That the equity risk premium is mean-reverting has been amply documented. Bob Shiller, who won the 2013 Nobel Prize, was one of the first economists to explore in depth the phenomenon of mean reversion in time series of market prices. The behavioral interpretation is that investors over-extrapolate recent price movements and news, which then causes overshooting in prices; subsequent earnings growth then disappoints the irrational expectation, which causes reversal in returns.

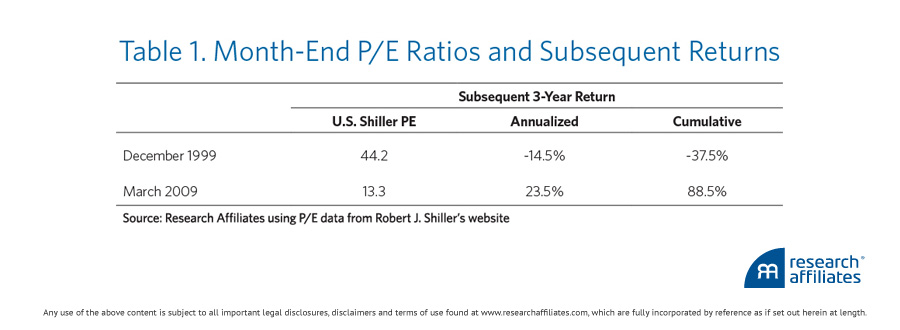

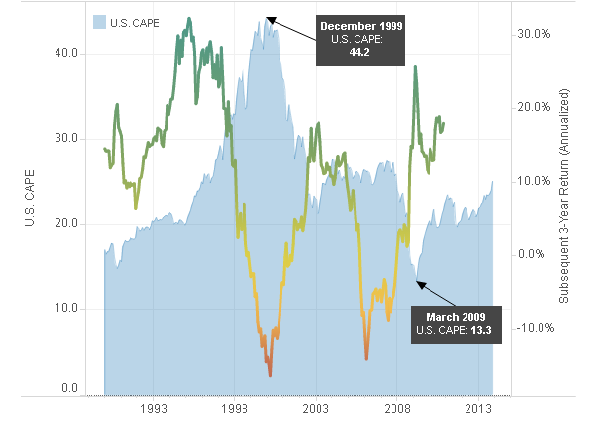

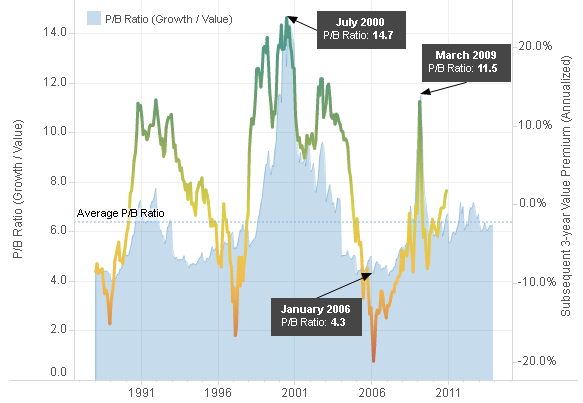

Two examples will serve to illustrate the pattern. Irrational exuberance experienced during the tech bubble drove the Shiller P/E to a breathtaking high of 44.2 at the end of 1999, and the stock market return in the subsequent three years was -14.5% per year or -37.5% cumulatively. Fear at the depth of the Global Financial Crisis plunged the Shiller P/E to its lowest level in the last two decades, 13.3 in March 2009; equity returns were 23.5% per year, or 88.5% cumulatively, in the following three years (Table 1). For each month-end from January 1990 to November 2010, Figure 1 shows the cyclically adjusted Shiller P/E ratio and the annualized rate of return for the subsequent three years. (P/E ratios are shown through November 2013.) The chart indicates that, to some extent, rates of return can be predicted on the basis of P/E ratios.

Figure 1. Month-End P/E Ratios and Subsequent Annualized Returns

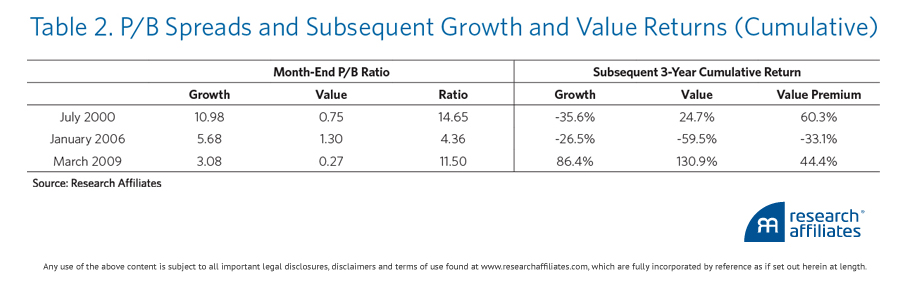

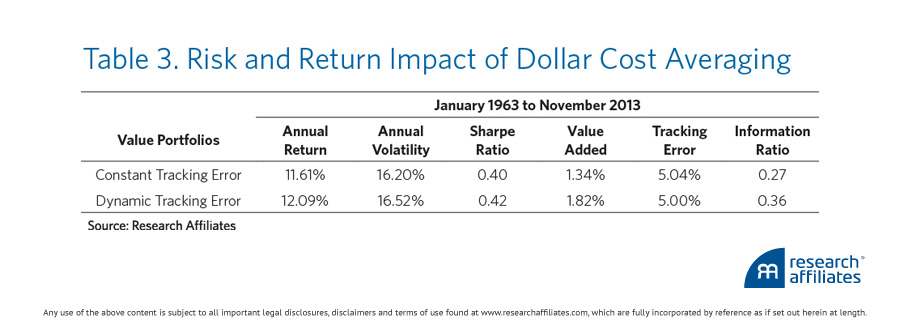

There is growing empirical evidence that the value premium is also mean-reverting.1 For example, the tech boom drove the ratio of the growth P/B to the value P/B to 14.65 in July 2000. (In other words, at that point in time the average P/B ratio of growth stocks was 14.65 times the average P/B ratio of value stocks.) In the subsequent three years, value cumulatively outperformed growth by 60.3%. The housing and sub-prime mortgage bubble drove up prices for the banking and consumer staples sectors, which are traditional value sectors. In January 2006 the growth stock P/B ratio was 4.36 times the value stock P/B, and value cumulatively underperformed growth by 33.1% in the subsequent three years. The ratio expanded again as the economy recovered from the Global Financial Crisis, reaching 11.5 times in March 2009; in the following three years, value outperformed growth by 44.4% cumulatively. Table 2 summarizes these observations, and Figure 2 displays the ratio of growth and value P/B ratios at each month end with the corresponding difference between annualized growth and value returns for the three years then starting.

Figure 2. Month-End P/B Ratios and Subsequent Value Premia

It is known that one can capture the value premium either by investing in low P/B stocks or by rebalancing from the last few years’ winner stocks (those whose prices have appreciated the most) into the losers. Indeed, many research papers refer to the value premium interchangeably with contrarian profits or the mean-reversion effect. However, when momentum carries prices away for an extended period of time, rebalancing can cause value stocks to underperform, perhaps substantially. The larger and more prolonged the value underperformance, the bigger the spread between growth and value stock P/B ratios. The large P/B spread is then a signal for the magnitude of the forthcoming return reversal. There is mean-reversion in the mean-reversion effect.

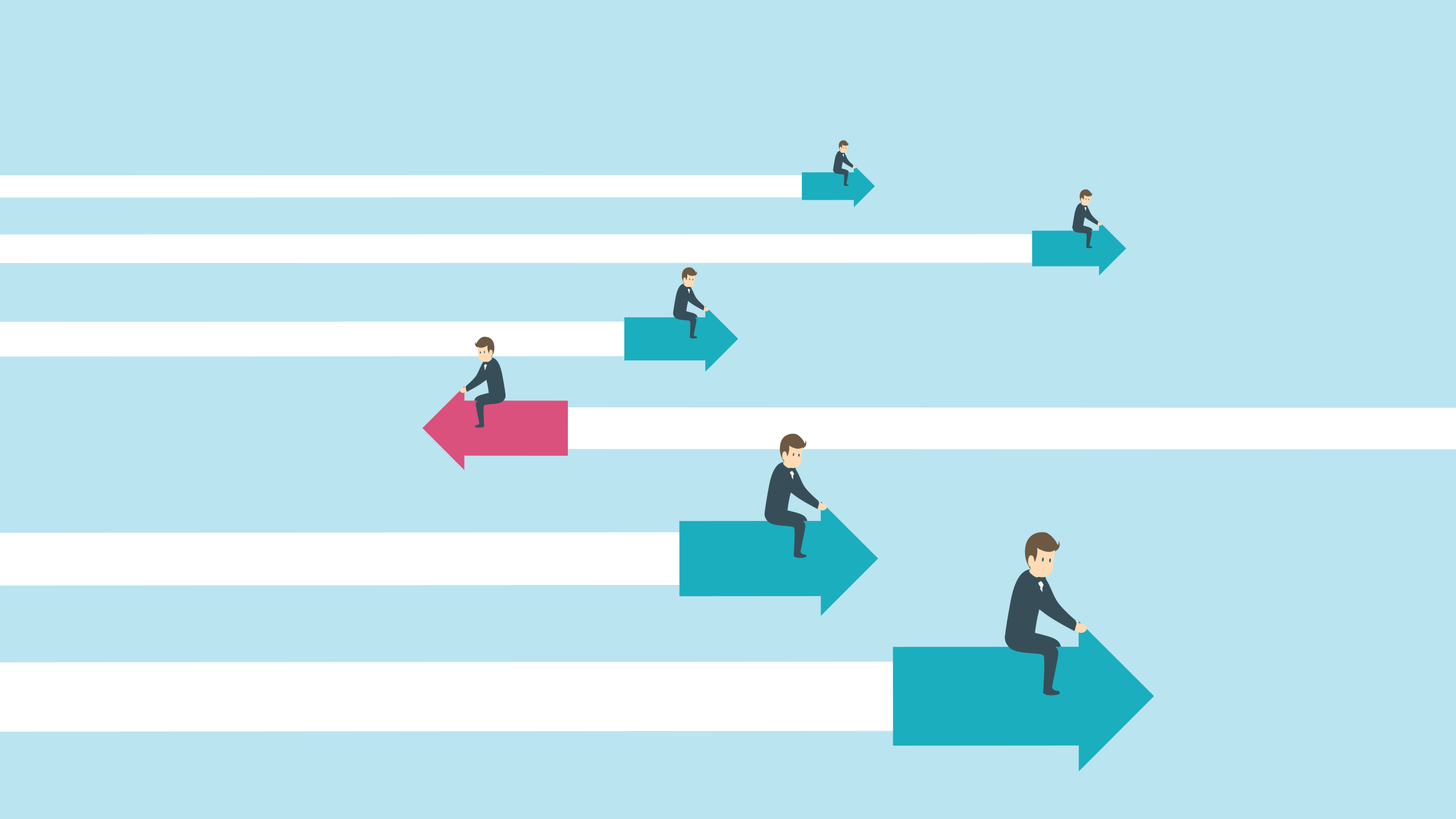

When the mean-reversion effect shows evidence of mean reversion, it makes sense to dollar cost average contrarian bets.2 Let me show this by comparing two portfolios: one which allocates a constant tracking error to low P/B stocks, and another which dynamically allocates more tracking error when the gap between growth and value P/B ratios widens. The first portfolio is akin to the traditional value strategies, which tilt toward cheap stocks in order to generate outperformance. The second portfolio is similar to fundamentals-weighted and other simpler Smart Beta indices, whose rebalancing heuristics implicitly contain dollar cost averaging. Table 3 shows the simulated long-term results: the value portfolio with the dynamically adjusted tracking error (that is, the value portfolio that automatically engages in dollar cost averaging) outperforms the value portfolio whose tracking error is held constant (the traditional portfolio with a value bias) by 48 basis points with no incremental risk.

Thus the fact that the value premium is mean-reverting has strategic implications. Merely tilting toward value stocks may leave a good part of the total value premium on the table. By comparison, some smart beta approaches may squeeze much more juice from the value apple by means of a rebalancing rule that effectively carries out dollar cost averaging.

SMART BETA SERIES

Please read our disclosures concurrent with this publication: https://www.researchaffiliates.com/legal/disclosures#investment-adviser-disclosure-and-disclaimers.

Endnotes

- See Clifford S. Asness, Jacques A. Friedman, Robert J. Krail, and John M. Liew, “Style Timing: Value versus Growth,” Journal of Portfolio Management, vol. 26, no. 3 (Spring 2000), 50-60, and Randolph B. Cohen, Christopher Polk, and Tuomo Vuolteenaho, “The Value Spread,” Journal of Finance, vol. 58 no. 2 (April 2003), 609-642.

- See Michael J. Brennan, Feifei Li, and Walter N. Torous, “Dollar Cost Averaging,” Review of Finance, vol. 9 no. 4 (2005), 509-535.