The purported discovery of many new anomalies and the consequent proliferation of supposedly uncorrelated factors in recent years raises questions about the quality of financial research.

We find that the value, low volatility, and momentum anomalies are very significant; the market and illiquidity factors are significant; and other asserted factors, including various definitions of quality, are insignificant.

Among other characteristics, a factor is more likely to generate a return premium out-of-sample if it has survived over time, works outside the United States, stands up to minor definitional variations, has a credible explanation, and exceeds a higher-than-usual t-stat threshold to adjust for data-snooping.

Factors are becoming so numerous and exotic that John Cochrane referred to the collection as a zoo.1 While the concept is entertaining, the proliferation of factors is deeply troubling. The sheer number of factors suggests that it’s better to have more factors than less, but how can investors determine how to use factors in their equity portfolios? The options are endless, particularly given the smart beta movement under way today. We believe one cannot make intelligent choices regarding smart betas without first understanding factors and their role in investment portfolios. Luckily for investors, most so-called factors can be ignored.

Factor Proliferation

When we were in the Ph.D. program at UCLA, we were taught the four-factor model in our asset pricing class. The world was simple; there were the market risk factor and the value, small-cap, and momentum return factors.2 The three non-market factors carried juicy return premia that could be had by investors willing to diversify into non-market exposures and exploit retail investors’ behavioral biases.

Fifteen years later, we are shocked to learn that some quant shops now use an 81-factor model to build equity portfolios. This inflation in factors has certainly made us feel inadequate and has potentially eroded the real value of our paper diploma. Understandably, we are concerned with the relentless onslaught of shiny, exciting, and sexy new factors introduced by bright-eyed, bushy-tailed young financial engineers.3

Frankly, we expected the number of “accepted” factors to decrease rather than explode over time. We expected that at least one of the three documented anomalies would be revealed as a fluke—a data artifact that would disappear with better quality international data and with additional decades of out-of-sample data following the original discovery.

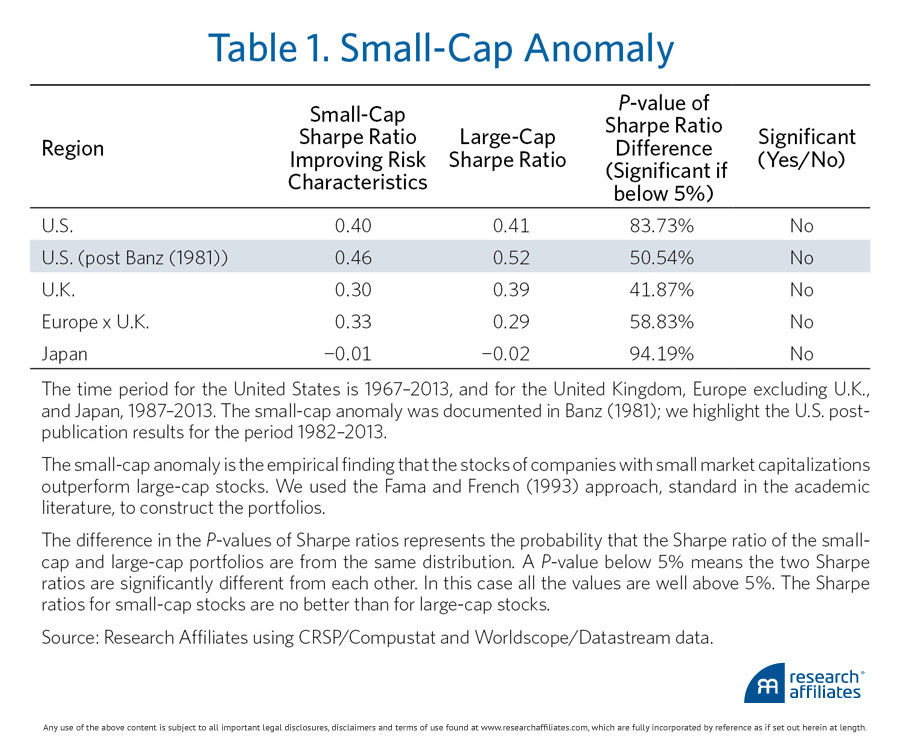

Indeed, that is what we have seen. The small-cap anomaly has not been observed in the United States since the early 1980s and does not exist outside the U.S. dataset (Table 1). This lack of “robustness” out-of-sample led Tyler Shumway and Vincent Warther to re-examine the small-cap anomaly; they concluded that it was likely driven by a mistake in how researchers treated missing data for delisted stocks. Apparently, missing returns for delisted stocks in the CRSP database created a systematic bias in the computed returns for small stocks, which are more likely to face delisting. When this bias is adjusted for, the small-cap anomaly is no longer observed (Shumway and Warther, 1999).

Oddly, the nullification of the small-cap anomaly has received scant notice. At the same time, between academia and the investment industry, the mining of new equity anomalies has yielded a great many new return factors that offer exotic and diversifying premia. Today, quantitative managers and smart beta solution providers peddle breathtaking Sharpe ratios from back-tested equity portfolios, which optimally hold uncorrelated “pure” factors. As providers rush to outdo each other, the number of shiny new factors and the resulting portfolio Sharpe ratios have both grown improbably large.

We can completely understand the providers’ incentive to “factor-proliferate.” Equally, we can sympathize with the investors’ desire to believe that there might really be 81 unique factors which can be combined to provide an equity portfolio with a Sharpe ratio of 2. We have seen this very same phenomenon in the “alpha” space. Managers, consultants, and investors alike dream that lush dream of combining diversifying alpha portfolios to create an equity core with an information ratio of 2. For those of us who are skeptical of “alphas,” this is our chance to dream that same dream in the smart beta space. Except, of course, we get to invoke the arbitrage pricing theory (APT) framework and throw around big words like multi-factors and optimization, which gives our version an added air of intellectual rigor and authority.

Now, in fairness to our academic colleagues and professors, we were warned. Recognizing the dangerous combination of cheap computing power and overzealous young finance Ph.D. students, our professors explained that if one runs 10,000 back-tests, one is bound to discover a few incredible factors which generate huge Sharpe ratios. These “data-mined” factors will unfortunately offer no future premia. Recognizing further that Ph.D. students tend to believe everything they read in finance journals, our professors quickly added that with 10,000 academics globally, each running one honest back-test a year, we would similarly end up with “data-snooped” factors, reported in top journals, which would have no greater probability of delivering future premia.4 The first lesson is generally well understood in our industry; the second lesson is less widely understood. Now, given the proliferation in factors, academia is increasingly turning up the volume to warn against “factor” proliferation.

A Zoo of Factors

Perhaps the proliferation of new factors has hit the tipping point. McLean and Pontiff (2013) re-examined 82 factors published in tier-one academic journals. They were only able to replicate the reported results for 72 of them; at least 10 out of 82 factors were artifacts of reporting mistakes in the databases, which have now been corrected. Levi and Welch (2014) took the kitchen-sink approach and examined 600 factors from both the academic and practitioner literature. They found that 49% of the factors produced zero to negative premia out-of-sample, suggesting that investing based on the identified factors is only ever so slightly better than tossing coins. Of course, net of transaction and management fees, tragically, you will likely do worse than a monkey throwing darts.

Cam Harvey, past editor of the Journal of Finance, with co-authors Yan Liu and Heqing Zhu, studied 315 factors from top journal articles and highly regarded working papers. Adjusting for “data-snooping,” Harvey, Liu, and Zhu (2014) conclude that only a handful of the factors in the zoo are actually statistically significant. Using this adjustment technique, our old friends the value, low volatility, and momentum anomalies are very significant; well-understood risk factors like market and illiquidity are significant; and small-cap is insignificant, as are many of the newer and more exotic factors (such as idiosyncratic volatility and various definitions of quality5 like default risk, ROE, and ROI).

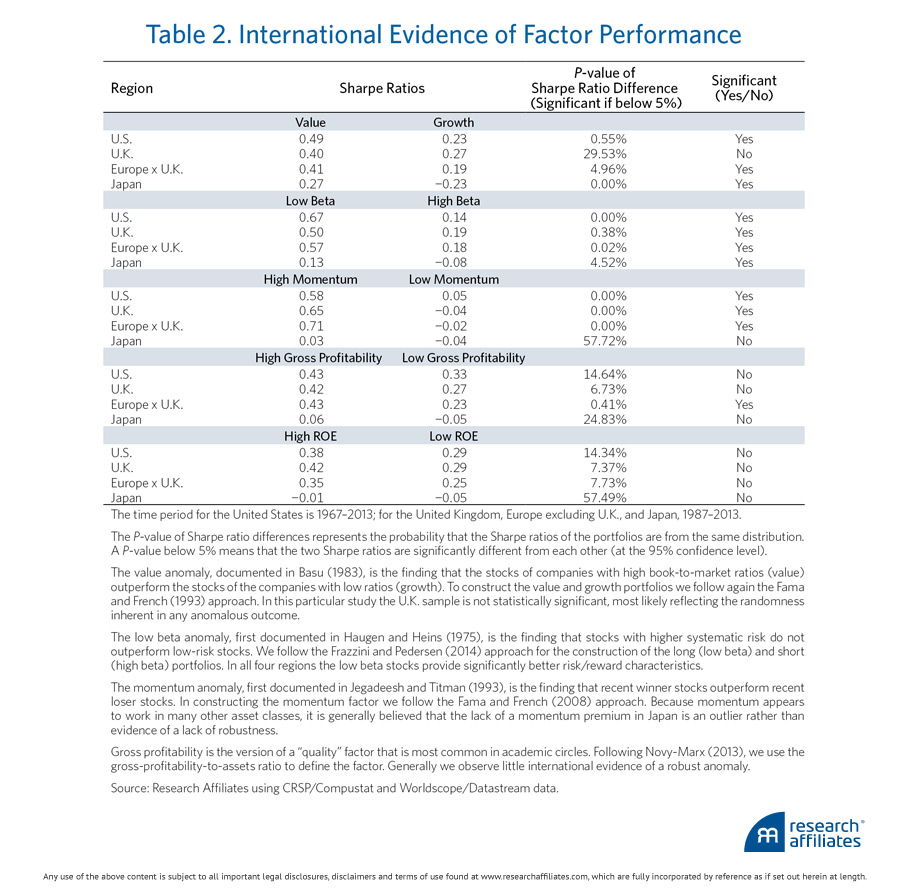

So far, many of the re-examinations of equity factors have used U.S. data exclusively. Our research on factors used both U.S. and non-U.S. data to examine robustness. Our results corroborate what others have concluded using U.S. data. In Table 2, we find that value and low beta are two anomalies which also work in Europe and Japan, while small-cap and other factors such as ROE, profitability, etc., do not work outside the United States. This finding argues for the likelihood that many popular factors are more artifacts of U.S. data than real sources of return premia. Again, we find value, low beta, and momentum to be robust... and we find other factors show significantly less robustness.

ROE, defined as the earnings-to-book-value ratio, is frequently used in practitioner settings to identify high-quality stocks. There is very little evidence of any premium associated with profitability.

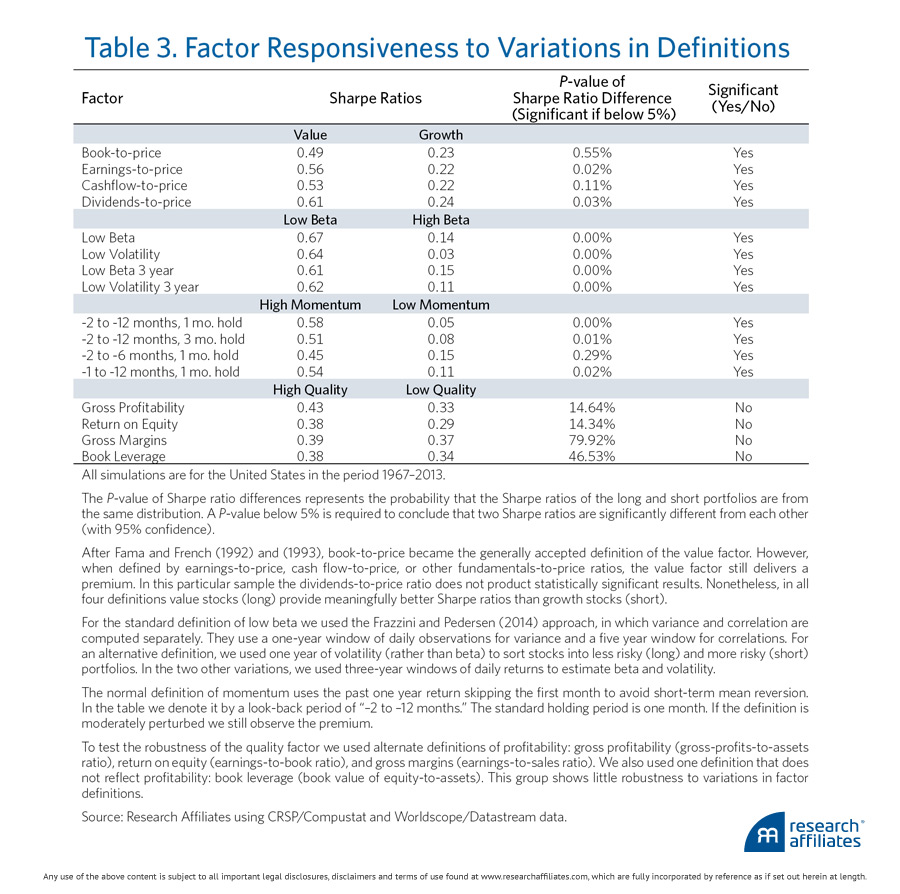

To further examine factor robustness, we explored the change in the measured factor premium due to small changes in the factor definition/construction. For example, we changed the value signal from book-to-price to earnings-to-price and changed the momentum signal from a 12-month look-back to a 6-month look-back. In Table 3, we report the impact on the factor premium arising from reasonable variations in factor definitions.

Smart Beta in the Factor Zoo

The smart beta movement makes it particularly important to understand this zoo of factors and how best to capture factor premia in an equity portfolio.

Equity smart beta indices are often described as portfolios which tilt toward various (combinations of) equity factors. Thus, one cannot make intelligent choices regarding smart betas without first forming a view on which factors are “for real” and which are data-mined or data-snooped. The academic literature provides useful guidance on decision heuristics that investors can lean on to ascertain whether a factor truly contains a return premium. Summarizing from the studies cited above, the following set of characteristics would constitute evidence of an actual factor:

1. The factor was discovered many decades ago; it has survived numerous database revisions as well as extensive out-of-sample data.

2. The factor has been vetted, replicated, and debated in top academic journals over decades.

3. The factor works in non-U.S. countries and regions.

4. The factor premium does not change materially due to minor variations in the factor definition/construction.

5. The factor has a credible reason to offer a persistent premium

a. It is related to a macro risk exposure, or

b. It is related to a deep-rooted behavioral bias that is present in a meaningful fraction of investors, or

c. It is related to an institutional feature that cannot be easily changed.

6. The factor exceeds a more stringent t-stat threshold of 3.5 (preferably 4.0) instead of 2.0 to adjust for data-snooping and other biases evidenced by the recent explosion in factor proliferation.

Once investors have determined which factors they actually believe in, they then need to figure out how best to capture the factor premia in their equity portfolios. For example, which factor premia can be accessed in low cost, transparent, and formulaic smart beta indices and which are better accessed through high-fee actively managed products? It is generally believed that the momentum premium is best accessed through skilled active managers, who can trade carefully and get ahead of the crowd in buying and selling, given the short holding horizon and liquidity-taking nature of the strategy. If that hypothesis is true, a smart beta index chassis may fail to effectively capture the momentum premium.

Similarly, an illiquidity premium requires active managers with either market making capabilities or sophisticated trading skill, so an index replication approach is unlikely to be successful in capturing this premium. High-fee active management may be necessary. On the other hand, value and low beta strategies require no more than 10% and 20% annual turnover, respectively, and have very slow signal decay. These two premia are well-suited to be captured in low cost smart beta index products.

In determining an appropriate core equity portfolio, investors need to consider their measure of risk. For example, is tracking error to a cap-weighted policy benchmark the measure of risk? And, relatedly, is the value-added return relative to a benchmark the primary measurement of success? Or is portfolio volatility the dominant risk measure with absolute return the key success criterion?

Once investors define their portfolio “bull’s-eye,” it is relatively straightforward to determine which mix of smart beta index products and active products would lead to the desired equity holdings.

In Closing

We have become what we hated when we were in graduate school. We are now the curmudgeonly party poopers who scoff at the latest and greatest new factors discovered by enthusiastic financial engineers. We like to think we have become wiser and thus developed a healthy skepticism, not merely grown more cynical of academia and the industry. Fortunately, we seem to be in good company; the titans of academia have similarly grown weary of the factor proliferation, which has created a dizzying zoo of factors. The sheer variety seems to serve the purposes of publication for tenure and product creation more than better investor outcomes. We will gladly bet a simple blend of market, value, low beta, and momentum exposures against anyone’s optimized 81-factor portfolio.

Endnotes

- John Cochrane of the University of Chicago coined the term “zoo of factors” in his 2011 presidential address to the American Finance Association.

- We use risk factor to mean factors whose premia are compensation for risk and behavioral factors to mean factors whose premia are excess returns from exploiting behavioral mistakes. We use return factor to mean factors which may be behavioral or risk in nature. The literature remains divided on whether factors like value and momentum are driven by risk or behavioral biases.

- Harvey, Liu, and Zhu (2014) reported that 59 new factors were discovered between 2010 and 2012.

- The phrase “data snooping” was coined by Lo and MacKinley (1990).

- We have argued elsewhere that quality is not a factor in itself. On the other hand a value investor can benefit from knowing the financial and economic health of a company. See “The Moneyball of Quality Investing,” Research Affiliates, June 2014.

References

Banz, Rolf W. 1981. “The Relationship between Return and Market Value of Common Stocks.” Journal of Financial Economics, vol. 9, no. 1 (March):3–18.

Basu, Sanjoy. 1983. “The Relationship Between Earnings’ Yield, Market Value and Return for NYSE Common Stocks: Further Evidence.” Journal of Financial Economics, vol. 12, no. 1 (June):129–156.

Cochrane, John H. 2011. “Presidential Address: Discount Rates.” Journal of Finance, vol. 66, no. 4 (August):1047–1108.

Fama, Eugene F., and Kenneth R. French. 1992.”The Cross-Section of Expected Stock Returns.” Journal of Finance, vol. 47, no. 2 (June):427–465.

———. 1993. “Common Risk Factors in the Returns on Stocks and Bonds.” Journal of Financial Economics, vol. 33, no. 1 (February):3-56.

———. 2008. “Dissecting Anomalies.” Journal of Finance, vol. 63, no. 4 (August):1653–1678.

Frazzini, Andrea, and Lasse H. Pedersen. 2014. “Betting Against Beta.” Journal of Financial Economics, vol. 111, no. 1 (January):1–25.

Harvey, Campbell R., Yan Liu, and Heqing Zhu. 2014. “…and the Cross-Section of Expected Returns.”

Haugen, Robert A., and James Heins. 1975. “Risk and Rate of Return on Financial Assets: Some Old Wine in New Bottles.”Journal of Financial and Quantitative Analysis, vol. 10, no. 5 (December):775–784.

Jegadeesh, Narasimhan, and Sheridan Titman. 1993. “Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency.” Journal of Finance, vol. 48, no. 1 (March):65–91.

Levi, Yaron, and Ivo Welch. 2014. “Long-Term Capital Budgeting.” Working Paper (March 29).

Lo, Andrew W., and A. Craig MacKinley. 1990. “Data-Snooping Biases in Tests of Financial Asset Pricing Models.” Review of Financial Studies, vol. 3, no. 3 (Fall):431–467.

McLean, David R., and Jeffrey Pontiff. 2013. “Does Academic Research Destroy Stock Return Predictability?” Working Paper (May 16).

Novy-Marx, Robert. 2013. “The Other Side of Value: The Gross Profitability Premium.” Journal of Financial Economics, vol. 108, no. 1 (April):1–28.

Shumway, Tyler, and Vincent A. Warther. 1999. “The Delisting Bias in CRSP’s Nasdaq Data and Its Implications for the Size Effect.” Journal of Finance, vol. 54, no. 6 (December):2361–2379.