The Bubble That Never Came (and Other Misconceptions about Treasury Bonds)

Contrary to common wisdom, we show that low yields do not imply that US Treasury securities are expensive.

After accounting for macroeconomic trends, Treasury bonds are only moderately overvalued.

A proper valuation of the bond market requires going beyond simply blaming the Fed’s unprecedented policies of monetary easing.

Given their recent negative correlation with stock returns, Treasury bonds may not be as unattractive as one might think.

In the frantic months following the fall of Lehman Brothers in 2008, the US Federal Reserve embarked on an unprecedented program of unconventional monetary policy easing. This program included purchases of mortgage-backed securities as well as Treasury bonds, and it continued until October 2014, well beyond most people’s expectations. The large degree of uncertainty associated with the effects of these policies logically led to a wide range of predictions from commentators and practitioners, including the downfall of the US dollar, rapidly rising inflation, and the build-up of a significant bubble in the Treasury bond market. These scenarios, albeit dramatic, were all reasonable possibilities within a highly uncertain economic evolution.

Ten years after the onset of financial troubles, the view of policy makers and investors has changed. On the shoulders of a moderate but persistent economic expansion, the US dollar has appreciated against major foreign currencies. Despite an unemployment rate at or below its natural level, core inflation has proven to be stubbornly low, forcing policy makers to reluctantly question their ability to influence prices (e.g., Cochrane, 2017). Yet this benign economic prognosis has hardly changed one belief: policies of easy money have pushed the Treasury bond market into bubble territory (e.g., Mooney, 2017).

One may be forgiven for blaming the Federal Reserve; given the long-lasting expansion, a 10-year Treasury note yielding just little above 2% does “feel” expensive. A notably slow process of policy normalization has failed to push long-term interest rates closer to their historical values. Moreover, the US stock market has also been on a multi-year run, which is inducing asset managers to speculate on the sustainability of current valuations across US capital markets.1 If a lower dividend yield is associated with expensive equities, then a lower bond yield should indicate expensive Treasuries.

In this article, we challenge the conventional wisdom. Different from equities, the empirical evidence shows that low Treasury yields do not necessarily imply expensive bonds. Indeed, our research shows that macro fundamentals are major drivers of real interest rates and largely explain the historically low yield environment. Whereas bonds do appear overvalued, we should not mistake a new normal of expected lower returns for a bond bubble. In addition, returns are not the only dimension that should determine an investor’s asset allocation. Bond and stock returns have been negatively correlated over the last 20 years, suggesting that in the future Treasuries could again offer a hedge against stock market fluctuations.

Rightly or wrongly, the Federal Reserve has been a favorite foe of many in the market place. Yet just as policy makers acknowledge the limits of monetary policy, so should investors. In relative terms, Treasury bonds are not as unattractive as one might think.

First Misconception: Low Yields Imply Expensive Bonds

In recent years, historically low yields have been interpreted as the manifestation of a bond bubble (e.g., Oyedele, 2017). Yet more than 50 years of empirical evidence indicates that this may be an unfounded conclusion.

We note that although bond yields forecast returns, they may be uninformative of bond valuations. To appreciate this insight, we rely on finance theory and decompose the returns earned from investing in a generic long-term bond into two building blocks—the short rate and the return in excess of this rate:

Total Bond Return = Short Rate + Excess Bond Return

Over the long run, the excess bond return represents the average risk premium earned from investing in a long-term security. For instance, purchasing a 10-year security and selling it after one year as a 9-year security is a riskier business than purchasing a security with exactly one year to maturity.2 Uncertainty regarding monetary policy decisions, the business cycle, and other potential risk factors can all affect the yield curve and lead to capital losses.

If a bond yield is a useful metric of a security’s over- or undervaluation, then this yield should be predictive of future excess return. In fact, higher expected excess returns are suggestive of an undervalued security, a situation likely to occur at times when investors are somewhat reluctant to hold long-term assets and thus are compensated with some extra return. Conversely, lower expected excess returns are indicative of an overvalued asset. Therefore, do yields forecast excess returns?

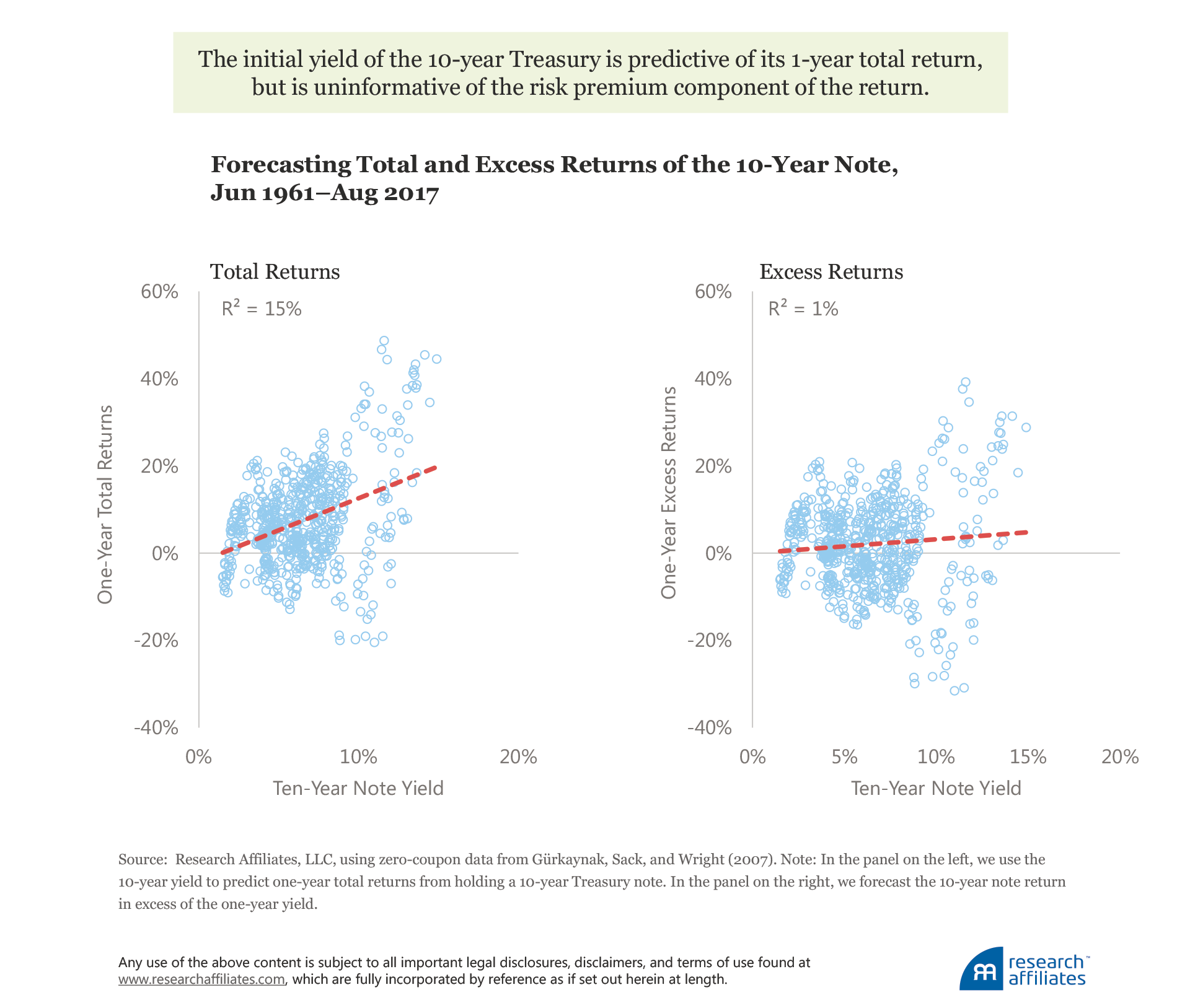

In an attempt to answer this question, we evaluate the predictive power of the 10-year yield using data from June 1961 through August 2017. Consistent with a tactical allocation exercise, we focus on short-term fluctuations and forecast the one-year return of the 10-year Treasury note. We find that the initial yield is indeed predictive of the security’s total returns, and this predictability becomes even more impressive over long horizons (e.g., Brightman, 2012). We also find that the yield is generally uninformative of the risk premium component of these returns. Historically, the level of yields has had little to say about the over- or undervaluation of a Treasury bond.

The lack of predictability associated with the 10-year yield does not rule out the existence of other useful indicators of bond valuations. For instance, Cochrane and Piazzesi (2005) show that the excess returns of Treasury bonds are indeed forecastable, which is suggestive of significant variation in investors’ risk appetites for duration over the course of the business cycle. The search for a useful valuation metric of Treasury bonds brings us to the second misconception about government securities: macro fundamentals are unrelated to the level interest rates.

Second Misconception: Fundamentals Do Not Matter

The holy grail of bond investors is to find new ways to “refine” bond yields and extrapolate useful valuation metrics. But what kind of refinement may work?

To evaluate the attractiveness of a bond, we have no choice but to try to guess the path of monetary policy. Indeed, recall that the yield of a long-term Treasury security can be decomposed into at least two components:

Bond Yield = Expected Average Short Rate + Risk Premium

Hence, we must form an estimate of the expected average short rate by the market, which is necessary in order to quantify the risk premium priced into the security. This rate is a function of the decisions of the Federal Reserve, and because of the way the Fed nominally operates, the rate should reflect the fundamentals of the US economy over long horizons. That is, higher inflation and potential real GDP would typically be associated with a higher level of interest rates. Instead, a low bond yield may be symptomatic of expected subpar macroeconomic expectations.

Guessing future average short rates is a tricky exercise. On the one hand, inflation is a known major driver of bond yields, so various measures of long-term inflation expectations can offer a reasonable forecast. On the other hand, substantial disagreement still exists on the long-term drivers of real yields, whose secular value is known as the natural or equilibrium rate of interest. In particular, real yields appear mostly unrelated to the rate of economic growth, a fact that has prompted researchers to look for alternative explanations, such as global capital imbalances (e.g., Rachel and Smith, 2015).

Two thought-provoking papers by James Montier (2015a, 2015b) exemplify the degree of skepticism surrounding the economic drivers of real interest rates in the investment community. Montier is critical of the building-block approach applied to forecasting and argues that the equilibrium rate of interest is “a make-believe concept with no foundation in the way our financial world really works” (2015a). We respectfully disagree with this statement.

In Garg and Mazzoleni (2017), we argue that the connection between the real economy and bond markets is much stronger than otherwise thought. In particular, introducing growth data in an otherwise canonical term-structure model allows for more accurate predictions of bond excess returns, and therefore, offers a more refined bond valuation metric. In other words, modeling the equilibrium rate of interest is essential for properly valuing Treasury bonds.

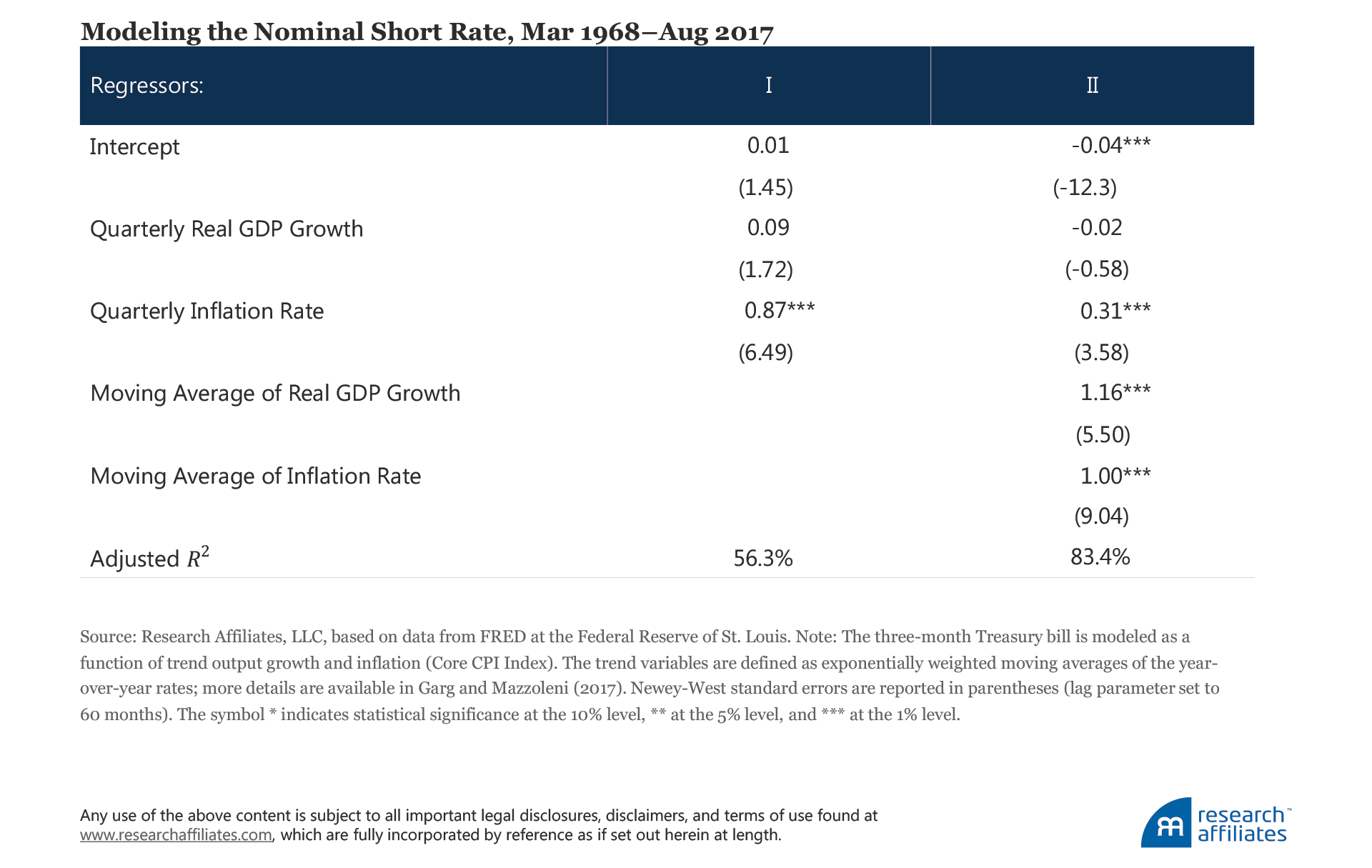

The following table illustrates our insight, showing that inflation and real GDP growth are, in fact, major drivers of the three-month Treasury bill rate. The first column illustrates no significant association exists between the quarterly rate of real GDP growth and short rates, after controlling for the quarterly rate of core inflation. This negative result is not new and may be initially viewed as a puzzle, however, the evidence differs when we employ backward-looking measures of economic performance.

In the second column of the table, we introduce moving averages of output growth and inflation as a way to proxy for the potential growth rate of the overall economy. Their association with the short rate is particularly significant and suggests that the Fed calibrates policy rates in a way that is consistent with the recent path of the US economy. It should be no surprise that smoothed backward-looking macroeconomic variables co-move more closely with short-term yields than more volatile quarterly rates. The Fed is well known to be a cautious policy maker, and adjusts target rates only when there is sufficient confidence regarding an economic trend. As a result of this approach, interest rates tend to reflect both current and past economic fundamentals.

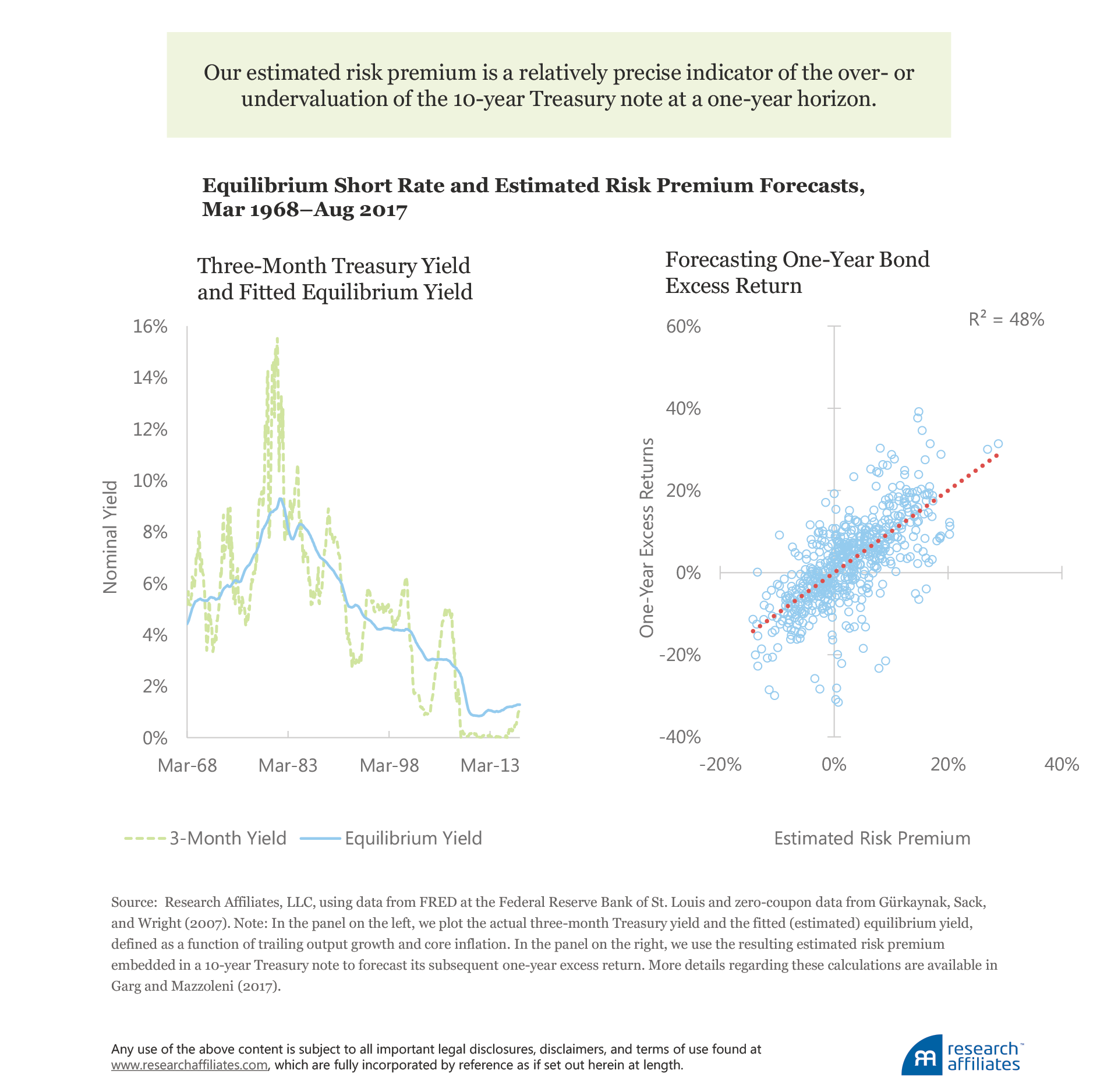

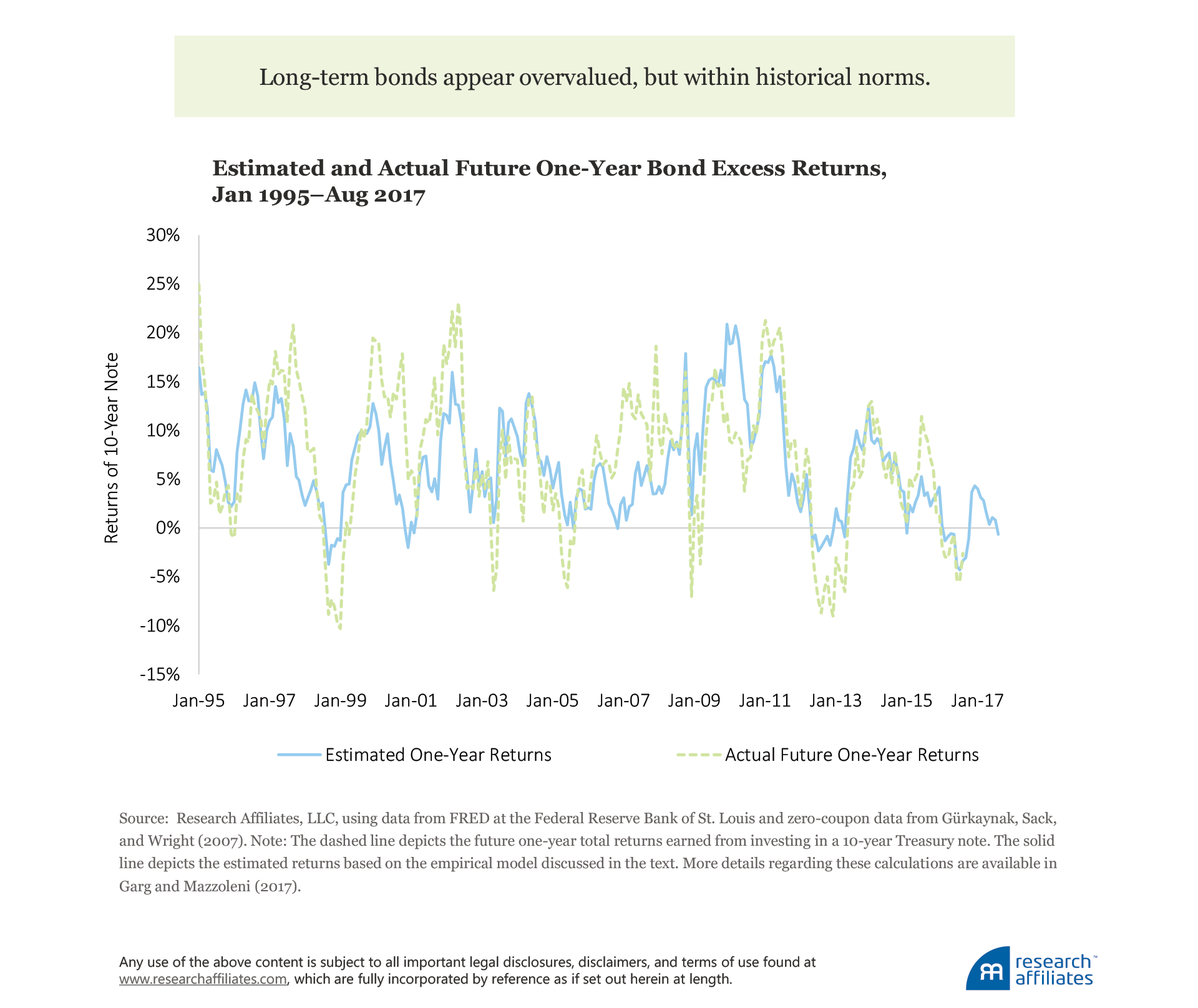

Supported by these data, we can return to our original challenge: refining the 10-year yield to obtain a more successful valuation metric. We can do so in three steps. First, the relationship between short rates and macroeconomic fundamentals can be used to generate an estimate of the equilibrium rate of interest of the economy. We do this by plotting the actual three-month Treasury yield and the fitted (estimated) equilibrium yield, defined as a function of trailing output growth and core inflation over the period March 1968 through August 2017. Next, we use this equilibrium rate to produce the market’s estimate of the expected average short rate. Lastly, the difference between this latter expectation and the actual long-term yield is an estimate of the bond risk premium.

Our estimated risk premium offers a relatively precise indicator of the over- or undervaluation of a bond at a one-year horizon. The difference with respect to the ability of the 10-year yield to do so (as demonstrated earlier) is stark. Hence, the equilibrium rate of interest is real, and accounting for it can deliver significant forecasting improvements.

Equipped with a more precise indicator of bond valuations, we can conclude this section by assessing the common claim that current Treasury yields are indicative of a bubble. The time-series evidence suggests that government bonds are indeed expensive, but far from bubble territory: today’s valuations are well within the norm of the Treasury market’s fluctuations in recent history. Moreover, it appears that quantitative easing programs did not have the cataclysmic effects that many had initially feared. Hence, for a proper valuation of the bond market, one must look beyond the Fed’s policies of monetary easing.

Thus, we conclude that macroeconomic trends are major drivers of the level of interest rates, and therefore, of bond return forecasts. And returns are not the only dimension that should drive an investor’s asset allocation decisions. Given the widespread focus in the press on returns, we take the opportunity in our last section to recall the varying relationship between stocks and bonds.

Third Misconception: Expected Return Is All You Need

Even assets with disappointing expected returns can be a significant part of an asset allocation plan, as long as they offer diversification benefits. Treasury bonds may be exactly such an asset class, and to quantify their role in a portfolio, interested readers are invited to explore the Research Affiliates Asset Allocation Interactive tool on our website.

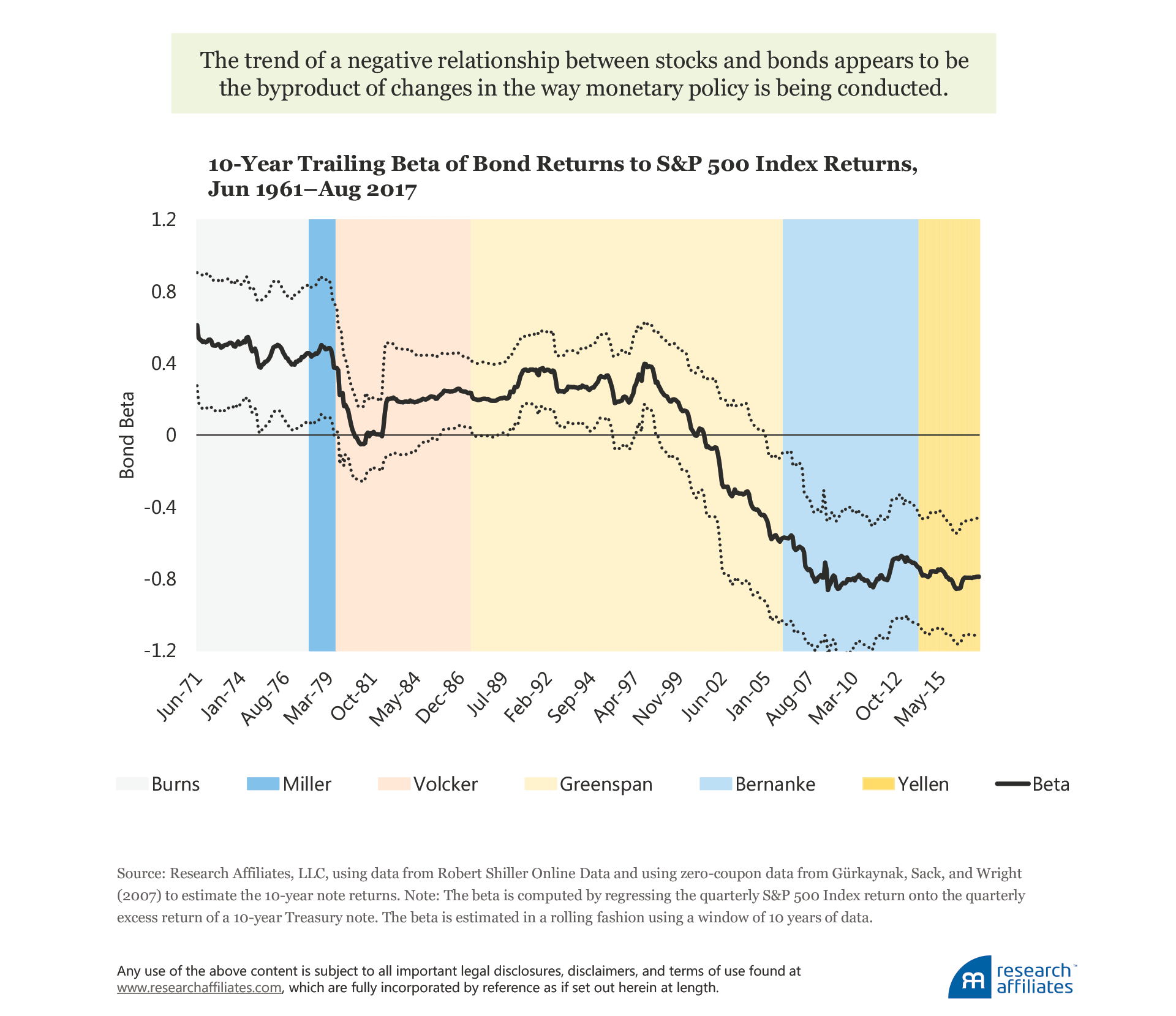

To appreciate how Treasury bonds can hedge against stock market swings, we plot the beta of the 10-year note’s returns to the returns of the S&P 500 Index. Specifically, the returns are quarterly, and the beta is estimated in a rolling fashion using a window of 10 years of data. In this way, we are able to highlight the changing nature of the relationship between bonds and stocks. The evidence is incontrovertible. During the second half of Greenspan’s tenure, the relationship between stocks and bonds began to fall and turned negative. This relationship has been confirmed to be statistically significant during the turbulent times that coincided with Bernanke’s leadership and, more recently, with the calmer periods of Yellen’s tenure.

The trend of a negative relationship between stocks and bonds does not appear to be related to the quantitative easing programs of the Fed, but rather, as emphasized by Campbell, Pflueger, and Viceira (2015), is the byproduct of changes in the way monetary policy is being conducted. If in the 1980s the focus of policy makers was on anti-inflationary policies, in the 1990s this focus shifted to output fluctuations. In other words, Treasury bonds have become a good hedge against bad economic outcomes.

Should we expect this state of affairs to continue in the future as well? This is a fair question, and the answer will also depend on who President Trump decides to appoint to lead the Fed. Even in the case of an unorthodox nominee, we should remember that the FOMC is more than just one individual. At least in the medium term, it appears a reasonable bet to expect bonds to maintain their hedging property against equities.

Conclusions

Recent warnings about stocks being overvalued have been regularly followed by similar conclusions regarding US government bonds. The narrative finds fertile ground in blaming the Federal Reserve, whose significant programs of quantitative easing and loose interest rates may have pushed the bond market to perhaps the longest bubble ever recorded. Nine years since the Lehman bankruptcy, a 10-year Treasury note yielding just little above 2% does “feel” expensive. Yet, the actual state of the market may be more complicated than this description.

In this article, we offer an alternative reading of the bond market by evaluating common misconceptions about Treasury securities. First of all, we show that yields are generally uninformative of bond valuations. For instance, at the time of this writing, the 10-year note yields about 2.30%, a historically low yield. Yet we should not rush to conclusions about Treasuries’ over- or undervaluation. Indeed, we show that a substantial share of this low yield can be explained by a secular downward trend in the rate of inflation and potential real GDP growth of the US economy.

After accounting for macroeconomic trends, we conclude that Treasury bonds are moderately overvalued, however, they are far from bubble territory. Today’s valuations are well within the norm of the fluctuations of the Treasury market in recent history. Moreover, it appears that quantitative easing programs did not have the cataclysmic effects many had initially feared. Hence, for a proper valuation of the bond market, we must go beyond simply blaming the Fed’s unprecedented policies of monetary easing.

Lastly, we stress that grim forecasts should not be sufficient to induce investors to snub Treasuries. Over the last 25 years, bonds have displayed a very valuable negative relationship with the US stock market, and thus have been an excellent hedge against macroeconomic risk. All in all, bonds are not as unattractive as a simple historical comparison of their yields may suggest.

Endnotes

1. For example, Mackintosh (2016), McCrum (2017), and Moore (2017).

2. The value of a 52-week Treasury bill at expiration is equal to its principal payment, which in nominal terms is known with certainty.

References

Brightman, Christopher. 2012. “Expected Return.” Investments & Wealth Monitor(January/February).

Campbell, John, Carolin Pflueger, and Luis Viceira. 2015. “Monetary Policy Drivers of Bond and Equity Risks.” NBER Working Paper No. 20070 (June).

Cochrane, John. 2017. “The Grumpy Economist” blog (October 20).

Cochrane, John, and Monika Piazzesi. 2005. “Bond Risk Premia.” American Economic Review, vol. 95, no. 1 (March):138–160.

Garg, Ashish, and Michele Mazzoleni. 2017. “The Natural Rate of Interest and Bond Returns.” Available on SSRN.

Gürkaynak, Refet, Brian Sack, and Jonathan Wright. 2007. “The U.S. Treasury Yield Curve: 1961 to the Present.” Journal of Monetary Economics, vol. 54, no. 8 (November):2291–2304.

Mackintosh, James. 2016. “Stocks and Bonds Today: Expensive, Expensive, Expensive.” The Wall Street Journal (April 18).

McCrum, Dan. 2017. “The Perils of Calling the Peak of the Equities Bull Run.” Financial Times (August 16).

Montier, James. 2015a. “The Idolatry of Interest Rates, Part I: Chasing Will-o’-the-Wisp.” GMO White Paper (May).

———. 2015b. “The Idolatry of Interest Rates, Part 2.” GMO White Paper (August 11).

Mooney, Attracta. 2017. “Bond Bubble Brews as Central Banks Retreat from QE.” Financial Times (July 23).

Moore, Simon. 2017. “What to Do About Expensive US Stocks.” Forbes (May 23).

Oyedele, Akin. 2017. “Forget Bitcoin: An $8 Trillion Bubble in Global Markets Is Waiting to Pop.” Business Insider (October 13).

Rachel, Lukasz, and Thomas Smith. 2015. “Secular Drivers of the Global Real Interest Rate.” Bank of England Staff Working Paper No. 571 (December).