From Abundance to Austerity: Why the Next Decade Won’t Be Like the Last

Extended periods of zero interest rates combined with expansive fiscal policy enabled investors to amass plentiful capital to withstand the most rapid tightening cycle in 40 years.

The current equity selloff could be an inflection point in the transition from a decade of abundance to one of austerity that pressures securities prices as economies normalize and markets seek equilibrium

Higher interest rates and inflation are expected to persist, amplifying the risks of U.S. budget deficits on GDP growth and limiting the Federal Reserve’s ability to stave off recession.

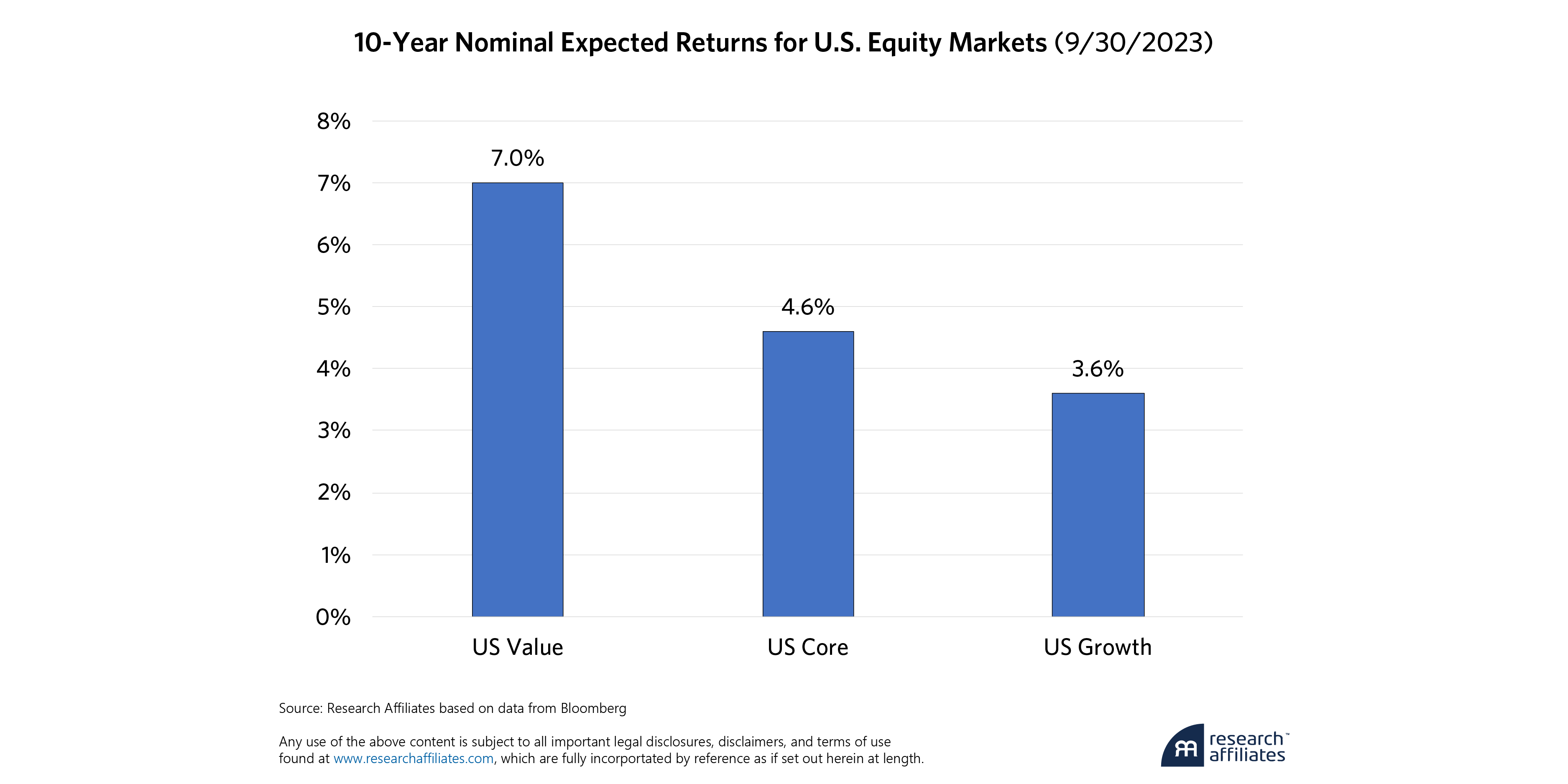

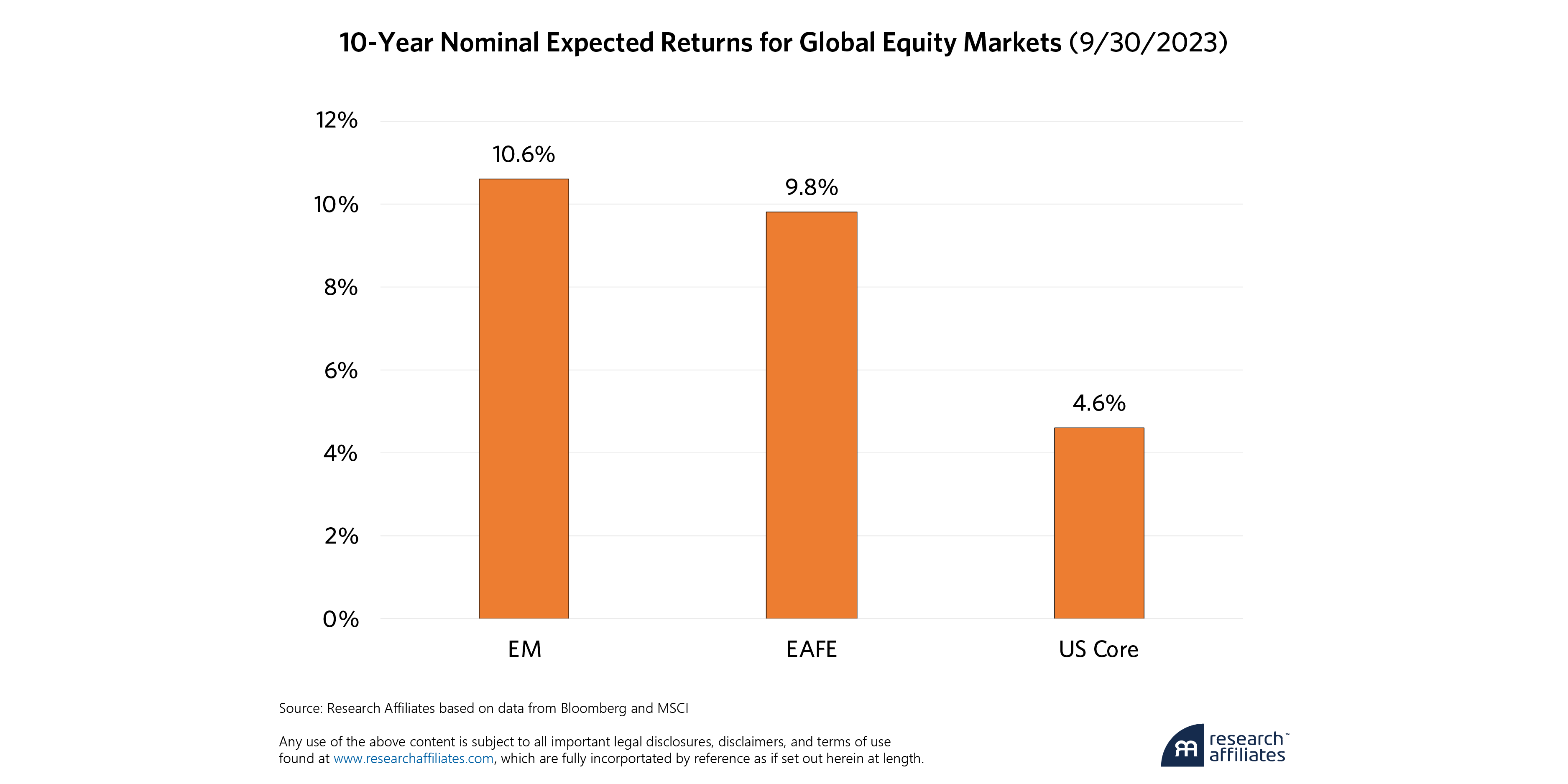

The return of macro volatility should motivate investors to reconsider tactical asset allocation. We believe value stocks, real assets as well as emerging market equities and local currency debt are well suited for such an environment.

A U.S. economic downturn that seemed a foregone conclusion at the start of 2023 — what some have dubbed “the most anticipated recession ever”— has yet to fully materialize. Cracks continue to appear, but so far those have yet to coalesce. Many, including us to some extent, underestimated the resiliency of the economy and capital markets, given the plentiful liquidity and accommodative policy environment since the Global Financial Crisis. For starters, the Federal Reserve adopted a zero-interest rate policy for 10 of the last 15 years, the most recent easy money period ending in March 2022. Expansive fiscal policy, most notably in response to the COVID-19 pandemic, further enhanced liquidity, providing the foundation for investors, homeowners and corporations to amass a war chest of capital to withstand the effects of the most rapid tightening cycle in 40 years.

Create your free account or log in to keep reading.

Register or Log in

Securities owners enjoyed a wealth effect from steadily rising stock and bond markets, homeowners refinanced to lock in generationally low mortgage rates while companies termed out their debt obligations at similarly low rates. According to Goldman Sachs, roughly half of debt issued by S&P 500 companies is not due to expire until after 2030!1 Even consumers without capital investments were able to pad their savings during the pandemic due to generous government outlays. A plethora of corporate cash also allowed larger companies to reduce the competitive playing field through merger & acquisition activity and pricing, setting the stage for the equity market dominance of the Magnificent Seven2.

Normalization a Wakeup Call from Complacency

Cracks started emerging in the first quarter with a regional banking crisis fueled by the distortions of rapidly rising interest rates. After a robust first half boosted by enthusiasm over generative artificial intelligence, fears of higher for longer interest rates sent the S&P 500 Index into a correction by late October.

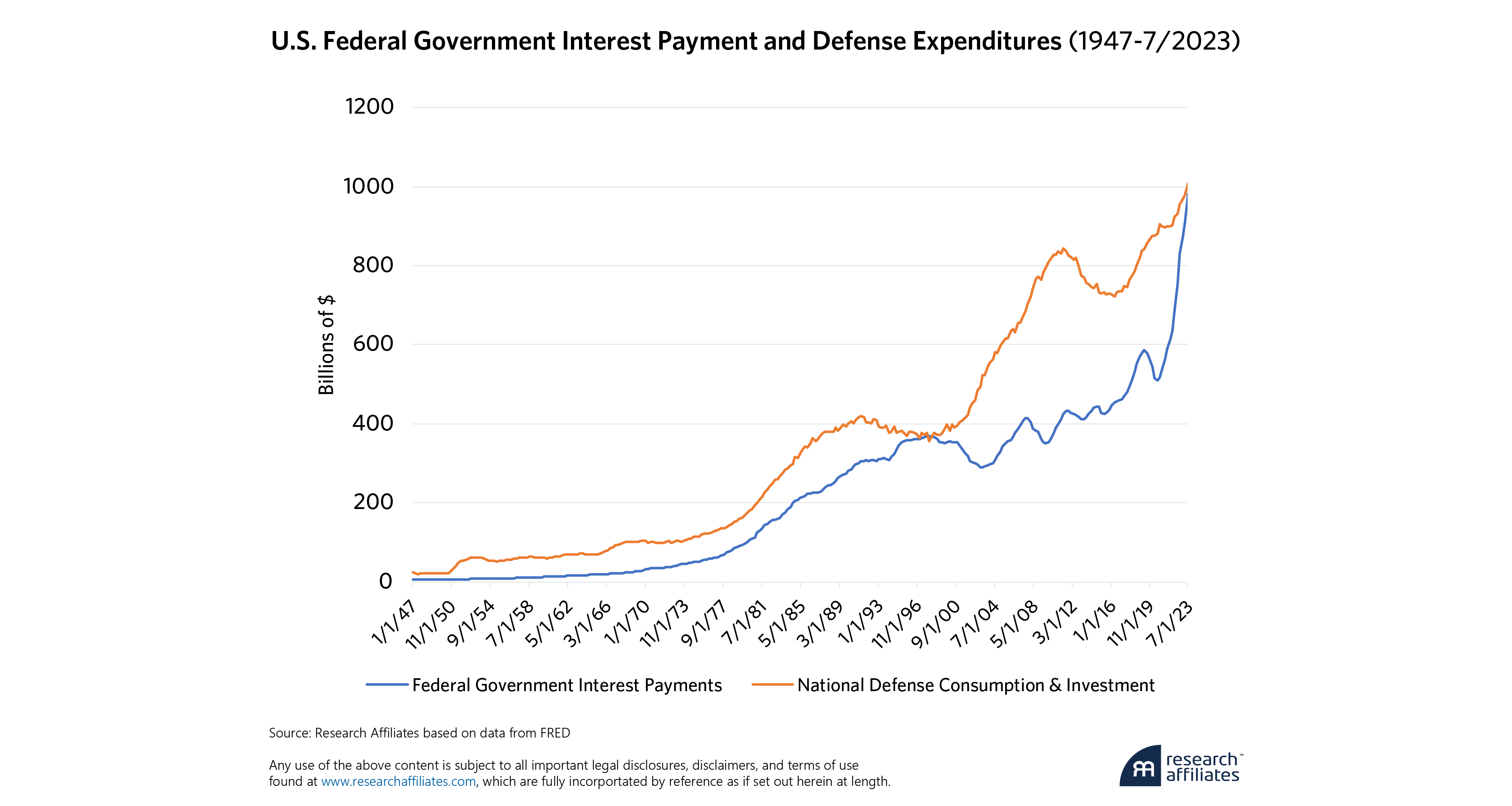

A 525-basis point hike in the fed funds rate has put interest expense on the national debt on a course to eclipse defense spending in coming quarters.

”We see the current selloff as a potential inflection point in the transition from a decade of abundance to one of austerity. At least it will feel that way as the economy normalizes from the distortions of COVID-19 and the unprecedented policy response. Equity and long-term fixed income prices could endure continued pain as capital markets seek equilibrium after years of increasing mega cap concentration and a negligible, and often negative, term premium.

In the short term, the economy could remain buoyant and investors complacent, but the end of student loan forbearance, the depletion of COVID-era savings and the impact of inflation on consumers, are the latest headwinds paving the way for an eventual recession. Only this time, persistent inflationary forces and higher debt service are likely to prevent the Fed from riding to the rescue.

Higher Borrowing Costs Amplify Deficit Risks

The biggest difference between the past decade and the one ahead is the level of interest rates. Rising budget deficits did not pose much of a threat when borrowing costs were near zero, but a 525-basis point hike in the fed funds rate during the current tightening cycle has put interest expense on the national debt on a course to eclipse defense spending in coming quarters. Interest payments now comprise 32% of all tax receipts3 and in the next year could exceed spending on Medicare. And the pain of accelerating debt service costs is just beginning. Covering soaring interest expenses will impact spending in other parts of the Federal budget and economy, making it less likely for a sharply divided Washington to pass major fiscal stimulus programs to support GDP growth.

Higher rates are also expected to lower asset prices, unleashing a vicious cycle of lower capital gains and similar tax receipts that the government relies on for revenue. Lower government revenues, in turn, create the need for more borrowing, causing annual budget deficits and the national debt to spiral even higher. While no one stopped the music for the better part of the last 15 years, this game of macroeconomic musical chairs cannot go on forever.

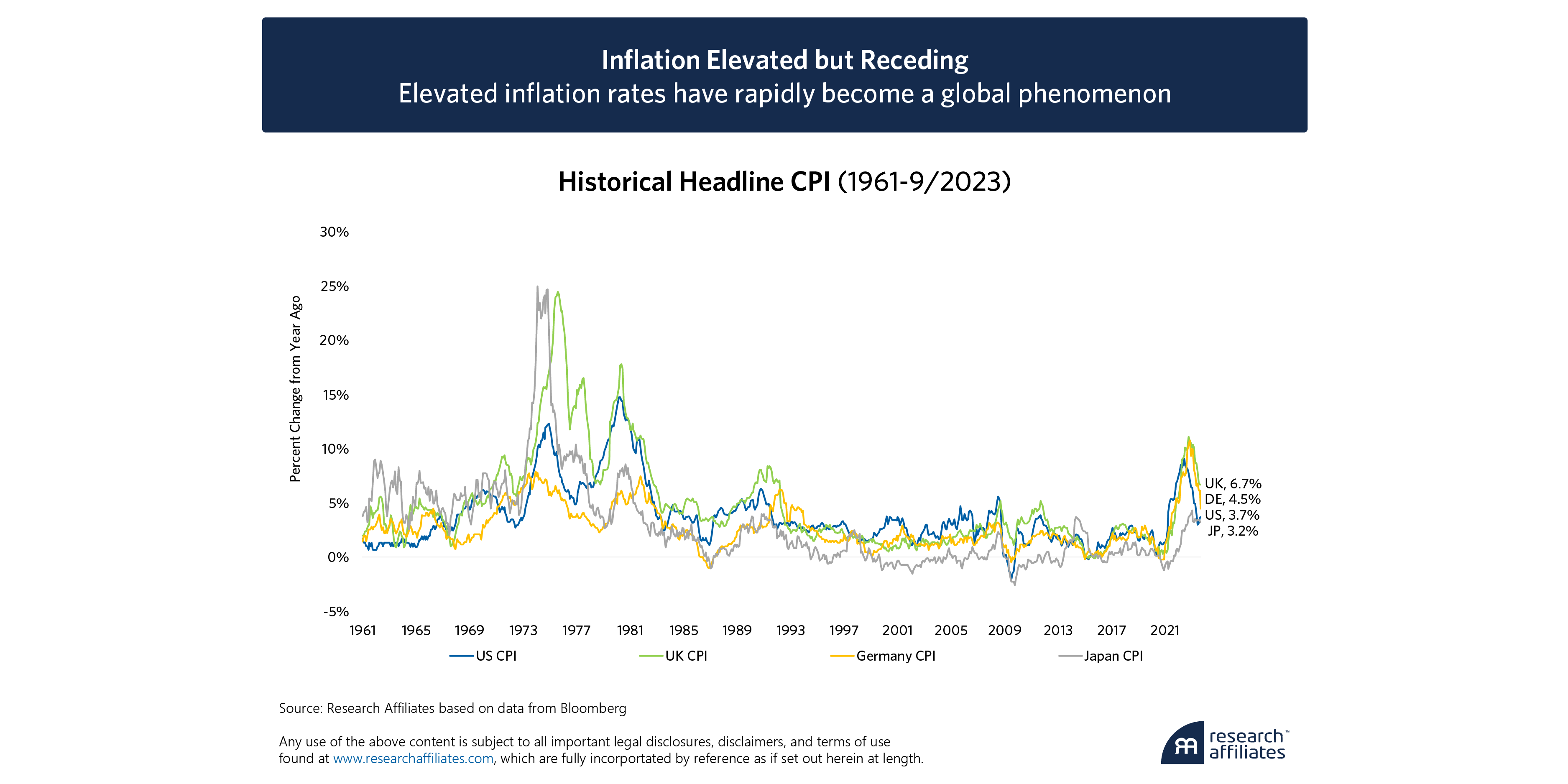

Inflation Likely to Persist

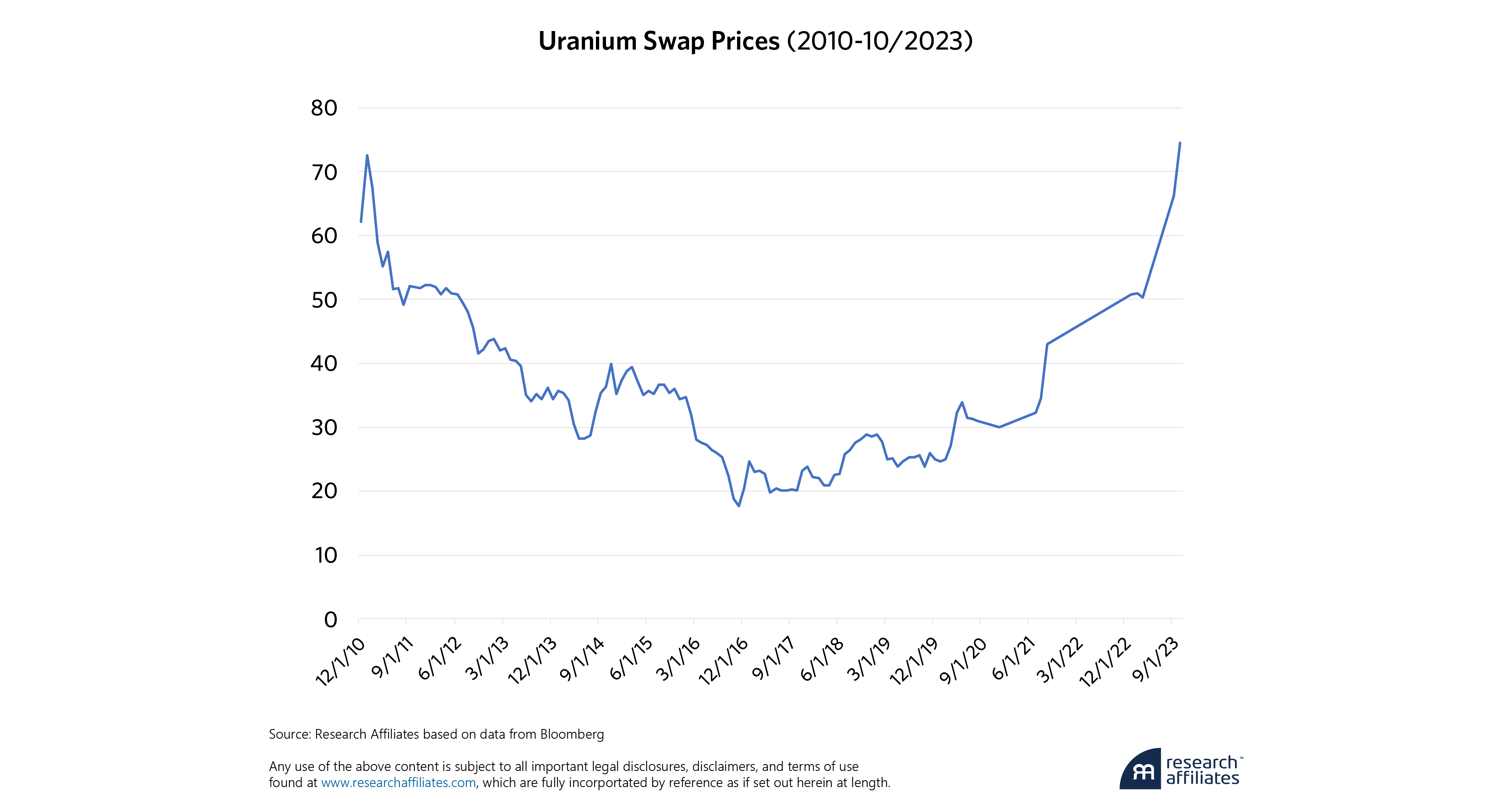

A second distinction is inflation. After cooling from nearly double-digit year-over-year levels in mid-2022, U.S. consumer and producer prices are increasing again. Commodity prices have been a key driver of the recent uptick in inflation and are expected to remain elevated in the medium to long term due to rising demand for both fossil fuel and renewable energy. Capital spending on oil & natural gas exploration has fallen for the last several years as producers have been forced to cope with the risks of the green “evolution” and the impact on strategic planning. Yet the global economy has not yet reached peak oil demand, meaning production must be maintained at current levels or even increased. The International Energy Agency (IEA) estimates global oil demand will increase to 105.7 million barrels per day (mb/d) by 2028, from 99.8 mb/d in 20224. Many renewable energy sources, such as nuclear and battery storage, are also commodity-dependent, creating long-term demand for the mining of materials ranging from copper to uranium and rare earth metals. Uranium prices, for example, after a decade of largesse have rebounded sharply as demand expectations have risen5. As a result, commodity inputs will be a stubborn headwind to managing inflation.

Inflationary and related pressures are even worse outside the U.S. In the United Kingdom, inflation spiked above 10% last year and remains several points higher than the U.S. Australia and Germany are also struggling to bring down price increases. Instead of the demand inflation it sought, the Bank of Japan is now dealing with the same price inflation as the rest of the developed world. With a weakening yen, rising yields and dependence on energy imports, rising oil prices could lead to more complications for a recovering Japan such as reducing its foreign investments. As Mohamed El-Erian recently noted, “There is a risk here that a disorderly exit by the Japanese authorities destabilizes domestic balance sheets with large JGB holdings, forcing them to dispose of positions in foreign corporate and sovereign bonds."6

The secular outlook over the next decade also looks less bright as wealthy generations continue to age. Indeed, demographics look unfavorable for both growth and inflation in all but a select few emerging markets. China is one of many regions confronting the reality of an aging population. While lower productivity poses the biggest risk in Asia, the Baby Boomers and other aging populations in the West are starting to unwind a lifetime of capital accumulation, selling assets to buy goods and services. This transition creates a tailwind for inflation while pressuring asset prices.

Positioning for an Era Where Real Returns Matter

Taken together, the normalization of liquidity and economic policy, most notably the end of the Fed put (central banks stepping in at the first sign of systemic stress) requires investors to prepare for a new era of inflation and volatility. In terms of asset allocation, where to increase or decrease exposures depends on where you are in your personal investment lifecycle, taking into account risk tolerance, time horizon and impending liquidity events.

While no one stopped the music for the better part of the last 15 years, this game of macroeconomic musical chairs cannot go on forever.

”While the post-GFC period has been an era dominated by the exceptional return of the U.S. 60/40 portfolio, the reintroduction of macro volatility in the 2020s, to go along with increasing geopolitical risks in the China region, Eastern Europe and the Middle East, are reasons investors should also reconsider tactical asset allocation in their portfolios.

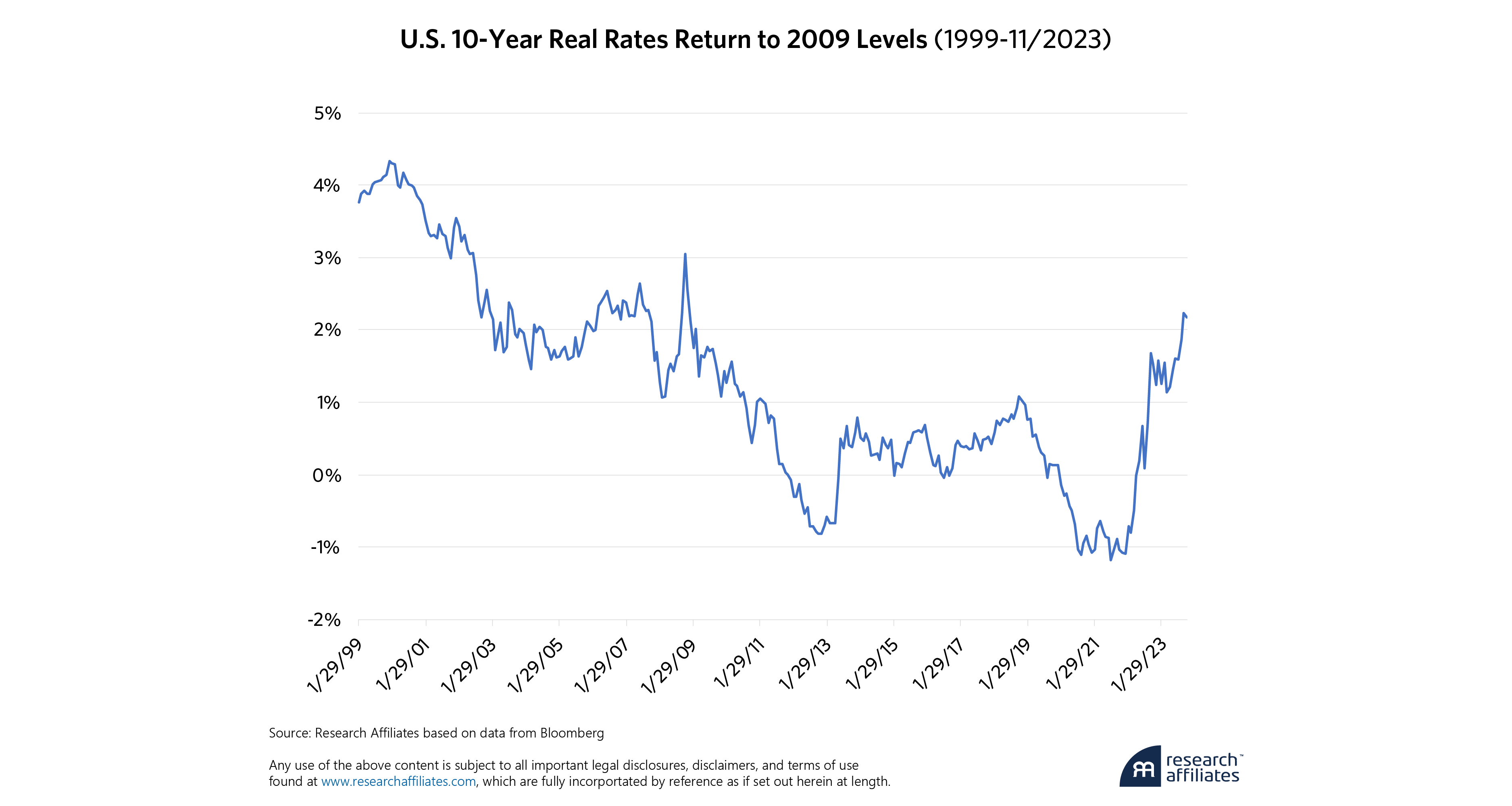

For those in retirement or on a fixed income, higher rates are a welcome relief from the paltry yields of the past decade. To understand the impact of rising rates, consider that from the end of 2021, through the end of October, cash has returned about the same as the S&P 500 Index. We expect real interest rates to stay positive over the next decade, making bonds a compelling asset.

Given our inflation forecast for the next decade of 2.6% is above current 10-year breakeven inflation rates, we generally favor TIPS over nominal bonds for conservative income generation. If our expectation for heightened inflation volatility in the decade ahead does come to pass, there will be additional value available by tactically allocating between the two.

Current debt levels are simply too high to effectively tame inflation, especially if U.S. deficit spending remains at wartime levels. Real assets with ample liquidity including gold, commodities, real estate and potentially even a small measure of digital assets, for those that fully understand the risk, are well suited for such an environment. Investors can also consider collectibles such as wine, art and watches but need to be cognizant of the high transaction costs for these sleeves of real assets.

For equity investors, now is a good time to rebalance portfolios heavily skewed to the growth leadership of the last decade. We believe value is better positioned than growth and expect the growth/value spread to shrink as stock valuations take on greater importance in determining expected returns.

While we have not explicitly addressed the dollar in this discussion, we believe that it’s too strong6 and should weaken on a secular basis. Our research shows that in a weakening dollar environment, international stocks and bonds should outperform. Over the next decade we see interesting opportunities in emerging market equities and local currency debt, although over the short-term these assets may continue to get cheaper during the risk-off environment that comes with recession.

Twenty years ago, emerging market balance sheets were in much worse shape than those in developed markets. That dichotomy has been shifting over the past decades as EM economies have learned from their mistakes and demonstrated much better fiscal and monetary restraint compared to both the past and to many of their developed market counterparts today. EM policymakers raised rates earlier and got inflation under control with less fallout than in past episodes. The emerging markets enjoy access to commodities in high demand, providing a natural base of growth, and their capital markets are poised to rebound from oversold conditions due to years of under-allocation.

Market resilience has lasted longer than many had expected, but strong global headwinds make for small odds of sidestepping recession altogether. Although increasing volatility can lead to short-term pain, it also unlocks investment opportunities previously unavailable. The global rate selloff has been difficult for bond holders, but a return to a more normal hurdle rate provides future opportunities for income. Recent high inflation has been painful for consumers, and we expect more inflation volatility to come from weakening currencies and increasing commodity demands. Offsetting the pain of high inflation comes from the ability to tactically adjust positioning to take advantage of assets that outperform in these times.

Please read our disclosures concurrent with this publication: https://www.researchaffiliates.com/legal/disclosures#investment-adviser-disclosure-and-disclaimers.

Endnotes

- Goldman Sachs Top of Mind, August 10, 2023: https://www.goldmansachs.com/intelligence/pages/top-of-mind/corporate-credit-concerns/report.pdf

- The Magnificent Seven refers to seven US stocks that have driven equity markets in 2023. They are Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia and Tesla

- See report from https://fred.stlouisfed.org/graph/?g=sOG

- https://www.iea.org/reports/oil-2023/executive-summary

- See report from International Atomic Energy Agency for various scenarios. https://www-pub.iaea.org/MTCD/Publications/PDF/Pub1104_scr.pdf

- Bloomberg article “(BBO) Time to Hasten YCC Exit or Fuel Instability”, 10/27/2003

- In our recent analysis The Buck Stops Here, we find the US dollar’s direction is an important consideration in portfolio positioning because of the asymmetric relationship between global asset returns and the price of the US dollar. In a weakening dollar scenario that we expect to continue, unhedged foreign stocks and bonds not only typically outperform, but are the only statistically reliable relative relationship we observe.