-

-

Search

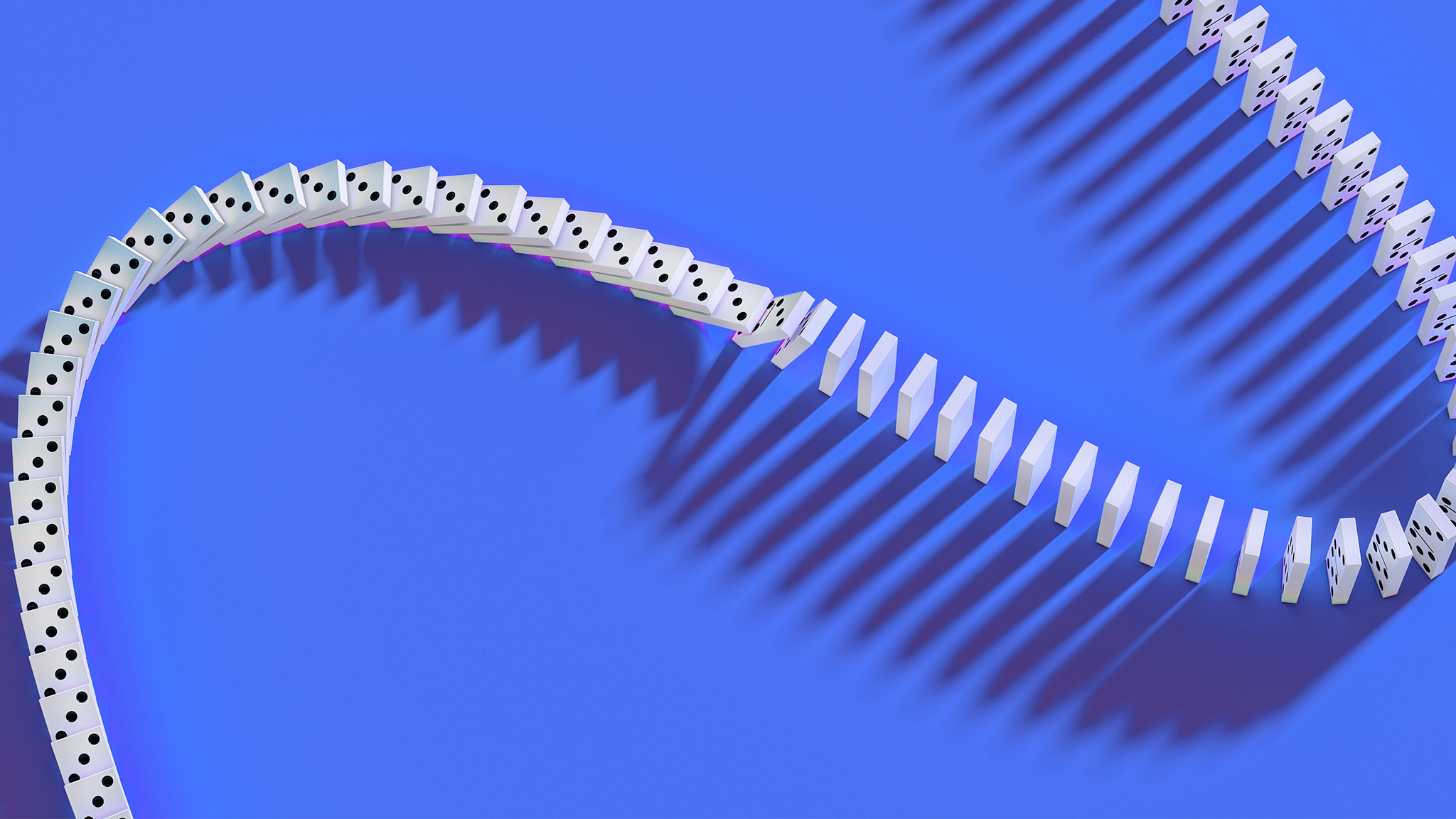

Passive Aggressive: The Risks of Passive Investing Dominance

May 2025

Read Time: 20 min

Save

Abstract

Passive capitalization-weighted index funds now surpass active management in aggregate investor allocations. Flows into passive strategies cause unrelated socks to move synchronously, undermining diversification and potentially increasing systemic risk. New flows into passive products mechanically overweight overvalued stocks and underweight undervalued stocks due to market-price weighting, exacerbating momentum-driven price distortions. Rebalancing at the stock level to non-price-based anchor weights may mitigate these distortions and enhance long-term returns.

FEATURED TAGS

RELATED CONTENT

Learn More About the Authors

- How to Invest

- Mutual Funds & ETFs

- Institutional, SMAs, and Commingled

© 2025 Research Affiliates, LLC. All Rights Reserved.