Building Portfolios: Diversification without the Heartburn

Adding diversifying assets to portfolios of mainstream stocks and bonds can improve expected returns and lead to better long-term investment outcomes.

Finding the diversifying mix a client is comfortable living with over the long term is crucial to a diversifying strategy’s success.

Introduction

This article is the third in a series designed to help financial advisors successfully address the challenges associated with the management of their clients’ portfolios by merging key lessons from investment science and behavioral finance. In the first two articles of the series, our colleagues laid out a crucial baseline for this and future articles in the series. They explained how to form reasonable long-term return expectations and why achieving those expected returns is facilitated with a clear understanding of the different risks inherent in an investment portfolio. An informed awareness of both return and risk is essential before we can construct portfolios that meet our clients’ financial goals.

Jonathan loves spicy food. Jim, not so much. Jonathan grew up in Paris, where his mom’s go-to cuisine was Moroccan food, especially tagine, while Jim grew up understanding that a great steak, prepared correctly, has all the flavor it needs without any extra accoutrement. Whether just a dash of salt and pepper or a heaping spoonful of harissa, our individual palates dictate the amount of spice we can comfortably handle. Indeed, in addition to pleasing the senses, some evidence for the health benefits of spicing up meals exists, including recent research suggesting a regular diet of spicy foods is associated with a longer life.1

Like adding spice to a meal, adding asset classes beyond traditional core stocks and bonds to an investment portfolio can induce uncomfortable reactions, starting with the occasional heartburn despite the indisputable benefits of diversification. The decision to construct a diversified investment portfolio requires us to include asset classes beyond the most familiar and mainstream, which can be uncomfortable for many investors. Like adding spice to food, adding diversifying asset classes—to the degree our individual risk tolerance allows—offers the benefit of more rewarding long-term investment outcomes. Adding these asset classes—and just as importantly holding them through the interim periods that give us heartburn—offers investors the potential to reap the benefits of diversification over the long run.

How Much Diversification Is Enough?

The most common objective of individual investor portfolios is to maximize after-tax net-of-inflation (or real) returns, such that those returns are capable of providing the funds for ordinary (and sometimes extraordinary) expenditures when or whenever needed. For many, that means supporting consumption in retirement, after the regular paychecks have ended. Most advisor–client conversations typically include a discussion around portfolio diversification as a means to assist in meeting this objective, among others.

The aspects of diversification that advisors typically stress to their clients include:

1. Diversification is a long-term strategy. Over shorter horizons, particularly in volatile markets, we must remember the long-term value proposition of diversification.

2. Diversification is not an all-or-nothing choice. We can put diversifying asset classes into the current portfolio mix to the extent we are capable of tolerating the inevitable short-term discomfort.

3. Finding the right allocation to diversifying asset classes helps avoid the costly but common practice of rotating into and out of diversifying strategies at the wrong times.

Diversification and its long-term benefits have been accepted as a core investment insight over the last 50 years. But in recent years, many have begun to question the benefits of diversification. The main reason for this is the recent pummeling of most diversifying asset classes. The eight-year market rally in US stocks—the second-longest bull market in the past century—has made it very tempting for investors to abandon the pursuit of diversification or retreat to the widely adopted 60/40 portfolio. And why not? Recent returns of a US 60/40 portfolio have been outstanding—7.7% and 10.0% annualized over the last three and five years, respectively—particularly when compared to a sample diversifying portfolio with returns of 1.6% and 1.0%, respectively, over the same intervals.

Most investors are aware of the benefits of diversification from a risk-reduction perspective. This is, absolutely, one of its great benefits, however, in this article, our focus is primarily on diversification as a means of return enhancement. We take this perspective to be consistent with a question we often hear from investors and advisors—How can I make more money for accepting the same amount or risk?—as opposed to—How can I make the same amount of money taking less risk?

Diversify, Diversify, Diversify

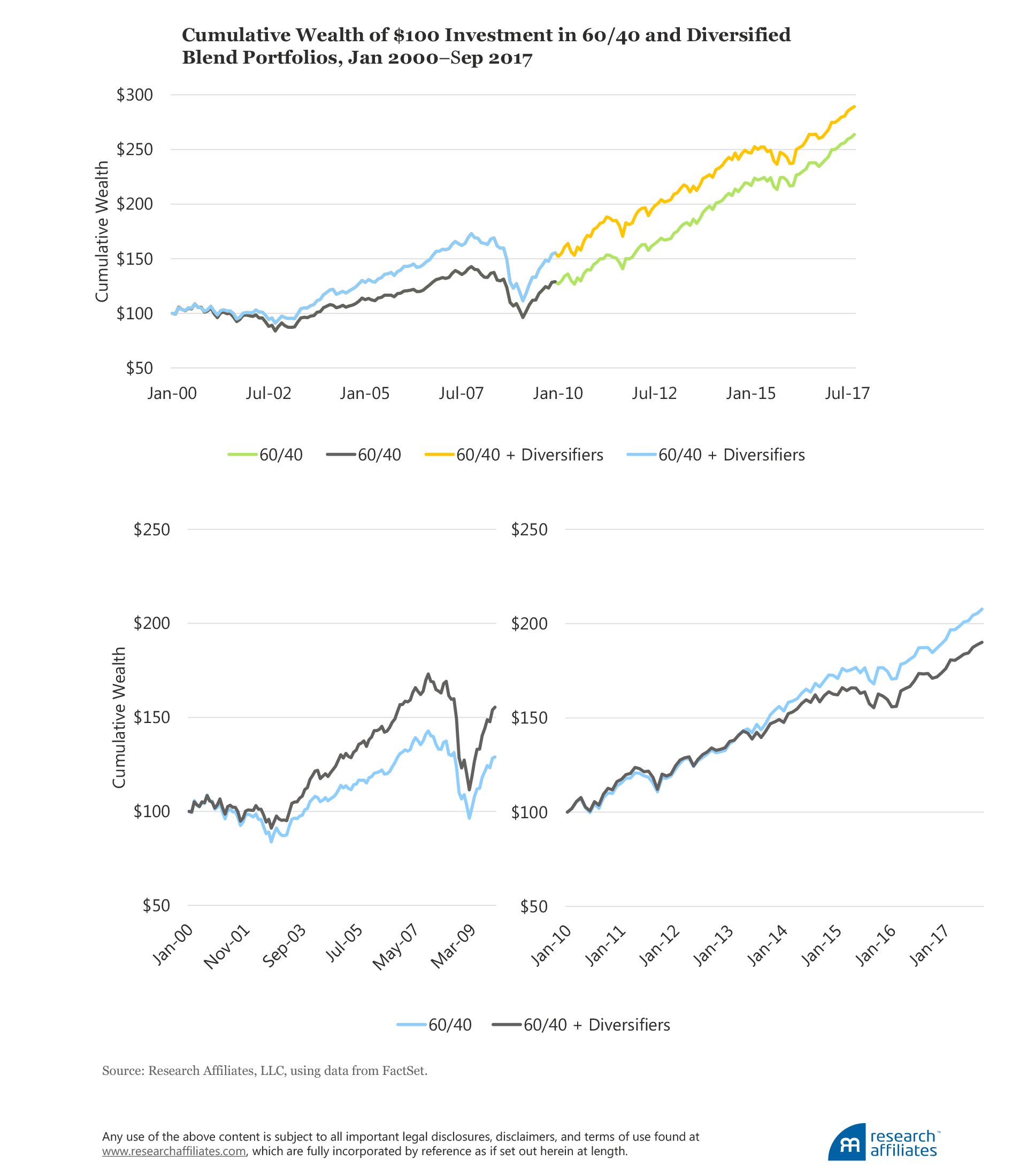

A core insight of the last half-century of finance theory is that diversification is one of the closest things we have to a free lunch in investment management. “Diversify, diversify, diversify” has rightly become to finance what “location, location, location” is to real estate. Like real estate, where occasionally location can backfire (those of us in California are deeply aware of earthquake risk), diversification can also fail to produce the intended results over certain time periods. Whereas in the first decade of this century,2 a blended portfolio composed of 75% US 60/40 and 25% diversifying assets (an equal weight of commodities, long TIPS, REITs, and emerging market stocks) trounced the US 60/40 portfolio by 2.0% a year (4.3% to 2.3%), from January 2010 to September 2017, the US 60/40 portfolio had a phenomenal run, besting the blended portfolio by 1.3% a year (10.0% to 8.7%).

Diversification can be a free lunch, but sometimes, like the last seven years, that lunch is only a ham sandwich compared to the filet mignon of mainstream portfolios. Since 2000, however, a patient investor in the blended portfolio would have come out ahead by 60 basis points a year (6.0% to 5.4%).

While recent history offers an excellent example of the different results of adding diversifying assets over different short-term intervals, we must remember this is just an example, and different time periods can be cherry picked to show different results. Far more important is to move from a backward-looking historical perspective to the more practical forward-looking vantage point of expected risk and return. This is exactly the perspective our Asset Allocation Interactive (AAI) tool takes.

The Asset Mixes of a Diversified Portfolio

The Asset Allocation Interactive tool on the Research Affiliates website can assist in helping advisors and their clients visualize the benefits of additional diversification in their current portfolio mix. AAI uses a common risk-and-return framework to identify efficient (from a return per unit of risk perspective) portfolios, which are well diversified for a range of target volatilities. We can use these portfolios to dig deeper into what efficient portfolios look like in practice.

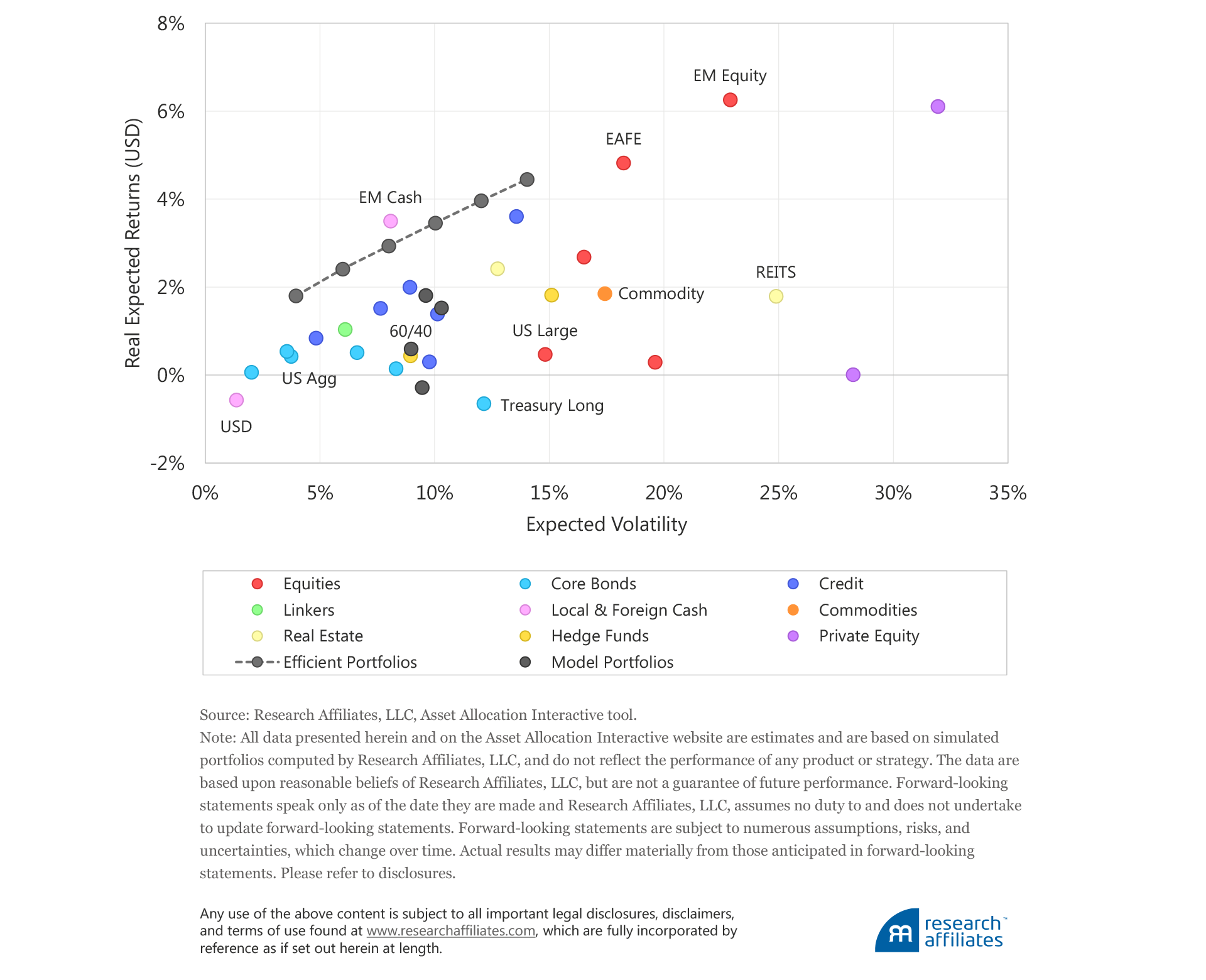

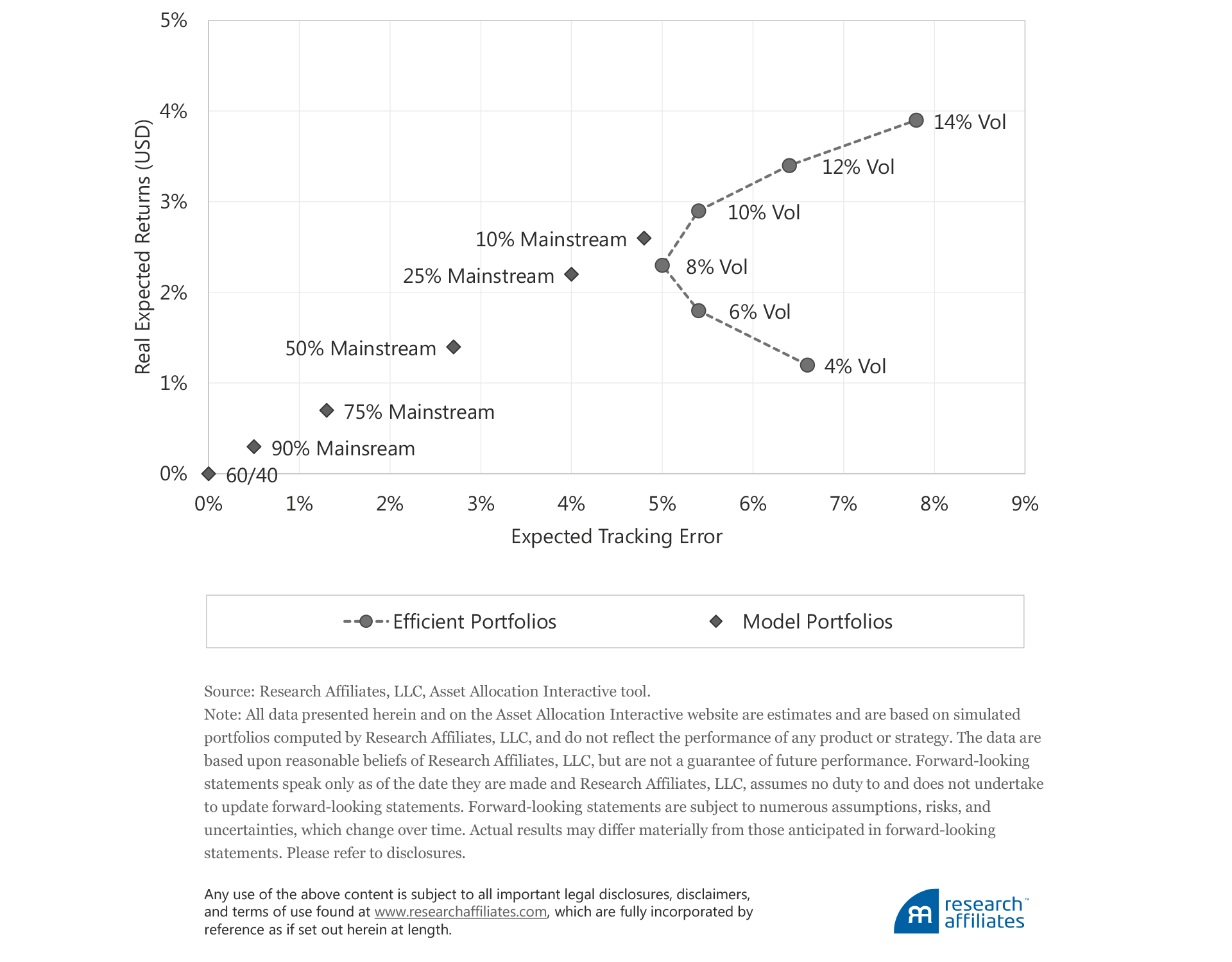

The following scatter plot from AAI shows the long-term real risk and return expectations (based on data as of September 30, 20173) for 27 global asset classes and six portfolios along the efficient frontier.4,5

Why would an investor not merely adopt the portfolio that best satisfies their risk appetite, such as a 10% volatility target? First, this approach implies an investor is able to identify their risk appetite, not easy even for sophisticated investors, let alone novices. So, for our discussion here, we’ll do what many investors do when presented with a similar range of choices, we’ll select a portfolio in the middle of the efficient frontier. On this scatter plot that is either the 8% or 10% volatility portfolio. We’ll choose 10%! We do not mean to be flippant in our choice of risk, but only to highlight that asking an investor to provide a well-reasoned response to their risk tolerance presents real challenges.

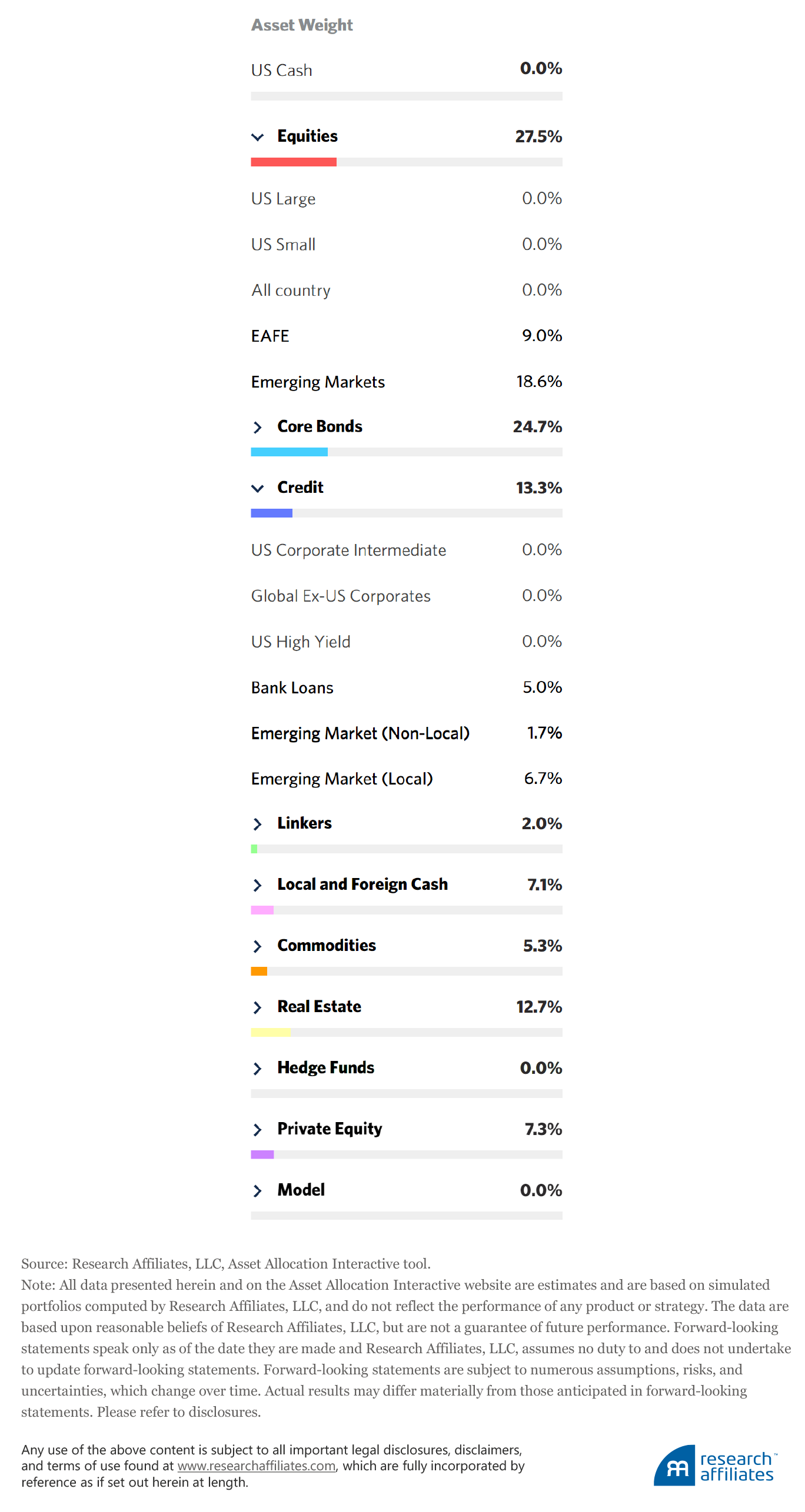

The majority—or over 66%—of the portfolio consists of asset classes outside of developed-market equities and bonds. A deeper dive shows these asset classes to be allocated 15% in credit, 13% in real estate, 7.5% in foreign and local cash, 7.2% in private equity, 5% in commodities, and 1.6% in inflation-linked assets, also known as linkers.

The Asset Allocation Interactive tool allows us to reallocate away from any asset class, and in an ideal world, diversification calls for putting capital to work in some fairly exotic asset classes, some that may not be accessible to all investors, such as private equity, and some that may be beyond an acceptable comfort zone for certain investors, such as commodities which have declined over 13%, net of inflation, over the past three years.6

Let’s take yet a deeper dive into the composition of 10%-volatility efficient portfolio, which at first glance may appear relatively benign to most investors. In particular, let’s look at the equity allocation. Start by asking whether 27% in equities seems too little, too much, or just right. We would not be surprised by the response “too little,” because many investors and advisors think of the stock market as the main place to allocate investment dollars for the long run. Now take a look at the following breakdown. Approximately 67% of the equity allocation is in emerging markets and 33% in Europe, Australasia, and the Far East (EAFE), with a 0% allocation to US equities. This is not a typo: today’s diversified portfolio does not invest in US equities at all.

This outcome is not predetermined, perhaps driven by a deep-rooted dislike of US companies. Rather, buying US equities at current high valuations sets up investors to “ride the wave” of “buy low, sell high” in the wrong direction! As a result, at today’s valuation levels (as of September 30, 2017), an efficiently diversified portfolio calls for stepping even further out of the mainstream than would otherwise be the case, given the better bargains that exist elsewhere in the capital markets.

Diversification: Not an All-or-Nothing Choice!

After peering into the 10%-volatility efficient portfolio, many may conclude this diversified mix is just too alien and uncomfortable. We get it. Even though the rational side of our brain knows we should hold diversified portfolios, the idea of stomaching the discomfort can lead us to gravitate toward a more familiar mix, such as the US 60/40 allocation. The behavioral finance literature (e.g., French and Poterba, 1991) shows that investors are naturally predisposed to tilt their portfolios toward the stocks and bonds of their own country. Referred to as home bias, this tendency is often fueled by a preference for the familiar and an aversion to the unknown.

Our behavioral biases go even further. Investors can easily feel more regret when losing money in foreign markets than they do when underperforming in their home markets. For this reason, diversification is unfortunately sometimes referred to as “regret maximization.” So, it’s no surprise the predominant risk in most investors’ portfolios is mainstream equity risk, and that the average asset allocations of financial advisors, wealth managers, and public plans are heavily weighted to mainstream stocks and bonds.

Yes, the urge to invest within the friendly confines of home is both strong and natural. But this doesn’t mean we should sacrifice global diversification altogether. We can still harness the potential of diversifiers if we first accept that building and holding a diversified portfolio is not an all-or-nothing choice. We can successfully engage in the pursuit of diversification by building asset mixes that marry individual preferences or tolerances with forays into an expanded opportunity set. Even if diversifying assets compose a small portion of our overall portfolio, any nudge in this direction puts us on a path toward better long-term outcomes gained by achieving the potential benefits of diversification.

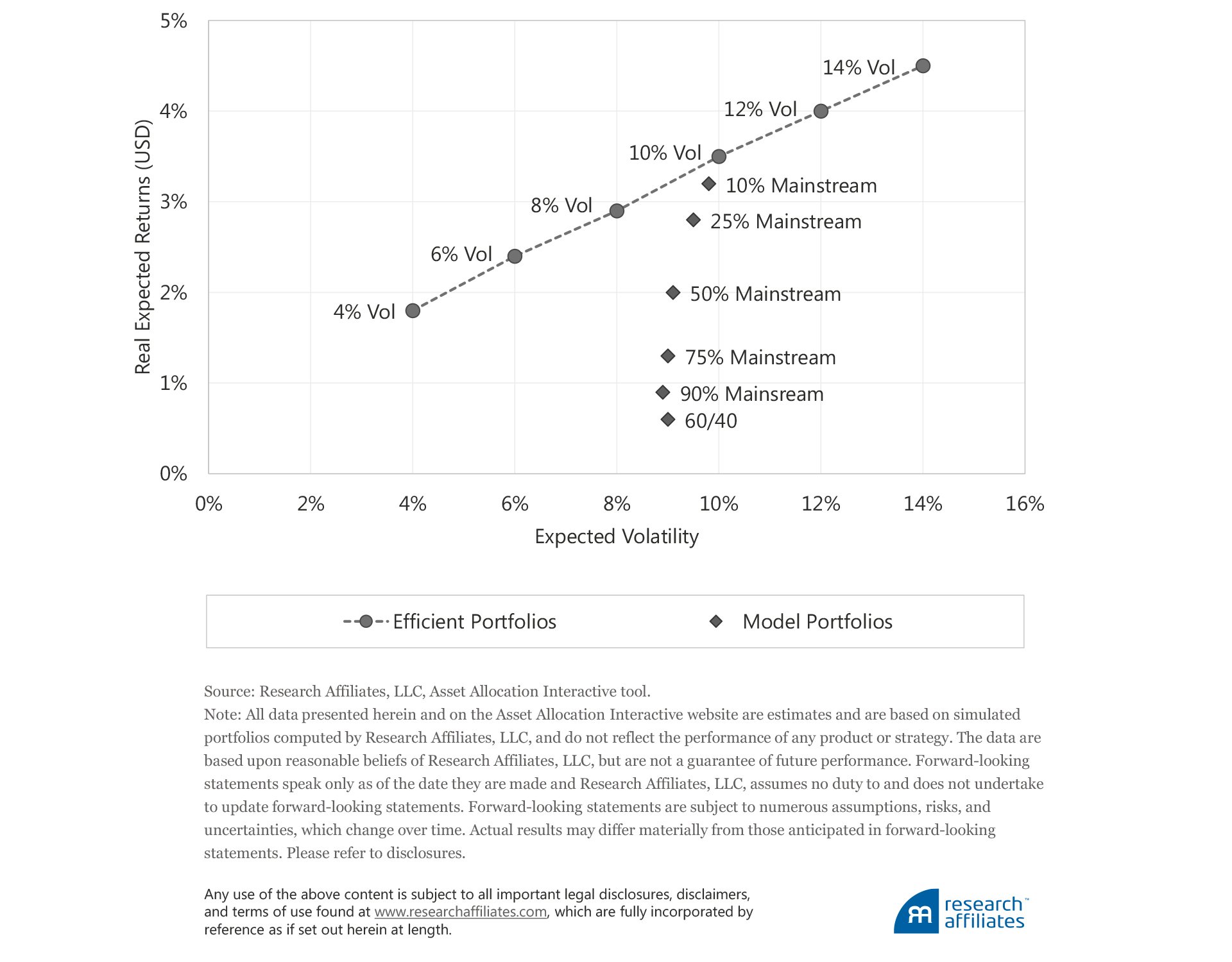

The Asset Allocation Interactive tool allows us to experiment and assess various diversifying mixes. For instance, we can begin with a US 60/40 mix, and then blend in the 10%-volatility efficient portfolio at various allocations. Let’s assume that if a quarter of our portfolio is reallocated to the 10%-volatility portfolio, the new blended portfolio remains within the confines of our comfort zone. By expanding our opportunity set to include a moderate shift into these diversifiers, we double our expected return, from 0.6% to 1.3%, without increasing volatility.

As Shepherd (2017) pointed out, although volatility is roughly the same for any of the blend portfolios constructed using the 10%-volatility efficient portfolio, tracking error should also be considered. Tracking error, or the volatility of relative returns between a portfolio and its benchmark, represents the risk taken by an investor who strays from the benchmark. As we noted earlier, most investors don’t think of their portfolio relative to an investment benchmark per se, but often benchmark their returns against their friends, family, or the Dow Jones Industrial Average touted on their smartphone screen.

In our 25% blend example, we take on 1.3% tracking error to the standard 60/40 portfolio. This means that roughly one-third of the time the returns from our blended portfolio will differ from the returns of the 60/40 portfolio by more than 1.3%. This tracking error grows to 6.0% a year for the full 10% volatility (0% mainstream) portfolio, a hard pill to swallow for all but the most ardent believer in portfolio diversification.

Increasing our allocation to the 10%-volatility portfolio above 25% would commensurately lift expected returns. Granted, these prospective return and risk metrics fall short of those exhibited by a pure 10%-volatility efficient portfolio, but they position portfolios for meaningfully improved outcomes beyond the less diversified mix held by many investors today.

An important point for advisors and their clients is that by consciously constructing a blended portfolio, keeping tolerance to discomfort in check—as we have done in our example—we can increase the likelihood of willingly holding the portfolio over a longer horizon. That is, the chance of fleeing from the diversified mix is far higher if the starting point is a portfolio already stretching our comfort zone.

Conclusion

A consistent diet of spicy food has been linked to health benefits, including a longer life span. For those who want these benefits, but are especially averse to the painful flames, do not despair! Simple remedies abound for those who want to ramp up their tolerance for spicy food. Medical research indicates a few sips of milk or a slice of bread can effectively alleviate the burn by preventing capsaicin—the source of the burning sensation—from reaching the mouth’s pain receptors. Ultimately, how much heat to ingest is a personal choice. The same is true when it comes to investing.

Just as we would actively seek a bit more spice to promote better health outcomes, we can do the same for our investment health by finding the right level of asset class diversification for our investment portfolios. The Asset Allocation Interactive tool on our website is a great starting place, providing the means to survey the risk–return profiles of a wide range of asset classes and portfolios; to create and blend portfolios; and to compare expected outcomes and various asset-class allocations. AAI’s flexibility allows us to better assess and balance clients’ long-term return needs against their baseline risk tolerance levels.

Beyond the obvious practical implications for customizing client portfolios, we can use the tool to possibly extend the client’s baseline tolerance level, especially in times when the heat of short-term underperformance seems intolerable, but enduring the heat will likely be beneficial in the long run. Much like a sip of milk helps to relieve the burn in intense moments, extending the advisor–client dialogue by illustrating the likely risk and return trajectories of a spectrum of diversified portfolios can be a simple yet crucial solution. The opportunity to encourage trust through greater understanding, while reiterating a few enduring principles—such as the long-term value proposition of diversification—can help us steer our clients to better long-term outcomes, particularly in those “heartburn” moments when the need to maintain diversification is most urgent.

Endnotes

- A study from the Harvard School of Public Health published August 4, 2015, in the British Medical Journal found that people who ate spicy foods almost every day had a 14% lower risk of death than people who ate spicy foods once a week (Harvard Health Publishing, 2015). The study, conducted through the China Kadoorie Biobank, uses a population-based prospective cohort of over a half-million adults from 10 geographically diverse areas across China.

- December 31, 1999, through December 31, 2009.

- Asset Allocation Interactive is updated quarterly with the most recent expected returns data.

- On the scatter plot, the grey dots depict the efficient portfolios along the efficient frontier (the dashed line). Please note that AAI deals with assets classes in the form of market indices and does not include investible vehicles. This approach gives investors the freedom to choose their own investing vehicle. In moving from indices to investment vehicles, however, costs will be incurred. Explicit costs, such as expense ratios, can easily be found on fund provider websites, but other meaningful costs, such as those incurred by fund providers tracking indices, especially in less liquid or high transaction cost markets, are not easily determined, but also lower investor returns.

- Previously in this series, West and Ko (2017) discussed how Research Affiliates thinks about and models future expected returns (both income and capital appreciation), and Shepherd (2017) examined how we model estimated risk, so we won’t cover those details again here. Because tax situations are investor specific, Asset Allocation Interactive does not currently consider taxes. Interest and dividend income and capital appreciation can have a meaningfully different impact on investors’ realized return due to tax considerations.

- For investors who view valuation as a driver of return, severe price declines, and the undervaluation that accompanies them, can often be thought of as bargain-buying opportunities, but for other investors these declines elicit deep fear. To reach a long-term investment horizon, investors will necessarily experience one or more short-term periods of underperformance in their portfolios, requiring that they overcome a perhaps visceral reaction to abort the long-term diversifying strategy.

References

French, Kenneth, and James Poterba. 1991. “Investor Diversification and International Equity Markets.” American Economic Review, vol. 81, no. 2: 222–226.

Harvard Health Publishing. 2015. “Spicy Foods Associated with Longer Life, Harvard Researchers Find.” Harvard Health Letter (October).

Shepherd, Shane. 2017. “Risk: Preparing Clients for an Uncertain Journey.” Research Affiliates (October).

West, John, and Amie Ko. 2017. “The Most Dangerous (and Ubiquitous) Shortcut in Financial Planning.” Research Affiliates (September).