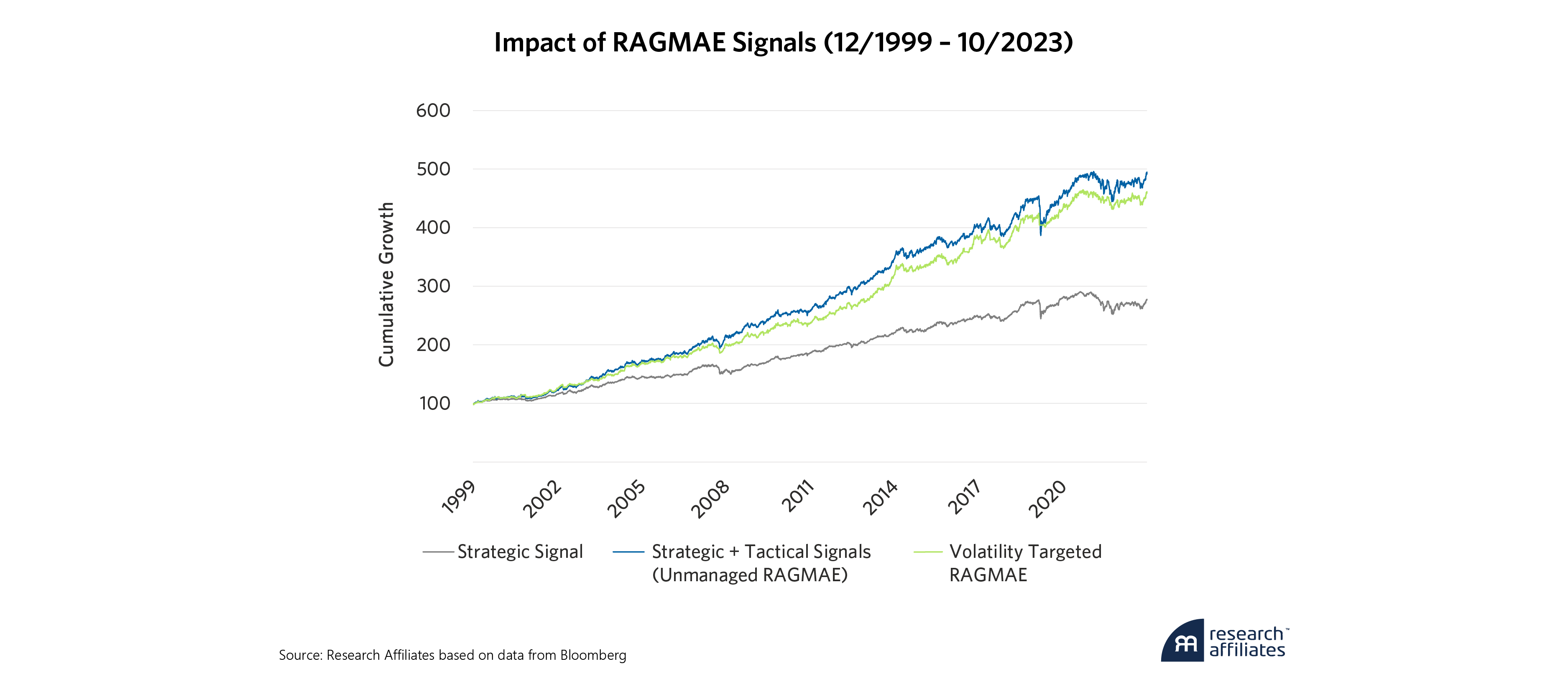

With this simple single asset example as a backdrop, let’s turn our attention to applying volatility targeting on a multi-asset portfolio. For the purposes of this analysis, we will use the Research Affiliates Global Multi-Asset Index (RAGMAE)5. The Research Affiliates Global Multi-Asset Index is a 5% volatility targeted multi-asset index combining futures exposure to 226 global equity markets, global government bonds and commodities, incorporating native diversification into the portfolio. The assets are combined using a set of both strategic/secular and tactical signals and wrapped in a custom volatility targeting framework. The base strategic portfolio utilizes Research Affiliates capital market expectations to ground the positions in forward looking expectations based on where assets are priced to go, not where they’ve been in the past7. On top of the strategic allocations are tactical over- and underweights based on the carry, value and trend momentum of the various assets. Utilizing these robust signals allows the index to capture shorter-term pricing opportunities that surround the secular trajectory of asset markets.

The RAGMAE index also improves upon simple volatility targeting using a unique multi-step approach. Similar to the simple single asset approach, we determine leverage and position sizes based on expected volatility. However expected volatility can be noisy and slow to adjust to very rapid changes in volatility. The RAGMAE index also adjusts leverage based on realized short-term volatility. The index uses a tail risk management approach where positions are liquidated and moved to cash if realized short-term volatility is greater than 7%. This is done in an effort to get ahead of major market selloffs.

The below table highlights the impact of the strategic, tactical and volatility targeting components of the index. The strategic and tactical components have provided returns of 4.3% and 2.5%, respectively, over the course of our simulation, while the volatility targeting detracted 0.3%. As mentioned earlier, the goal of volatility targeting is not enhanced returns, but rather to provide a more stable ride over time.

As with the earlier single asset portfolio example, we see similar benefits of volatility targeting with this multi-asset index. Over the full simulation period, our volatility targeting algorithm provided a positive benefit by both reducing portfolio volatility as well as increasing Sharpe ratio. As mentioned previously, our focus in applying volatility targeting is for the reduction in volatility. The increase in Sharpe ratio is a nice added benefit, but the impact of additional turnover negates much of that in transaction costs.7

In the mid-2010s decade, the impact of volatility targeting is less meaningful as volatility itself was muted. This is the same impact we saw with our previous simpler example. However, even in this case, there is an added benefit as the “vol-of-vol” is greatly reduced. “Vol-of-vol,” or the volatility of 252-day rolling volatility, shows the variability in the risk of the portfolio itself. So, in addition to getting closer to our target volatility over time, the volatility targeting algorithm reduces the variability around the target, thus providing a smoother ride.

The RAGMAE index is designed to go beyond standard volatility targeting during crisis periods by over de-levering when volatility rises dramatically, while taking into account expected reductions in liquidity during these periods. Comparing the unmanaged portfolio to the volatility targeting portfolio during the COVID crash highlights this benefit. During the period of extreme market volatility in March of 2020, the RAGMAE index switched to cash. While the market subsequently quickly rebounded, the volatility managed portfolio still outperformed from March through June by 3.0%.

Portfolio Allocation

Due to low correlation with the 60/40 assets that make up the bulk of many investor portfolios, a multi-asset volatility managed portfolio like RAGMAE is a nice addition from a return and diversification perspective. The correlation of RAGMAE to the S&P 500, US core bonds and US 60/40 is 22%, 44% and 29%, respectively.

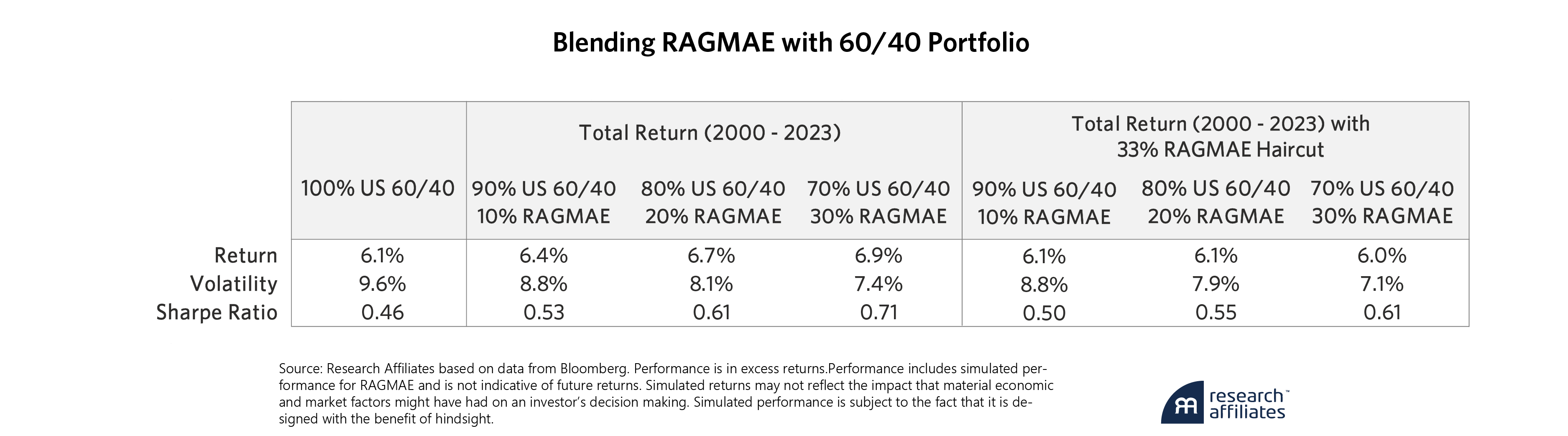

We illustrate the benefits of blending RAGMAE with a 60/40 portfolio at various allocations below. Thus far we have focused on the excess return of RAGMAE to focus specifically on the value of the index. However, this ignores the fact the RAGMAE performance is from futures exposure and is stacked on top of cash returns. With rates expected to stay higher for longer, the ability to reinvest cash collateral is an additional tailwind for investors. Even just a 10% allocation to RAGMAE increases overall return while reducing volatility, resulting in a Sharpe ratio increase of approximately 15%. Greater allocation towards RAGMAE results in even greater risk reduction and an increase in risk-adjusted returns.

Acknowledging that much of the RAGMAE history is from a simulation, and tempering expectations of the future, even two thirds of the previous performance would be beneficial to the overall risk-adjusted performance of a 60/40 portfolio. Even after haircutting the historical simulation by a third, adding just 10% of RAGMAE to your 60/40 allocation increases Sharpe ratio by 10%.

Conclusion

Volatility targeted multi-asset strategies provide several benefits: diversification, increased risk-adjusted returns and a smoother ride over time. For investors, particularly those nearing retirement, multi-asset volatility targeted portfolios offer an interesting choice. Our Research Affiliates Global Multi-Asset Index offers exposure to equities, bonds and commodities while providing a risk management overlay that keeps volatility in a manageable range and moves out of risky assets during periods of heightened volatility. Investors looking for increased diversification and reduced risk should consider adding an allocation to volatility targeted portfolios to their overall portfolio mix.

Please read our disclosures concurrent with this publication: https://www.researchaffiliates.com/legal/disclosures#investment-adviser-disclosure-and-disclaimers.

End Notes

- From January 2020 through December 2023, the VIX average increased 50% to 23.

- Large changes in volatility tend to follow large changes, and likewise for small changes.

- \(R_{VM,t}=\frac{Target Vol}{Expected Vol} ∑w_{(t-1,i)} R_{(t,i)}\)

- Effectively executing a volatility targeting program requires the knowledge, tools and comfort with managing leverage in the portfolio.

- Analytics in this section are based on Research Affiliates internal calculations and may have minor differences with the published ticker; however, any differences are immaterial to the comparisons being made here. The Research Affiliates Global Multi-Asset Index went live in November of 2023, previous performance is based on simulation.

- ASX SPI 200 Index, CAC40 Index, FTSE/MIB Index, FTSE 100 Index, Nikkei 225, S&P 500 Index. Australia, Germany, Italy, Japan, UK, US government bonds. Corn, Brent Oil, Gasoline, Gasoil, Gold, Heating Oil, Kansas Wheat, Silver, Soybean Meal, Soybeans.

- https://www.researchaffiliates.com/aai

References

Moreira, Alan and Muir, Tyler. 2017. “Volatility-Managed Portfolios.” The Journal of Finance, vol. 72 no. 4 (August), 1611-1643.

Christian L. Goulding, Campbell R. Harvey & Michele G. Mazzoleni. 2023. “Breaking Bad Trends.” Financial Analysts Journal, DOI: 10.1080/0015198X.2023.2270084

Koijen, Ralph S. J. and Moskowitz, Tobias J. and Pedersen, Lasse Heje and Vrugt, Evert B. 2016. “Carry.” Fama-Miller Working Paper, Available at SSRN: https://ssrn.com/abstract=2298565 or http://dx.doi.org/10.2139/ssrn.2298565

Asness, Cliff S. and Moskowitz, Tobias J. and Pedersen, Lasse Heje. 2012. “Value and Momentum Everywhere.” Chicago Booth Research Paper No. 12-53, Fama-Miller Working Paper, Available at SSRN: https://ssrn.com/abstract=2174501 or http://dx.doi.org/10.2139/ssrn.2174501