Ask anyone—anyone at all—and you will get the same answer. Whether it’s an offhand remark in the elevator or a solemn pronouncement in the board room, the message comes from all sides: Interest rates will shoot up.

Granted, they all say, we’ve had false alarms before. The consensus was that interest rates would rise in 2010. Then for sure in 2011, and again in 2012, 2013, and 2014. The markets paid no attention. But Janet Yellen finally appears to have lost her patience. Following last month’s meeting, many observers perceived a subtle shift in Fed-speak1 that seemed to imply that, at the June conclave, the Federal Open Market Committee (FOMC) will nudge nominal interest rates up from the Zero Lower Bound.

But wait. Before we get ahead of ourselves, why have rates remained so low for so long?

As the Fed attempted to balance its two mandates—control inflation and maintain full employment—the slow-growth economy coming out of the Global Financial Crisis resulted in a new paradigm. The U.S. economy has registered stubbornly high unemployment and persistently low readings in the Fed’s preferred measure of inflation, the Personal Consumption Expenditures Price Index. An extended period of low rates appeared to be just the fuel our economy needed to stoke the engine of growth and put more people to work.

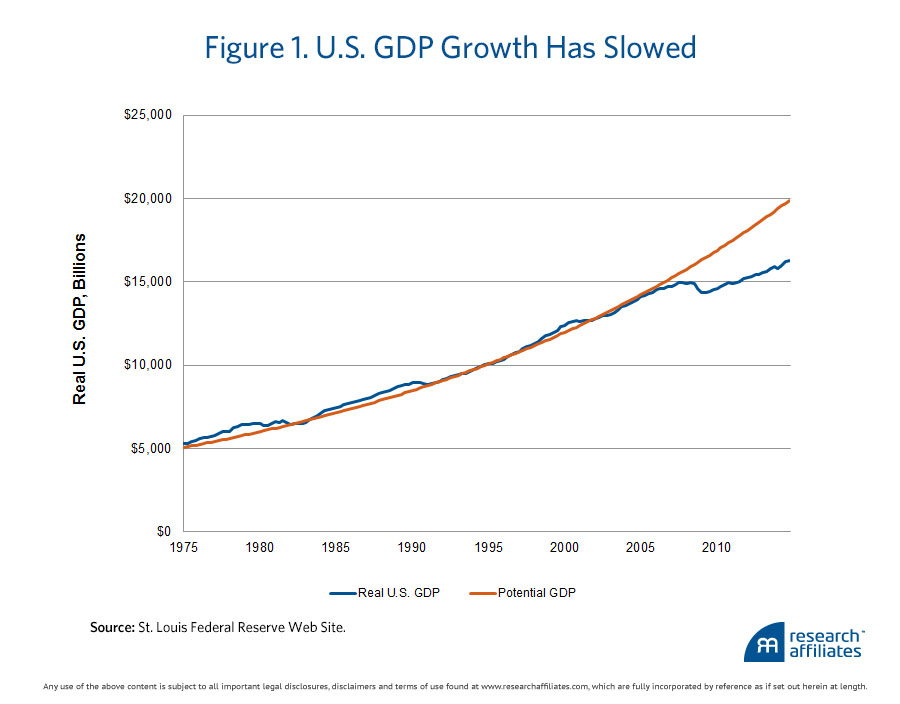

Or was it? A closer look at the numbers suggests this policy may not have been as effective as anticipated. Our GDP growth remains well below par. The output gap (the difference between actual and potential GDP)2 stands at 16% and shows no sign of disappearing anytime soon (see Figure 1). Rather than emerging from the 2009 recession with a period of rapid GDP expansion to make up for lost production, we have slogged through a time of slower-than-average economic growth. GDP has merely grown at an annual rate of 2.2% since 2009, and it is not accelerating; in 2014 the growth rate reached only 2.4%.

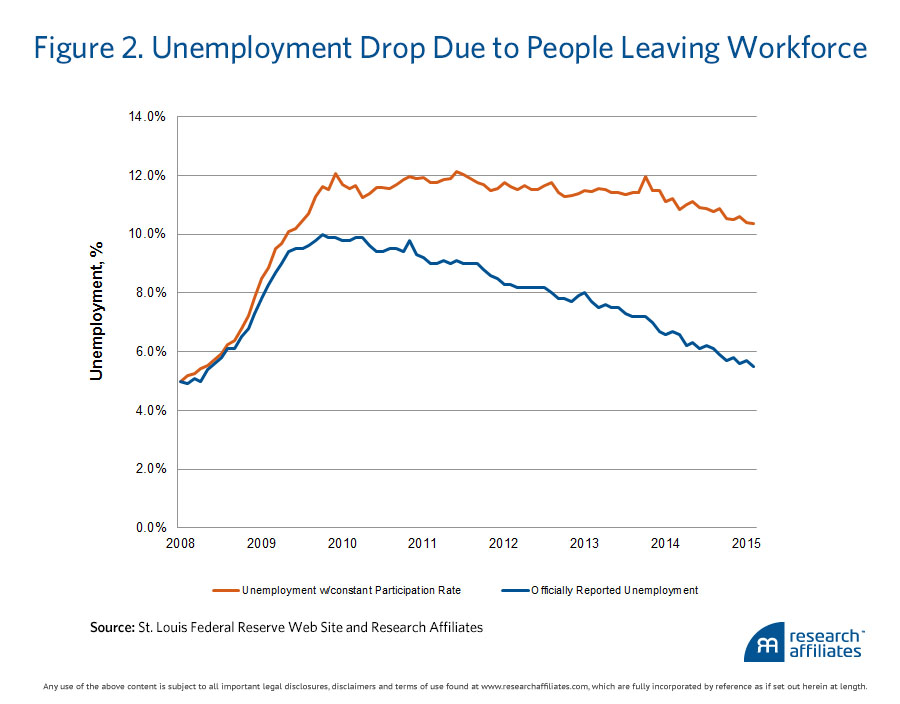

What about unemployment? The official numbers show the U.S. Civilian Unemployment Rate declining from a reported high of 10.0% in 2009 to a comfy 5.5% (the number we used to call “full employment”) as of February 2015.3 But dig deeper. That number masks the fact that the labor participation rate has declined from 66.2% in 2008 to 62.8% now.4 In fact, as Figure 2 shows, most of the drop in the unemployment rate can be attributed to people leaving the workforce rather than job creation. A huge “shadow inventory” of unemployed workers hangs over the labor market, unrecognized in the official numbers.5 An improving economy could encourage many non-participants to return to job-seeking status. If the labor participation ratio were to return to its 2008 level, today’s unemployment rate would sit at 10.4%! This shadow inventory helps explain the tepid wage growth we have seen even as the job market becomes tighter, and it will likely continue to keep a lid on wage growth going forward.

Fed officials, of course, are well aware of this issue6 and choose to believe that the declining trend will continue rather than reverse. Certainly some of the drop in the participation rate can be attributed to shifting workforce demographics, and it may be unrealistic to project a return to 66%. Nonetheless, it seems peculiar to disregard the fact that the participation rate held steady at 66%—only a percentage point below its all-time peak—from 2003 through 2008, and started falling only in response to the 2009 recession. Surely a combination of long-term demographic trends and cyclical pressures must be at work.

Perhaps Fed officials are right to continue to revise their goals for the unemployment rate. They justifiably claim to be data-dependent, but the data they emphasize, the official unemployment rate and personal consumption expenditures, simply don’t tell the full story anymore. Additionally, Janet Yellen recently seems to be paying more attention to real wage growth. (We have had none at all.) Wage growth merely in line with inflation may not be sufficient to push rates significantly higher.

So how fast will interest rates rise, and how high will they go? Given these intractable imbalances in the labor market, the answer is likely “slowly and not as high as many think.”

In our reading of the March FOMC statement, the Fed was preaching caution and confessing a willingness to err on the side of lower rates. A key line in the statement says: “The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.” Lower for longer indeed.

But what rate is “normal in the longer run”? The equilibrium real interest rate is perhaps the most crucial rate for long-term investors in any financial market. Note, however, that this rate is unobservable, and estimates invariably provoke strong disagreement. Charles Plosser and Janet Yellen, both brilliant economists with deep insight into this question, would give very different answers. What drives this long-term equilibrium rate? Importantly, it is not set by the Fed. The Fed merely tries to keep prevailing rates roughly in line with this ideal, and it manages short-term rates to smooth out business cycle fluctuations. Economic conditions, not Janet Yellen, set the long term equilibrium rate.

Macroeconomic theory gives us some guidance. At Research Affiliates, we model the equilibrium real rate as a function of two key variables: country-specific real GDP growth and a time preference factor that favors current consumption over future consumption. If these factors represent the supply side and demand side, respectively, for an intertemporal transfer of wealth, then the equilibrium rate of interest is the price at which supply will equal demand.

A growing economy offers many investment opportunities for those who are willing to delay consumption. This high natural demand for investment may cause interest rates to rise in order to attract an increased supply of investment funds. On the other hand, lifecycle events drive natural preferences for saving and spending. An increase in the desire to save will result in a greater supply of investment funds, and exert downward pressure on interest rates.

Our models use demographic variables to proxy the long-term supply of savings, and forecasted real GDP growth to estimate the demand for funds represented by investment opportunities.7 Demography tells us that, as the baby boomers age and shift their focus toward retirement, their emphasis on saving grows; this exerts downward pressure on real interest rates. At the same time, slow economic growth provides a relative dearth of investment projects. These projects, as a result, need only offer a modest return to attract investment capital.

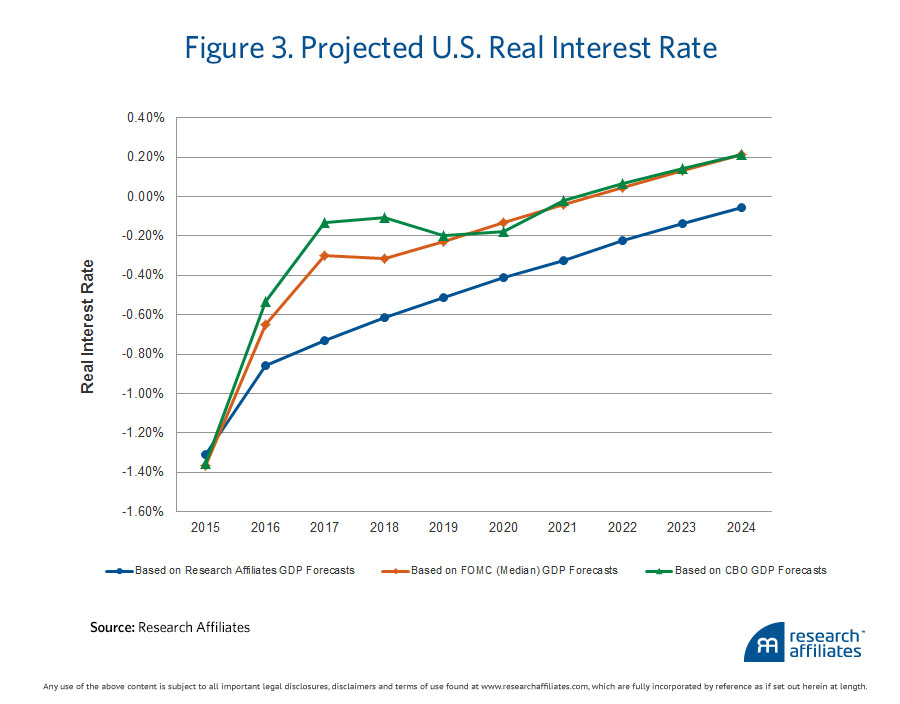

Both factors imply a continuation of low real rates for an extended period of time. Our 10-year forecast (Figure 3) is for real interest rates to rise from a current −1.38% to just about zero in 2024.8 Because this baseline rate reverberates throughout the economy, expected real returns on bonds of all maturities and risk characteristics, and even equities, should also remain low.

Our GDP forecasts, which incorporate a slowing trend in productivity growth due to the demographic effect of an aging population,9 may strike some readers as overly pessimistic. Most now agree that potential growth will be slower than our historical 3.5% rate. For example, early this year the Congressional Budget Office (CBO) released forecasts that slashed long-term estimates for potential GDP growth.10 The CBO points to slower growth in hours worked as the major cause, with productivity growth in line with its historical averages. We project a slowdown in both of these key inputs.

To allow some room for debate, Figure 3 also shows rates produced by our model using GDP forecasts from the FOMC and the CBO.11 These higher GDP growth forecasts do indeed produce higher real interest rate forecasts—all the way to 0.20% by 2024. Increased investment opportunity helps, but it doesn’t erase the strong demand for savings. Looking toward retirement and still needing to repair their balance sheets in the aftermath of the housing recession, Main Street Americans are reluctant to borrow at any price. To reach significantly higher real interest rates, we need not only more optimistic GDP forecasts but rectified balance sheets and greater willingness to spend rather than save and invest.

Our economy is characterized by slow growth, unsatisfactory employment, and a Federal Reserve not overly concerned with inflation. The demand just isn’t there. After seven years of trying to bring the punchbowl back to the party, the Fed may be realizing that this time nobody seems interested in drinking off the hangover. Don’t expect the party to ramp up anytime soon.

Endnotes

- Board of Governors of the Federal Reserve System Press Release, March 18, 2015.

- On the basis of historical data, the output gap assumes a 3.5% steady-state GDP growth rate.

- Federal Reserve Bank of St. Louis, Civilian Unemployment Rate.

- Federal Reserve Bank of St. Louis, Civilian Labor Force Participation Rate.

- In addition, millions scrape by with part-time and/or low-paying jobs. They would gladly take better jobs if they were only available.

- “The Rise and Fall of Labor Force Participation in the United States,” 2014, Federal Reserve Bank of St. Louis Review, vol. 96, no. (First Quarter):1–12.

- For a full description of our real rates forecasting methodology and resulting forecasts, visit our capital markets expectations website.

- This implies, of course, a Fed Funds rate equal to the true inflation rate (which may be different from the Fed’s preferred PCEPI measure of inflation).

- See Arnott and Chaves (2012). As workers age, their productivity levels increase, but the growth rate of their productivity slows down. Thus shifting demographics imply that the productivity of our labor force will grow more slowly in future years than it has throughout the rise of the Baby Boomer generation.

- This also effectively erases a good portion of the output gap shown in Figure 1. In essence, the CBO is admitting that potential growth will never be recaptured.

- Research Affiliates estimates an average of 1.5% real GDP growth over the next 10 years, while the FOMC and CBO estimate 2.2% and 2.4%, respectively. For more information, visit our asset allocation website.