Modern Monetary Theory (MMT) argues that governments with fiat currencies should coordinate treasury and central bank actions to fund government programs by directly printing money, unconstrained by tax receipts or borrowing capacity.

Progressive politicians embrace MMT because the doctrine allows them to advocate substantial increases in social spending without imposing the taxes traditionally assumed necessary to fund such spending.

MMT is attracting a growing following because it also promises to reverse the contribution to wealth inequality of today’s conventional monetary policy.

Historical experience with policies similar to MMT has resulted in periods of high and volatile inflation, which depresses the real returns of mainstream stocks and bonds.

Savers and investors may wish to revise financial plans to allow for the heightened risk of inflation given that policies influenced by MMT appear to be increasingly likely.

Don’t dismiss Modern Monetary Theory (MMT) as unlikely to influence policy. This heterodox economic doctrine advocates sharply increased fiscal expenditures backed by money creation. An alluring promise of MMT is that it directly confronts a perceived flaw in today’s conduct of monetary policy: pumping liquidity into financial markets as the standard response to stock market and economic turbulence inflates asset price bubbles and thereby exacerbates income inequality.

Recognize that monetary policy–fueled bull markets only benefit the few who own stocks. Three US billionaires are now collectively worth more than the 160 million Americans in the bottom half of the wealth distribution. A dramatic increase in social spending as prescribed by MMT advocates may well help alleviate some of this inequality.

Investors, however, should be aware that MMT-inspired policy raises the risk of inflation. Unexpected inflation shocks cause the prices of stocks and bonds to plummet. Proponents of MMT may interpret destruction of financial wealth as necessary and beneficial because few of the bottom 160 million hold any stocks or bonds. A burst of inflation will help level the playing field.

Many prominent politicians currently embrace MMT more as political strategy than economic policy. Over recent decades, Republicans have successfully prevented an expansion of US government spending to fund European levels of social benefits by cutting taxes and raising deficits when in power, and then demanding austerity to remedy the accumulating debt when Democrats are in power. Having learned from this gambit, prominent members of the progressive wing of the Democratic party are now turning the tables. MMT allows them to promote a massive expansion in government spending without admitting that a corresponding tax increase (likely a European-style VAT) will become necessary to offset that spending.

The frightening problem with this political game of chicken is that we may end up with a rerun of the Great Stagflation of the 1970s and its dismal capital market returns. Younger readers who have become accustomed to the recent stable inflation rate achieved through independent central banks may not appreciate the misery inflicted by high and volatile inflation. I’m old enough to remember. When I began my first college economics course, the US inflation rate was racing at double digits, while the unemployment rate was headed to nearly 11%, its post-WWII high. Diagnosing the cause of that miserable inflation disease and administering a cure was the most important practical problem for economic policy of the time.

In this article, I summarize the past six decades of monetary policy in the United States to remind readers of the cause of the Great Stagflation of the 1970s and the pain of repairing the damage in the early 1980s. I note that technological advances have since rendered the clear rules of monetarism obsolete. I discuss why today’s complex econometric models invite heterodox new theories. I briefly touch upon a potentially more sensible cousin to MMT, the fiscal theory of the price level (FTPL). I note where MMT departs from economic orthodoxy and highlight the harsh assessment of prominent economists, notably including those from the political left. I conclude by referencing the terrible capital market returns of the 1970s. In that decade, cash and bonds provided negative real returns, while stocks provided a real return of about zero.

Keynesian Policy and Inflation During the 1960s

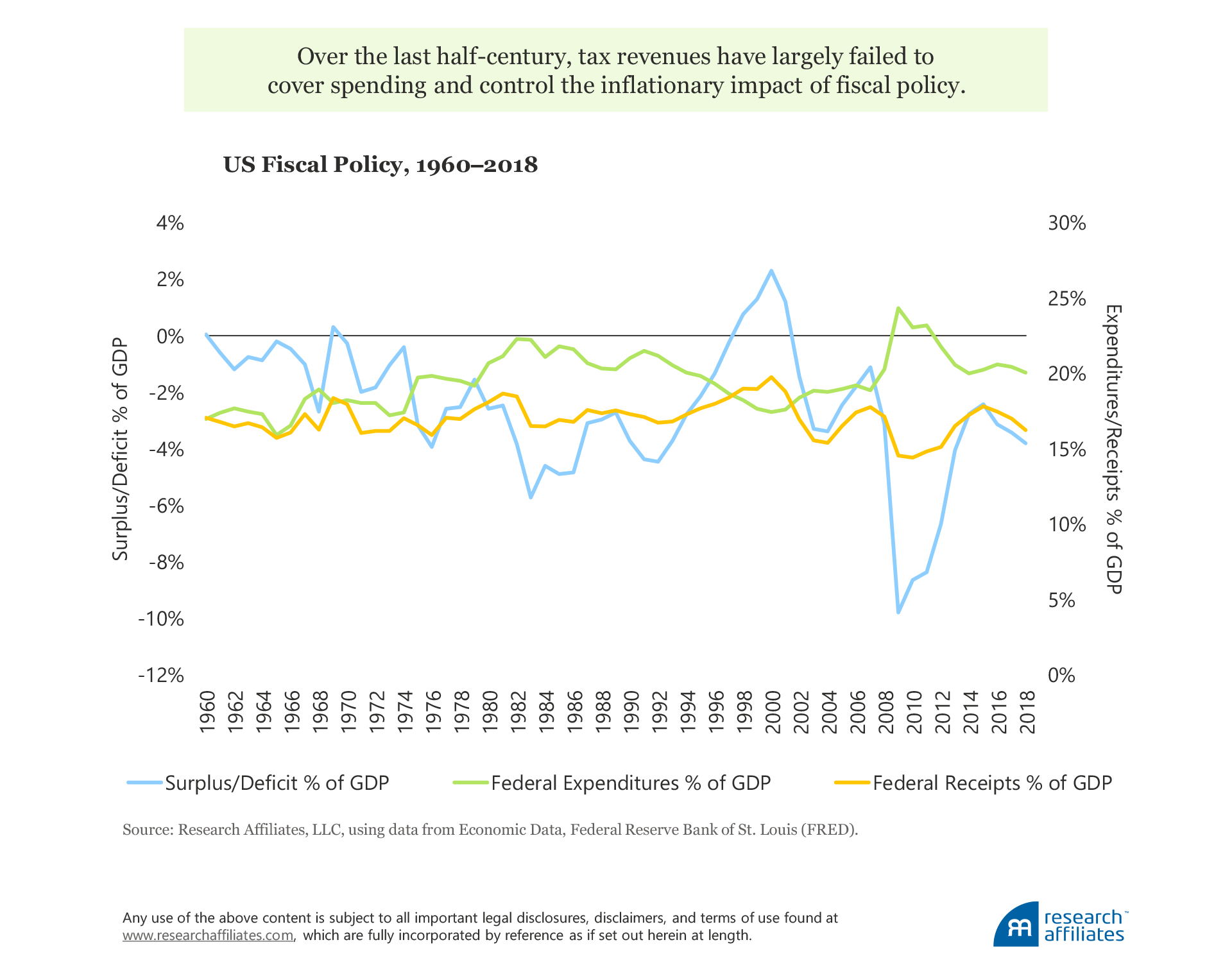

The fiscal and monetary policies of my childhood foreshadowed MMT. In 1964, Congress cut income tax rates by approximately 20% to boost growth and raise employment, enacting a policy originally proposed by the recently assassinated President Kennedy. This tax cut, paired with large increases in government spending for the moon shot, the War on Poverty, and the undeclared (but nonetheless all too real) war in Vietnam, fueled an economic boom along with a jump in the inflation rate. From 1963 to 1966, unemployment declined from 6% to below 4%, while inflation more than doubled from less than 1.5% to 3%.

Can tax policy control the inflationary impact of a too-aggressive fiscal policy, as asserted by today’s MMT proponents? In an explicit effort to control the rapidly rising inflation rate following the fiscal stimulus of the mid-1960s, Congress reversed course to enact a large tax increase, the Revenue and Expenditure Control Act of 1968. While this led to a tiny and temporary budget surplus, as discussed at length by Arthur Okun (1971) the effort to control inflation through taxation utterly failed.

Stagflation of the 1970s and the Failure of Wage and Price Controls

Republicans made a bad situation worse. In 1971, President Nixon ended convertibility of the US dollar into gold, imposed wage and price controls, and raised tariffs. In 1972, Nixon pressured Fed Chairman Arthur Burns to ease monetary policy in order to boost the economy heading into the election of 1972 despite the elevated inflation rate. The economy duly strengthened and Nixon was re-elected in a landslide.

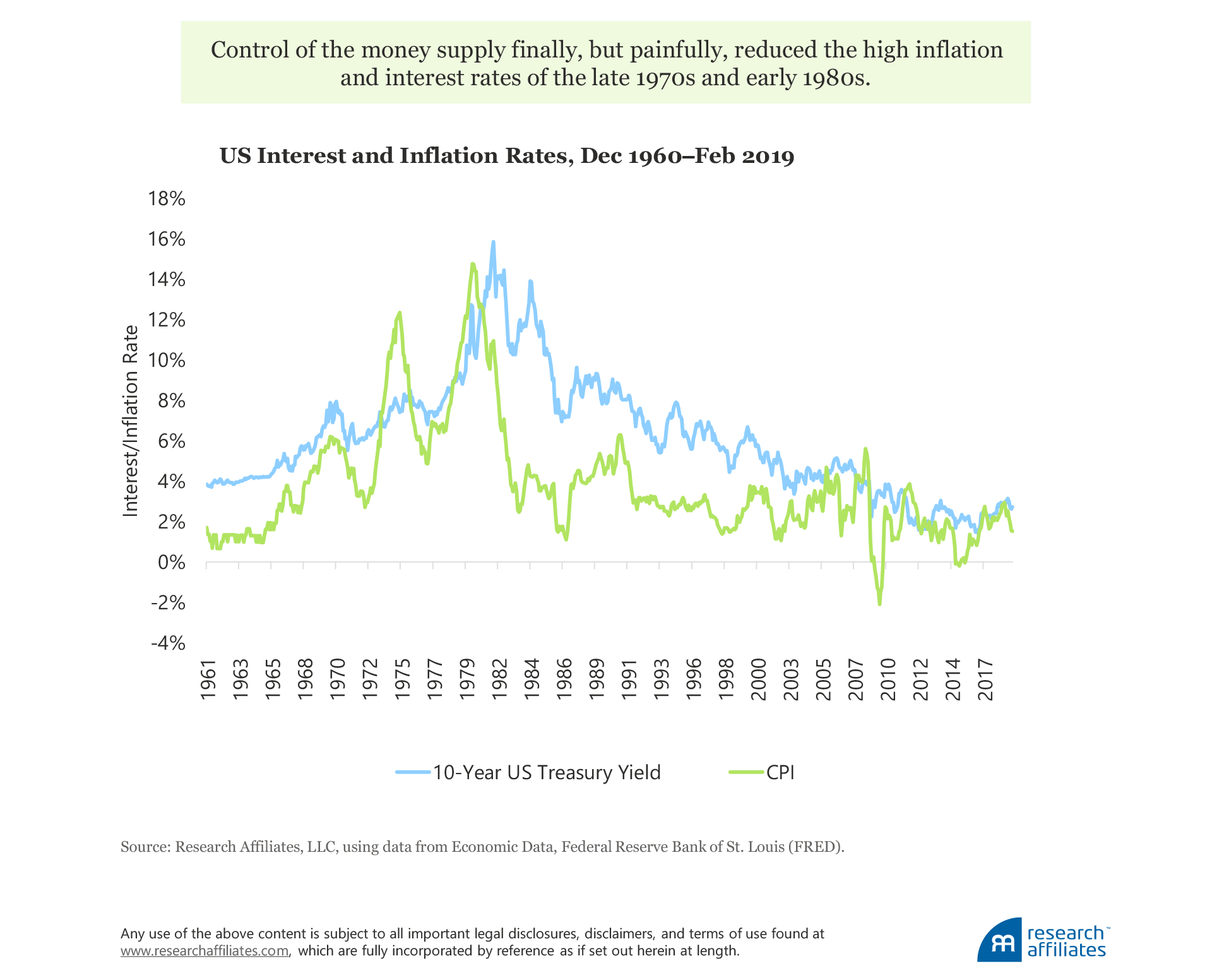

This episode teaches us about the risks of politicizing conduct of monetary policy. Nixon’s wage and price controls paired with politically motivated easy money propelled inflation much higher. The Consumer Price Index (CPI) doubled from 3% in 1972 to 6% in 1973. The next huge step-up in prices coincided with the oil price shocks of 1973 and 1974. CPI soared to 11% by 1974.

Following Nixon, President Ford tried to control the then-raging rate of inflation by urging patriotic, voluntary action to reduce consumption and increase savings, passing out WIN (Whip Inflation Now) buttons. In 1978, President Carter instituted voluntary wage and price controls, which proved as futile as Ford’s WIN buttons.

Through the latter half of the 1970s and into the early 1980s, high and volatile inflation coincided with rising unemployment. The unemployment rate rose from less than 4% in 1969 to nearly 11% by 1982. Whether this Great Stagflation was caused by rapid expansion of money or by oil price shocks remains a subject of debate to this day. Beyond debate was the human suffering. To quantify the suffering of that time, Arthur Okun invented the “misery index” as the sum of the inflation and unemployment rates, which peaked at over 22% in the early 1980s.

Volcker Tames Inflation with Monetarism

Milton Friedman famously stated: “Inflation is always and everywhere a monetary phenomenon....” By the time I began my study of economics, events proved Friedman and his collaborator Anna Schwartz prescient. Following Friedman and Schwartz, I was taught that excessive growth in the money supply caused the inflation of the 1970s. The growth rate of money, as measured by M2, rose from 1.5% in 1960 to 3% in 1970, to 4% in 1975, and then to 10% by the early 1980s. Correspondingly, CPI rose from below 2% in 1960 to a peak of over 14% by 1980.

When I entered high school in the 1970s, monetarism had already gained influence among Fed economists. Simply stated, monetarism teaches that an increase in the supply of money causes rising prices. The theory is summarized by the well-known equation MV = PQ, where M is the aggregate money supply; V is the velocity of money, or the number of times an average unit of money is used to purchase goods and services in a given period; P is the general price level, for example, the level of CPI; and Q is the quantity of real goods and services produced, or real annual GDP.

From the vantage point of the 1970s, tight regulation of banks and interest rates had produced a sufficiently stable velocity of money such that economists assumed V was approximately a constant. If V is constant, then a change in M equals the change in PQ (growth of the nominal economy). Further, when the economy is operating at potential, real growth is constrained by real resources: land, labor, and capital. If both V and Q are effectively constant over the short run, then a change in M equals a change in P, which is inflation.

Monetarism solved the inflation puzzle: growth of the money supply in excess of the growth of the real economy causes rising prices. To control inflation, the Federal Reserve would need to slow the growth of money.

A month before I began my university studies in 1979, President Carter nominated the then President of the Federal Reserve Bank of New York, Paul Volcker, to chair the Federal Reserve Board of Governors. Volcker embraced monetarism, intentionally slowed the growth of the money supply, and allowed market interest rates to rise above the double-digit level of inflation. After two nasty recessions in the early 1980s, coinciding with a spike in interest rates into the mid-teens, the growth rate of money, inflation, and nominal interest rates all began their decades’ long decline to the lows of recent years.

Contemporary Monetary Policy

Complicating monetary theory and the conduct of monetary policy, advances in financial technology have dramatically changed the nature of money. Today, nearly a billion people, many without bank accounts, transact using smart phones. The money supply now defies practical measurement and theoretical definition. Velocity of money no longer appears stable. Because central banks cannot control a money supply they cannot measure, growth of money no longer provides a practical guide to the conduct of monetary policy.

In place of monetarism’s simple target for the growth of money, central banks now target a low and stable rate of inflation, with an emphasis on expectations and forward guidance. Actual conduct of monetary policy to achieve this inflation-targeting objective relies on the subjective judgment of policy makers informed by well-known models including the Phillips Curve and the Taylor Rule. As became obvious in the Great Recession and its aftermath, however, the inputs to such simple models cannot be estimated with the accuracy necessary to provide a precise operational guide to setting monetary policy.

The present state of orthodox monetary theory provides little help. Staff economists at central banks (and those in academia who advise them) produce complex models—as a class they are labeled dynamic stochastic general equilibrium (DSGE) models. DSGE models synthesize several branches of economic theory including rational expectations, an endogenous private sector operating within competitive markets, sticky prices, and multi-period analysis. In theory DSGE models inform policy by forecasting employment, output, and inflation in response to alternative policy decisions. In practice, DSGE models seem devilishly complex to most of us, and the experts who might comprehend them express little confidence in their forecasts.

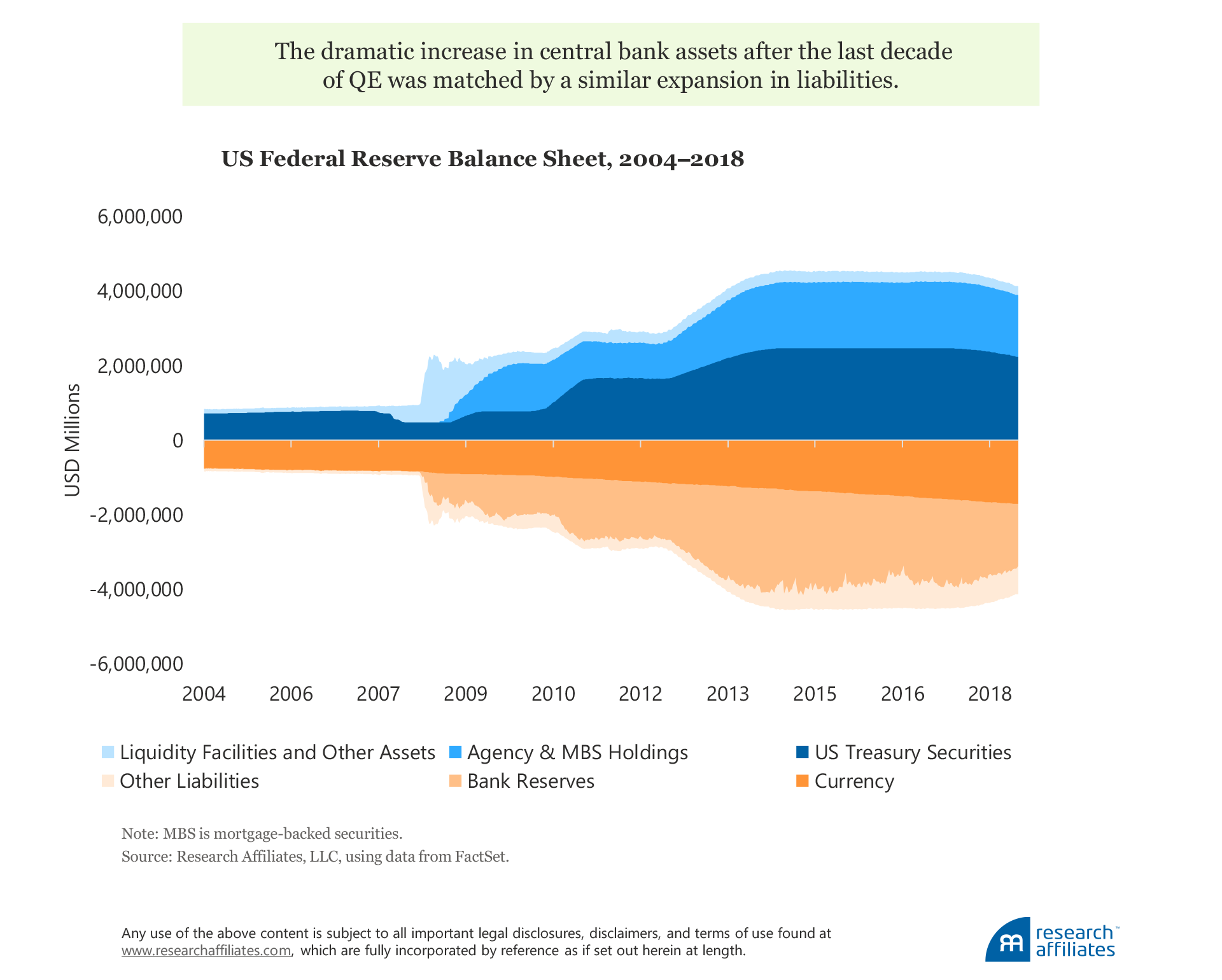

Ben Bernanke expressed the absence of a well-accepted theory to guide monetary policy with his pithy quip: “Well, the problem with QE [quantitative easing] is it works in practice, but it doesn’t work in theory.” If current monetary policy appears to be a set of ad hoc practices in search of an applicable theory, then we shouldn’t be surprised that heterodox theories are receiving increasing attention.

The Fiscal Theory of the Price Level

John Cochrane (2019) asks: “Is there a theory of inflation that continues to work as we move to electronic transactions and a money-less economy?” His answer is the fiscal theory of the price level (FTPL).

In common with MMT, the FTPL holds that a government spending its own fiat currency has no nominal budget constraint. Most debt issued by governments is nominal, not real. (Real government debt includes inflation-linked bonds and borrowing denominated in a currency backed by a real asset such as gold.) Increases in nominal government borrowing that exceed the real value of future primary budget surpluses necessary to repay that debt will increase the price level (inflation) to keep the real value of the borrowing equal to the real value of the future budget surpluses.

More formally, the FTPL posits that B/P = present value of future budget surpluses, where B is the nominal amount of government borrowing and P is the price level. This simple equation provides an intuitive sense of why borrowing more than can be repaid from future tax receipts produces inflation.

The FTPL helps explain why QE has not yet caused inflation. In our twenty-first century economy, central banks have accumulated enormous quantities of government debt on the asset side of their balance sheets, matched by bank reserves and currency on the liability side of their balance sheets. Correspondingly, commercial banks possess enormous quantities of excess reserves on the asset side of their balance sheets. Because central banks now pay interest on bank reserves at rates approximately equal to the yield on short-term government debt, when a central bank conducts open market operations, it merely swaps bank reserves for government debt, both obligations of the government paying the same rate of interest.

As I have explained, such swapping of equivalent financial instruments, as in QE, has no direct effect on the money supply or the rate of inflation. The FTPL explains why even the proportionally larger QE undertaken in Japan has not produced inflation. Japanese debt monetization has coincided with a tightening of fiscal policy and declining deficits.

As its name explicitly asserts, the key insight of the FTPL is the importance of fiscal policy to the determination of the price level and the rate of inflation. A corollary is the relative impotence of monetary policy. John Cochrane concludes his 2018 essay “Four Heresies of Monetary Policy” with the statement: “The Fed is nowhere near as powerful as conventional wisdom suggests.” These assertions of the impotence of monetary policy and the primacy of fiscal policy are echoed by MMT.

Modern Monetary Theory

I attempt an explanation of MMT with some trepidation. Little of MMT is published in the traditional manner. MMT’s promoters communicate their ideas primarily through blogs and podcasts. Even progressive economists, who support a larger role for government and downplay concerns about deficit spending, struggle to explain it. Paul Krugman has likened his engagement with MMT advocates as playing Calvinball, a fictitious game in which the rules are constantly changing. Nonetheless, here I go.

In common with Abba Lerner’s theory of functional finance, MMT argues that governments should coordinate monetary and fiscal policy to ensure full employment. Stephanie Kelton (2019) explains Lerner’s approach: “The government should use its fiscal powers (spending, taxing and borrowing) in whatever manner best enables it to maintain full employment….” So far, such a description of MMT seems to align with mainstream Keynesian proscriptions for fiscal policy.

A seemingly more sensational claim of MMT is that governments with fiat currencies can fund any amount of government spending simply by creating new money. We might reasonably assume that such a radical change in policy would require abolishing central bank independence. MMT advocates do not explicitly promote this change, so far as I can find. Rather, they envision a consolidated treasury and central bank. In the US context, Congress would direct the Fed or its successor to create whatever amount of money is necessary to fund government spending.

Released from the constraint to fund government spending with taxes, promoters of MMT back a massive increase in government control of the economy, from universal healthcare and free college education to an immediate transition to clean energy as well as government jobs for all of the unemployed. MMT acknowledges that too much government spending might cause inflation, but that taxes and regulation can and will prevent it. Relying on Congress to manage inflation through tax policy seems recklessly naïve regardless of whether it would be theoretically possible.

To be fair, when markets fail to provide sufficient investment in public goods—such as infrastructure, research, education, and healthcare—then government spending for such programs may well provide an economic return above the foregone alternative private investments. Advocating an expansion of government investment thus resides well within the bounds of conventional macroeconomics.

Where then does MMT depart from orthodoxy? MMT asserts that government investment doesn’t crowd out private investment because government spending creates bank reserves, which lowers interest rates. The obvious objection to this heterodox assertion is that real resources are finite. To the extent that government directs investment of finite real economic resources, less of those finite resources will be available for private investment. As Fed Chairman Jerome Powell recently testified before Congress: “The idea that deficits don’t matter for countries that can borrow in their own currencies I think is just wrong.... We’re going to have to either spend less or raise more revenue.”

James Mackintosh (2019) wryly observes that MMT is neither modern, monetary, nor a theory. Nonetheless, the embrace of MMT by influential progressive politicians has compelled many prominent economists to publicly warn of its dangers. Kenneth Rogoff (2019) refers to MMT as “nonsense.” Paul Krugman (2019), though deeply sympathetic to progressive policy goals and deficit spending, says unequivocally that “the MMT people are just wrong.” Larry Summers (2019) calls MMT a “recipe for disaster.”

As Bill Dudley (2019) explains:

MMT hasn’t worked out well for other countries. Consider Germany in the 1920s, or Venezuela and Zimbabwe more recently. The US tried a milder version in the 1960s and 1970s, when the government tried to pay simultaneously for the Vietnam War and Lyndon Johnson’s Great Society programs. The result was inflation, America’s withdrawal from the gold standard and the demise of the Bretton Woods system of fixed exchange rates. The Fed had to increase interest rates to double digits in the late 1970s and early 1980s, at great economic cost, to get inflation back under control.

Dudley’s warning resonates with me. I vividly recall the stagflation of the 1970s, the pain measured by the misery index, and the two recessions of the early 1980s as I began my first professional job search.

Financial Market Implications of MMT

What does a return to stagflation, similar to that of the late 1970s, imply for capital market returns? For the full decade of the 1970s, bonds and cash provided negative real returns as unexpected inflation turned real rates negative. If MMT becomes policy, then we can expect a similar bout of high and volatile inflation leading to negative real returns for bonds and cash.

Would the mighty US stock market provide protection from high and volatile inflation? Not if history is our guide. High inflation is associated with declining stock prices. Stocks provided a real return barely above zero for the decade of the 1970s. The Shiller P/E of the US stock market dropped from an average valuation of 17 at the start of the decade to below 10 in 1977, and then remained in a range between 6 and 10 until 1984. From the present Shiller P/E of 31, this historical valuation implies a plunge in stock prices of 70%, even before considering the damage to corporate profits!

Real assets provide a measure of inflation protection. TIPS, commodities, and REITs may appreciate as and when investors attempt to reposition for an inflationary regime. Unfortunately, today TIPS provide real yields below 1%, commodities pay no real yield at all, and REIT prices are highly correlated with the US stock market.

Repositioning portfolios to hold capital assets domiciled in countries with more conservative policies provides an alternative approach to protecting portfolios from inflation. Such protection comes at a cost. The premium the wealthy willingly pay to protect real purchasing power at least partly explains the current negative real interest rates charged on Swiss bank deposits.

One way or the other, a return to high and volatile inflation can be expected to depress future capital market returns. Informed investors can prepare by paring back positions in mainstream stocks and bonds, diversifying into real assets, and revising down future real return expectations.

References

Arnott, Robert, Tzee Chow, and Denis Chaves. 2017. “King of the Mountain: The Shiller P/E and Macroeconomic Conditions.” Journal of Portfolio Management, vol. 44, no. 1 (Fall):55–68.

Brightman, Christopher. 2012. “Expected Return.” Investments & Wealth Monitor(January/February).

———. 2015. “What’s Up? Quantitative Easing and Inflation,” Research Affiliates Fundamentals (January).

Cochrane, John H. 2018. “Four Heresies of Monetary Policy.” Defining Ideas, Hoover Institution (March 1).

———. 2019. The Fiscal Theory of the Price Level. Self-published.

Dudley, Bill. 2019. “Budget Deficits Still Matter.” Bloomberg (February 19).

Kelton, Stephanie. 2019. “Modern Monetary Theory Is Not a Recipe for Doom.” Bloomberg Opinion (February 21).

Krugman, Paul. 2019. “MMT, Again.” The Conscience of a Liberal Blog, New York Times(August 15).

Mackintosh, James. 2019. “What Modern Monetary Theory Gets Right and Wrong.” Streetwise, Wall Street Journal (April 2).

Okun, Arthur M. 1971. “The Personal Tax Surcharge and Consumer Demand, 1968–70.” Brookings Papers on Economic Activity, Brookings Institution, vol. 1:167–211.

Rogoff, Kenneth. 2019. “Modern Monetary Nonsense.” Project Syndicate (March 4).

Summers, Lawrence. 2019. “The Left’s Embrace of Modern Monetary Theory Is a Recipe for Disaster.” Washington Post (March 4).

For more information about:

Increases in government spending in the 1960s

Federal Reserve Bank of Cleveland. 1970. “Patterns of Federal Government Outlays and Revenues.” Economic Review (November):3–14.

Nixon-era: End of convertibility of US dollar to gold and wage/price controls

Ghizoni, Sandra Kollen. 2013. “Nixon Ends Convertibility of US Dollars to Gold and Announces Wage/Price Controls.” FederalReserveHistory.org (November 22).

Oil price shocks of 1973–74

Corbett, Michael. 2013. “Oil Shock of 1973–74.” FederalReserveHistory.org (November 22).

Carter-era: Wage and price controls

Farnsworth, Clyde H. 1978. “Carter Economic Message Asks Voluntary Price and Wage Brake.” New York Times (January 21).

Mid-1970s velocity of money

Economic Research, Federal Reserve Bank of St. Louis (FRED). Velocity of M2 Money Stock.

Phillips Curve

Federal Reserve Bank of San Francisco. 2008. “Dr. Econ, What Is the Relevance of the Phillips Curve to Modern Economies?” frbsf.org (March).

Taylor Rule

Bernanke, Ben S. 2015. “The Taylor Rule: A Benchmark for Monetary Policy?” Ben Bernanke Blog, Brookings.edu (April 28).

DSGE models

Fernández-Villaverde, Jesús. 2009. “The Econometrics of DSGE Models.” NBER Working Paper No. 14677, National Bureau of Economic Research (January).

Interest paid by Federal Reserve on commercial bank reserves

Fagan, Doreen. 2018. “Why the Fed Pays Interest on Banks’ Reserves.” Open Vault Blog, Federal Reserve Bank of St. Louis (April 11).

Open market operations

Board of Governors of the Federal Reserve System. “Credit and Liquidity Programs and the Balance Sheet.” FederalReserve.gov.

Functional Finance

Lerner, Abba. 1943. “Functional Finance.” Bradford Delong’s Grasping Reality. www.bradford-delong.com.