An industry-wide underallocation to inflation-fighting assets in TDFs leaves investors vulnerable to macroeconomic and market risks, including high-surprise-inflation conditions, bear markets, and volatile markets.

We urge investors to proactively put inflation-fighting assets in place when the need does not seem self-evident—not after the markets have already inflicted damage and the need for protection is obvious.

A diversified exposure across multiple inflation-fighting asset classes via a contrarian multi-asset approach can serve as powerful insurance for retirement portfolios.

We both recently moved and bought homeowners’ insurance, once again. Like most Americans,1 for our most valuable assets—our homes typically being the most valuable asset—we willingly pay for protection against a variety of natural disasters such as earthquakes, hurricanes, tornados, and floods.2 Even though the possibility that any of these individual risks materializes is remote, we don’t bat an eye when it comes to buying insurance coverage. As long as risks specific to our geographic location are fully covered by our yearly premium, we “sleep easy.”

Protecting our retirement assets should be no different. Inflationary waves, market downturns, and jolts in volatility are all legitimate threats that can shrink our retirement nest eggs, compromising the spending power of our eventual withdrawals. Unfortunately, traditional retirement portfolios offer minimal protection against these risks, even though the cost of insuring against them is cheap and the likelihood of their materializing is rising.

In this article, we delve into 1) why an industry-wide underallocation to real, or inflation-fighting, assets in target-date funds (TDFs) leaves investors vulnerable to macroeconomic and market risks that can undermine their financial security in retirement; 2) how adding real assets to retirement portfolios may lead to improved outcomes; and 3) the potential challenges investors face in gaining the protection they desire for their retirement portfolio

Composition of TDFs

Introduced in 1994, TDFs have been touted as a “one-stop” investment vehicle for retirement savings. They are intended to be a well-diversified, dynamic, multi-asset portfolio set-it-and-forget-it option that de-risks over time by increasing exposure to bonds at the expense of equities.3 Given that they automatically address asset allocation, rebalancing, and portfolio construction considerations relevant to specific age cohorts, TDFs have—not surprisingly—grown rapidly, especially over the last decade. Having assumed the role of default option for the majority of corporate sponsors of defined contribution plans, TDFs have accumulated over $1 trillion in assets as of year-end 2017 (Holt, 2018).

Are TDFs really the one-stop solution they claim to be, providing adequate diversification to protect our retirement assets over a variety of market and inflationary regimes? Or are we “sleeping easy” just before our basement, which is notcovered by our insurance policy, is flooded?

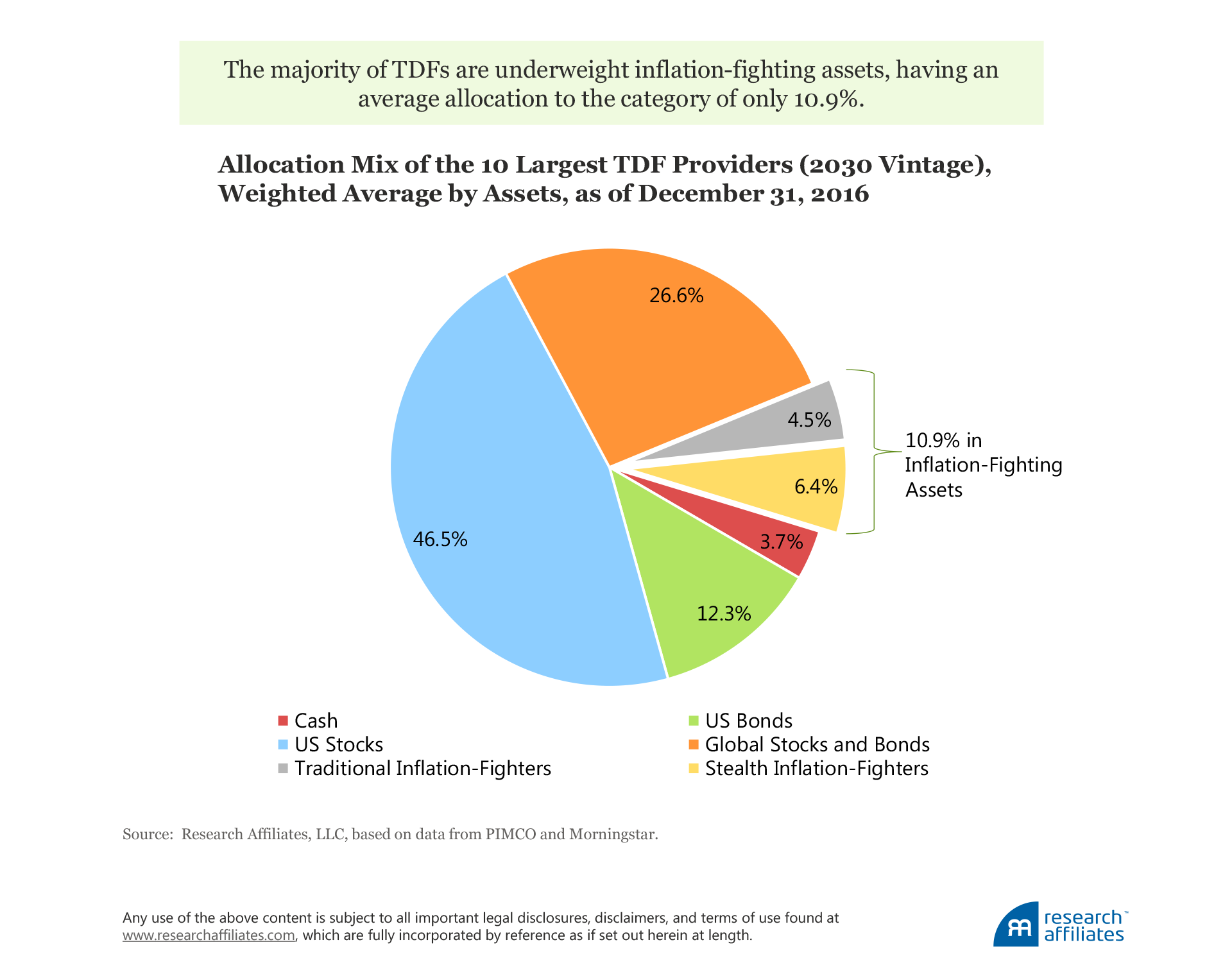

Let’s look under the hood of the 10 most dominant providers of mutual fund TDFs, which had combined assets of just over $820 billion of the total $880 billion, an all-time high, across all vintages as of December 31, 2016 (Holt, 2017).4 All of these portfolios hold considerable positions in US stocks and bonds. For instance, on an average asset-weighted basis, the 2030 TDF vintage across the 10 largest providers allocates 63% to US assets. Further, we conservatively estimate that over three-fourths of the exposure within the Global Stocks and Bonds category is actually developed-market stocks and bonds,5 which raises the total allocation to mainstream stocks and bonds to over 80%.6

But what about real assets? The average TDF exposure to real assets, those assets typically considered to offer direct protection against rising inflation, was only 4.5% at year-end 2016. These “traditional inflation fighters” include 1) Treasury Inflation Protected Securities (TIPS), whose prices adjust annually with the CPI inflation rate and are guaranteed by the US Treasury; 2) commodity futures, whose prices change to reflect changes in the cost of the respective underlying raw material; and 3) real estate investment trusts (REITs), whose prices change in line with changes in the rents earned by the real estate property the REIT owns.7

Asset classes other than real assets also provide inflation protection, even if they are not commonly viewed as inflation fighters. We at Research Affiliates refer to these asset classes as “stealth inflation fighters,” a category that includes high-yield bonds and bank loans, along with allocations away from the US dollar into emerging markets (EM) currencies, bonds, and equities. (After all, what is inflation, if it’s not US dollar debasement?) These asset classes have demonstrated positive correlation with US inflation, with many offering inflation protection superior to that provided by TIPS.8Across the 2030 TDF vintages offered by the 10 largest providers, these stealth inflation-fighters had an average allocation of 6.4% as of December 31, 2016. Adding this to the 4.5% allocation to real assets, the total allocation to inflation-fighting assets was only a modest 10.9%.

For investors getting closer to retirement, the average exposure to inflation-fighting assets only falls from these low allocations as they age. Consider (as of July 2018) the most popular target retirement fund built for investors who are retiring five years hence. These soon-to-be retirees have barely 4.0% in traditional inflation-fighting markets, and their exposure to high-yield bonds, EM bonds, and EM currencies is zilch. Their sole allocation to stealth inflation fighters is 3.5% to EM equities, which puts combinedinflation-fighting exposure at a measly 7.5%. We believe investors should, instead, be increasing portfolio diversification and raising inflation protection as retirement gets closer.

Underinsured for Market Risks

Target-date funds have such scant exposure to inflation-fighting asset classes today because investment experience tends to shape mindsets and behaviors, and for nearly four decades, investors’ experience has been shaped by a disinflationary environment. Since peaking in March 1980, US inflation levels have fallen from 14.6% to 2.8% through June 2018,9 resulting in a substantial tailwind to the returns of developed stocks and bonds.

Mainstream stocks and bonds thrive in disinflationary conditions. Bond prices tend to rise as fears fall that future inflation will erode the purchasing power of bonds’ fixed coupon payments. Over the disinflationary period 1980–2018, US aggregate bond yields fell from 14.1% to 3.1%, leading to annualized total returns of 7.8% over that span. Mainstream stocks also tend to experience return tailwinds through rising valuations in disinflationary regimes, because falling or low inflation reduces the rate that market participants use to discount future cash flows. For example, over the same roughly 37-year period, the US CAPE (cyclically adjusted price-to-earnings, or Shiller PE) ratio rose from 8.1x to 32.1x, soaring from the lowest 6th to the highest 97th percentile rank since 1871. As a result, annualized total returns to US stocks came in at an extremely elevated 11.9% over that period. Not only have these asset classes offered impressive historical returns, but they also complement each other well because bonds tend to outperform in disinflationary bear markets, whereas stocks naturally outperform during disinflationary bull markets.

Given the continuous disinflationary environment of the last nearly 40 years, combined with the common practice of using the past to forecast the future,10 the fact that the overwhelming majority of TDF assets is allocated to disinflationary-biased stocks and bonds is easy to understand. Recall that TDFs were launched within the last quarter-century, and disinflationary conditions have defined the collective experience of investors active during this time. In fact, some TDF providers are increasing their exposure to mainstream equities now, believing that doing so can improve their odds of funding the retirements of populations with increasing life expectancies.11

At the present time, it seems little attention is being paid to how TDF portfolios could suffer in inflationary conditions. Because expected inflation levels are typically baked into prices in the short term, we focus on how asset classes fare in inflation-surprise environments, or unanticipated moves in inflation levels relative to what was expected at the beginning of each quarter.12

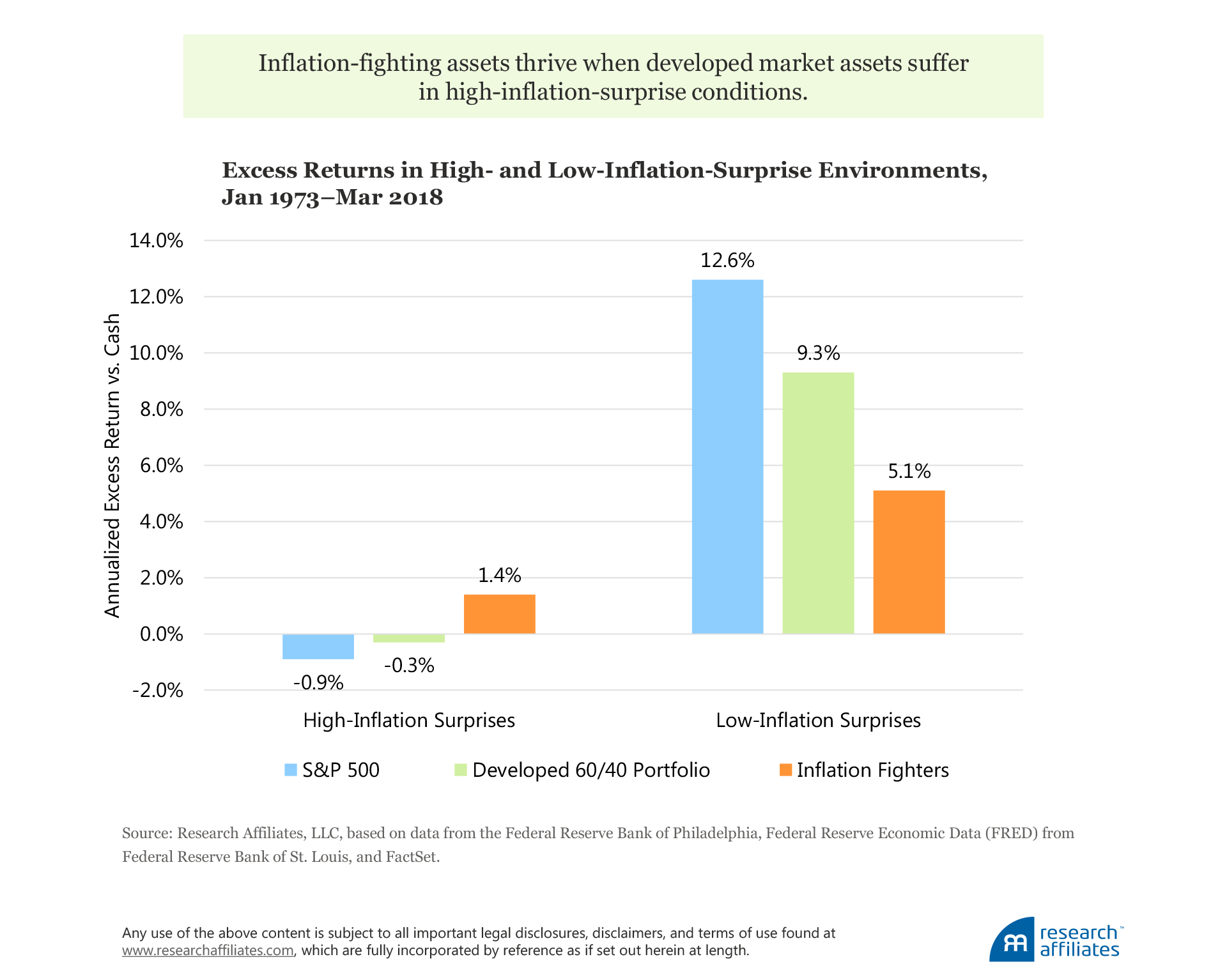

When inflation is lower than anticipated, developed-market stocks and bonds shine. For example, since 1973, in low-inflation-surprise environments, these assets delivered brilliant average annualized returns in excess of the cash return of 12.6% for US stocks and 9.3% for a developed 60/40 mix. An equally weighted basket of inflation-fighting assets13 lagged these conventional assets, but nevertheless delivered a reasonable positive average excess return of 5.1%.

When upward moves in inflation catch investors off guard, portfolios of conventional assets suffer. High-inflation shocks lead to losses in developed-market stocks and bonds, the asset classes that compose the vast majority of most retirement portfolios. In the high-inflation-surprise environments experienced since 1973, the average annualized excess return of US stocks was –0.9% and for a developed 60/40 portfolio was −0.3%. And whereas bonds are intended to provide diversification away from equity risk, they fail to do so in inflationary environments. Across these periods of positive inflation surprises since 1973, the average correlation levels between developed-market stocks and bonds rose two-fold to 33%. In other words, the complementary nature of stocks and bonds breaks down in environments when a portfolio complement is needed most! We find that the appropriate portfolio complement in inflation surprise environments is a basket of inflation-fighting assets, which earned positive annualized excess returns averaging 1.4% in such environments.

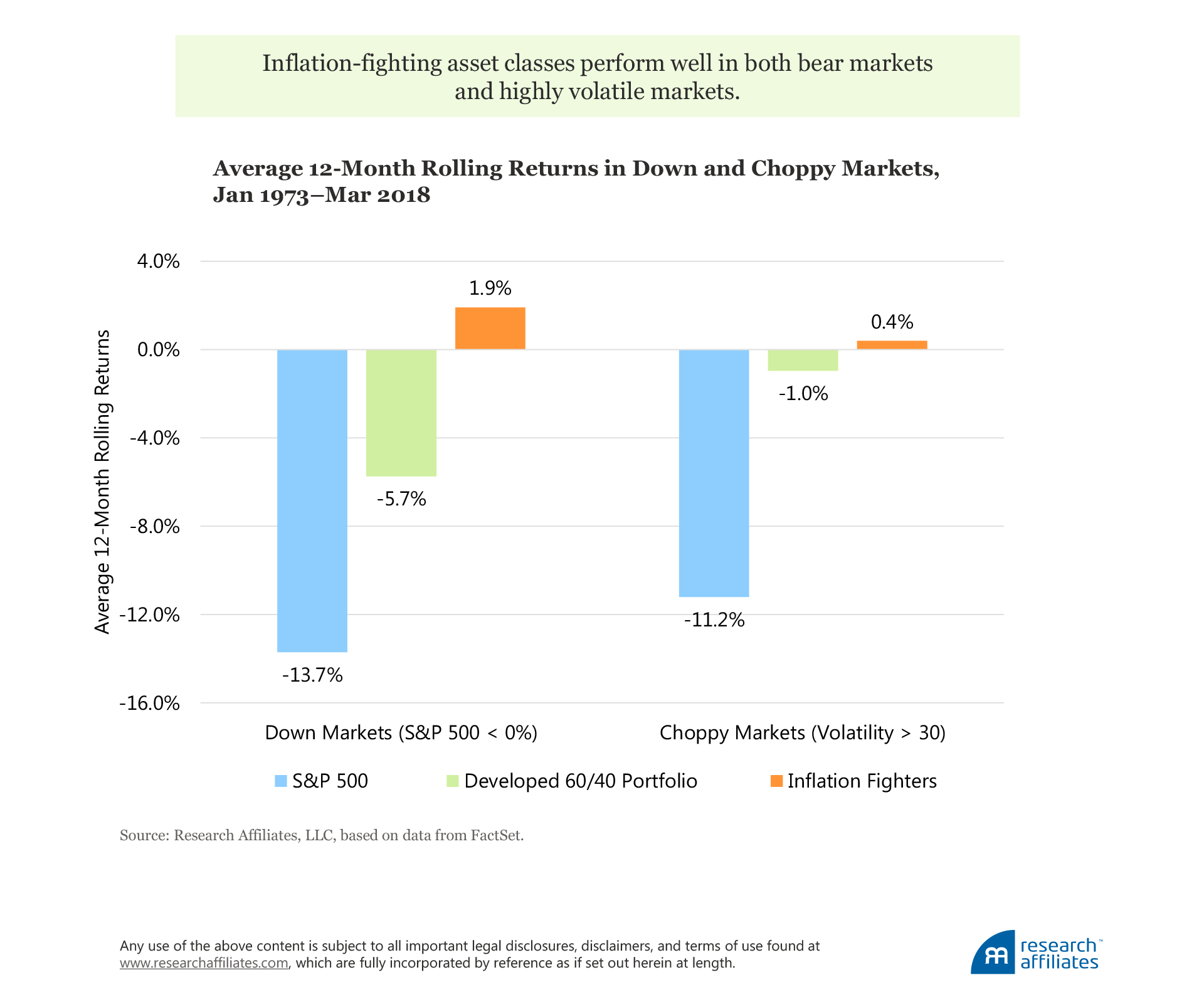

Inflation-fighting assets also provide powerful protection in other conditions of distress for developed-market stocks and bonds—both bear markets and volatile markets. Consider the times over the last 45 years when the S&P 500 Index delivered a negative 12-month rolling return. In these bear markets, mainstream assets gravely suffered, delivering an average rolling 12-month return of −13.7% for US stocks and −5.7% for a developed 60/40 portfolio. In stark contrast, under these same conditions, an equally weighted mix of real-return inflation-fighters provided significant downside protection, providing an average gain of 1.9%!

Similarly, in volatile environments, as characterized by an average rolling 12-month US stock volatility exceeding 30%,14 mainstream assets fared poorly. On average, US stocks tumbled by 11.2% and a global 60/40 portfolio fell by 1.0%. Inflation fighters, however, returned an average annual gain of 0.4% during such market turbulence.

When to Insure?

We all understand the need to buy insurance before we actually need it, but sometimes the cost is hard to swallow when no impending dangers are evident on the horizon. In extended environments of disinflation or prolonged periods of low volatility and positive movement in the equity market, some investors will continue to position their portfolios for a continuation of recent history. Such an approach is behaviorally understandable, but increasingly unlikely to pay off.

A “wait and see” mode, that is, seeking the catalyst to a regime shift before repositioning the portfolio for the new regime, is typically too little, too late. As is the case with most natural disasters, a change in economic or market regime rarely pre-announces its arrival. Thus, lacking the clairvoyance needed to accurately and consistently identify regime shifts in advance (as is the case for most of us), investors will likely be repositioning their portfolios after the catalyst. Such an approach is akin to buying insurance after our homes are damaged and premiums have spiked. It’s classic performance chasing.

Contrarians, on the other hand, patiently buy insurance before the regime shift and while insurance premiums are low. In other words, they proactively put real-return-producing assets in place when the need doesn’t seem self-evident—not after the markets have already inflicted damage and the need for protection is obvious.

Given that market and economic environments, which warrant some portfolio protection, happen more frequently than investors have been conditioned to accept, we believe inflation-fighting assets with their powerful diversification benefits merit substantially higher exposure within investors’ retirement portfolios. The current environment, in fact, may prove timely for investors to add portfolio protection, if for no other reason than a simple truism: current conditions will not persist indefinitely.

Consider the following:

- Since 1802, the average length in the United States of an equity market rally—maintaining a positive annual return over rolling monthly outcomes—is slightly over three-and-a-half years.15 At nine years and counting, today’s rally is only 18 months away from being the longest bull market of the past two centuries!

- The current period of persistently calm markets—characterized by an average rolling volatility less than 20%—has reached nine years, surpassing the six-year average span of historical quiet periods. This near-decade-long period of calm falls within the longest 83rd percentile rank of all tranquil outcomes since 1860.

- In the last five years, we have not experienced a singlequarter (that’s not a typo!) of a high-inflation-surprise environment, which has been the case one-third of the time over the last 45 years.

With current positive market conditions appearing excessively stretched, adding insurance now seems prudent before it’s too late and the regime shifts.16

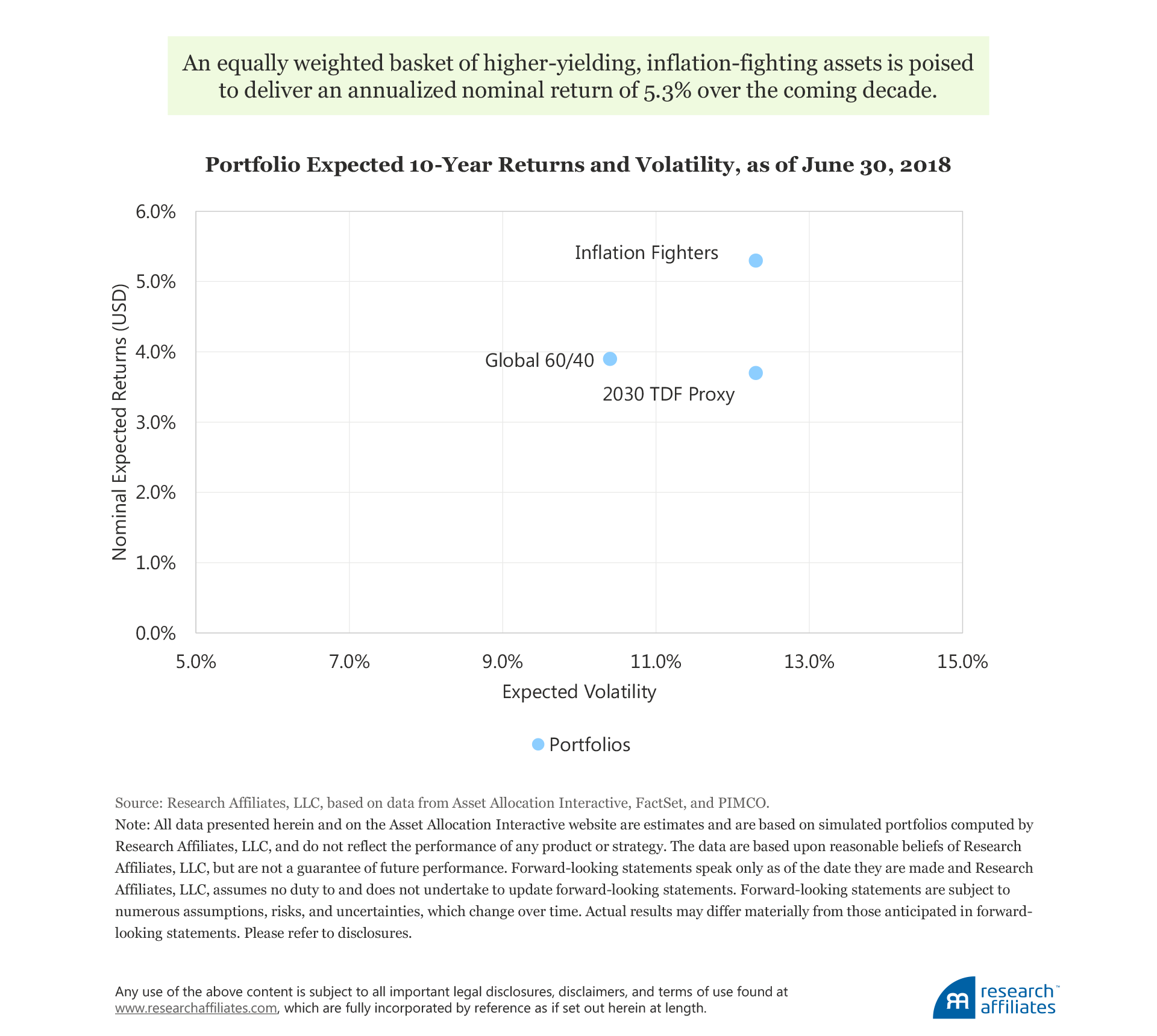

Additionally, we believe the long-term return prospects of inflation-fighting, real-return-producing assets are currently attractive relative to the investment opportunity set. Based on a building-block-return approach that focuses on expected yield, growth in yield, and future changes in asset and currency valuations, the Research Affiliates Asset Allocation Interactive (AAI) tool, which is available on our website, provides 10-year return estimates for asset classes and portfolios. Even after a rebound in many inflation-fighting markets since the 2013–2015 bear market, an equally weighted basket of these higher-yielding assets is poised to deliver an annualized nominal return of 5.3% over the coming decade.

In other words, the inflation-fighting asset classes today are real bargains—priced to deliver a prospective excess return of 1.4% a year compared to a global 60/40 portfolio and 1.6% a year versus a 2030 TDF proxy over the coming decade. For instance, if we were to start today with $100, 10 years from now we would expect our inflation-fighting basket to rise to $168, surpassing the end values of a 60/40 portfolio and a 2030 TDF proxy, $147 and $144, respectively. Simply increasing our exposure to inflation-fighting real assets is likely to deliver improved returns and diversification benefits beyond what mainstream-centric TDFs can offer.

Should our longer-term forecasts materialize or we experience unanticipated upside moves in inflation, renewed bouts of market volatility, and/or bear markets, then increasing exposure to inflation-fighting real assets now would clearly deliver enhanced return and diversification benefits to our otherwise mainstream-centric TDFs.

Selecting the Best Strategy for Protection

How we add inflation-fighting asset exposure to retirement portfolios is important in achieving the best possible outcome and the best possible portfolio protection. Consider, for example, the volatility characteristics of commodities and REITs. Since January 1973, the annualized standard deviation of their returns has been 16.9% and 17.6%, respectively. Assuming normally distributed returns, an investor who invests in REITs or commodities—as a stand-alone asset class—can expect to lose more than 25% once every 20 years!17 Such painful experiences encourage many investors to succumb to the natural tendency of exiting these regret-maximizing positions precisely when their forward return potential is highest. Study after study (e.g., Kinnel 2005, 2014, 2015, 2016; Hsu, Myers, and Whitby, 2016; and Arnott, Kalesnik, and Wu, 2017) has confirmed that investors consistently buy recently winning exposures while selling recent losers, thereby locking in losses and ensuring lower forward-return prospects. Given these behavioral consistencies, adding stand-alone exposure to these asset classes would almost certainly lead to disappointing results.

TIPS may seem a superior option given their lower annualized volatility levels of 9.4% since inception in March 1997, but their current yield of 0.7% is grossly below the 3–4% yield levels the JPMorgan TIPS 1-10 Year Index offered before March 2002. In today’s environment, TIPS’ low long-term nominal expected returns of approximately 3.0% pale in comparison to other inflation-fighting markets, which are offering both higher return prospects and superior inflation-hedging characteristics at this stage in the cycle.

Research suggests that broad exposure across several inflation-fighting asset classes via a contrarian multi-asset approach can mitigate the line-item risk of investing in a single inflation-protection asset class. The benefits of diversification are well established (e.g., French and Poterba, 1991; Binstock, Kose, and Mazzoleni, 2017; and Viciera, Wang, and Zhou, 2017), and investors exploiting this “free lunch” and the “buy high, sell low” tendency of their peers through their inflation-protection solution can benefit from consistently higher returns at more tolerable levels of volatility. Such an approach can serve as powerful insurance for retirement portfolios, protecting future retirees in the very conditions that render mainstream assets vulnerable—namely, inflation surprises, market turbulence, and/or bear markets.

Is Opportunity Knocking Now?

The best time to protect our retirement portfolios is when the insurance against the looming possibilities of inflationary waves, market downturns, or volatility jolts is cheap. Now seems an opportune time to increase our retirement portfolios’ protection against damage from unforeseen, but not entirely unexpected, turbulence in financial conditions.

Endnotes

1. The Insurance Information Institute’s (III) Opinion Research Corporation International poll estimates that 95% of homeowners in the United States have homeowners’ insurance. More information on how the III arrived at the 95% figure is available here.

2. We attribute this metaphor to Irwin (2018).

3. Arnott (2012) provides more information about the potential flaws of this standard de-risking approach.

4. According to the Morningstar report by Holt (2017), these fund companies and their TDF assets as of year-end 2016 include Vanguard ($280 billion), Fidelity Investments ($193 billion), T. Rowe Price ($148 billion), American Funds ($54 billion), JPMorgan ($45 billion), TIAA-CREF Asset Management ($31 billion), Principal Funds ($26 billion), American Century Investments ($17 billion), John Hancock ($16 billion), and BlackRock ($12 billion).

5. Based on a holdings analysis in FactSet as of May 31, 2018, 91% of the iShares MSCI ACWI Index is in developed equities (54% in US equities and 37% in developed ex US equities).

6. This observation is not unique to the 2030 vintage. Across all vintages, TDFs are heavily allocated to developed-market stock and bond markets, exhibiting a large home-country bias.

7. The pass-through of rents is not 100% as some slippage from maintenance costs and so forth occurs.

8. From March 1997 to March 2018, the quarterly correlations of returns to US inflation were 50% for bank loans, 31% for EM currency, 28% for high-yield bonds, and 21% for EM equities. These levels exceed or are comparable to the correlation of US TIPS return to inflation, which is measured at 22% over the same span.

9. Inflation is measured as the 12-month percentage change in the US CPI City Average Seasonally-Adjusted Index, as provided by the US Bureau of Labor Statistics (BLS).

10. West and Ko (2017), the first of eight articles in a series by Research Affiliates focused on the needs of financial advisors, provides more details about the impact of using historical returns to forecast the future.

11. Pollock (2018) provides more information on some TDFs’ boosts in stock exposure.

12. Consistent with the analysis by Johnson (2012), inflation surprises reflect the difference between actual inflation at the end of the quarter and expectations for inflation at the start of the quarter, so that a “high (low) inflation surprise” is a quarter that falls in the top (bottom) third of all historical inflation surprises from June 1973 through March 2018.

13. This basket is an equally weighted mix of traditional and stealth inflation-fighting asset classes, which are added into the mix in the first month the returns are available. The asset classes, representative indices, and dates of available data are as follows: 1) High-yield bonds, IA Barclays US HY Corporate Bond Index (Jan 1973–Dec 1992) and BofA ML US High Yield, BB-B Rated, Constrained Index (Jan 1993 onward); 2) Commodities, S&P GSCI TR Index (Jan 1973–Dec 1990) and DJ UBS Commodity TR USD Index (Jan 1991 onward); 3) REITs, FTSE REIT All REITs TR Index (Jan 1973); 4) Bank loans, CSFB Leveraged Loan Index (Jan 1992); 5) EM equities, MSCI EM GR USD TR Index (Jan 1988); 6) EM currencies/local bonds, JPM ELMI Index (Jan 1994–Dec 1993) and JPM GBI EM Global Diversified TR USD (Jan 1994 onward); and 7) US TIPS, Barclays US Treasury US TIPS TR USD Index (Mar 1997–Jun 1998) and Barclays Capital US Treasury Inflation Notes: 10+ Year Index (Jul 1998 onward).

14. We acknowledge that rolling 12-month volatility exceeding 30% is extreme. Since 1973, such bouts of severe turbulence occurred slightly less than 5% of the time, notably in April–May 1975, October 1987–September 1988, and March–September 2009. When we relax the threshold and use 12-month volatility of 20%, we find that highly volatile markets occurred 15% of the time from January 1973 to March 2018. Over this period, the average 12-month rolling return is 1.5% for the S&P 500, 3.2% for a developed 60/40 portfolio, and 4.3% for the inflation-fighting basket. Therefore, at the 12% level, inflation-fighters typically outperformed conventional assets, although the latter did deliver positive, albeit average returns. In the section “When to Insure?” we use the 12% threshold to characterize calm versus volatile markets.

15. This calculation is based on rolling 12-month returns of the US stock market from 1802 through March 2018. The duration of a market rally is the total number of consecutive positive rolling return periods without a gap exceeding two rolling periods. For example, the length of the latest rally is 9.25 years or 99 12-month rolling outcomes (99+12)/12. Within this span, the longest time during which the rolling 12-month return was consecutively negative was two periods (the 12-month periods ending January 2016 and February 2016); that is, the largest gap is two, and therefore this period is captured within the latest rally episode. The sources of data used to compute the US stock market are Ibbotson/Morningstar, Robert Schiller’s Online Data, and William Schwert’s Indexes of US Stock Prices.

16. Aside from these excessively stretched conditions, we believe reversal risks are skewed to the upside for other reasons. First, the United States is emerging from a period of highly irregular monetary policy, which was designed to bring about market and macroeconomic stability and keep interest rates low (i.e., bond prices high). With the removal of such accommodative policy, market and macroeconomic volatility should naturally rise as the Fed “put” is stricken further out of the money. Second, the US Federal Reserve’s Federal Open Market Committee’s dual mandate of full employment and price stability skews inflation risks to the upside. From 2012 to mid-2018, the Fed’s preferred measure of inflation—the Personal Consumption Expenditures (PCE) inflation rate—has fallen below its long-term 2% target nearly 95% of the time (73 of 77 months). In light of this persistent undershooting and the recent emphasis on this target’s symmetrical nature, the Fed will likely tolerate modest overshooting of the PCE inflation rate even after having met the 2.0% PCE objective in June 2018. Third, the Fed isn’t the only entity seeking higher inflation. Because fiscal austerity measures are unpopular, governments are also incentivized to create higher inflation in an effort to reduce the real value of their debt burdens. In the United States, late-cycle fiscal stimulus and trade tariffs only increase inflationary upside along with growing debt and deficits. Finally, decomposing the components of the core inflation basket also points to a continued upside for inflation. US dollar depreciation in recent years may result in flattening (instead of falling) import prices, causing the core goods component of inflation to be less of a drag on realized inflation moving forward. On the core services front, a negative unemployment gap indicates higher upside potential to services prices as wage pressures loom amid an economy with an unemployment rate that, since early 2017, has fallen below NAIRU (the non-accelerating inflation rate of unemployment).

17. Shepherd (2017) provides more information on the volatility characteristics of commodities and REITs.

References

Arnott, Robert. 2012. “The Glidepath Illusion.” Research Affiliates Fundamentals (September).

Arnott, Robert, Vitali Kalesnik, and Lillian Wu. 2017. “The Folly of Hiring Winners and Firing Losers.” Research Affiliates Publications (September).

Binstock, Jay, Engin Kose, and Michele Mazzoleni. 2017. “Diversification Strikes Again: Evidence from Global Equity Factors.” Research Affiliates Publications (October).

French, Kenneth, and James Poterba. 1991. “Investor Diversification and International Equity Markets.” American Economic Review, vol. 81, no. 2 (May):222–226.

Holt, Jeff. 2017. “2017 Target-Date Fund Landscape: Answers to Frequently Asked Questions.” Morningstar Manager Research (April 20).

———. 2018. “2018 Target-Date Fund Landscape: Sizing Up the Trillion-Dollar, Increasingly Passive Giant.” Morningstar Manager Research (May 7).

Hsu, Jason, Brett Myers, and Ryan Whitby. 2016. “Timing Poorly: A Guide to Generating Poor Returns While Investing in Successful Strategies.” Journal of Portfolio Management, vol. 42, no. 2 (Winter):90–98.

Irwin, Neil. 2018. “Why Markets Have Gotten So Jumpy.” The New York Times (February 23).

Johnson, Nicholas. 2012. “Inflation Regime Shifts: Implications for Asset Allocation.” PIMCO In Depth(October).

Kinnel, Russel. 2005. “Mind the Gap: How Good Funds Can Yield Bad Results.” Morningstar FundInvestor.

———. 2014. “Mind the Gap 2014.” MorningstarAdvisor (February 27).

———. 2015. “Mind the Gap 2015.” MorningstarAdvisor(August 11).

———. 2016. “Mind the Gap 2016.” MorningstarAdvisor (June 14).

Pollock, Michael. 2018. “Target-Date Funds Adjust for a Stock Pullback.” The Wall Street Journal (February 4).

Shepherd, Shane. 2017. “Risk: Preparing Clients for an Uncertain Journey.” Research Affiliates Publications (October).

Viciera, Luis, Zixuan Wang, and John Zhou. 2017. “Global Portfolio Diversification for Long-Horizon Investors.” Harvard Business School Finance Working Paper No. 17−085.

West, John, and Amie Ko. 2017. “The Most Dangerous (and Ubiquitous) Shortcut in Financial Planning.” Research Affiliates Publications (September).