With EM stock prices plummeting and investors fleeing EM funds, the fear of emerging markets is palpable. Our examination of three key metrics—external debt, foreign exchange reserves, and current account balance—shows, however, that EM countries have low risk of a broad funding crisis.

EM stocks are comparatively cheap when measured by CAPE, price-to-book ratio, price-to-sales ratio, market cap to GDP, and other metrics. Now, when fear reigns supreme, it’s time to buy, not sell.

“The overall shape EM countries are in has a lot more cracks now than it did five years ago and certainly at the time of the global financial crisis.” —Carmen Reinhart

“It’s become at least possible to envision a classic 1997-8 style self-reinforcing crisis: EM currency falls, causing corporate debt to blow up, causing stress on the economy, causing further fall in the currency.” —Paul Krugman

Before its $50 billion bailout by the International Monetary Fund agreed to in June, Argentina had raised short-term rates to 40%! In May, Turkey raised rates by 300 basis points (bps) as the lira fell to fresh lows. At the same time, emerging markets (EM) stock prices have been plummeting. Since the peak on January 25, 2018, through June 15, 2018, EM stocks are down 11 percentage points and retail investors are fleeing EM funds. In May, net EM outflows totaled $12 billion.

We feel the fear. To decide if we ought to abandon our EM equity positions, we examine the risk of a broad EM funding crisis with our frontal cortex rather than with our limbic system. Is the panic peddled by pundits today justified? We think not, for several reasons: First, the global economy has become more stable. Second, EM countries have become wealthier and financially healthier. Third, countries that are under threat, and thus making headlines, compose only a small fraction of the value of EM equity markets. Fourth, the relative valuation of EM stock markets is discounting quite a bit of bad news, especially relative to the valuations of US stocks. And fifth, the instinctive reaction to a 10% correction in the US market is to “buy the dip,” while the instinctive reaction to a similar decline in EM is contagious fear.

First, let’s start with some good news too often ignored by the media. The global economic landscape, as indicated by almost all measures, has steadily and cumulatively progressed over the decades. For a book-length discussion of global progress on a broad range of topics, we recommend one of our recent favorites, Enlightenment Now by Steven Pinker.

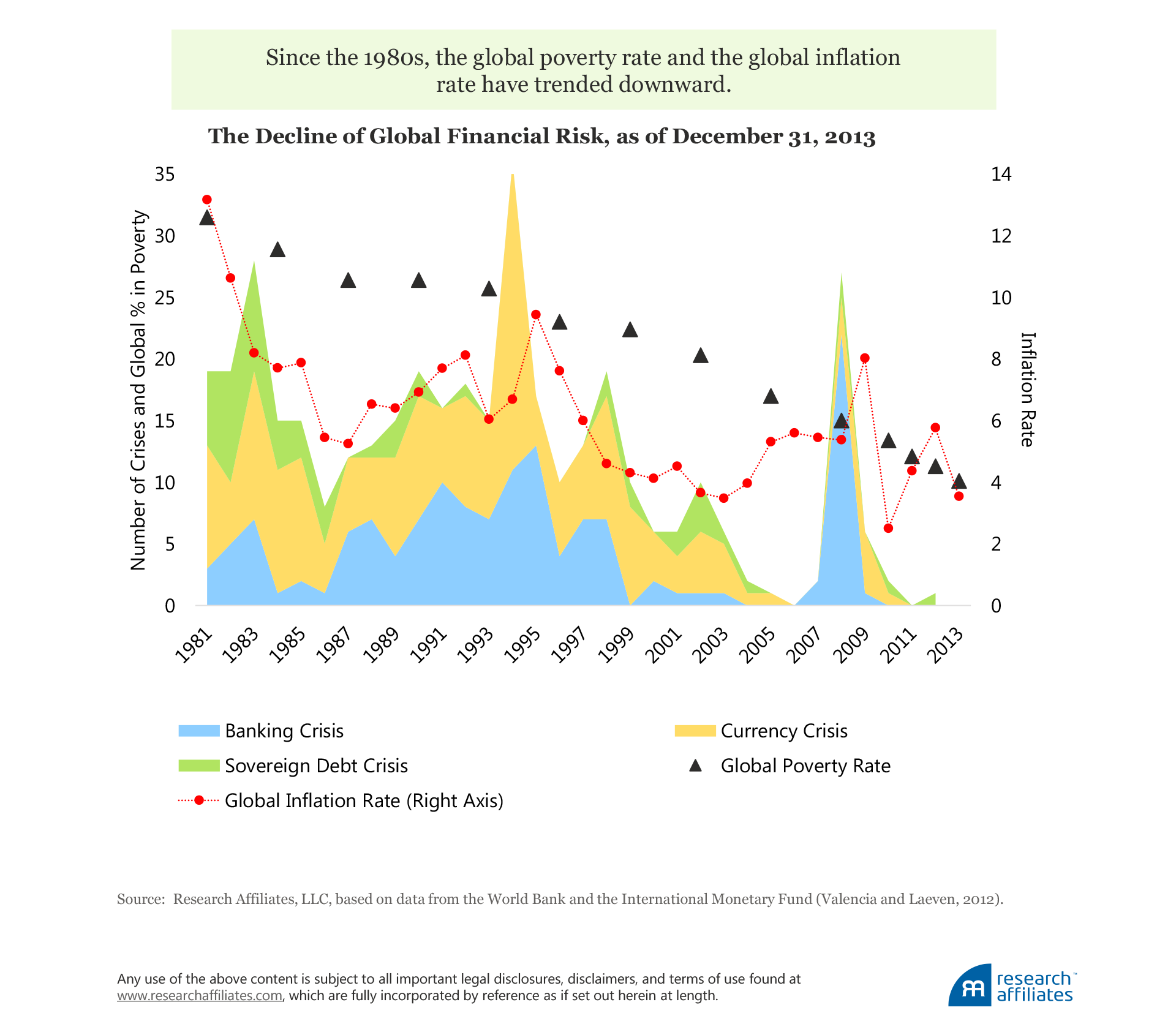

Since the 1980s, the global poverty rate has declined steadily from over 30% to 10%. Inflation has trended downward from double digits to the low single digits. With the notable exception of the global financial crisis, banking, currency, and sovereign debt crises have also been on the decline. In short, the world is more stable today than during episodes of EM risk contagion from decades past.

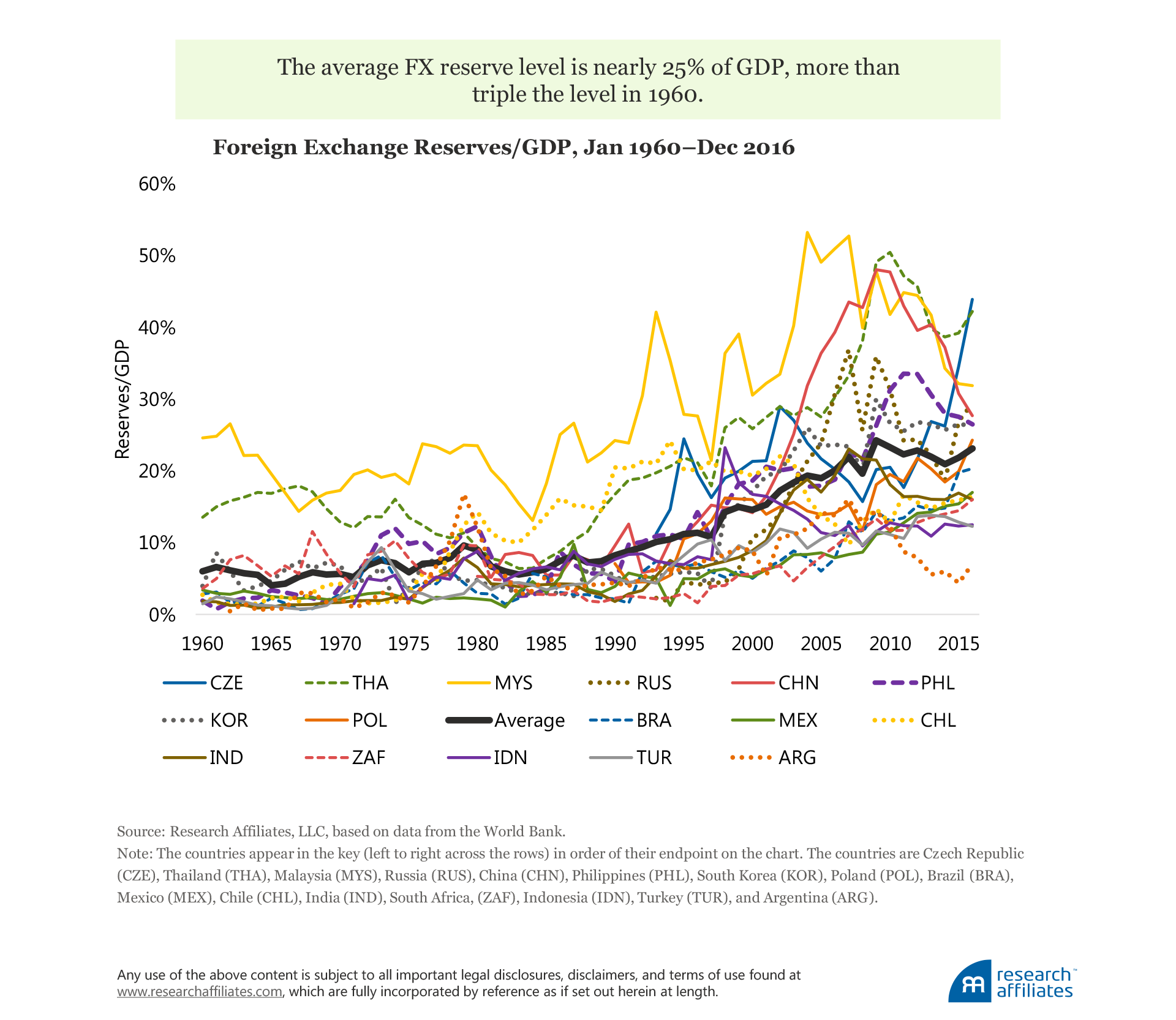

EM countries have become much wealthier. Since 2000, China’s real GDP per capita in purchasing power parity (PPP) terms has grown by 60%, India’s by 41%, Korea’s by 24%, and Taiwan’s by 22%. In contrast, Italy’s real GDP per capita contracted by 1%, and those of Germany, Japan, Great Britain, and the United States expanded by about 7%–8%. EM countries have steadily shored up their finances. Foreign exchange (FX) reserves have grown as EM countries have become wealthier. Currently, the average reserve level approaches 25% of GDP, having more than tripled since 1960.

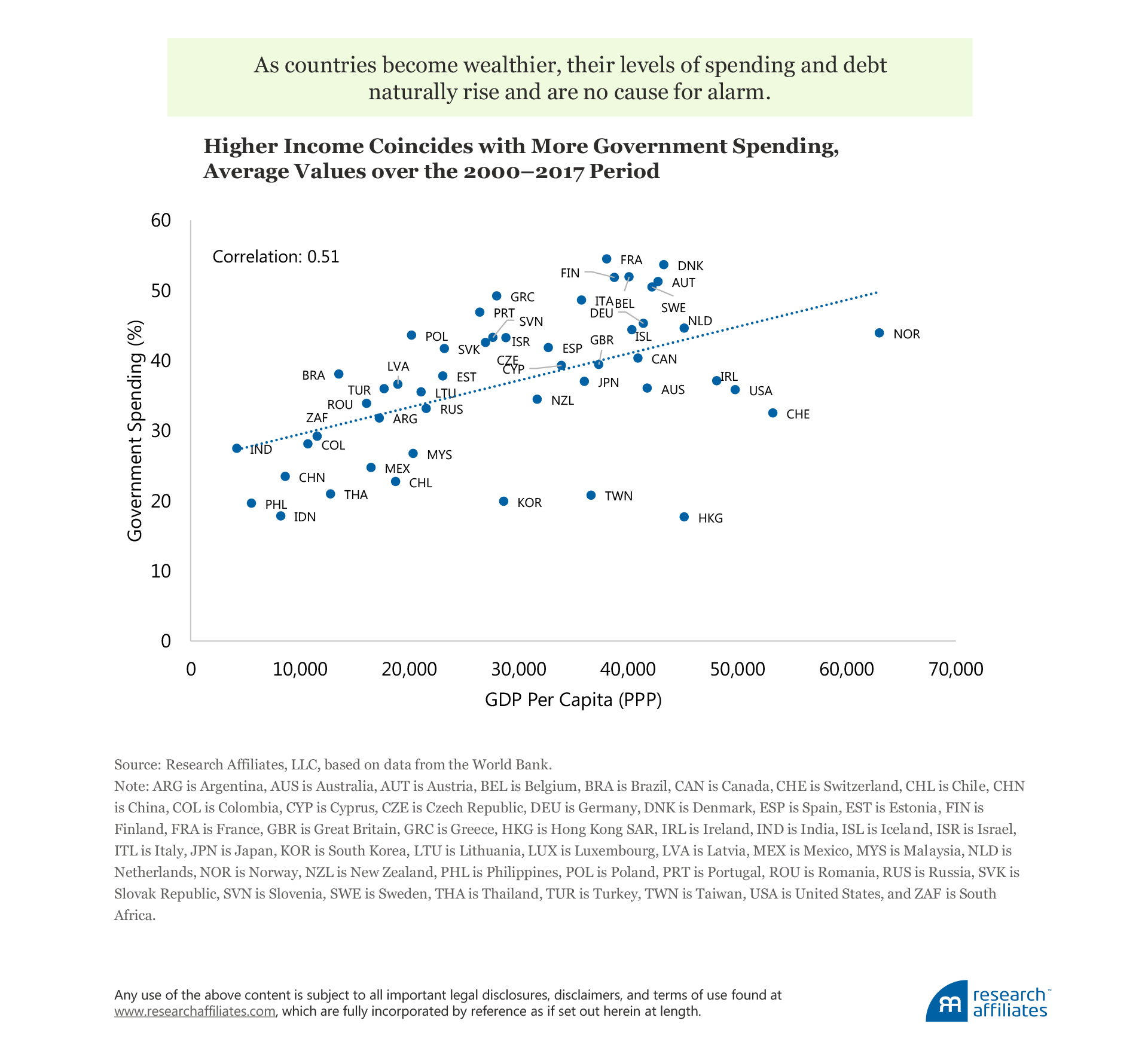

Some pundits point to seemingly bad news derived from the good news. Higher levels of government spending and increased debt are no cause for alarm. As countries become wealthier, they provide their residents with more government services and develop deeper capital markets

The most compelling reason not to fret about media chatter asserting elevated risk of an EM funding crisis is that the largest EM equity markets are not at risk of a funding crisis. Russia provides an illustrative example. Yes, its military adventures in neighboring countries (and the Middle East) dissipate financial and human capital, while its meddling in other countries’ elections subject it to sanctions. These dubious activities do not, however, create the risk of a funding crisis. Russia does not need to borrow from abroad to finance its consumption and investments. It sells more in oil and gas to its European neighbors than it buys in goods from the rest of the world. With little external debt, ample FX reserves, and a large current account surplus, the risk of a Russian financial crisis is remote (especially with the price of oil hovering between $60 and $80 a barrel).

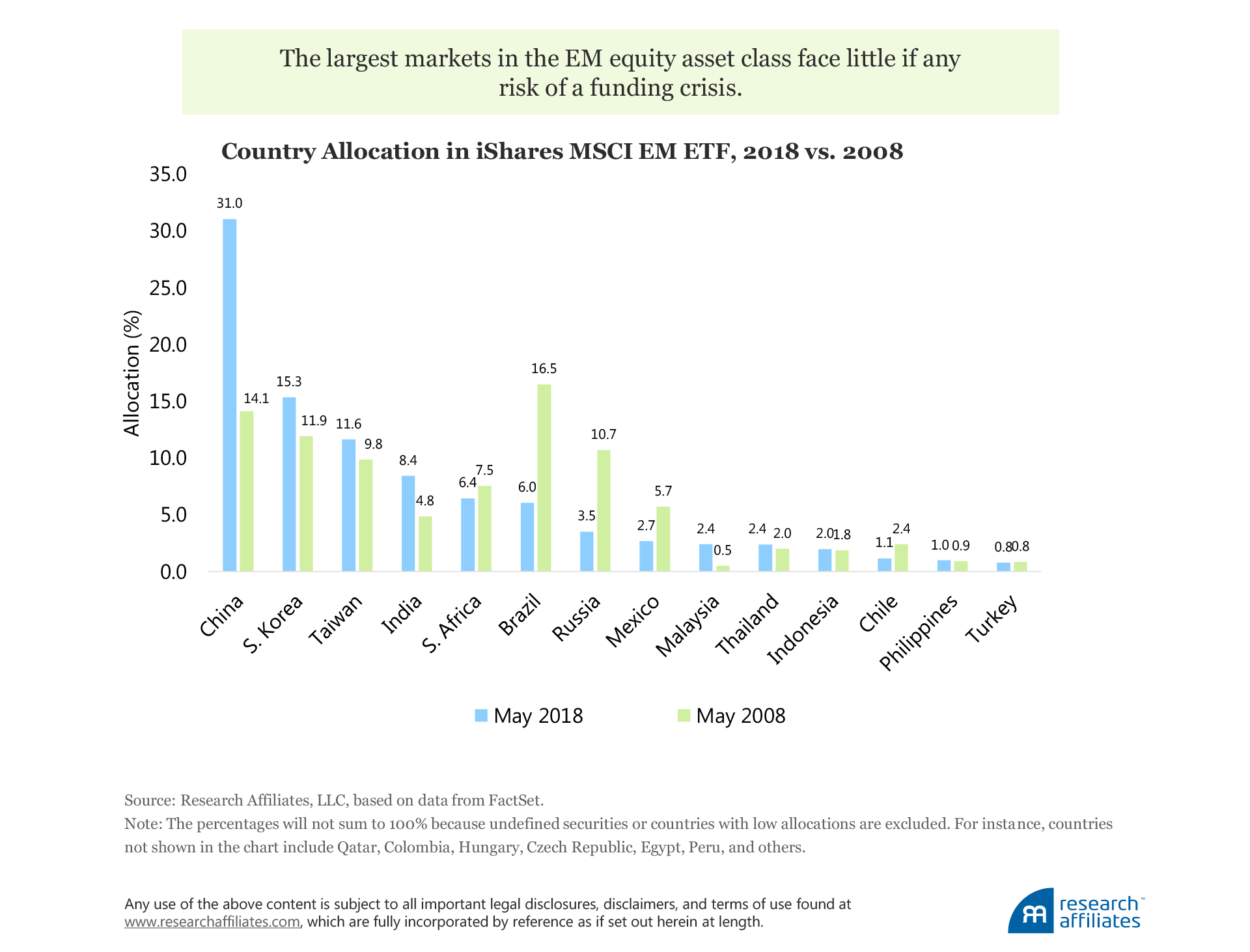

Argentina and Turkey, understandably, are much in the news. Yet these countries are nearly irrelevant for EM equity investors. Argentina is no longer classified as an emerging market, and Turkey’s equity market represents less than 1% of all EM stock markets. So, let’s take a look at the countries that do matter for those of us invested in EM equities.

We assess the risk of a funding crisis by examining three key metrics: external debt, FX reserves, and current account balance. External debt may need to be refinanced if foreign investors lose confidence in a country’s credit. FX reserves provide the immediate liquidity to repay the external debt. The current account measures whether the risks of external debt and FX reserves are likely improving or worsening.

China, Korea, Taiwan, India, and Russia, each in its own way presents political or economic risks—that’s what makes them emerging markets. How much of that risk is unknown to the market? How much is fully priced into these nations’ valuations? According to our analysis, none presents any measurable risk of a funding crisis. All have low external-debt-to-GDP ratios and ample FX reserves, and most run current account surpluses. (India runs an immaterial current account deficit.) Together, these large, low-crisis-risk markets compose about 60% of the MSCI Emerging Markets Index.

Brazil, Mexico, and South Africa run current account deficits, but also have low external debt to GDP paired with healthy FX reserves. These three countries, which display modest risk, compose 15% of the MSCI Emerging Markets Index. A few countries, including, notably, Turkey and Indonesia, seem at more material risk with high external debt, low FX reserves, and significant current account deficits. These markets, however, are only a small fraction of the total EM equity market.

Interestingly, the United States fares poorly on the three crisis risk measures we analyze. External debt to GDP is higher than in the worst EM countries, and we run a persistent current account deficit. But with great wealth and the world’s reserve currency, the United States seems in no immediate danger of a funding crisis. Longer-term, as government deficits are heading to over 100% of GDP, complacency seems ill advised.

Let’s recap the risks. Less than 20% of the MSCI Emerging Markets Index seems at elevated risk of a funding crisis. Another 20% faces moderate risk. The largest markets, representing 60% of the EM equity asset class, face little if any risk of a funding crisis.

As investors, we assess risk relative to prospective return. Is EM risk underpriced, priced about right, or are these markets cheap? Prior to the 1997–1998 EM funding crisis, the EM CAPE (cyclically adjusted price-to-earnings ratio) was trading at a premium to the US CAPE. Today, the EM equity markets are priced at less than half of the US CAPE. With only a few small markets at any material risk of crisis, EM equity markets seems to provide fair compensation for their risks. With a CAPE over 30x, the US equity market seems the riskier bet when comparing risk to forward-looking expected returns.

Finally, we are impressed by investors’ hasty and fearful reaction to a modest correction in EM stocks. Contrast that to the minimal fear of a US correction since the market’s fast rebound off the summer 2011 correction in the wake of the US debt downgrade. The “buy on dips” mantra is classic rhetoric in mid- to late-cycle bull markets; the “get me outta here” reaction is the standard response during mid-cycle bear markets through early-cycle bull markets. EM investors are behaving exactly opposite to what relative valuations are indicating. But EM investors are in good company. Polls of economists have reliably shown that 90% to 100% will forecast rising long-bond yields just when rates are poised to tumble. And Krugman, who predicted a market crash on the evening Trump won the election, now forecasts a rather catastrophic environment for emerging markets.

Fear of emerging markets seems more elevated today than at any time since the early 2016 EM lows. Remarkably, even after EM stocks have delivered nearly a 100% total return from those lows, they remain comparatively cheap when measured by CAPE, price-to-book ratio, price-to-sales ratio, market cap to GDP, and other metrics. When the risks and the bad news are well known to the market and fear reigns supreme, it’s time to buy, not sell.

References

Pinker, Stephen. 2018. Enlightenment Now: The Case for Reason, Science, Humanism, and Progress. New York, NY: Viking.

Valencia, Fabian, and Luc Laeven. 2012. “Systemic Banking Crises Database: An Update.” International Monetary Fund Working Paper No. 12/163.