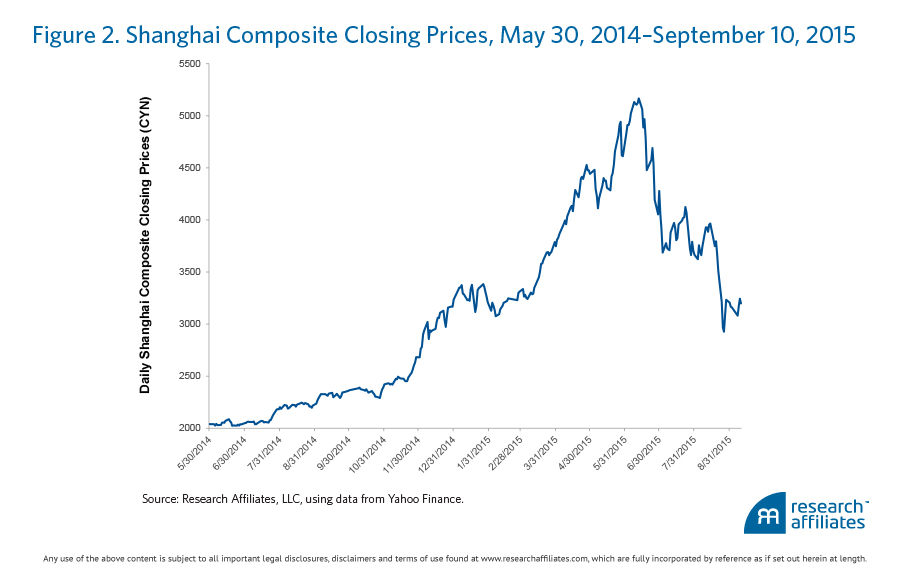

The Chinese stock market rallied more than 150% as the Shanghai Composite Index rose from 2,037 at the end of June 2014 to its peak of 5,166 in June 2015. Many market commentators, most notably Bill Gross, called it a “stock market bubble” and predicted a collapse. However, it bears asking, “What is a stock market bubble and how is it different from just a run-of-the-mill bull market?”

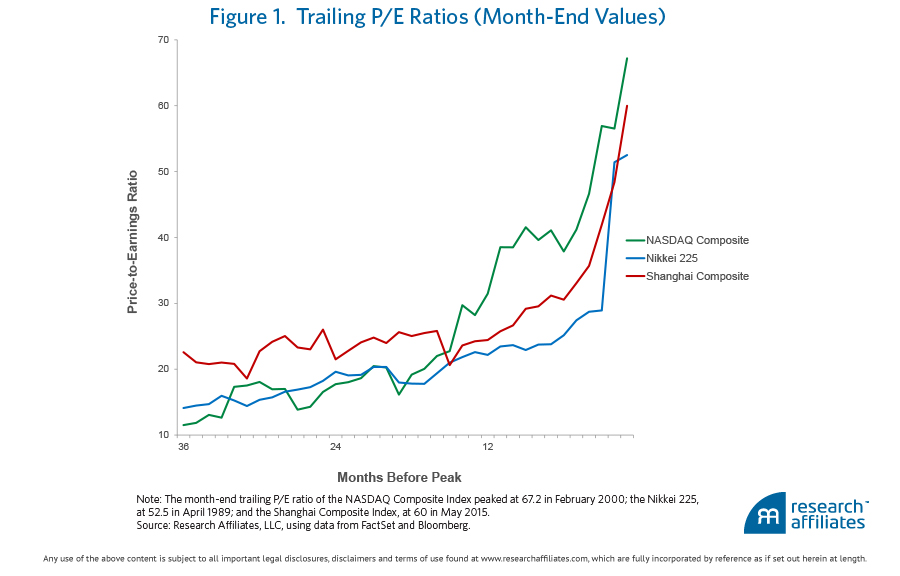

Simply stated, a bubble is an irrational bull market, where prices for stocks have run up much more than can be justified by improvements in the underlying corporate fundamentals. Classic stock market bubbles were the Japanese bubble during the late 1980s and the U.S. tech bubble that occurred in the 1990s (see Figure 1). A characteristic attribute of a bubble is an unjustifiably high price-to-earnings multiple (P/E) for the market.

For the average investor, a bubble market isn’t bad in the short run. Investors are wealthier than they were a year ago and better off than their colleagues who did not invest in the stock market. The problem is that bubbles eventually burst. After the boom, the bust is psychologically painful to an investor who rode the Chinese A-shares market from 2,000 to 5,200 and then back down to 3,000 (see Figure 2).

Nonetheless, even after a 40% decline (as of this writing), this hypothetical buy-and-hold investor earned a 50% return in 12 months. The naïve investors who were lured into the market near the peak suffered real pain in the form of large financial losses. In fact, many investors who bought stocks on margin have seen their portfolios wiped out because of the leverage. As we have shown elsewhere, the average retail investor’s portfolio return is substantially below the buy-and-hold return on the market index (Hsu and Viswanathan, 2015). This return gap is especially large during bubbles and crashes.

It is often joked that a bubble market is where naïve investors feel like financial geniuses.1 That illusion inevitably destroys wealth. Hsu, Myers, and Whitby (2015) show that the less sophisticated an investor is, the larger his return gap over time. The enormous return gap that emerges for average retail investors is one of the most undesirable aspects of a stock market bubble.

Winners and Losers

For every transaction there is a buyer and a seller. As the A-shares market rose, trading volume also stepped up meaningfully. Investors might have recognized the rapidly expanding amount of margin debt in the system as a sign of rampant speculation and prudently reduced their positions. No doubt, many sophisticated investors—local hedge fund managers and traders at large financial institutions— took profits as the market became more expensive and increasingly speculative. It is also common knowledge that company insiders aggressively issued new shares and unloaded their personal stakes to take advantage of what they perceived to be irrationally high prices for their stock.

Many of the buyers opposite these profit-taking sellers were naïve investors who did not properly evaluate company fundamentals or assess the investment risk of buying equity shares at three-digit P/E’s. Is it a failure of the stock market when investors who choose not to properly assess company fundamentals and investment risks are penalized or even eliminated from participation?

Quite the contrary, a well-functioning market should chasten those who compete poorly and reward those who compete well. However, the brutal efficiency of transferring wealth from retail investors into the pockets of hedge funds and iBank proprietary desks is inconsistent with the values of many policymakers who favor economic equality. It bears mention that bubbles can also catch hedge funds, proprietary trading desks, and insiders unawares, too; it’s not just the little guy who gets crushed by the aftermath of a bubble. Nonetheless, I suggest that the Chinese bubble is not primarily an economic crisis. It is better understood as a social crisis occasioned by a massive wealth redistribution that disfavors average investors.

There are always winners and losers in the stock market. Can we truly feel sorry for the losers, even if they are retail investors who can ill afford losses? After all, people enter the market voluntarily. What damage do we do if we seek to over-protect adults who make mistakes? As an old Chinese saying goes, “You lay down the bet, you live with the consequences.”

Yet there are valid reasons to be concerned about retail participation in the equity market. Naïve speculation in the stock market has features in common with smoking and pathological gambling. Smokers face horrible illness and early death; compulsive gamblers face ruination. Similarly, stock trading leaves most retail investors worse off than they would be if they simply held index funds (Barber and Odean, 2000). Moreover, smoking and addictive gambling have negative externalities. Smoking produces harmful second-hand smoke and contributes heavily to the cost of health care, while pathological gambling breaks families apart and fosters crime. Likewise, naïve speculators’ active trading has negative externalities: By adding noise to the price discovery process, it can actually decrease market efficiency, and damage the real economy in the process.

Most societies try to discourage people from smoking at all and gambling too much. I think there are strong reasons for policymakers, investment industry associations, and finance educators to dissuade individuals from engaging in uninformed speculation. The issue isn’t just that retail investors tend to be long-term losers in the stock market. They also hurt the quality of the market and thus injure the real economy over time.

When Markets Fail

The stock market isn’t meant to be a casino. Its primary purpose is to help high-quality businesses raise capital at a reasonable cost to develop and provide innovative services and products. In an efficient stock market, sound businesses and talented entrepreneurs attract capital and thrive. Companies that are ill-conceived and/or mismanaged do not attract capital at a viable cost and are eliminated.

However, in a bubble market, shady firms and incompetent or dishonest entrepreneurs can also raise ample amounts of capital on favorable terms. In the recent A-shares bubble, stories abound where retail investors paid 400 times earnings for firms with no actual assets or sales. This creates a perverse incentive to business owners. Why work so hard to build a long-term enterprise? It is much easier to sell a pie-in-the-sky dream to investors and profit from their optimism and trust by unloading personal shares at ridiculously high prices. An irrational stock market could actually convert talented business operators into scheming stock price manipulators looking for quick personal profits.2

In a very inefficient stock market dominated by retail trading, taking advantage of credulous investors becomes a powerful profit engine for owners of listed firms and traders at hedge funds and other financial institutions. This turns the stock market mostly into a wealth transfer mechanism with little positive benefit to the real economy.

Should Naïve Investors Be Disqualified?

Retail investors achieve better investment results buying professionally managed funds than speculating in individual stocks (Barber and Odean, 2013). There is also evidence that the overall quality of the market improves when the ratio of professional investors to retail investors rises. Akbas et al. (2015) show that, in aggregate, mutual fund flows exacerbate cross-sectional mispricing, presumably because mutual funds disproportionately purchase stocks that are already overvalued. Hedge fund flows, however, act as arbitrage capital that corrects cross-sectional mispricing. Their findings suggest that increasing the share of institutional investment would tend to make markets more efficient. There are indeed grounds for arguing that retail trading should be curbed.

Of course, prohibiting retail investors from directly speculating in the stock market is not feasible. However, governments might improve the professional-to-retail investor ratio by encouraging more institutional participation. In the case of China, that means affording pension funds greater participation in the equity market and raising the Qualified Foreign Institutional Investor quota.

It has long been an unstated fear in Asian countries—notably China—that savvy foreign investors trading for short-term profits would wreak havoc on the domestic equity market. For example, an external high frequency trader could trigger a flash crash in the Chinese stock market. The more likely outcome, however, is that global pension funds would provide long-term institutional capital to the Chinese market on the basis of disciplined valuations. The benefits are potentially enormous: A more efficient stock market would nourish good companies and reduce the profitability from fleecing retail investors.

To Intervene or Not?

Should the government intervene in response to a bubble or not? The answer is not black and white. Government intervention was widely adopted in the developed countries during the global financial crisis of 2008 and the European sovereign debt crisis of 2010. Enthusiasts for a muscular government role claim that governmental actions may have headed off a global systemic breakdown in market and macroeconomic function; others argue that interventions did far more harm than good. Both are untestable hypotheses.

What is a systemic crisis? It is a liquidity crunch that erupts and spreads when very large negative shocks hit the economic grid, throwing normally well-functioning enterprises into distress. In the event of a systemic crisis, governmental intervention chiefly aims to buffer these “good” firms from the full brunt of the shock with loans and direct equity investments. Oftentimes these short-term liquidity provisions result in very positive investment gains for the government and, indirectly, the taxpayers. Viewed from this perspective, successful intervention can thus be seen as a wise investment at a time of low prices and high prospective returns.

The problem is that the government may, and often does, intervene ineffectively or even harmfully. For example, due to inexperience or regulatory capture, the government might misidentify the firms to support. If the government regularly provides financing to bad firms in crisis situations, the intervention would be counterproductive. The investment would likely be lost, resulting in nothing more than a transfer of wealth from taxpayers to politically well-connected business owners. Another unintended consequence is that Schumpeter’s “creative destruction,” clearing bad businesses from the world stage, is blocked.

It is not uncommon for Asian governments to mobilize state-controlled capital pools to intervene in the stock market by buying equity shares. The goal is usually to prevent a crisis in investor confidence which could lead to a panicky sell-off with worse effects than the irrational run-up. In a precipitous price decline, good firms with great investment opportunities could fail due to insufficient capital. This problem can be particularly severe with banks and insurance companies whose assets often include stock shares.

But direct intervention in the stock market rarely accomplishes its goals. First, the government cannot assess fair value. No government can know if the market has actually entered an irrational sell-off in which good firms trade at unreasonably low prices and cannot raise capital at a fair cost. The government may fail to recognize that the market decline actually reflects a return to rational pricing and a fair cost of capital.

Second, the government often justifies a direct stock market intervention in the name of helping retail investors who have lost money in the crash. This motive, if true,3 communicates a policy that unintentionally supports overpricing by removing the economic penalty for poor judgment. Ironically, price support programs launched under this pretext would actually erode market confidence on the part of institutional investors, both foreign and domestic. Bans on selling are even more pernicious: If I might be prevented from selling, why should I buy in the first place? In the long run, regular intervention discourages institutions, including the much-sought foreign pension funds, from investing in the stock market because it reduces the quality of the market and increases regulatory risk, such as arbitrary market closures or pressures to limit selling.

Waving the Flag

Most global pension funds and other state-controlled pools of capital invest heavily in their domestic stock market. This is true, although to a lesser extent, for the Chinese market. After a meaningful price collapse, it is completely reasonable for a government fund to invest in quality companies that have become cheap. This, of course, presumes that the pools of capital are managed by experienced professionals who invest solely with the objective of earning high returns under acceptable risks. Insofar as the government buying activity suggests favorable investment opportunities, this activity can additionally provide a signaling benefit.

But economists have long cautioned against making “signaling to the market” the primary objective. Attempts to fool the market generally fail and sometimes backfire. Chinese A-shares had an aggregate market capitalization of USD12.5 trillion when the Shanghai Composite reached 5,200. The nearly 40% decline from that peak represented a loss of USD5 trillion. Additionally, each day roughly USD150 billion of stock shares were sold and bought. A few tens of billions of dollars in government buying is simply unlikely to move market prices in a meaningful and lasting way.

Ultimately, investors will form an opinion regarding the government’s competence in stock market intervention. Market participants will either come to believe that the government is a savvy investor that steps in to buy equity shares when prices are cheap, or they will conclude that the government is a bad investor, too quick to jump in after the initial decline—when prices are still expensive—in an attempt to appease retail investors. If the former, investors will tend to synchronize with government buying, and if the latter, government buying may accelerate liquidation from institutional investors.

In Closing

Stock markets, even the most efficient and well-functioning ones, are volatile, producing daily short-term winners and losers. This noisy short-term fluctuation can often distract from the important long-term function of the equity market, helping good businesses and good entrepreneurs acquire capital to provide better products and services. Bubbles or irrational bull markets are an indication that the equity market is failing at its job—bad businesses and perhaps bad people are being funded instead.

The more the market is dominated by the irrational exuberance of naïve speculators, the more and the longer prices will deviate from rational valuations. The consequences of a low-quality equity market are severe; that’s why some economists have endorsed regulation and even intervention. However, regulation and intervention can only work when policymakers are at least as adept and knowledgeable as market participants, including investment professionals, and when regulators are not in thrall to the industry and populist pressures.

Endnotes

- It’s a joke with a point. Beyond the cognitive bias of overconfidence, to which even experts are prone, the illusion of superior skill reveals among less accomplished individuals a fundamental inability to appraise their own performance. Kruger and Dunning (1999, p. 1132) find that “those with limited knowledge in a domain suffer a dual burden: Not only do they reach mistaken conclusions and make regrettable errors, but their incompetence robs them of the ability to realize it.”

- In addition to tempting people who considered themselves honorable to cut corners, manic markets entice outright criminals to take advantage of trusting investors. In his classic history of the 1929 crash, John Kenneth Galbraith (1997, p. 133) observed that the “bezzle”—his name for the “inventory of undiscovered embezzlement”—varies with the business cycle: as-yet undetected fraud increases in good times and shrinks as swindles come to light in depressions. “In the late twenties,” he wrote, “the bezzle grew apace.”

- Peter Schuck argues that governmental initiatives fail because of internalities that are symptomatic of disharmony between a program’s publicly stated goals and the private goals of its administrators. Levy and Peart (2015) discuss Schuck’s insights from their perspective as economists.

References

Akbas, Ferhat, Will J. Armstrong, Sorin Sorescu, and Avanidhar Subrahmanyam. 2015. “Smart Money, Dumb Money, and Capital Market Anomalies.” Journal of Financial Economics (forthcoming).

Barber, Brad M., and Terrance Odean. 2000. “Trading Is Hazardous to Your Wealth: The Common Stock Investment Performance of Individual Investors.” Journal of Finance, vol. 55, no. 2 (April):773-806.

———. 2013. “The Behavior of Individual Investors.” In Handbook of the Economics of Finance, vol. 2, part B, chapter 22, ed. by George M. Constantinides, Milton Harris, and Rene M. Stulz. Amsterdam: Elsevier: 1533–1570.

Galbraith, John Kenneth. 1997. The Great Crash 1929. London: Penguin Books.

Hsu, Jason, and Vivek Viswanathan. 2015. “Woe Betide the Value Investor.” Research Affiliates Fundamentals (February).

Hsu, Jason, Brett W. Myers, and Ryan J. Whitby. 2016. “Timing Poorly: A Guide to Generating Poor Returns While Investing in Successful Strategies,” Journal of Portfolio Management, vol. 42, no. 2 (winter):90–98.

Kruger, Justin, and David Dunning. 1999. “Unskilled and Unaware of It: How Difficulties in Recognizing One’s Own Incompetence Lead to Inflated Self-Assessments.” Journal of Personality and Social Psychology, vol. 77, no. 6 (December):1121–1134.

Levy, David M., and Sandra J. Peart. 2015. “Learning from Failure: A Review of Peter Schuck’s ‘Why Government Fails So Often: And How It Can Do Better.’” Journal of Economic Literature, vol. 53, no. 3 (September):667–674.