Fintech: Investor's Friend or Foe? Part 2

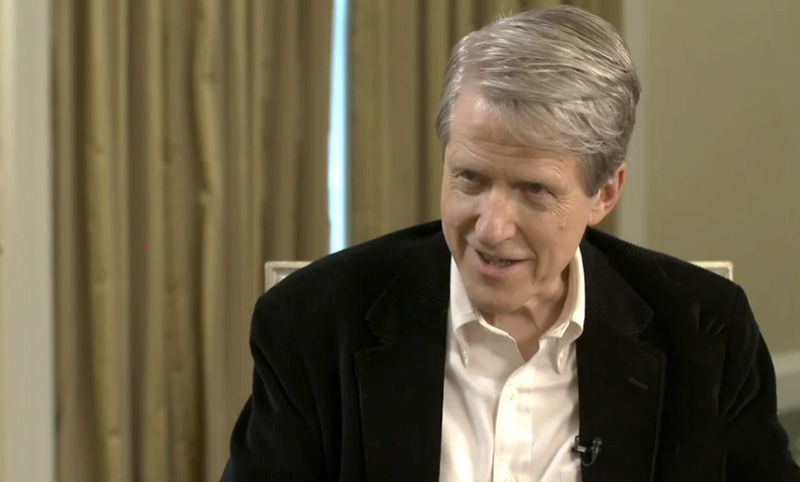

Advisors are positioned to be winners in the technological innovation currently revolutionizing the investment industry, asserts Cam Harvey. He also explains his research on gold as an inflation hedge, among other topics.

Fintech: Investor's Friend or Foe? Part 1

Cam Harvey cuts through the fanfare on cryptocurrencies, one of the most popular topics from RA advisor events. He begins with a brief explanation of his views on the advantages of blockchain technology.

Jason Hsu and Vitali Kalesnik discuss which definitions of the quality factor are robust and have been shown to generate a return premium based on their Graham and Dodd award-winning article. Their findings suggest a link between the quality factor and ESG investing.

Do Investors Value Sustainability?

Samuel Hartzmark explains his and Abigail Sussman’s findings on investors’ perception of the sustainability ratings of US mutual funds and the resulting investment implications.

Nobel Laureate Robert Shiller, interviewed by Rob Arnott, expounds on the importance of narratives in driving economic events.

The Inverted Yield Curve and Stock Returns

Cam Harvey explains the link between the yield curve inversion and future stock returns as well as why value offers investors a potential hedge against downside risk after a yield curve inversion.

The Unintended Consequences of Thinking in Dollars

Kelly Shue’s research challenges the conventional wisdom that size is the fundamental determinant of volatility and offers investors a window on an under-appreciated driver of asset price movements.

Cam Harvey speaks to the currently inverted yield curve as an indicator of a slowing economy, further expounding on his Conversations of January 2019.

The History of the Cross-Section of Stock Returns

Juhani Linnainmaa cautions investors to be wary of alpha decay in newly discovered factors. Using fresh, pre-discovery data, his out-of-sample analysis shows about half of the many factors tested were not robust.

Surprise! High Employee Satisfaction = More Positive Earnings Surprises

ESG and SRI strategies filter companies on metrics that often measure intangibles. Alex Edmans finds that employee satisfaction does correlate with corporate outcomes, but the market is not yet adequately valuing this intangible.

Beyond Willpower: Strategies For Reducing Failures of Self-Control

David Laibson discusses his findings on what types of strategies work best to encourage investors to exert self-control, whether it may be saving more for retirement or resisting the impulse to sell into a falling market.

Cam Harvey looks at the yield curve today through the lens of his 1986 pioneering work on yield-curve inversions and their foreshadowing of economic downturns.