The diversified approach of a multi-factor strategy offers a “smoother ride” through economic and market cycles than a single-factor strategy.

Investors should consider both the quantitative and qualitative characteristics of the two most popular multi-factor strategy construction methods—mixing and integrating—before deciding which is best suited for achieving their desired investment outcome.

Integrating can be a good candidate for a quant active strategy when high active risk is allowed, capacity is not the primary concern, and sophisticated implementation can mitigate trading cost concerns.

Investors who value full transparency, diversification, minimal governance oversight, and low fees, should find a mixing multi-factor index strategy a sensible choice.

Many of us know the painstaking process of weaning infants onto solids and persuading them to try new foods. We as parents constantly grapple at the mystery of what drives their likes and dislikes. An early favorite of many Brits is peas, chopped bangers, and mash (to those unfamiliar with British vernacular, these latter two are known more commonly as sausages and mashed potatoes). To more effectively shovel in this new form of sustenance, we combine all three together into one unsightly mess and, with one hand trying to stabilize the baby, scoop up the sticky texture and go for gold.

Whereas integrating all elements into a single conglomeration can be very efficient, human nature can be inexplicable, and sometimes the previously successful combination of peas, bangers, and mash fails miserably on subsequent attempts. Instead of the open invitation of a gaping mouth, the infant shuts up shop and stubbornly refuses to consider even a single mouthful, swatting away the spoon, creating a royal mess, and leaving his or her parents in despair—a wasted dinner!

When behavior deviates from past experience, we want to understand the reason why. What ingredient or ingredients does the child no longer like? If we had instead attempted to shovel each of the foods in separately, it might have been easier to determine the source of the problem. The approach we take in constructing a multi-factor strategy follows a similar line of reasoning: creating a portfolio of stocks with individual factor characteristics or stocks that satisfy the criteria across all factors. In this article, we compare the two most popular multi-factor strategy construction methods of mixing and integrating, and recommend when each of the two strategies is the more suitable for an investor’s needs.

Why Multi-Factor Investing?

Smart beta products that focus on a single factor have gained increasing acceptance over the last 15 or so years. Only a handful of the myriad factors identified in the literature have been shown to be robust over the long run. Based on strong empirical evidence, as provided by Hsu and Kalesnik (2014) and Beck et al. (2016), the value, low beta, momentum, and illiquidity factors are robust in the absence of transaction costs, whereas the quality and size factors do not earn a return premium consistently over time and across different regions.

Each of these factors has had long periods of underperformance, such as the large losses experienced by low-volatility investors in the 1990s and those of value investors during the tech bubble. Unsurprisingly, to even out performance and to hedge away the risk of lengthy bouts of poor returns, investors have come to favor the more-diversified approach of multi-factor strategies, which offer a “smoother ride” through economic and market cycles (Brightman et al., 2017).

Multi-factor strategies do not just happen, however, they need to be designed and portfolios constructed. Not everyone, of course, agrees on the best method for constructing a multi-factor strategy and the implications of the method for investor outcomes. How then should investors assess which approach is more suitable—mixing or integrating—and whether to apply it in a quant active or a passive manner?

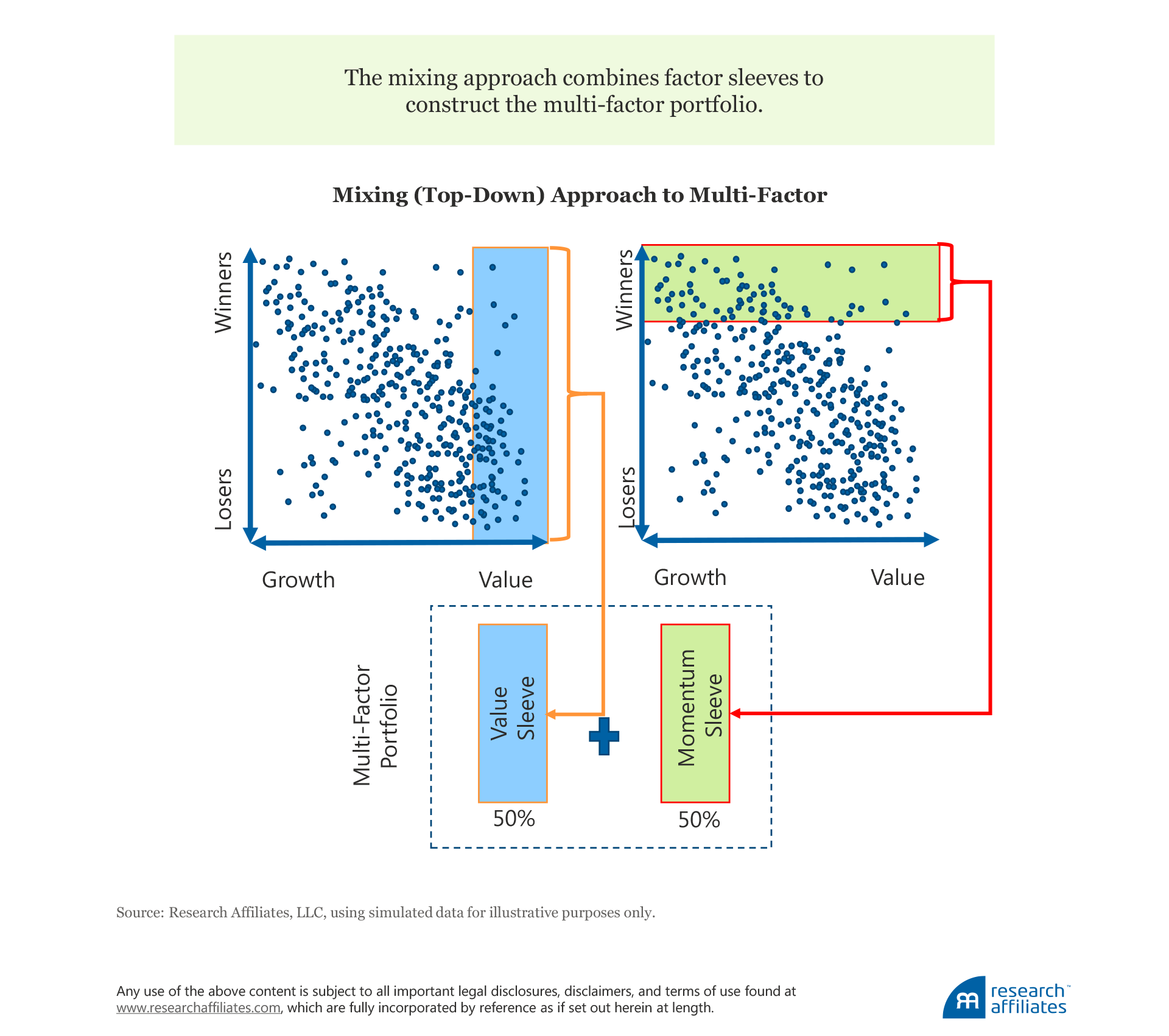

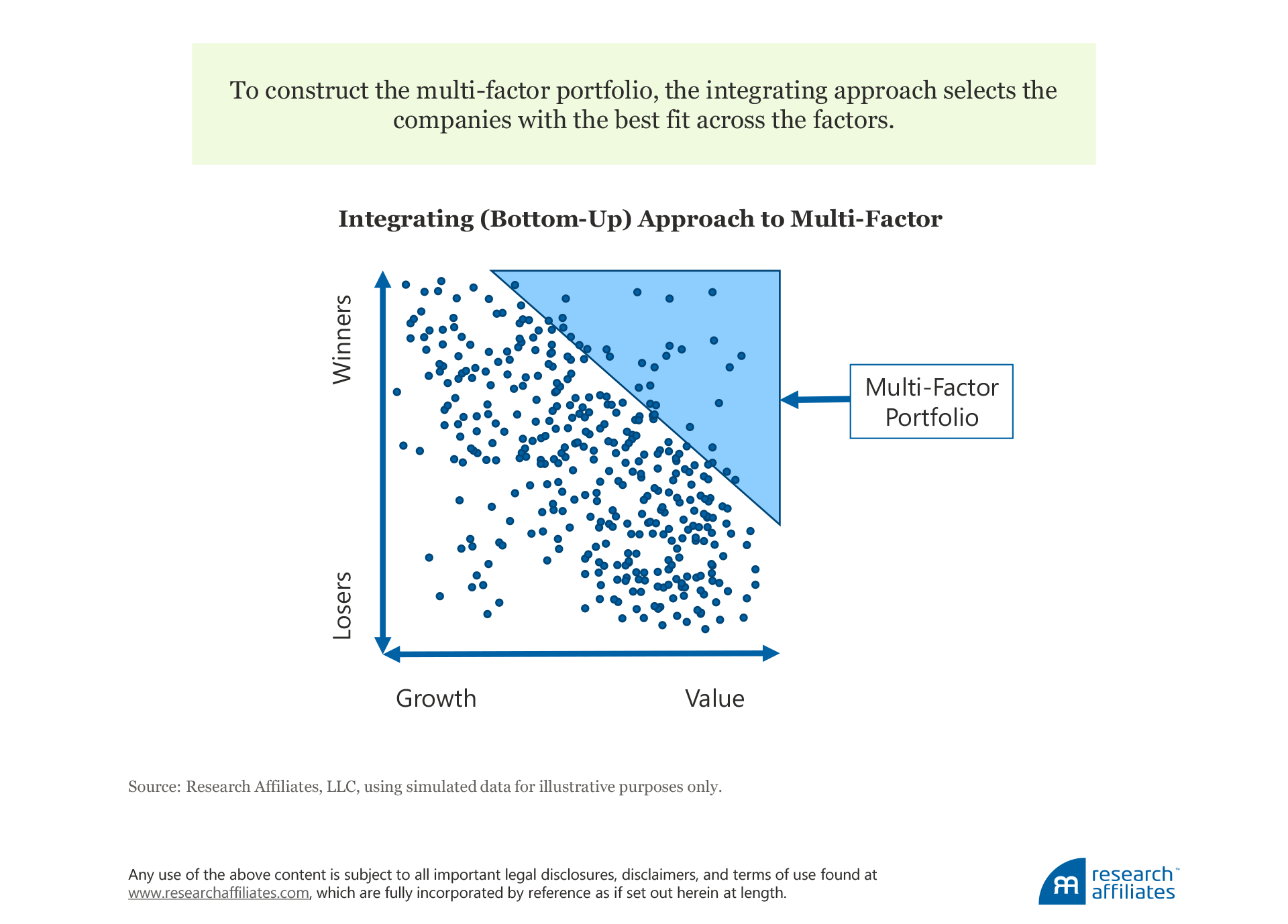

Mixing (top-down) is a two-step process. The first step is to create single-factor portfolios, and the second step is to allocate assets across them to form a multi-factor portfolio. Integrating (bottom-up) is a one-step process, which involves surveying suitable securities across an opportunity set and selecting those with the strongest combined exposures to all target factors.

Let’s take a simple two-factor example to illustrate each approach.

First, let’s consider the mixing approach. The dots in the mixing scatterplot represent the universe of stocks, ranked across two dimensions: momentum on the y-axis and value on the x-axis. The first step is to create a value sleeve, which contains the cheapest stocks, as illustrated by those in the blue box at the far right of the growth–value x-axis, and a momentum sleeve, which comprises the most-recent winners, as illustrated by the stocks in the green box at the top of the winners–losers y-axis. We then combine the two sleeves, giving each a 50% weight, to form the two-factor mixing portfolio.

Now, let’s consider the integrating approach. As in the mixing illustration, the dots in the scatterplot represent the universe of stocks, ranked across the same two dimensions of momentum and value. We select the companies with the best fit across the two factors: 1) recent winners, in the case of momentum, and 2) cheapest, in terms of value. As more factors are added to a multi-factor strategy, each stock selected for the portfolio must meet another layer of criteria so that the available opportunity set for integrating narrows considerably with each additional factor.

The theoretical evidence to indicate which approach yields the optimal results is weak at best. Leippold and Ruegg (forthcoming 2018) argue that when more-robust tests are used, they find no empirical evidence to statistically validate the claim that integrating is superior. They therefore assert that their findings cast a shadow over the conclusions of prior research, which mainly favor the integrating approach.

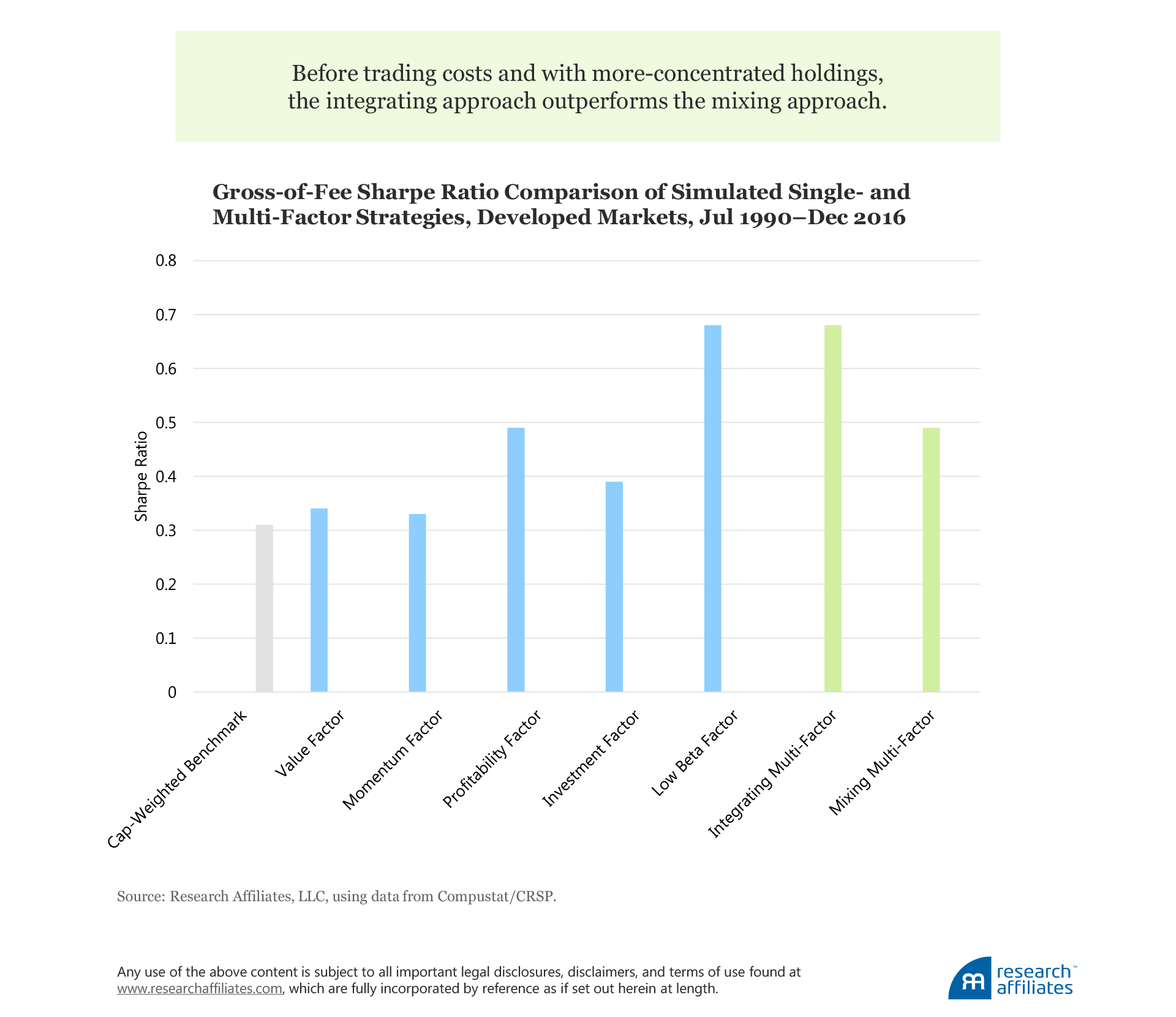

Our recent research published in Chow, Li, and Shim (hereafter CLS) (2018) uses the value, momentum, profitability, investment, and low-beta factors to construct a multi-factor strategy using both the mixing and the integrating approaches and to compare the results. The first step in constructing the mixing strategy is that each factor portfolio is created from large- and mid-cap stocks that have the strongest factor characteristics—the top 20% by factor strength—weighted by each stock’s market capitalization. The multi-factor mixing strategy is simply a quarterly equal-weighted mix of the five factor portfolios, reconstituted either annually or quarterly (momentum).

The integrating strategy, in contrast, selects the 20% of stocks with the highest average score based on the five factor characteristics (more details are available in CLS) and rebalances quarterly. From a technical perspective, one of the limitations of integrating is the reduced flexibility as regards each factor. For example, momentum has much faster signal decay than the other factors (Arnott et al., 2017) and requires more frequent rebalancing, whereas value, low beta, and quality have more-stable signals, which have a longer half-life and require less-frequent rebalancing. These technicalities result in big differences in portfolio turnover and factor efficiency, so that trade-offs need to be made when integrating multiple factors.

A naïve comparison (i.e., before transaction costs) of the two portfolio construction approaches favors the integrating approach, which delivered higher absolute and risk-adjusted returns over the nearly three decades from July 1990 through December 2016. The integrating multi-factor portfolio’s annualized return of 11.0% and Sharpe ratio of 0.68x meaningfully surpassed the mixing multi-factor portfolio’s annualized return of 9.3% and Sharpe ratio of 0.49x, and also surpassed that of all individual stand-alone factors (except the low beta factor) as well as a representative cap-weighted benchmark. This finding is consistent with a few previous studies (e.g., Fitzgibbons et al., 2016), but which set up the tests in slightly different ways.

So, is that it, case closed? No. Far from it.

Relying only on the quantitative, and apparently superior, gross-of-fee performance results is a dangerous practice. Doing so provides an incomplete picture and ignores critical information, thereby leading to suboptimal investment decisions. Investors are better served by conscientiously expanding their evaluation tool-kit when assessing which multi-factor construction approach is more appropriate for their investment goals.

What Construction Criteria Should Investors Consider?

A deeper dive into the differences between mixing and integrating requires evaluating performance results after accounting for a number of practical considerations. These include a wide scope of both measurable metrics, such as transaction costs, turnover, and idiosyncratic risk, and nonmeasurable or qualitative criteria, such as ease of performance attribution, transparency or ease of understanding, and governance issues. Our recent research (CLS, 2018) considers both measurable and nonmeasurable portfolio characteristics, which are important to investors but often overlooked by academics. In this section, we discuss the quantifiable construction criteria, and in the next section, the qualitative criteria.

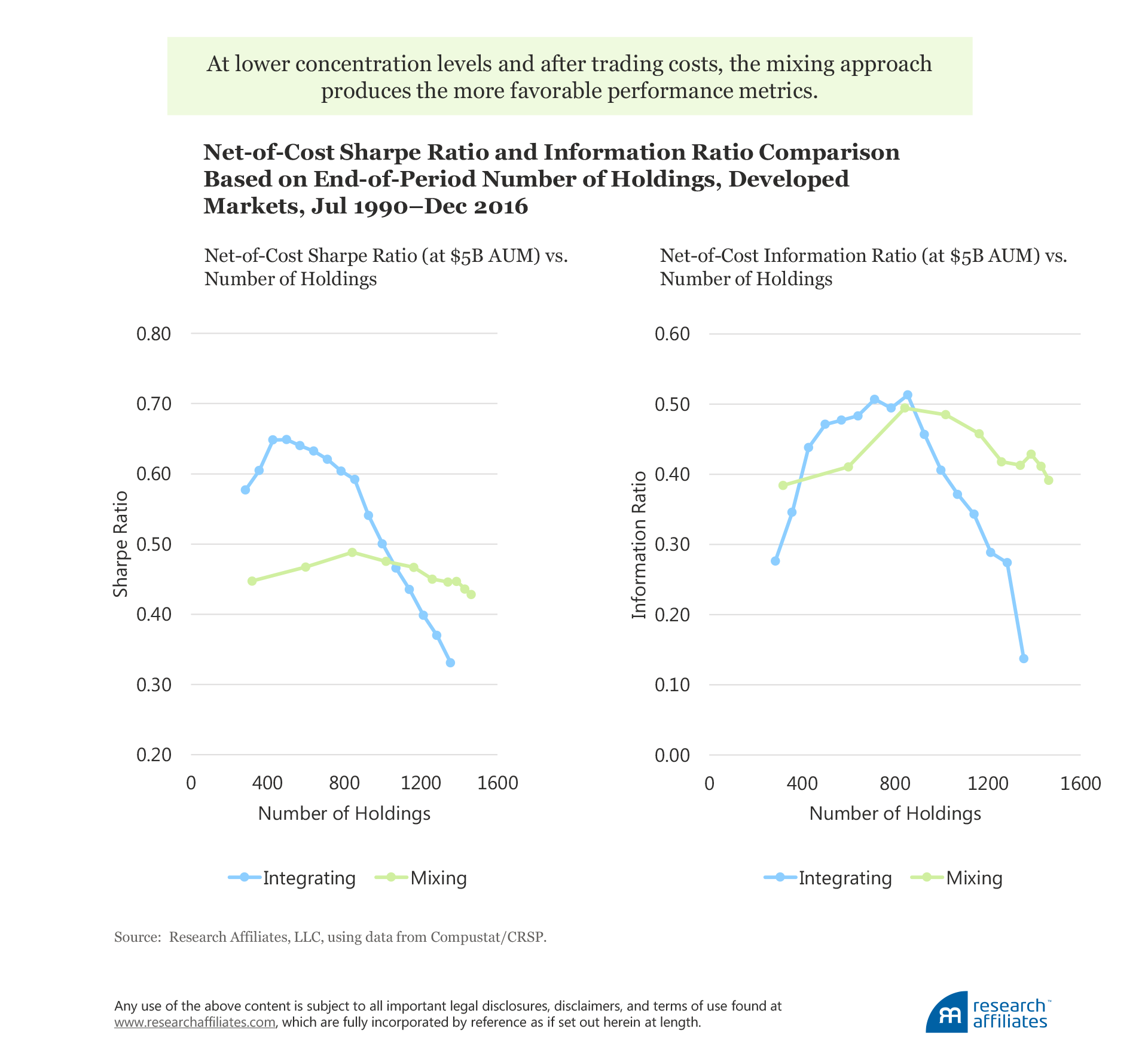

At first glance, the integrating approach appears to yield improved return prospects relative to the mixing approach. The reason is that the transaction costs required to maintain the efficacy of the integrating approach—which must rebalance regularly to preserve the quickly deteriorating factor characteristics of its stocks—are not being considered. But when we increase the number of holdings in the portfolio, so that the portfolio becomes more diversified and less concentrated—and perform the analysis after trading costs—the earlier-observed return advantage of the integrating approach diminishes.

For investors interested in benchmark-related risk-adjusted returns, diversification is important. Thus, a net-of-cost analysis of mixing versus integrating using the number of end-of-period holdings is a relevant basis for comparison. As measured by both the Sharpe ratio and the information ratio, when the number of stocks in the portfolio is increased with a concurrent reduction in portfolio concentration and increase in diversification, the attractiveness of the integrating approach vanishes.

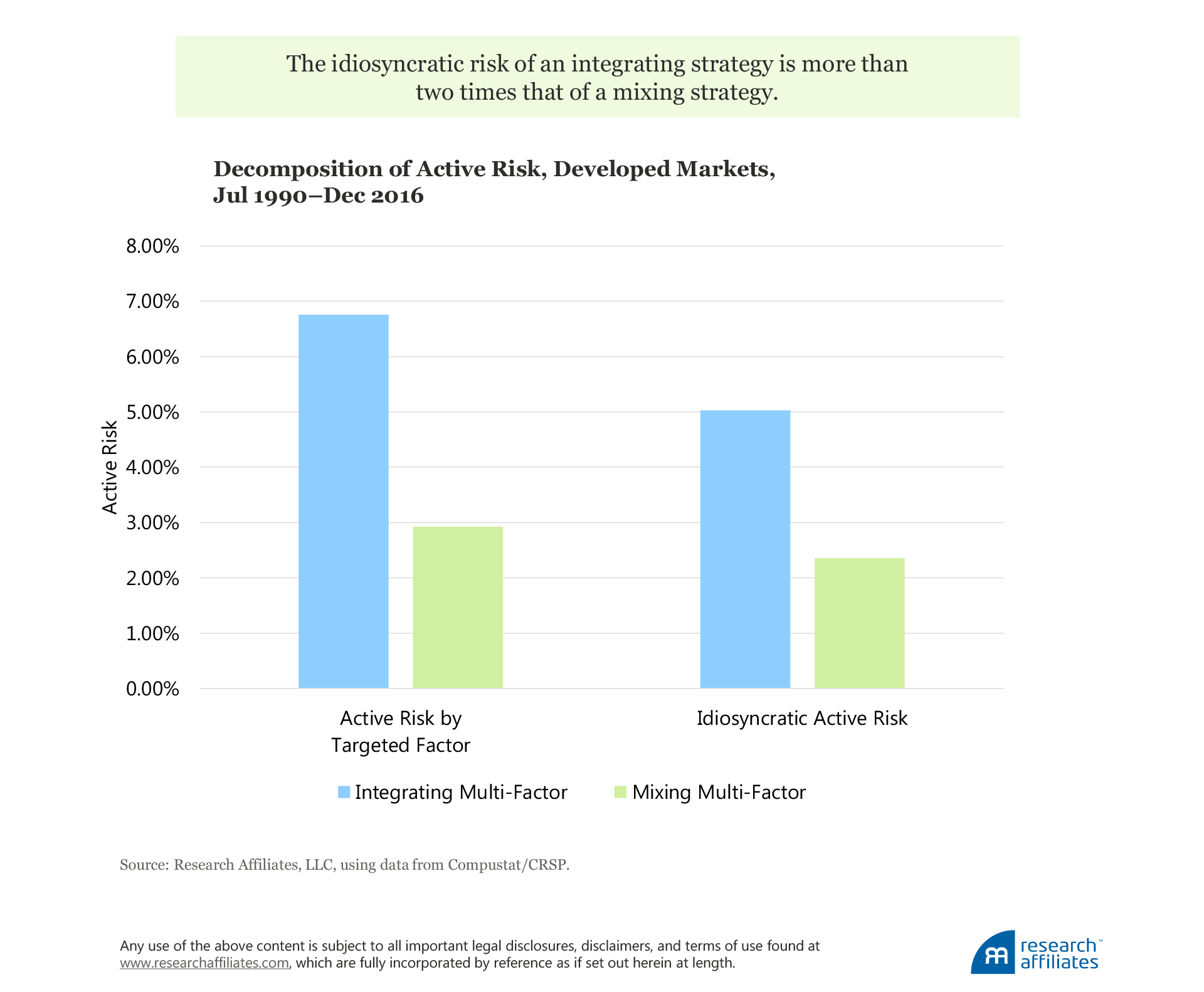

Portfolio concentration levels also tend to coincide with the level of unexplained or idiosyncratic risk in a portfolio. Our research findings (CLS, 2018) suggest that a more-concentrated portfolio displays higher unintended idiosyncratic risk. After decomposing risk into active risk by factor risk and idiosyncratic risk, we find that the idiosyncratic risk of an integrating strategy is more than two times that of a mixing strategy (5.02% vs. 2.35%). Such a high level of idiosyncratic risk is undesirable for two reasons: 1) only the systematic risk of a portfolio is compensated for by a return premium, and 2) the unpredictable component of risk is not going to be a reliable source of performance going forward.

Our research shows that an investor’s desired level of diversification should play a role not only in whether the multi-factor strategy they choose is constructed by mixing or integrating, but also whether it is active or passive. When diversification is not a primary concern and higher concentration can be tolerated, we believe an active multi-factor integrating strategy should produce more favorable results. The active manager can tactically use the liquidity of underlying stocks to mitigate the trading cost concerns related to a more-concentrated portfolio. If, however, diversification is a key requirement, we believe a thoughtfully constructed mixing multi-factor index strategy, in which returns can be harvested through low-cost passive management, may be a better fit.

What Qualitative Criteria Should Investors Consider?

Up to this point, our focus has been on measurable criteria based on research results. Let’s turn now to practical real-world considerations that are harder to quantify: governance, transparency, and ease of performance attribution. We find that the qualitative criteria strongly support a mixing multi-factor strategy, likely in the form of an index vehicle.

Unfortunately, the investment industry is mad for complexity (Hsu and West, 2016), driven perhaps by the belief that more complexity should earn a greater fee or maybe, on a more positive note, that our quest for solutions drives us to over-engineer strategy design. But complexity is problematic, and in most cases unnecessary, as Einstein prudently advised: “Everything should be made as simple as possible, but no simpler.”

Not only does simpler make it easier for investment teams to explain the strategy to stakeholders, it helps reduce the labor costs associated with executing the strategy and conducting due diligence. Multi-factor index strategies that are transparent and rules-based will have the same focus five years in the future as they have today, so that, once explained, the investor’s understanding of the key sources of the return premiums and their persistence over time does not need to change. An index approach also allows for ease of performance attribution so investors can readily understand the drivers of returns, ex post.

Transparency, aided by simplicity, is a surrogate for trust. In a factor world tainted by the quant crash of 2008, trust is an essential ingredient for investors to be willing to stay the course and to reap the benefits of a multi-factor approach.

Food for Thought

Investors considering a multi-factor strategy should evaluate both quantitative metrics and qualitative criteria to assess which approach is more suitable to their needs. Yes, an integrating multi-factor strategy can result in higher risk-adjusted returns, but this outperformance only materializes when concentration is high and the stocks in the portfolio are well balanced in each of the factor exposures. Because this caveat creates limited liquidity and limited capacity, integrating is not suitable as an index strategy, but can be a great candidate for a quant active strategy where high active risk is allowed (Fitzgibbons et al., 2016), capacity is not the primary concern, and sophisticated implementation can mitigate the trading cost concern.

For investors who value full transparency, minimal governance, diversification, oversight, and of course, low fees, a mixing multi-factor index strategy is a sensible choice, given that capacity and liquidity constraints are adequately met through thoughtful index design, which also controls explicit and implicit implementation costs. As asset gathering in the multi-factor strategy space gathers speed, investors can gain insights into which strategy is right for them by weighing the benefits of combining the ingredients in an integrating approach (like the sticky goo of peas, bangers, and mash) or of separating them in a mixing approach.

References

Arnott, Rob, Vitali Kalesnik, Engin Kose, and Lillian Wu. 2017. “Can Momentum Investing Be Saved?" Research Affiliates Publications (October).

Beck, Noah, Jason Hsu, Vitali Kalesnik, and Helge Kostka. 2016. “Will Your Factor Deliver? An Examination of Factor Robustness and Implementation Costs.” Financial Analysts Journal, vol. 72, no. 5 (September/October): 58–82.

Brightman, Chris, Vitali Kalesnik, Feifei Li, and Joseph Shim. 2017. “A Smoother Path to Outperformance with Multi-Factor Smart Beta Investing.” Research Affiliates Publications (January).

Chow, Tzee, Feifei Li, PhD, and Joseph Shim. 2018. “Smart-Beta Multifactor Construction Methodology: Mixing versus Integrating.” Journal of Index Investing, vol. 8, no. 4 (Spring):47–60.

Fitzgibbons, Shaun, Jacques Friedman, Lukasz Pomorski and Laura Serban, 2016. “Long-Only Style Investing: Don’t Just Mix, Integrate.” AQR White Paper (June 30).

Hsu, Jason, and Vitali Kalesnik. 2014. “Finding Smart Beta in the Factor Zoo.” Research Affiliates Fundamentals (July).

Hsu, Jason, and John West. 2016. “The Confounding Bias for Investment Complexity.” Research Affiliates Fundamentals (January).

Leippold, Markus, and Roger Ruegg. 2018. “The Mixed vs. the Integrated Approach to Style Investing: Much Ado About Nothing?” European Financial Management(forthcoming).