Alice’s Adventures in Factorland: Three Blunders That Plague Factor Investing

Exaggerated Expectations of Future Returns

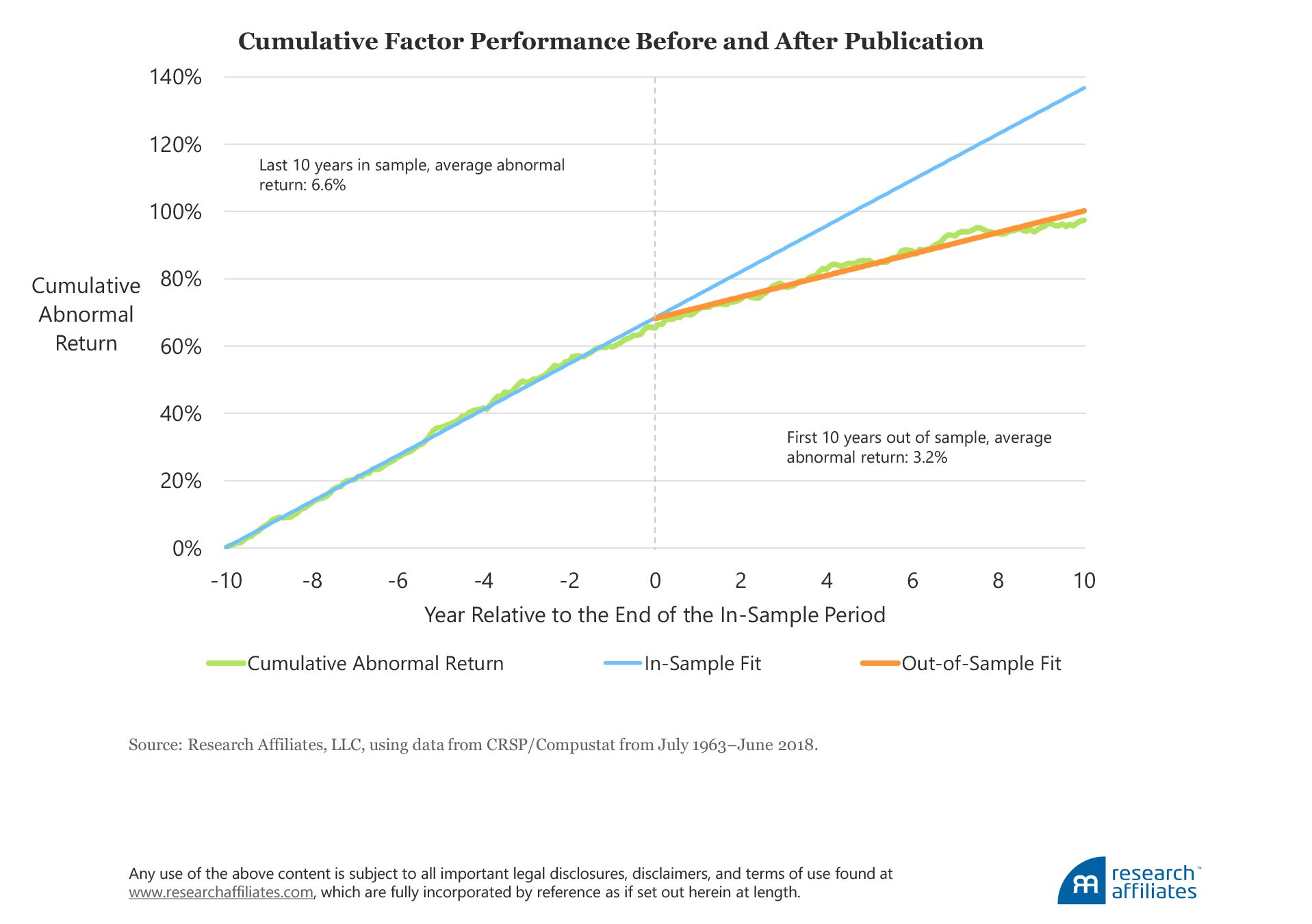

Hundreds of factors are vying for investors’ attention, but only a handful are robust and able to deliver long-term excess returns. Every one of the factors published in academic journals works, of course, in the backtest that supports them, but in real-world portfolios most factors disappoint.

First off, most factors are identified as a result of aggressive data mining. Researchers are motivated by the academic pressure to publish, and the fast track to tenure is helped by discovering a new factor. When these factors are then used in live portfolios, they typically fail to capture the excess return premium they promise.

Crowding, implementation costs, and careless trading—none considered, of course, in simulated paper portfolios—also trim realized returns.

Investors can mitigate the risk of factors underperforming their expectations by asking a few simple questions: Does this factor make sense? How crowded is this factor? What are the likely trading costs to implement this factor?

Researchers rarely apply these tests to newly discovered factors. Investors, therefore, must do it for themselves.

Naïve Risk Management Assumptions

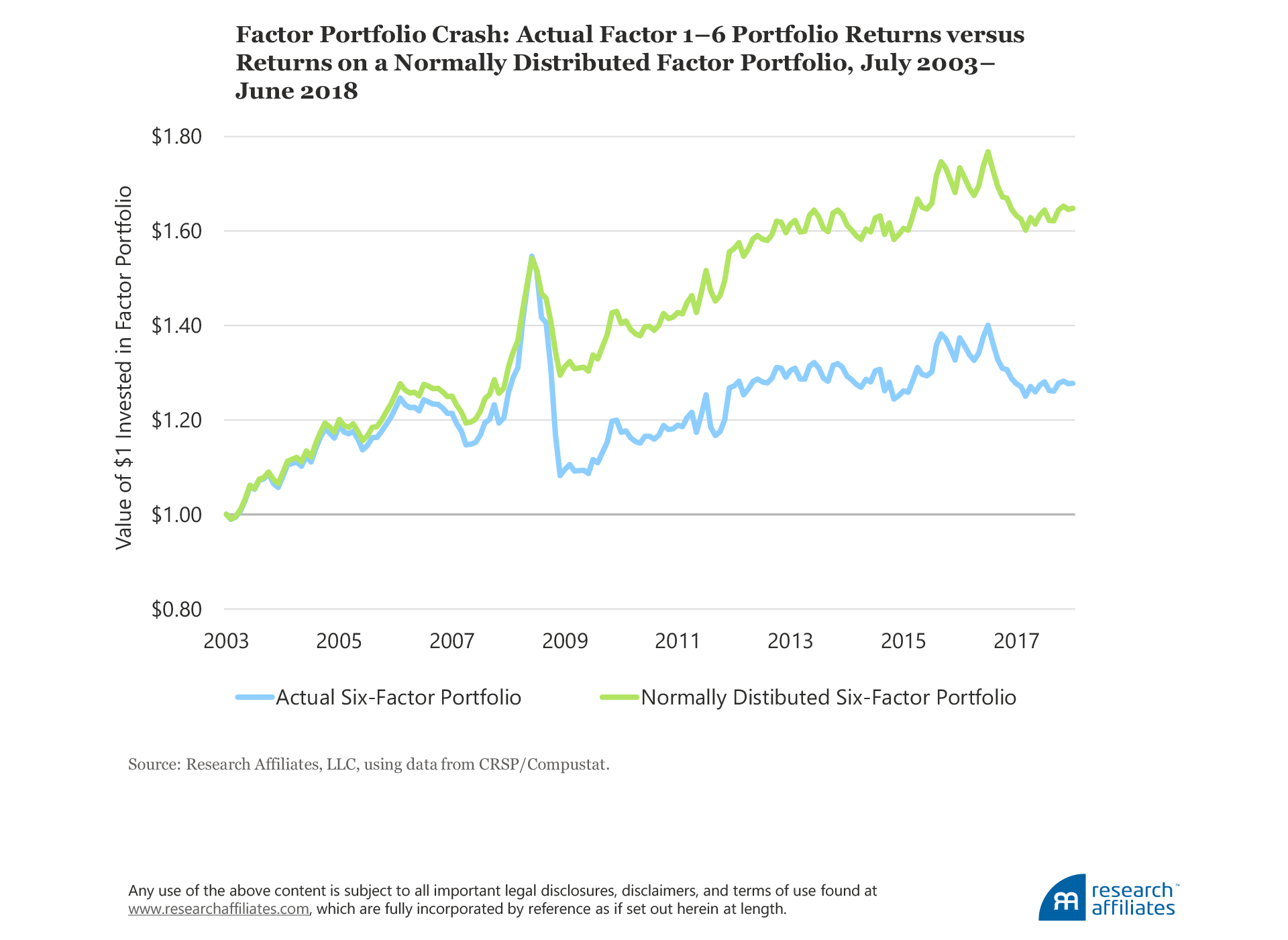

Factors are prone to big drawdowns. Their return distributions are far from normal, being asymmetric to the downside with a fat tail—the probability of a negative return.

Unfortunately, too many investors rely on very simple risk management tools that ignore tail behavior. Additionally, too many investors mistakenly believe a multi-factor portfolio can eliminate extreme tail behavior through diversification.

Our research in “Alice’s Adventures in Factorland: Three Blunders That Plague Factor Investing” shows that actual factor drawdowns over the last 15 years would never have been expected if the factor returns were normally distributed with the same volatility.

We looked at the 14 most popular factors, dividing them into two groups. The first group is the 6 most popular academic factors in multi-factor models: value, size, operating profitability, investment, momentum, and low beta.

The second group includes another 8 popular factors: idiosyncratic volatility, short-term reversals, illiquidity, accruals, cash flow to price, earnings to price, long-term reversals, and net share issues. For details on how we build the long–short factor portfolios, please refer to the article.

An investor who assumes factor returns are normally distributed could never have foreseen the outcomes we observed in our analysis.

For example, the worst month for 11 of the 14 factors should have occurred less than once in the past 2,000 years. The worst month for 9 of the factors should have occurred less than once during the time modern humans have roamed the earth, and the worst month for 3 of the factors should have occurred less than once since the universe was created! So much for a normal distribution!

Not having a clear understanding of the potential for such extreme outcomes can be a very dangerous oversight for investors.

Diversification Can Vanish in Certain Markets

In periods of market stress, factors can move in unison. Thus, building a multi-factor portfolio to diversify risk does not always succeed as planned. Large drawdowns of individual factors often happen at the same time.

We compared the actual returns and the normally distributed returns of a portfolio holding the 6 most popular factors from July 2003 to July 2018. Actual performance was far worse than the performance a normal distribution would indicate.

For investors who engage in factor investing, an understanding of how factors behave in different markets—high or low volatility, high or low inflation, high or low real yields, or economic expansion or recession—and how correlations change over time is essential. The diversification they intend by combining factors in portfolios can desert them just when they need it most.

Factors: Broken or Unlucky?

Over the last 15 years, factors have fallen far short on their promise to investors. Whether they are broken or just unlucky, it’s hard to say. We believe it’s likely a combination of both. Since 2003, performance has been disappointing compared to pre-2003 returns. Perhaps one explanation is that before 2003, returns were inflated due to data mining and selection bias, whereas after 2003, they were depressed because of crowding from widespread adoption.

For the last 15 years the stock market has enjoyed unusually strong performance, earning twice its historical Sharpe ratio. The probability of this outperformance is less than 2%. So if luck has played a role in the trajectory of the stock market, luck could also have played a role in factors’ underperformance over the same period.

We shouldn’t dismiss factors’ recent poor performance, yet giving up on factor investing is premature.

Factor investing has merit, but it has been oversold to an alarming extent. Only a few factors are robust and can truly deliver long-term value-add. Factor investing can be a powerful tool if investors understand the risks and moderate their expectations. Investors do themselves a disservice if they do not grasp the limits of factor diversification in mitigating risk and the limits of naïve risk management tools in assessing the incidence of extreme tail behavior.

Please read our disclosures concurrent with this publication: https://www.researchaffiliates.com/legal/disclosures#investment-adviser-disclosure-and-disclaimers.