The U.S. Federal Reserve surprised the markets by announcing its decision to postpone reducing the purchase of Treasury and agency mortgage-back securities. The Board of Governors said the central bank will continue buying $45 billion in Treasury bonds and $40 billion in agency MBS every month “until the outlook for the labor market has improved substantially in a context of price stability.”1 But it is inevitable that the Fed will start winding down its purchase program when labor market conditions improve and inflation expectations are within tolerance. How will equities and other risky assets be affected? Understanding the impact of tapering across asset classes and market sectors may enable investors to take advantage of the Fed’s reprieve and position their portfolios advantageously.

In the United States, the prospect of tapering, which is understood as the prelude to eventual tightening, has had the immediate effect of an upward shift in the Treasury yield curve and a bludgeoning of long bonds.2 It has also sent shockwaves to other asset markets; emerging market (EM) bonds, in particular, have declined significantly in sympathy. It warrants exploring why rising yields on U.S. Treasuries could affect prices of all income oriented instruments so significantly.

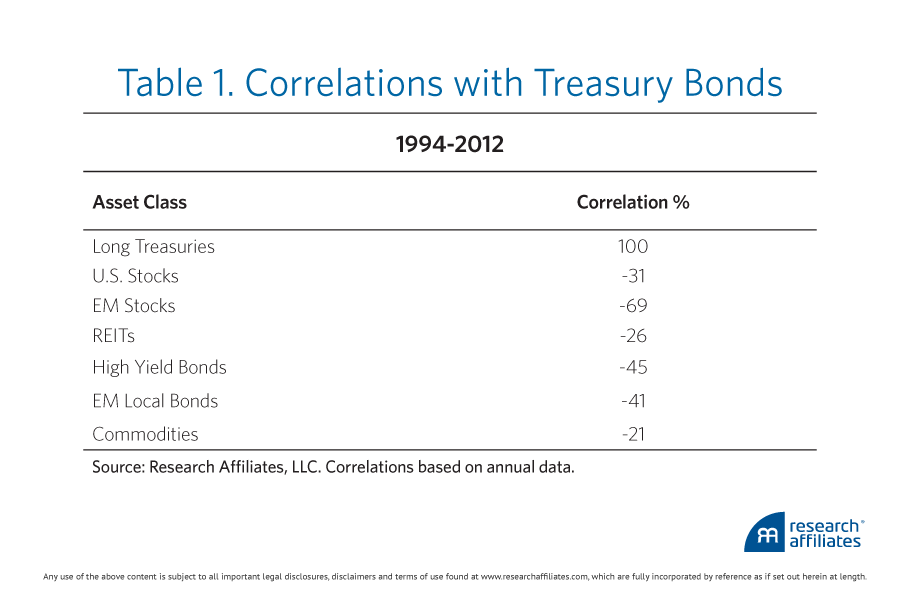

Historically, risky assets have exhibited varying degrees of interest rate sensitivity. Pro-cyclical assets, such as equities, real estate, high yield and emerging market bonds have historically displayed negative correlations with Treasury bonds over annual and longer horizons (Table 1). In normal conditions, interest rates provide information on economic growth. Rising rates suggest faster GDP growth, better ROIs and a greater demand for investment capital. These positive factors, in turn, also drive better corporate earnings growth and improve household, corporate and export-oriented EM balance sheets.

When there is monetary intervention, interest rates also reflect the government’s agenda. An artificially low nominal interest rate, resulting from quantitative easing (QE), signals a strategy of financial repression against savers in order to subsidize government borrowing and mortgage financing . As the Fed guides interest rates downward, it also injects an unprecedented amount of positive duration risk into all asset classes. As a result, pro-cyclical assets, which have historically displayed negative correlation with bond returns, become positively correlated with Treasury returns.

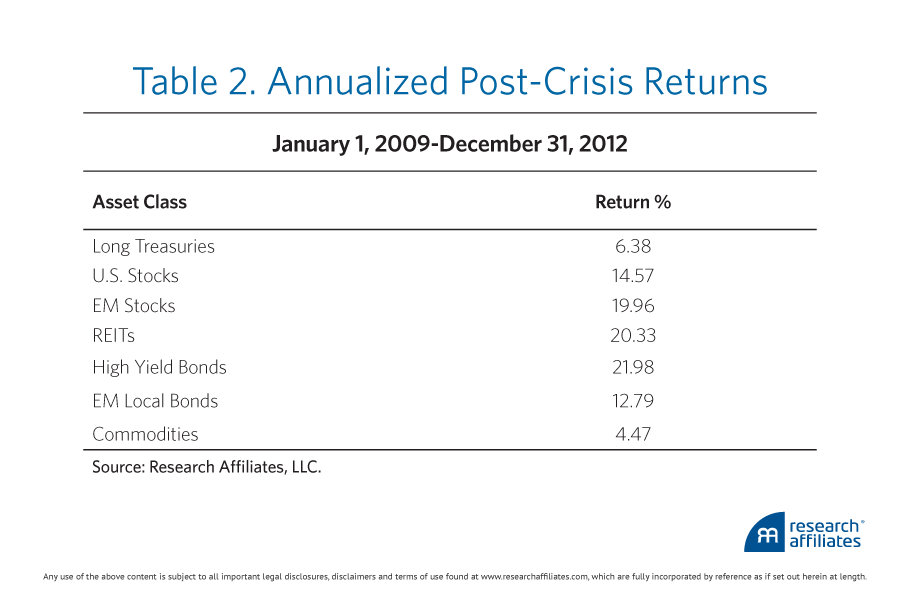

Central banks have undertaken multiple QE programs to combat the great recession. Short-term nominal interest rates have been near zero since the Global Financial Crisis, imposing negative real interest rates—or a wealth tax—on savers. In this environment, savers seek to escape financial repression by reaching for positive real yield through excess risk taking. Speculators are subsidized to lever up risky investments; everything with a yield has become a target for the carry trade. The prolonged period of near zero interest rates has set in motion a substantial flow of investment and speculative funds which has buoyed up prices globally to varying degrees (Table 2). The liquidity driven price appreciation, in turn, injects duration risk. The greater the liquidity induced appreciation, the more the asset class is exposed to the risk of future interest rate increases.

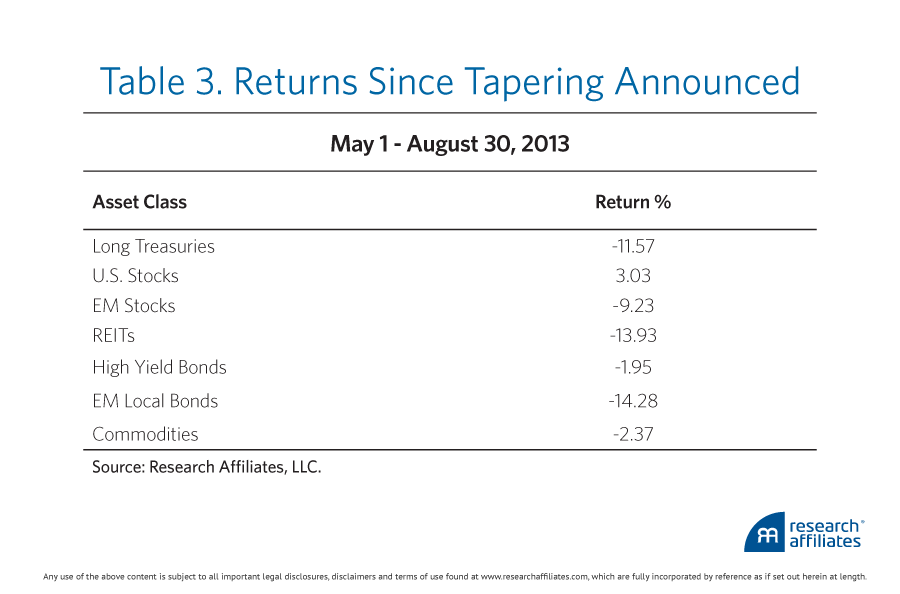

When U.S. rates ultimately rise (normalize), it is reasonable to expect some unwinding of the carry trades. If the 10-year Treasury rate were to hit 5%, then emerging market bonds would lose much of their appeal at their current blended yield of 6%. This very same dynamic will be in full force for all other asset classes; it has already impacted returns significantly since the tapering announcement in June (Table 3). U.S. equities, judging from their initial sharp negative response to the tapering announcement, have become bond like! Bad employment numbers and weak housing starts are now good news for equities as they keep rates low. High yielding stocks, which have enjoyed significant outperformance in the recent years thanks to their income advantage in a low rate world, appear to be most at risk.

Nonetheless, eventually prices are set by fundamentals, even if in the short-run liquidity and flows can push prices away from fair valuation. Ben Graham’s famous analogy captures this combination of long-term and short-term dynamics: the market is ultimately a weighing machine in spite of its more transient role as a voting machine. Knowing the estimated long-term valuation allows investors to profit from short-term over- and under-adjustments. As carry strategies are reversed and the ensuing momentum is driven by hot money, rising rates will continue to cause price declines for nearly all asset classes. This can mean buying opportunities for investors looking to take positions in pro-cyclical risk assets as the U.S. and global economy slowly regain their footings.

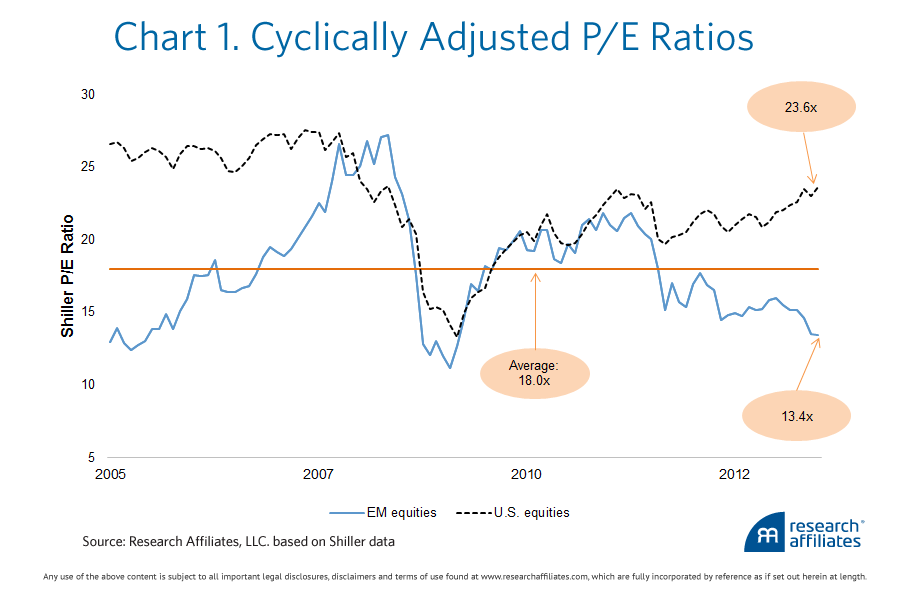

In particular, EM equities appear to be the more sensibly priced asset class for accessing global growth. They are trading at a Shiller cyclically adjusted PE (CAPE) of 13.4x, as compared to U.S. equities trading at a Shiller CAPE of 23.6x (Chart 1). EM bonds are great values against developed country sovereign bonds at the current spread of approximately 3%. They are expected to continue receiving more ratings upgrades and fewer downgrades than developed country bonds, and they are backed by stronger sovereign balance sheets and surpluses. Similarly, high yield bonds at a spread of about 5% are poised to experience yield compression as reflation and mild growth continue.

Thus flow induced price declines can be viewed as buying opportunities. As the carry trade unwinds and the hot money leaves, gone too will be the unnatural positive correlation between Treasury bonds and pro-cyclical assets. Correlations will return to the norm, and so, too, will the diversification benefits of a globally diversified multi-asset portfolio.

Endnotes

- Federal Reserve System press release dated September 18, 2013.

- On September 18th, the day the Fed announced that the purchasing program would continue unabated, the yield of the 10-year Treasury declined from 2.86% to 2.69%. The 17 basis point change probably reflects the fact that tapering was postponed but not cancelled.