The Most Dangerous (and Ubiquitous) Shortcut in Financial Planning

Using historical returns to forecast the future is one of the most common shortcuts in financial planning.

Investment advisors who use only past returns to forecast future returns may well be creating unrealistic expectations and poor investment outcomes for their clients.

Our online Asset Allocation Interactive, which uses starting yields to forecast future long-term returns, gives advisors a rich toolkit with which to construct portfolios most likely to achieve their clients’ financial goals.

Investment advisors who use only past returns to forecast future returns may well be creating unrealistic expectations and poor investment outcomes for their clients.

Introduction

The sizeable assets financial advisors oversee are more than just market positions to be managed, and sources of fees to be earned, but exist to meet clients’ future spending needs linked to a personal hope or dream, such as a secure retirement, college education, second home on the lake, or difference-making philanthropic endeavor. The investment advisor’s job is to help clients understand the feasibility of their financial goals and maximize their clients’ probability of achieving them. Of course, the activities associated with such a seemingly straightforward mission are countless. There are only so many hours in the day. Where do advisors get the best advisory bang for the client buck? Conversely, where are advisors missing the mark, spending time and effort with little incremental net benefit to client outcomes?

This is the first article in a series designed to address specific investment advisor activities most likely to lead to successful investment outcomes for clients, which also happen to be the most productive outcomes for advisors—a win–win situation. Research Affiliates has built, and can offer to advisors, a suite of tools powered by our research insights and which are publicly available on our website. This article, which references the practical application of our online tools, emphasizes how to set reasonable expectations for capital market returns. In other words, what’s the likely long-term return for an individual investor’s normal portfolio? Thanks for reading!

Poor long-horizon investment outcomes invariably can be blamed on a handful of “usual suspects”: high fees and expenses; ignoring rebalancing opportunities; performance chasing; lack of diversification; and improper expectations. Rarely do these usual suspects operate as lone wolves. They typically travel together.

The optimist in us believes that—slowly but surely—times are getting tougher for these culprits. Expense ratios are coming down; no doubt helped substantially by more wide-scale adoption of passive equity investing. Similarly, smart beta is on the march, a more effective means of capturing long-term excess returns than traditional active equity management. Investors are also becoming more aware of the softer, hidden costs of trading and market impact expenses (Chow et al., 2017). Automated rebalancing is now commonplace. Kinnel (2017) and others have shown how fund investors can be on the wrong side of mean reversion by chasing performance. And accessing diversifying assets has never been easier than it is today with the growth of reasonably priced mutual funds and exchange-traded funds (ETFs) offering investment opportunities ranging from emerging-market currencies to commodities to bank loans.

But what about the last suspect: setting improper return expectations? This culprit hasn’t received as much attention as the others, reminding us of a favorite all-time film, 1995’s The Usual Suspects. In the movie, a customs agent, Dave Kujan, tries to figure out which of five criminals is responsible for a drug deal gone bad on a ship docked in San Pedro Bay. Agent Kujan interviews the sole survivor of the crime, Verbal Kint (played by Kevin Spacey), who is intent on pinning the blame on one of the other suspects. Nobody at the police station suspects Verbal Kint, who has a palsied arm and foot—in their view, an unlikely suspect—was responsible. But the ending (spoiler alert!) reveals that not only is Verbal responsible, he is actually Keyser Söze, the “world’s most notorious” criminal. Of course by then, Kint, er Söze, had walked out of the interrogation uncharged, never to be seen again. The movie ends with a quote from Söze: “The greatest trick the devil ever pulled was convincing the world he didn’t exist.”

As we survey the range of long-term return forecasts in the industry, we are shocked to see so many—including some (deservingly) well-respected asset managers—seemingly ignoring today’s low yields (and their downward pressure on future returns). Instead, many continue to use historical returns to forecast the future, one of the most common shortcuts in financial planning, and one we believe will not serve investors or advisors well.

How can advisors avoid this dangerous and common practice? Research Affiliates’ Asset Allocation Interactive tool illustrates the likely sources of future returns and provides an easily accessible way for proactive, client-oriented advisors to educate clients on probable future financial outcomes. In a subsequent article, we will show how the allocations in today’s normal portfolio can be shifted to offer more attractive long-term risk-adjusted returns.

Setting Investment Objectives: What We Can and Can’t Control

Bear with us as we do a 30-second review of Actuarial Science 101. Conceptually, retirement math has five variables: 1) annual savings rate, 2) return on savings, 3) retirement date, 4) retirement spending rate, and 5) life expectancy. The savings rate, retirement date, and retirement spending are individual choices, and as such, are entirely predictable. Clients make these choices themselves; some might prefer to work longer in order to spend more in their retirement years, or vice versa.

Sadly, we have little control over our lifespan, and practically speaking, little control over the ultimate return on our portfolios. Sure, we can try to influence these variables by making smarter choices—eating right and exercising will lead to a longer life, just as minimizing unnecessary investment expenses (including trading costs) and swearing off performance chasing should lead to higher net returns. At the end of the day, we just don’t have the control we’d like to have. Instead, we’re left with an uncomfortably wide range of expectations. Today, a 65-year-old male has a life expectancy of 19.3 years (i.e., will live to 84.3 years).1 Of course, that’s the average experience. Some men will live far longer, and some will sadly pass while still in their sixties.

Not only do we have to deal with a range of possible life expectancies, but a changing average life expectancy over time. A 65-year-old male in 1980 would have been expected to live until 79.1 years, a five-year shorter period of retirement bliss than he would be looking forward to today. The combined positive effects of advanced diagnosis, less smoking, more nutritious diets, better safety in occupational workplaces, vaccines and antibiotics, and seatbelt laws, among other factors, equate to a longer life expectancy. Fairly indisputable. Obviously, it doesn’t make sense to use a mortality table from 1980 to determine a client’s most likely retirement horizon in 2017 (37 years later).

Starting conditions matter in life expectancy, and as we’ll see shortly, also in expected returns. Advisors intent on producing better outcomes for their clients need to communicate realistic return expectations not only for the destination (investment-horizon retirement savings), but for the duration of the journey. Our Asset Allocation Interactive tool is designed for this purpose.

The Inevitable Delta: Past Realized Returns vs. Reasonable Future Expected Returns

Investor behavior indicates a profound belief that past is prologue. Any time an investor replaces a bottom-quartile performer with a top-quartile performer, by definition the investor is extrapolating the past into the future. The same can be said when an investor swaps out a recent laggard in asset class or style with a recent winner. A quick survey of the behavioral finance literature shows this tendency, a form of the “representativeness heuristic” (Kahneman and Tversky, 1972), is pervasive across a wide range of investment decision making. Debondt (1993) shows experimental and survey evidence that investors are subject to using representativeness to over-extrapolate recent price trends when forecasting future returns. Along with the representativeness heuristic, investors tend to use other related rule-of-thumb shortcuts, such as availability bias (Tversky and Kahneman, 1973), a heuristic (a mental shortcut that allows people to solve problems and make judgments quickly and efficiently) that leads us to favor what is most recent or relevant.

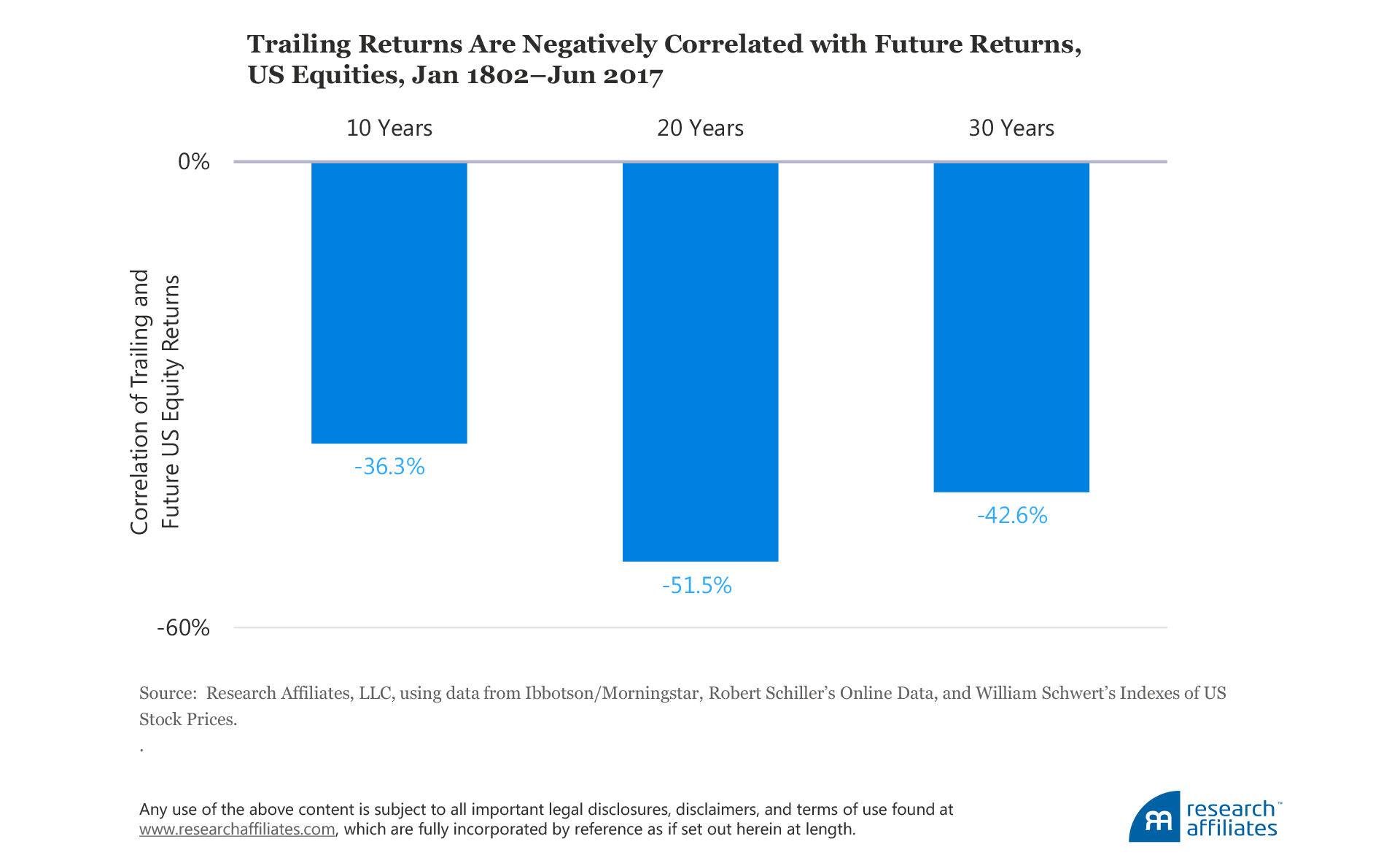

Unfortunately, these biases can be unhelpful or even dangerous in setting realistic return expectations. For example, past long-term returns of US equities are negatively correlated with their future long-term returns, whether we use a horizon of 10, 20, or 30 years. In other words, your clients’ experience in the capital markets (i.e., relatively high past returns), irrespective of the client’s age, is unlikely to be duplicated in the future—both the representativeness and availability heuristics lead us down the wrong path!

Despite this clear relationship, the retirement calculators at respected investment management firms—those with hundreds of billions of US dollars of client assets—appear anchored on history. For example, Vanguard2 uses a 4.0% real (after inflation) annualized long-term expected return. Dimensional Fund Advisors assumes real annualized long-term expected returns of 1.0% and 5.0% for global bonds and global stocks, respectively, implying a real return of roughly 3.9% for a 60/40 global portfolio.3 At first blush, these estimates seem entirely reasonable, and maybe even prudent. Indeed, looking back, a conventional 60/40 US stock/bond blend would have achieved real annualized returns exceeding 4.0% in each of the past 5-, 10-, 20-, 30-, and 40-year periods.

So, why is it unrealistic to expect the same in the future? After all, the past 40 years have witnessed a variety of economic and political regimes and should be a reasonable proxy for the future. To answer this, it is necessary to understand the sources of past returns, going as far back as possible. Let’s focus on equities, the lion’s share of a 60/40 allocation’s return. As Arnott and Bernstein (2002) explain, the majority of the real return on stocks over the past two centuries came from three sources: 1) dividends paid, 2) real growth in dividends paid, and 3) rising valuation levels. Valuation matters. Over the last 40 years ending June 30, 2017, rising valuation levels’ contribution to the annualized real return of the US stock market approaches one-third (2.1% of 7.4%).4

Today, yields are dramatically lower, and equity valuations are dramatically higher. The average bond yield over the last 40 years was 6.7% (Barclays Capital US Aggregate), and the average cyclically adjusted price-to-earnings (CAPE) ratio was 21.1 times. As of August 31, 2017, these measures are 2.4% and 30.3 times, respectively.5 In other words, today we are experiencing some of the lowest yields and highest equity valuations in modern history. Expecting bond yields to fall even further and CAPE ratios to continue soaring doesn’t seem sensible—but that’s precisely what’s happening when investors and their advisors rely on history to gauge the future.

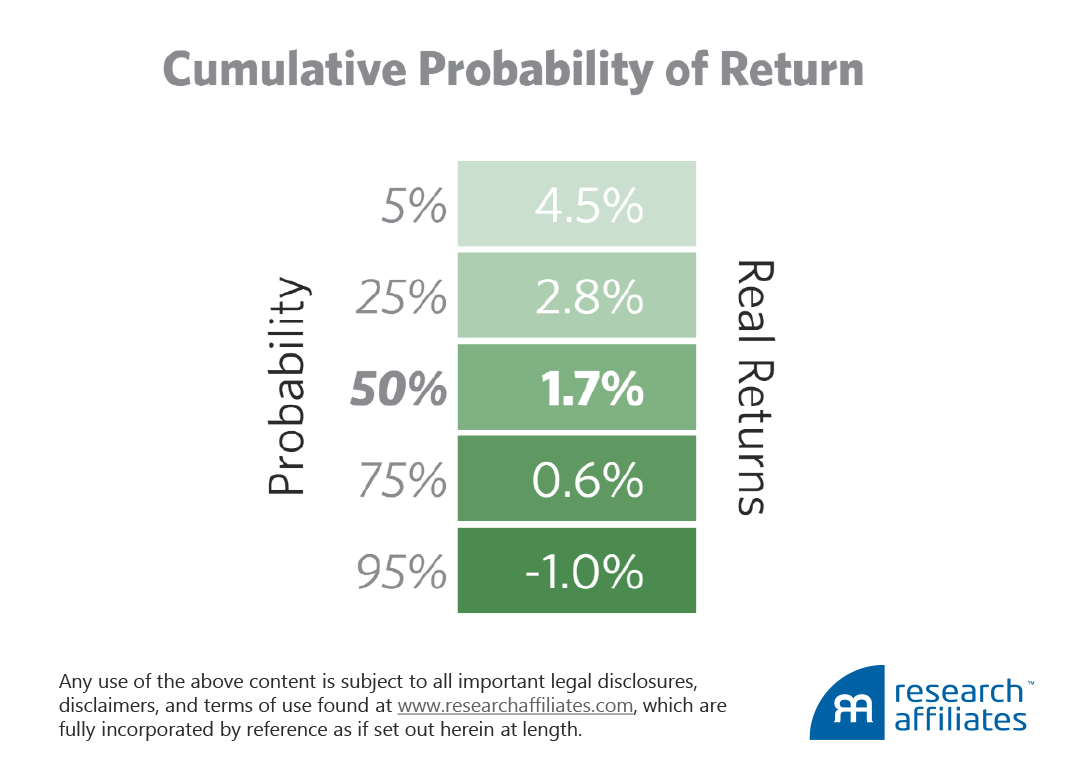

The Asset Allocation Interactive (AAI) tool on our website offers two methods to determine expected returns over the next 10 years. The default method assumes valuations will revert halfway back to a normal historical level (“Valuation Dependent”), while the second method simply assumes valuations won’t change (“Yield Plus Growth”).6 According to AAI, the asset mix of the Vanguard Target Retirement 2025 Fund produces real annualized expected returns of 1.7% and 2.8%, respectively, under the two forecasting methods, both well below Vanguard’s stated expected return.

Let’s look at how this may play out. Assume you are the trusted financial advisor of 55-year-old Lawyer Larry, who’s done just about everything right in planning for his retirement. Since the age of 25, he diligently saved, banking 10% of his annual wages every year, and now has nearly $825,000 in retirement savings.7 Larry dreams of retiring in 10 years. Cognizant of his spending and lifestyle desires, Larry thinks he’ll need at least $1.35 million before he can retire.

Larry turns to you for advice. Can he achieve his dream of retiring in 10 years? What balance can he expect to have at age 65? That depends. Using Vanguard’s real expected return of 4.0%, he would have a projected balance in his retirement account of over $1.36 million in 2027. Using the 1.7% default estimate from AAI indicates he should expect to have less than $1.10 million a decade from now, a shortfall of 20–25% (given rounding error). Ouch!

Could Vanguard’s expected return be right? Quite possibly, and what a delightful conversation that would be. But if Vanguard’s forecast (or any forecast for that matter) misses the mark an investor is relying on, there is no do-over. In that case, Larry would come up short. Larry deserves to hear the hard truth in order to explore his options for making up a potential shortfall in his retirement account, whether that option is saving more,8 more broadly diversifying, or possibly postponing retirement.

A single expected return is just the midpoint of a range of expected returns. Research Affiliates’ Asset Allocation Interactive provides the full range of 10-year annualized returns so investors can gauge if their target return is within the distribution. As of August 31, 2017, interpreting this screenshot from AAI suggests that the probability of achieving a 4.0% or higher real return over the next decade is around 10%. Not good.

Are our models overly pessimistic? Are we simply being “permabears” and raising false alarms? We don’t think so.9 Using the same equity decomposition framework we just explained, Vanguard’s founder, Jack Bogle, recently gave a fairly low assessment of future US equity returns:

Looking forward, Bogle said, in the next 10 years investors should expect only 2.0% from dividends and 4.0% from earnings growth. With P/E ratios at 26.3 (now 30), Bogle said investors could expect to lose 2.0% from P/E contraction, for a total return of 4.0% (Huebscher, 2017).

For an apples-to-apples comparison with our previous real-return estimates, we can net out our US inflation assumption for the next 10 years, 2.1%, to get a real return for US equities of 1.9%, based on Bogle’s estimate of 4.0%. If equities produce a real return of 1.9%, then bonds would have to deliver a return —net of inflation—of nearly 7.2% to get to a 60/40 real expected return of 4.0%. From a starting yield of 2.4%? Not. Gonna. Happen.

Conclusion

While seemingly prudent, using historical returns to forecast future returns is a dangerous financial planning shortcut. As we said before, an actuary who would suggest using a life expectancy table from 1980 in 2017 would immediately be labeled dangerously out of touch by a pension client. Online tools now complement the basic actuarial life expectancy estimate, helping clients understand their likely lifespan, and therefore, their likely retirement spend.

Similarly, online tools are now publicly available on our website that are designed to help advisors look beyond the past toward the future for estimates of expected returns. Starting conditions matter on the two most uncertain variables in retirement planning: expected returns and lifespan. Asset Allocation Interactive uses starting conditions to estimate future returns.

Kevin Spacey won an Oscar for Best Supporting Actor in his role as Verbal Kint, with the ending “devil trick” quote sealing the deal on his performance. But the quote isn’t original to The Usual Suspects; it can be traced to French poet Charles Baudelaire who said, “The finest trick of the devil is to persuade you that he does not exist.” Today’s low yields—the devil to future long-term investment success—do exist and will materially impact future returns.

Although, the basic services of communicating likely returns and making the necessary adjustments when they fall short aren’t captured in typical surveys of how advisors add value, they should be. Asset Allocation Interactive gives advisors the tools to gain an understanding of the delta between past and likely future returns when they still have time to adjust the controllable variables of retirement date and current savings by saving more, anticipating a longer career, or adopting less mainstream asset mixes, which we’ll cover in an upcoming article in the series. Again quoting Baudelaire: “Nothing can be done except little by little.” And little by little, proactive advisors can make big impacts. Please let Research Affiliates know how we can help by emailing us at financialadvisors@rallc.com.

Endnotes

- Social Security Administration Life Expectancy Calculator.

- https://personal.vanguard.com/us/insights/retirement/saving/set-retirement-goals.

- Please see the section “Key Assumptions” at the bottom of http://us.dimensional.com/defined-contribution/retirement-calculator. Research suggests a portfolio of diversified assets gains additional return from diversification itself. As such, the 60/40 portfolio’s expected return is higher than a simple weighted-average calculation of individual asset classes’ expected returns. For instance, from February 1802 through June 2017, the annualized return was 6.4% for US stocks and 6.1% for US 20-year bonds. If a 60/40 portfolio is constructed using a simple weighted-average calculation of these two asset classes’ returns, the result of 6.3% is indeed lower than the realized return of 6.6%.

- Research Affiliates, LLC, using data from Robert Shiller Online Data.

- The source of the bond yield is Bloomberg. The source of CAPE is Robert Shiller Online Data.

- For a more detailed discussion on the two methods, see Masturzo (2017).

- In this hypothetical scenario, we assume Larry is 55 years old in 2016 and began working at the age of 25 in 1986. According to the Census Bureau, the median earnings of a full-time, year-round employed male lawyer was $90,872 in the year 2000, the likely midpoint of Larry’s professional career. We derive an annual series of the percentage change in income, using the Census Bureau’s Current Population Survey’s median income data by age from 1947 to 2015. From 2016 onward, we assume Larry’s income remains constant (0% growth). Finally, we assume Larry invests his retirement savings in an equivalent of the Vanguard Target Retirement Fund 2025. Prior to the fund’s inception in 2004, we calculate weighted-average returns based on allocations provided by the target fund and on the total returns of cap-weighted indices: S&P 500, MSCI EAFE, Barclays US Aggregate, and Barclays Global Aggregate.

- Where an investor chooses to invest their savings matters. Unsurprisingly, investing savings in high-fee products is counterproductive, a truth that Jack Bogle has spent decades exposing and addressing.

- Granted, we have been called “permabears,” and it is worth noting that both methods have a bit of it’s-different-this-time approach by not assuming full mean reversion in valuations. Indeed, some valid reasons do explain why equity valuations may stay elevated above the historical average levels of the past 100 years (Aked, Mazzoleni, and Shakernia, 2017).

References

Aked, Michael, Michele Mazzoleni, and Omid Shakernia. 2017. “Quest for the Holy Grail: The Fair Value of the Equity Market.” Research Affiliates (March).

Arnott, Robert, and Peter Bernstein. 2002. “What Risk Premium Is ‘Normal’?” Financial Analysts Journal, vol. 58, no. 2 (March/April):64–85.

Chow, Tzee-Man, Yadwinder Garg, Feifei Li, and Alex Pickard. 2017. “Cost and Capacity: Comparing Smart Beta Strategies.” Research Affiliates (July).

De Bondt, Werner. 1993. “Betting on Trends: Intuitive Forecasts of Financial Risk and Return.” International Journal of Forecasting, vol. 9, no. 3:355–371.

Huebscher, Robert. 2017. “Jack Bogle on the Limits of the Fiduciary Rule and the Future of the Advisory Industry.” Advisor Perspectives (May 24).

Kahneman, Daniel, and Amos Tversky. 1972. “Subjective Probability: A Judgment of Representativeness.” Cognitive Psychology, vol. 3, no. 3 (July):430–454.

Kinnel, Russel. 2017. “Mind the Gap: Global Investor Returns Show the Costs of Bad Timing around the World.” Morningstar Research Library (May 30).

Masturzo, Jim. 2017. “CAPE Fatigue.” Research Affiliates (June).

Tversky, Amos, and Daniel Kahneman. 1973. “Availability: A Heuristic for Judging Frequency and Probability.” Cognitive Psychology, vol. 5, no. 2 (September):207–232.