As we enter 2020, a new decade, investment managers, economists, market pundits, and the like naturally turn to making all types of forecasts for the years ahead. In this article we offer our take on the difference between empirically based investment forecasts and “nowcasts,” the latter often touted and often wrong.

Using forward-looking data and our proprietary methodology, we discuss our expected returns for the next decade of core bonds and equities as well as real-return asset classes across the global markets and compare these return forecasts to historical returns.

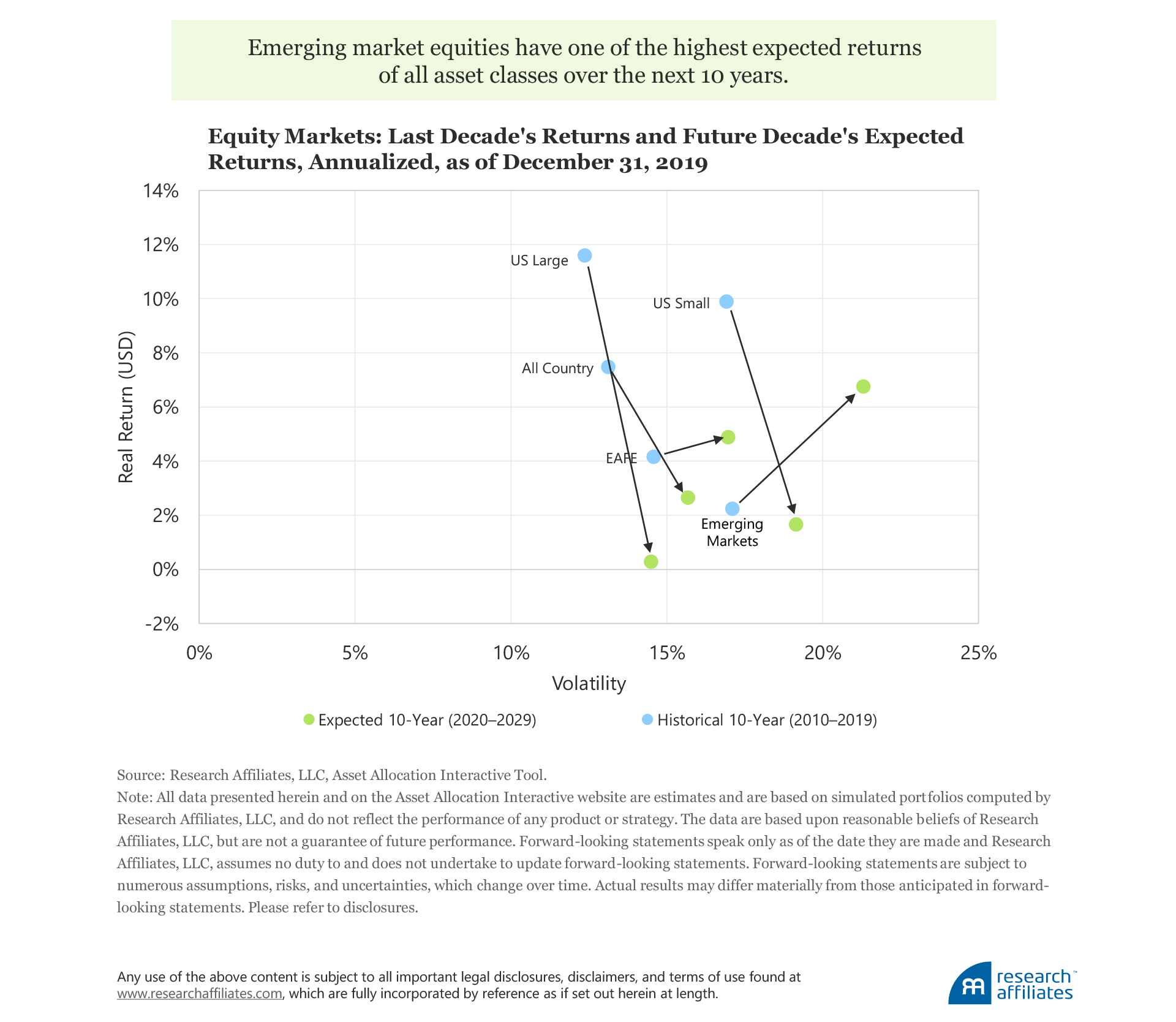

The next 10 years appear to offer much lower returns than the past decade delivered, with emerging market equities at the high end of expectations, sporting an annualized 6.8% real return, and long-dated US Treasuries set to substantially disappoint with an annualized expected real return of −1.3%.

Tick-tock (or TikTok, depending on one’s age group) says the clock, as we bid goodbye to 2019 and welcome 2020. Another year-end, and in this case, another decade is filed away. For those of us in the money management business, this is a time to reflect on what the last decade has taught us about capital markets. At the same time, a loud buzz is building among media pundits and market prognosticators who are offering a flood of economic and investment forecasts and predictions not only for the year ahead, but also for the decade ahead. This buzz includes a lot of “nowcasting.”

Nowcasting in economics refers to a legitimate estimate of an economic measure, such as quarterly GDP growth, which is based on currently available interim data in lieu of waiting for the final data that will be used for the official result. When applied to capital markets, we use the term in a different way: for our purposes, nowcasting is more often a cogent explanation of what has happened, but when presented by pundits, financial media, and market prognosticators as if it were a forecast of the future, it is not at all helpful. This form of nowcasting is shockingly common and uncommonly dangerous.

Shouldn’t we read market analysis actively rather than passively to distinguish insightful analysis from uninstructive noise? A colleague would sometimes read with a Sharpie in hand and black out any content he deemed to be the latter, happily redacting for himself as much as 80% of any material he read. We will briefly describe what we believe accounts for the vast majority of the forecasts worthy of the “Sharpie treatment.” When you know how to spot it, your brain is in for some rather delightful uncluttering.

Having made room for helpful information, we will turn our attention to what we believe may be helpful forecasts as we enter the 2020s. And we conclude by giving you an opportunity to decide which recent reports should be properly categorized as news, forecasts, or nowcasts.

Playing It Safe with Nowcasting

Nowcasting presents an educated explanation of recent events and market movements, masquerading as an insightful forecast; it is the de facto home base of financial forecasting. Turn on the TV and listen to most panel discussions: “Well, Bob, what do you think happens next?” “Obviously, markets will have to deal with _____ ,” where the blank space is all too often filled with the issue not of tomorrow or even today, but recycled from yesterday.1

Why is nowcasting so prevalent? Nowcasting appears to be informed: an analysis of the drivers behind recent events will certainly sound right. Even more attractive, it’s crowded and safe, with limited risk for reputational damage. Nowcasting leaves a stain only in the most extreme examples of getting it wrong—dare we say, quickly and "bigly." Many of us recall when Goldman Sachs predicted oil was on its way to $200 a barrel in 2008 just as crude was marching toward $150 a barrel, shortly before it crashed as the global financial crisis swept across Wall Street and Main Street. In fairness to the Goldman Sachs analyst in question, at least extrapolation of the recent trend is a step up from garden-variety nowcasting, which simply replaces the past tense with the future tense.

We certainly cannot fault nowcasting as being illogical. To cite one example, if a trade war has been moving markets and the issue is not resolved, then it seems reasonable to assume the trade war should continue to move markets until the issue is resolved. The problem with nowcasting, however, and why it often fails as a forecast, is markets move based on surprise.2 This self-evident and self-affirming quality is what makes nowcasting dangerous to one’s financial health. If a trade war has moved markets, they were moved because the trade war was a surprise to the market consensus; if a continued trade war is the new consensus, it’s already in the price and won’t move markets in the future. Indeed, the market-moving surprise could be either a sharp escalation of the trade war or dissipation of trade tensions.

Most nowcasts are based on a description of events that are no longer surprising, are already well known, and are fully discounted (often over-discounted) by markets. At best, most nowcasting is noise. At worst, it positions us to be hurt badly if the market-moving surprise dissipates or reverses, and it risks inviting us to chase a trend, rather than taking on informed maverick risk.

Mad Calls for Max Ink (or Eyeballs)

At the other extreme of the financial punditry spectrum is the wild pronouncement with high publicity skew. Many forecasters have struck gold in the past by making predictions with little or no sound basis and yet are vindicated after the fact.3 These forecasters mostly fall into two categories.

First are the throwing-spaghetti-at-the-wall prognosticators. After making innumerable calls, one big hit causes all the missed calls to be forgotten: “Mary predicted the fall of Lehman in late 2007. Click here to learn what she think happens to Google in the next six months.” Never mind the other 500 failed pronouncements Mary made before or after her 2007 call. Such pundits are spraying out many free call options for themselves, and some turn out to be in the money.4

The second kind are prognosticators who make outlandish claims in the moment for publicity’s sake. Stepping outside of finance for a second, Scott Adams made quite the splash in August 2015 by predicting Donald Trump would win the US presidency in 2016 with a 98% likelihood. This was a pure marketing gimmick a week after Nate Silver’s carefully designed models gave Trump a 2% probability of winning. Adams faced minimal risk to his reputation—he is a cartoonist, after all!5

True forecasting should be informed and information-additive (this alone makes it different from nowcasting), capturing facts and ideas that are not part of the mainstream market narrative. If it involves a numerical forecast, it should be designed to maximize ex ante accuracy, be unbiased in the language of statisticians (as likely too high as too low), and ideally should have carefully calibrated confidence bands.

Even for predictions that lack a quantitative statistical framework, the value ascribed to a forecast should not be based on the cherry-picked spot-on calls of the past, but the full track record of such predictions. By this yardstick, Byron Wien’s (2019) 10 annual surprises are very good examples of what nonquantitative predictions should look like. Given that the forecasts are deliberately provocative and surprising, his batting average is impressive. But what do our own empirically driven quantitative models tell us about what we may anticipate from capital markets in the decade ahead?

Our 10-Year View of Markets

Before we turn to the forward-looking data available to all on our website, let us reflect on the most recent decade and its extraordinary place in modern history.

From an economic standpoint, of all decades from which to nowcast, the 2010s may be among the least “normal.” Relative to all other full decades since World War II, and zeroing in on the United States for this application, the 2010s recorded the following milestones:

- the lowest inflation as measured by US CPI (1.7% annualized as of November 1, 2019),

- the lowest average yield on 10-year US Treasuries (2.4% versus 3.2% during the 1950s, the decade with the second-lowest average yield, which followed a period of war-related interest rate controls), and

- a dramatic reduction in civilian unemployment (a 6.4 percentage point decline relative to where unemployment stood at the start of the decade).

During this economically extraordinary decade, real (i.e., net of inflation) US equity market returns at 11.7% a year were middle of the pack versus the post-WWII experience. The recovery after WWII and the two-decade recovery from the stagflation decade of the 1970s all produced better equity returns than the 2010s. Meanwhile, real bond returns were similarly average, coming in at 1.9%, wrapping up a three-decade decline in bond yields since the Volker era.

As we look back on the 2010s, one asset class is worth highlighting: real estate. Real estate was at the center of the 2007–2009 meltdown and in the years since we have witnessed a very strong recovery in this sector of the economy. Over the last 10 years, US commercial real estate as measured by the NCREIF Property Index (NPI) very nearly matched “Ma S&P” with real returns of 9.5% a year and reported volatility of 3.7%.6 Real estate investment trusts (REITs) as captured by the FTSE Nareit All Equity REITs Index delivered 10.6% real return a year with a volatility of 14.7%, for a Sharpe ratio of 0.81.

At the risk of getting ahead of ourselves with our own forecasts, past is not prologue. Past returns are poor—even perverse—predictors of future returns. Investors should not expect a repeat of this post-crisis performance in real estate. We expect US commercial real estate to deliver 2.1% a year in real terms over the next decade with substantially higher “economic” volatility of 12.5%, and we expect REITS to return 1.2% net of inflation on an annualized basis with volatility of 22.7%.7 If real estate has been a success story since the global financial crisis, we should not expect more of the same as we step into the 2020s.

Let’s turn to charts and data from the Research Affiliates Asset Allocation Interactive (AAI) site to discuss robust and transparent expectations for global capital markets across the mainstream asset classes of core bonds and equities.8

Core Bonds

Research Affiliates AAI allows users to toggle between historical figures and forward-looking expectations, making the contrast between forecasts and nowcasts strikingly clear.

Referring to the historical 2019 returns on AAI, we can see that core bonds had a very good year indeed. While US and Global Aggregate indices earned very generous returns of 6.2% and 4.4%, respectively, net of inflation, the long end of the US Treasury market outpaced all expectations, returning 12.2% net of inflation through December 31, 2019. While bond investors may naturally wish for more of the same in the months and years ahead, the forward-looking 10-year picture is less promising.

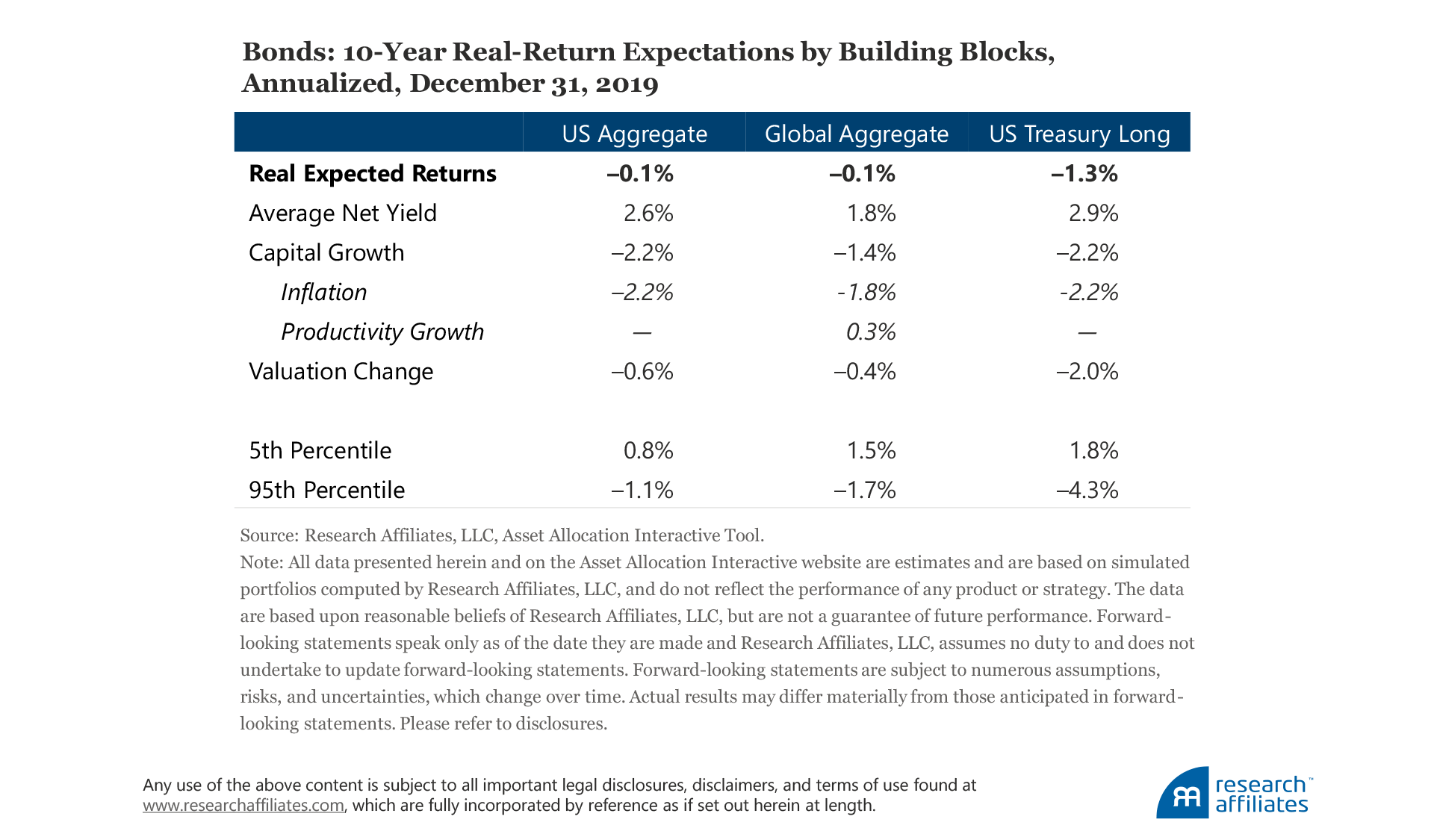

We forecast that the US Aggregate index will trail inflation slightly, returning an annualized average of −0.1% in real terms over the next 10 years. The same is true for the Global Aggregate bond market index, at a −0.1% real return a year. Even more sobering, long-dated US Treasuries have an expected annualized return of −1.3% in real terms. We derive these figures using a building-block perspective and refer readers to the AAI site for methodology details. As with any asset, the constituent parts of return are yield; capital growth, which in the case of fixed income arises from real growth in income; and changes in valuation levels.

While some plausible scenarios exist in which bonds manage to beat inflation (e.g., a 5% probability of a 1.8% annualized real return for US Treasury Long), the odds favor erosion of investors’ purchasing power over the next decade for investments in developed-economy government and investment-grade bonds. It is hard to miss the general symmetry between the last 10 years and our projections for the next 10 years.

Equities

The difference between the recent past and our 10-year forecasts for equities is even starker than for bonds. In 2019, US large equities reigned supreme, returning nearly 28.5% in excess of inflation. At the other extreme, emerging markets “disappointed” by returning a relatively healthy 16.1% real return over the same period.

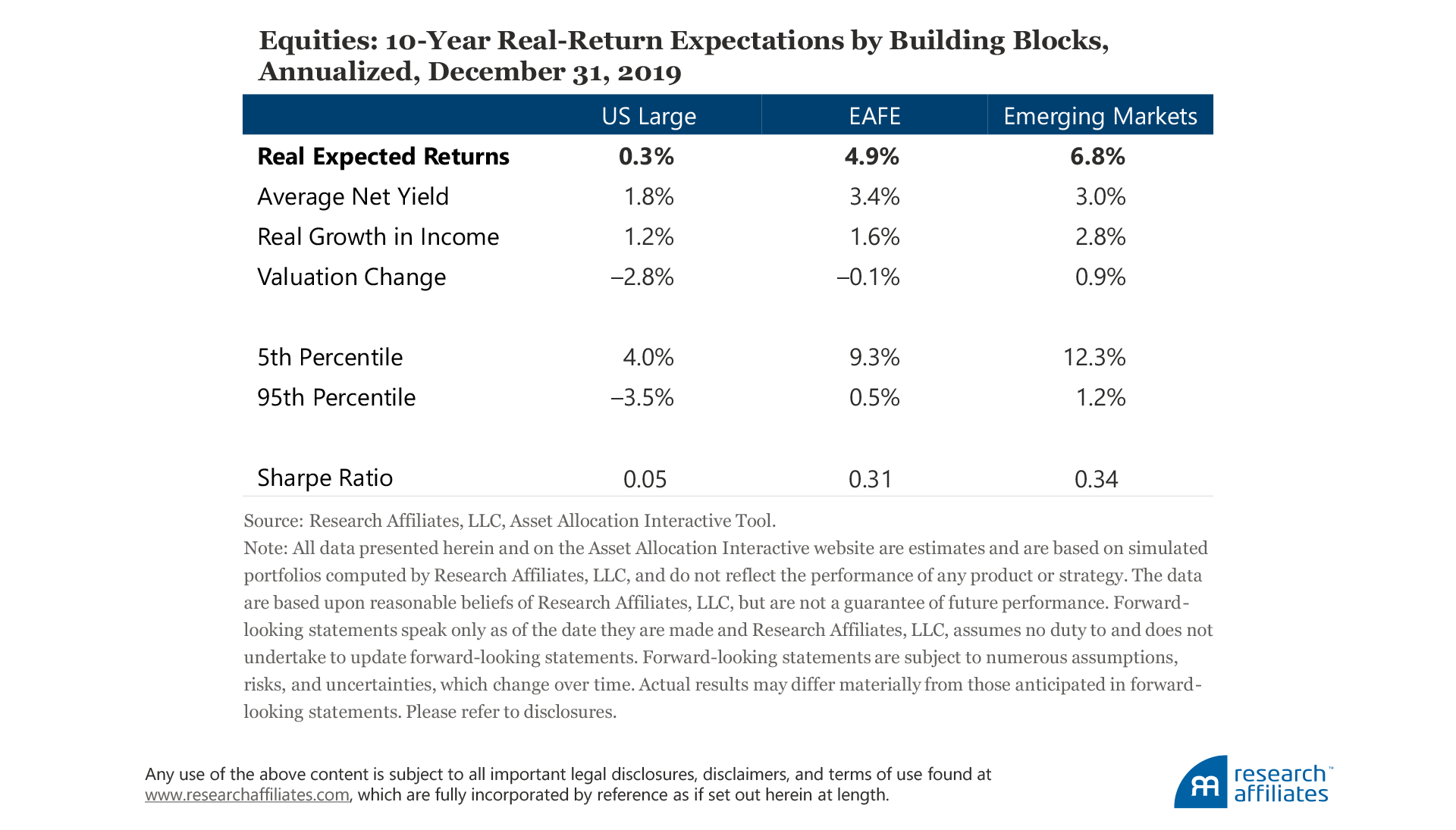

The price of an asset matters: richly priced assets tend to deliver underwhelming returns, while relatively inexpensive assets are better positioned to deliver healthy returns over the medium to long term. Over the next decade, based on our empirically informed understanding of capital markets, we expect emerging market equities to outperform developed market equities and to outperform US equities in particular. Our forecast is that US large equities should do marginally better than inflation at a 0.3% annualized real return and that emerging market equities should deliver a 6.8% real return a year over the next decade. In the middle of this range of expectations, our models tell us that EAFE equities are expected to return a still-robust 4.9% a year in real terms.

We understand some investors may be disappointed with our capital market expectations, especially given the US equity returns of the last decade, but we believe these forecasts capture the forward-looking reality of capital markets, given current conditions. We encourage investors to have realistic expectations. Realistic, to be clear, does not mean conservative for the sake of creating a buffer against disappointment, but rather an unbiased view of the future—as likely to surprise to the downside as to the upside—so that they can invest and plan accordingly. From this standpoint, emerging market equities have among the highest expected returns of all asset classes available to investors in absolute terms (6.8% a year) and in risk-adjusted terms (a 0.34 Sharpe ratio) over the next decade.

Let’s consider the drivers of expected performance. Dividend yields, a headline figure for investors to consider, captures the income paid to shareholders based on current dividend distributions and equity prices. These range from 1.8% for US large equities to 3.4% for EAFE equities, with emerging market equities carrying a 3.0% dividend yield. The second component, capital growth, is the combination of real growth in cash flows (fundamental growth) and productivity growth. The latter measures the expected change in real exchange rates from differentials in productivity gains; the greater an economy’s potential to gain in productivity relative to others, the more likely its currency is to appreciate relative to other currencies. In both cases, emerging markets are well positioned relative to US large equities, with a yield advantage of 120 basis points (bps) and a capital growth differential of 160 bps. These are healthy differences, but they are tiny compared to the differences in our expectations for valuation changes.

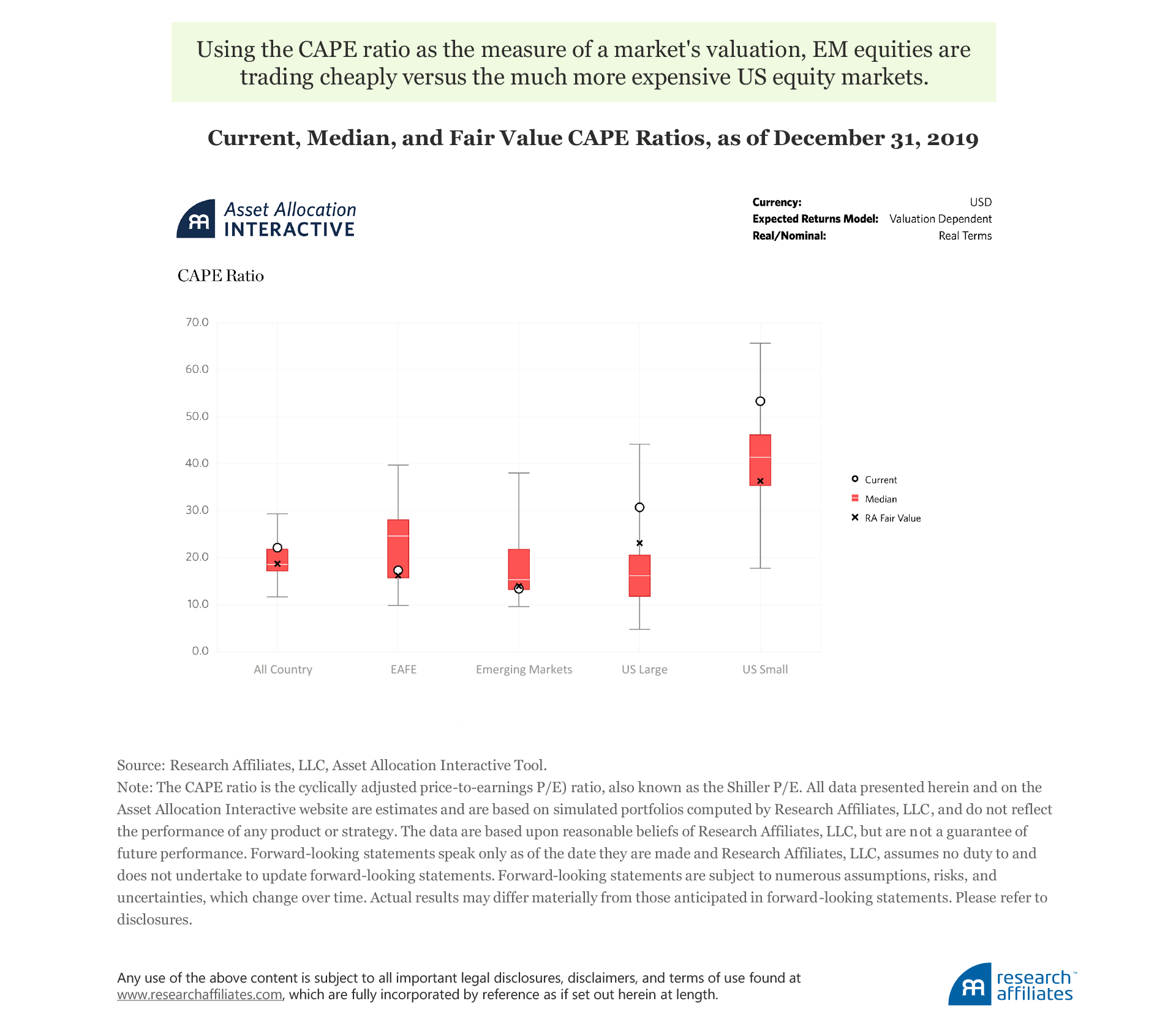

We expect US large equities to be revalued down by 280 bps a year and emerging market equities to be revalued up by 90 bps a year, for a total differential of 370 bps. This accounts for more than half of our overall expectations differential. This difference is, to some extent, caused by the historical richness of the US dollar versus other currencies—developed and emerging—but the dominant factor is relative equity valuations versus their own historical norms in terms of the price paid per dollar of cyclically adjusted real earnings. We owe the standard measure of equity market richness or cheapness to Robert Shiller, who developed the CAPE (cyclically adjusted price-to-earnings) ratio.

By this measure, and a number of comparable measures,9 US markets are very expensive relative to history. The current CAPE ratio of 30.8, which is the 96th percentile of historical values, is substantially higher than the median historical value of 16.2 and our estimated fair value of 23.1. In comparison, emerging market equities are trading at a CAPE ratio of 13.4 (the 28th percentile of historical values), below both historical median (15.4) and fair value (14.0, at the 37th percentile).

On the one hand, based on our interpretation of the facts, US equity markets are trading at very stretched valuation levels and have no room to rise from here on anything short of outstandingly good news. On the other hand, emerging market are cheap, although they are less cheap than US markets are expensive. Our forecasts are consistent with the more compressed distribution of CAPE values for emerging market equities with fair value only a few percentiles away from current levels.

We understand that taking into consideration expected valuation reversals—even half-way mean reversion—may feel more speculative and be too uncomfortable for some, which is why AAI offers a modeling option that is not valuation dependent. Adopting only the yield-and-growth approach certainly makes the US equity market look somewhat more attractive and emerging market equities somewhat less attractive, but the prospective return advantage of emerging markets over US equities is not fully offset by this change in assumptions. Valuations strengthen the case substantially, but they are not a requirement to support positioning away from US equities and tilting toward emerging markets.

Real-Return Asset Classes

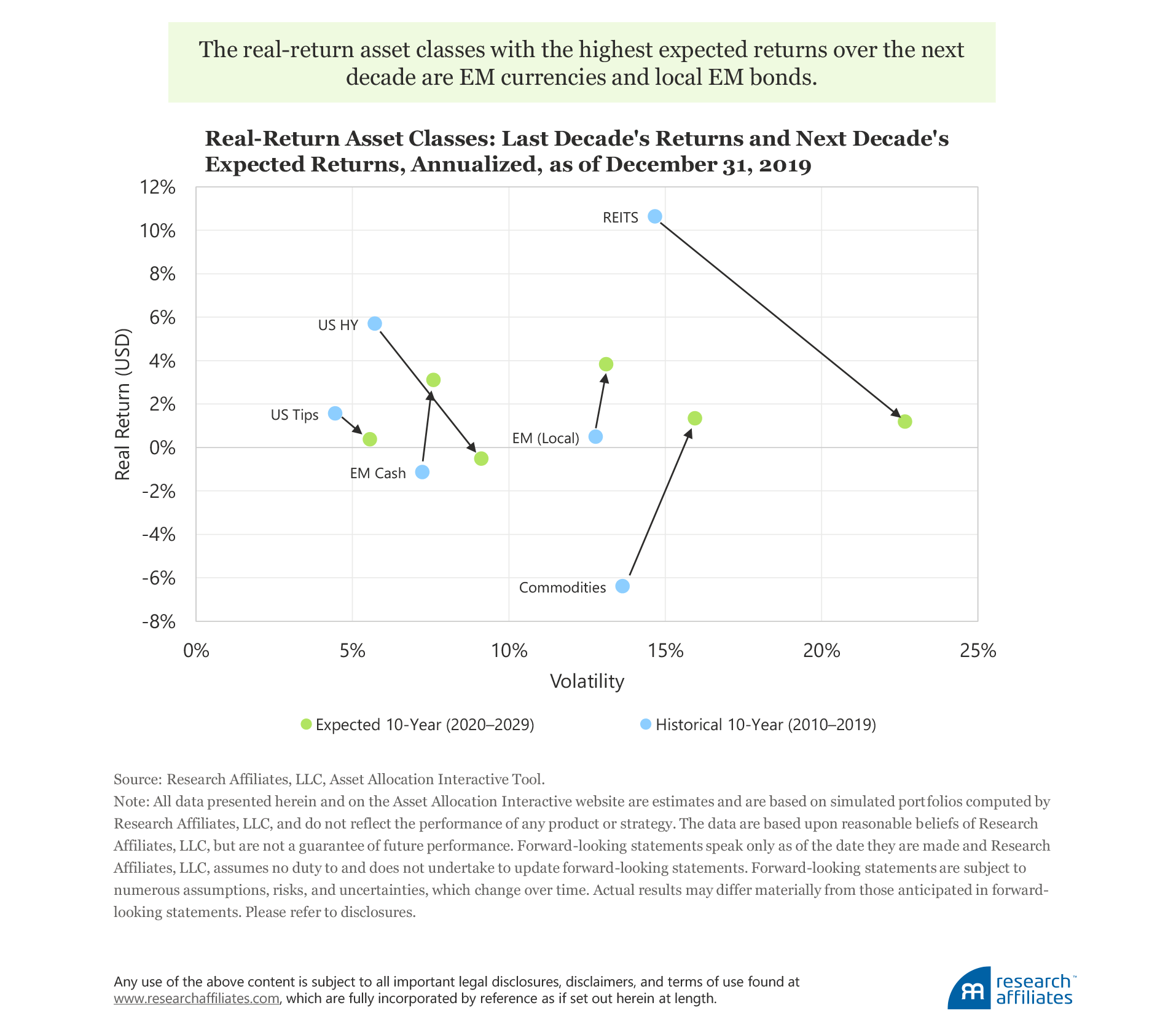

Moving away from the more-traditional asset classes of equities and bonds, let’s turn to our forward-looking return expectations of various real-return asset classes. These asset classes are lightly correlated with conventional equities and bonds and are positively correlated with inflation shocks. As such, they tend to protect investors from the wealth erosion caused by inflation. We refer to these asset classes as the “inflation fighters” in a well-diversified portfolio, complementary to the traditional building blocks of mainstream equities and bonds.

Traditional real-return asset classes include US TIPS, commodities, and REITs, offering the most direct protection against rising inflation.10 High-yield bonds and emerging market currencies and local bonds,11 which we regularly refer to as “stealth” inflation fighters, have also exhibited a positive correlation with US inflation shocks. Indeed, many of these asset classes offer better protection against inflation shocks than TIPS, even though TIPS are contractually linked to the US inflation rate.

REITs, high-yield bonds, and TIPS generated the highest historical 10-year real returns over the decade of the 2010s, reaching as high as 10.6% for REITs. Over the coming decade, we expect these three asset classes to deliver far more-modest forward-looking real returns, with REITS expected to earn only 1.2% a year and the other two to post lower or negative real returns. We expect a meaningful valuation reversal to reduce REITs’ forward-looking real-return potential, offsetting the asset class’s healthy starting yield levels. For high-yield bonds, negative growth expectations, coupled with a detracting valuation reversal, are likely to contribute to diminished return prospects. Finally, the current paltry starting yield level of TIPS implies low forward-looking returns.

Our 10-year real-return forecast for commodities is marginally higher than for high-yield bonds and TIPS, and on par with REITs. As the worst performing real-return market over the last decade, commodities are likely to benefit from a positive valuation boost over the coming decade. We anticipate significantly negative roll returns to offset the potential appreciation of spot prices, however, resulting in a forward-looking 10-year real-return forecast of 1.3% a year.

The real-return asset classes with the healthiest forward-looking real returns in the coming decade are emerging market currencies and local bonds with real-return forecasts between 3 to 4% a year. Not only do these assets have high starting yields, both trade at reasonably attractive valuations levels. Accordingly, we expect a modest valuation boost to lift their long-term expected return levels.

Outrageously Sober Forecasts…and a Reader’s Challenge!

In clear contrast to a pure nowcasting perspective, our own forecasts paint a relatively sober view of expected returns going forward, particularly relative to the most recent history. The Research Affiliates AAI forecasts, based on an empirically driven quantitative model, do not highlight any asset class with a current annualized real expected return in excess of 10% over the coming decade. Emerging market equities are at the high end of expectations, sporting an annualized 6.8% real return throughout the 2020s.

At the other extreme, long-dated US Treasuries are expected to disappoint the most, with an annualized expected real return of −1.3%. Of course, our forecasts allow for the uncertainty inherent in capital markets; this uncertainty is reflected in AAI’s confidence intervals. Capital markets may surprise to the upside or to the downside, but as a base line we encourage investors to contemplate that the returns of the last decade are very unlikely to repeat and therefore to position themselves for more muted returns in the decade ahead. We wish we could be more exuberant, but that would be a disservice to all if we ignored the facts.

That being said, it’s not all bad out there from a forecasting perspective, particularly for those with reasonably honed “Sharpie skills.” For instance, we consider the December 17, 2019, article “A Decade of U.S. Market Exceptionalism Probably Won’t Repeat” by the Wall Street Journal’s James Mackintosh a directionally well-thought-out forecast, which when coupled with our expected returns aligns narrative with quantitative expectations.

The next day, also in the Wall Street Journal, Gunjan Banerji’s article “Options Traders Eye Insurance Even as Stocks Soar” discusses the behavioral biases that arise from relying on near-term history. Namely, because equities sold off so dramatically in the fourth quarter of 2018, many investors were reportedly expecting a replay of this scenario in the last weeks of 2019 and are piling into put options for protection. The article quotes an equity and derivatives strategist as saying, “People still are traumatized by this time last year.” This is not quite nowcasting, given the all-time highs being recorded, but basing a forecast on “being traumatized” by past market behavior is not an informed forecasting technique. These two examples of forecasts are juxtaposed by the same publication in a thoughtful manner.

As we jump into the 2020s, here is a bit of fun for those who wish to join us. As you read articles in the financial press, we invite you to ask a few questions: Is this purely reporting factual news or does it tacitly introduce a forecast, particularly from market participants quoted in the article? If there is a forecast, is it merely extrapolating what has already happened? Is it therefore a likely nowcast? Try it! It’s fun! Here is a brief (and necessarily incomplete) starter set of articles that we have recently enjoyed reading from this vantage point. If you are so inclined, send your assessment (news, forecast, nowcast) to us at info@researchaffiliates.com. We’d love to hear from you. And allow us to wish you the best of luck in life and in investments, now that we’re officially off and running in a new decade!

Please read our disclosures concurrent with this publication: https://www.researchaffiliates.com/legal/disclosures#investment-adviser-disclosure-and-disclaimers.

Endnotes

- We should note that nowcasters can be right and sometimes are vindicated for a long time. Such “lucky but not (very) smart” outcomes expose investors to being unprepared, in particular, when trends break. We encourage you not to fall victim to what behavioral scientists refer to as outcome bias; that is, coming to the conclusion that a view or action (a forecast, in this case) was “good” because it turned out to be correct, at least for a time.

- This concept was formalized in academic economics in the rational expectations model of Muth (1961) and of those who followed, eventually earning Robert Lucas, Jr., a Nobel Prize in economics. Somewhat paradoxically, given that rational expectations models affirm the notion of market efficiency, this is also the reason why successful investing requires what Marks (2016) terms second-level thinking, which requires taking out-of-consensus views and positions and is linked to maverick risk.

- This type of forecasting leverages well-known behavioral biases, such as inattention and selective recollection. As humans, we can remember the wildly successful calls (they are, by their nature, memorable), but we can be quick to forget the many wrong calls (there are too many to keep inventory).

- One of us had a former boss who often reminded us of the comical (but career-supportive) advice dispensed among sell-side analysts: “Give them a number (a target) or give them a date, but never give them both.” Indeed, we need both a what and a when to be able to ascribe success or failure to forecasts!

- It bears mention that Scott Adams’ book, Win Bigly, reveals his forecast was not just an implausible forecast for the sake of publicity, although publicity was the motivation for his picking a “98% likelihood.” He also believed that Trump is a rare “master persuader,” who would fare far better than anyone expected. In other words, this was a hybrid of outlandish claim and logic-based maverick forecast.

- The historical volatility of US commercial real estate is almost certainly artificially low relative to economic truth and to liquid assets, given the inherent stale pricing in illiquid assets and the transaction-based nature of those prints (as opposed to marked to market in liquid markets). Imagine if your home was quoted in the daily equity listings. It would hardly have the low volatility of annual appraisals, so the oft-quoted Sharpe ratio of over 3.0 for commercial real estate is bogus!

- We encourage you to explore the real estate section of Research Affiliates AAI, which highlights national figures as well as regional market forecasts across the four major categories of apartments, industrial, office, and retail, including a graphical interface over a map of the United States.

- In addition to the asset classes we discuss in this article, the Research Affiliates AAI site covers the major asset classes of credit, linkers, commodities, hedge funds, and private equity. The Full Asset Mode allows visitors to explore over 130 assets, such as single commodities and national equity and cash markets.

- Brightman, Masturzo, and Beck (2015) compare equity valuation models.

- The prices of TIPS adjust based on the changes in the CPI inflation rate. The prices of commodity futures reflect changes in the cost of the respective underlying raw material. The prices of REITs move with changes in the rents earned by the real estate property owned in the REIT.

- We also view emerging market equities as a stealth inflation fighter, because their prices have exhibited positive long-term historical correlations to US inflation.

References

Adams, Scott. 2017. Win Bigly: Persuasion in a World Where Facts Don’t Matter. Penquin Randon House, LLC: New York, NY.

Arnold, Martin, and Alexander Vladkov. 2019. “Eurozone Economy Set To Slow Further in 2020—FT Poll.” Financial Times (December 27).

Banerji, Gunjan. 2019. “Options Traders Eye Insurance Even as Stocks Soar.” Wall Street Journal (December 18).

——. 2019. “Stocks and Bonds Haven’t Rallied Like This Since 1998.” Wall Street Journal (December 23).

Brightman, Chris, Jim Masturzo, and Noah Beck. 2015. “Are Stocks Overvalued? A Survey of Equity Valuation Models.” Research Affiliates Fundamentals (July).

Gilbert, Mark, and Marcus Ashworth. 2019. “$11,769,509,000,000 Reasons to Cheer 2020.” Bloomberg (December 20).

Henderson, Richard. 2019. “Global Drop in IPOs Stirs Fears for Shrinking Public Markets.” Financial Times (December 29).

Lahart, Justin. 2020. “Great Expectations for Stocks in 2020 Might Be Dashed.” Wall Street Journal (January 5).

Little, Joseph. 2019. “Why I’m Sticking With Stocks in 2020.” Financial Times (December 18).

Liu, Evie. 2019. “The Bank Stocks Rally Should Continue in 2020. So Will These Stocks, Analyst Says.” Barron’s (December 16).

Mackintosh, James. 2019. “A Decade of U.S. Market Exceptionalism Probably Won’t Repeat.” Wall Street Journal (December 17).

Marks, Howard. 2016. “What Does the Market Know?” Memo to Oaktree clients.

Muth, John F. 1961. “Rational Expectations and the Theory of Price Movements.” Econometrica, vol. 29, no. 3 (July):315–335.

Ponczek, Sarah, and Vilana Hajric. 2019. “Recession Gets Priced Out in a Stock Rally for the Record Books.” Bloomberg (December 28).

Sindreu, Jon. 2020. “Investors, Go Ahead and Put a Lot of Eggs in This Basket.” Wall Street Journal (January 3).

Smith, Molly, and David Caleb Mutua. 2019. “The Corporate Bond Market’s 100 Billion Buyer Is Here to Stay.” Bloomberg (December 26).

Sommer, Jeff. 2019. “Forget Stock Market Forecasts. They’re Less Than Worthless.” New York Times ( December 23).

Timiraos, Nick. 2019. “Fed’s U-Turn on Assets Faces a Year-End Test.” Wall Street Journal (December 26).

Wien, Byron. 2019. “Byron Wien Announces Ten Surprises for 2019.” Blackstone.com (January 3).